Macro Theme:

Key dates ahead:

- 9/18 FOMC/VIX Exp

- 9/20 Huge Quarterly OPEX

9/18 – 9/20 is a major inflection point for equities, due to VIX Exp & FOMC (9/18), followed by Triple-Witching-OPEX.

Key SG levels for the SPX are:

- Support: 5,620, 5,600

- Resistance: 5,650, 5,660, 5,700

- As of 9/17/24:

- Models are risk-on in the positive-gamma zone >5,600, with resistance at 5,660 & 5,700.

- Risk off <5,600

QQQ:

- Support: 472, 470

- Resistance: 475, 480

IWM:

- Support: 213, 210, 200

- Resistance: 220

- As of 9/17/24:

- Price will likely remain very fluid from 220 down to 200 due to negative gamma (i.e. risk below). We see dealers flipping to a positive gamma stance >220, and into 225 (resistance/slows upside movement).

Founder’s Note:

Futures have shifted 40-50 bps higher today, implying a test of 5,650-5,660 resistance. Support shows at 5,620 & 5,600. We currently see net positive gamma positions in through 5,700, which implies “risk-on” bullish options positioning >5,600 up to 5,700.

Conversely, we now show that

gamma flips

to a negative position <5,600, which shifts us to a risk-off stance should that level be broken.

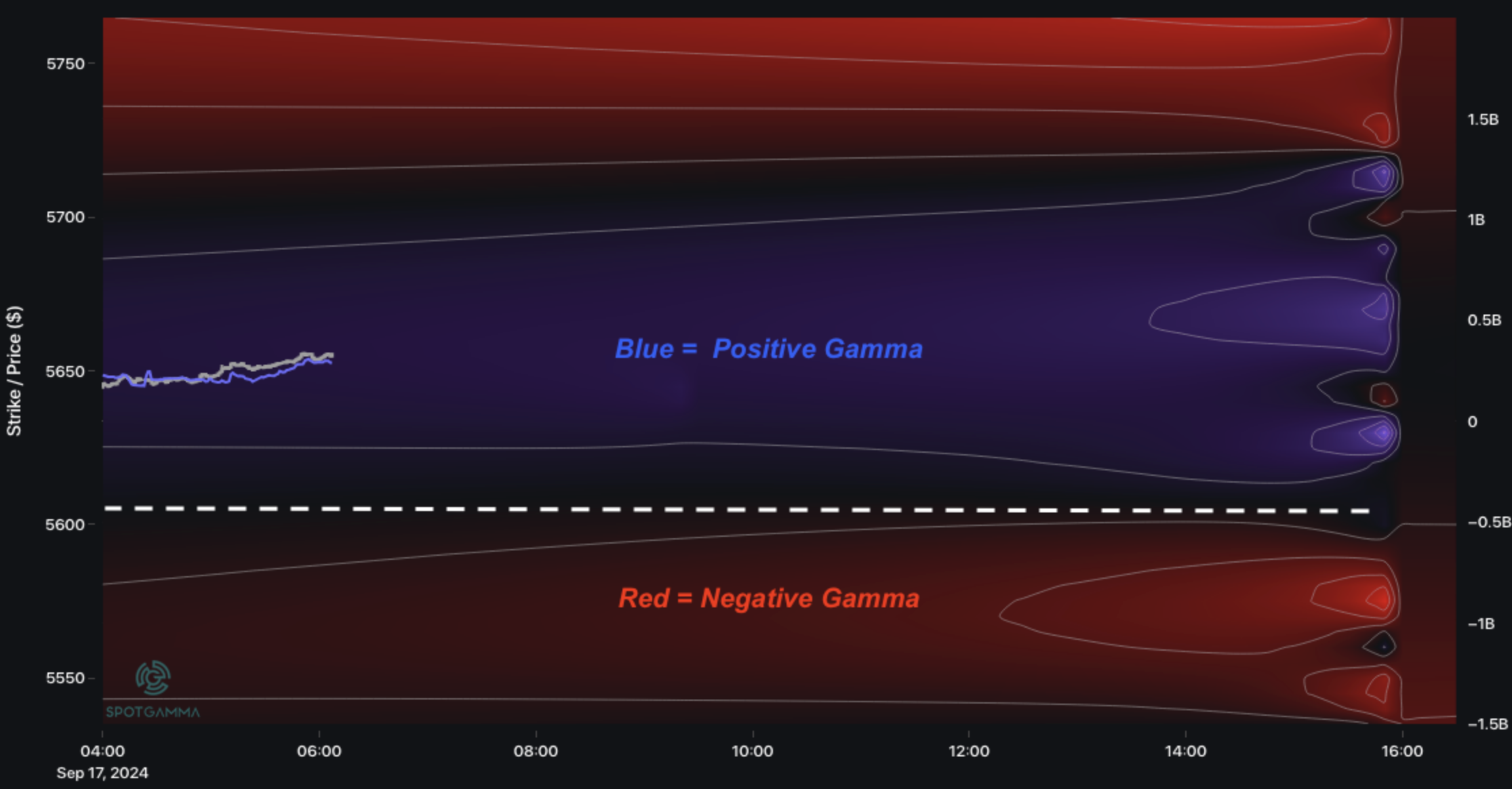

You can see this gamma positioning in our new SPX gamma map(s), called “Trace”, below. The zone of blue depicts dealer-supportive positive gamma zones, with the map shifting to negative gamma (red) <5,600. We will likely be using 5,600 as our risk-off level in through tomorrows FOMC event, wherein if that level is broken we’d want to be long puts/VIX calls and/or short equities.

These maps are driven by our proprietary dealer positioning model, and updated continuously throughout the day. If you want to know more about Trace maps join us today at 1pm ET!

Today is the last day for Sep VIX options to trade, as they settle/expire tomorrow AM (Wednesday). In the past we have seen some large, unexpected equity moves the day before VIX expiration. In this case, for today, we think its VIX movement which will dictate S&P action.

The strike to watch into VIX Exp is 17 (where the VIX is currently marked), as its the largest strike by open interest, by far: 350k puts +375k calls).

Depicting how the VIX is linked to SPX, note this example from yesterday. At 10:30AM ET we saw ~12k of the VIX 9/18 exp 17 puts trade…

…and at that exact same time the SPX dropped ~10 handles. Granted that’s not an Armageddon move, but we’re sure there were a few traders asking “what happened?”. It also highlights the importance of watching VIX

HIRO,

today.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5699.32 | $5633 | $562 | $19423 | $473 | $2189 | $217 |

| SG Gamma Index™: |

| 1.454 | 0.028 |

|

|

|

|

| SG Implied 1-Day Move: | 0.53% | 0.53% | 0.53% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5656.32 | $5590 | $560 | $19190 | $472 | $2130 | $213 |

| Absolute Gamma Strike: | $5666.32 | $5600 | $560 | $19450 | $475 | $2200 | $220 |

| Call Wall: | $5816.32 | $5750 | $570 | $19450 | $480 | $2200 | $220 |

| Put Wall: | $5566.32 | $5500 | $540 | $18500 | $440 | $2000 | $210 |

| Zero Gamma Level: | $5624.32 | $5558 | $557 | $18941 | $468 | $2167 | $217 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.162 | 1.032 | 1.52 | 1.024 | 1.063 | 0.923 |

| Gamma Notional (MM): | $551.476M | $399.722M | $13.693M | $122.355M | $8.037M | ‑$24.982M |

| 25 Delta Risk Reversal: | -0.047 | 0.00 | -0.046 | 0.00 | -0.022 | -0.018 |

| Call Volume: | 455.397K | 1.125M | 6.956K | 573.626K | 19.765K | 371.188K |

| Put Volume: | 776.402K | 1.488M | 8.138K | 666.825K | 31.636K | 447.033K |

| Call Open Interest: | 7.774M | 5.689M | 68.523K | 3.717M | 358.262K | 5.086M |

| Put Open Interest: | 14.948M | 14.804M | 87.563K | 6.68M | 560.159K | 9.497M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5550, 5650, 5500] |

| SPY Levels: [560, 550, 570, 565] |

| NDX Levels: [19450, 19500, 20000, 19000] |

| QQQ Levels: [475, 470, 480, 465] |

| SPX Combos: [(5898,94.24), (5875,72.88), (5847,93.05), (5825,77.66), (5796,97.94), (5774,90.07), (5768,77.35), (5757,87.84), (5751,99.75), (5740,80.69), (5729,74.91), (5723,98.09), (5718,77.22), (5712,92.96), (5706,94.85), (5701,99.46), (5695,82.59), (5689,86.84), (5684,77.41), (5678,82.17), (5673,97.56), (5667,94.97), (5661,81.73), (5656,91.61), (5650,99.15), (5644,73.89), (5639,85.09), (5633,85.24), (5622,86.56), (5599,90.15), (5549,80.77), (5504,71.89), (5498,94.98), (5475,79.79), (5447,82.10), (5425,74.74), (5402,80.08), (5397,93.89), (5374,76.36), (5357,71.00)] |

| SPY Combos: [575.24, 570.18, 565.11, 565.67] |

| NDX Combos: [19442, 19695, 19501, 19909] |

| QQQ Combos: [471.8, 477.95, 482.68, 472.75] |

0 comentarios