Macro Theme:

Key dates ahead:

- 9/18 FOMC/VIX Exp

- 9/20 Huge Quarterly OPEX

9/18 – 9/20 is a major inflection point for equities, due to VIX Exp & FOMC (9/18), followed by Triple-Witching-OPEX.

Key SG levels for the SPX are:

- Support: 5,620, 5,600, 5,500

- Resistance: 5,650, 5,660, 5,700

- As of 9/18/24:

- Models remain risk-on in the positive-gamma zone >5,600, with short term resistance at 5,660 & 5,700.

- Should 5,600 hold post-FOMC, we target 5,750 (JPM Collar strike) by Sep 30.

- Risk off <5,600, with a quick initial target of 5,500.

QQQ:

- Support: 472, 470, 460

- Resistance: 475, 480

IWM:

- Support: 213, 210, 200

- Resistance: 220

- As of 9/17/24:

- Price will likely remain very fluid from 220 down to 200 due to negative gamma (i.e. risk below). We see dealers flipping to a positive gamma stance >220, and into 225 (resistance/slows upside movement).

Founder’s Note:

Futures are quiet this morning, ahead of 9:30AM ET VIX Expiration and 2pm FOMC. Traders want to be weary of unusual ES price moves around the cash open, due to VIX expiration.

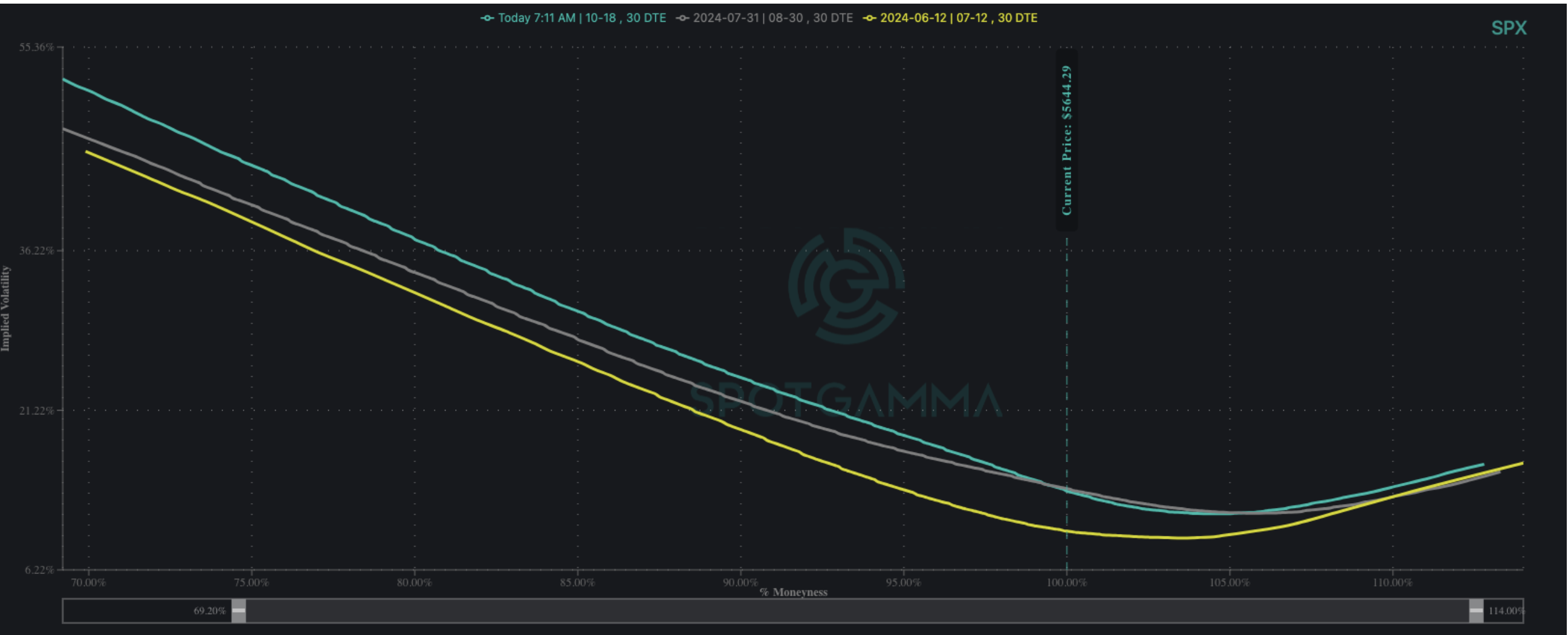

Vols are quite elevated vs recent FOMC’s, with 1-month skew for today (green) vs July (gray) and June (yellow). This higher IV makes sense give the rate uncertainty. However, in the context of risk-possibilities, we see 1% OTM puts at a ~14.5% IV…that isn’t much considering 1-month realized vol is at 14%.

This plays into our post-FOMC outlooking, with our most unique insight being the high potential volatility that emerges should the S&P break <5,600.

Before covering the downside, we’ll cover the upside, which is basic:

We continue to lean long until/unless 5,600 is broken, with 5,700 the initial upside target. There is a big pocket of

large gamma strikes

up at 5,750 (part of the JPM collar), which is the end-of-month level to watch.

Back to the downside, which is the more interesting case.

Our view that downside volatility may be in excess of what the market is pricing is due the twin-triggers of 1) negative gamma & 2) “correlation spasms”.

Correlation spasms encompass the idea that the NVDA/chip momentum trade, which was piled into on 9/11, will re-unwind. When this happens we see equity correlation snap higher (candle plot), which is linked to large jumps in IV (VIX, purple). These types of moves have triggered the largest equity selloffs we’ve seen this year: April, July, August & September – all moves which drew ~5% Index drawdowns and over -10% NVDA/chip declines (see video on this topic here).

In regards to the gamma complex, we find that its a flat to negative gamma complex at 5,600, and convincingly negative <5,600 (red dashed line = 5,620). There appear to be some heavy negative gamma strikes at 5,550 & 5,500, with “not much” down below that. Given this setup, should 5,600 break we would look for a quick test of 5,500, at which point we’d look to roll hedges “down (in strike) and out (in time)” as we update/reassess positioning.

As we discussed in yesterday’s webinar, this setup looks a lot like that of August 1st, wherein a break of 5,500 (vs 5,600 today) opened the door to higher volatility. We’re not saying VIX 65 is in the cards – but the combination of negative gamma + uncertain rate impacts are risky conditions. Taken together, ~15% IV for 1% OTM puts seems a pretty reasonable hedge – with Dec puts being more attractive given the IV-stickiness of elections.

(Note, this behind-the-scenes gamma plot is from our new proprietary positioning data, which powers Trace.)

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5699.43 | $5634 | $563 | $19432 | $473 | $2205 | $219 |

| SG Gamma Index™: |

| 0.953 | -0.039 |

|

|

|

|

| SG Implied 1-Day Move: | 0.52% | 0.52% | 0.52% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5655.43 | $5590 | $560 | $19190 | $473 | $2120 | $218 |

| Absolute Gamma Strike: | $5665.43 | $5600 | $550 | $19450 | $475 | $2200 | $220 |

| Call Wall: | $5815.43 | $5750 | $570 | $19450 | $480 | $2200 | $225 |

| Put Wall: | $5565.43 | $5500 | $540 | $18500 | $440 | $2000 | $210 |

| Zero Gamma Level: | $5625.43 | $5560 | $557 | $18950 | $472 | $2167 | $219 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.101 | 0.959 | 1.433 | 0.904 | 1.119 | 0.930 |

| Gamma Notional (MM): | $456.992M | $306.423M | $12.478M | $4.943M | $15.277M | $65.334M |

| 25 Delta Risk Reversal: | -0.048 | 0.00 | -0.05 | -0.032 | -0.02 | -0.014 |

| Call Volume: | 527.899K | 1.465M | 7.422K | 645.086K | 31.186K | 796.718K |

| Put Volume: | 886.222K | 2.049M | 7.424K | 819.117K | 37.204K | 1.018M |

| Call Open Interest: | 7.876M | 5.849M | 69.08K | 3.705M | 368.851K | 5.184M |

| Put Open Interest: | 15.103M | 15.065M | 88.951K | 6.802M | 572.972K | 9.707M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5550, 5650, 5500] |

| SPY Levels: [550, 560, 570, 555] |

| NDX Levels: [19450, 19500, 20000, 19000] |

| QQQ Levels: [475, 470, 480, 465] |

| SPX Combos: [(5899,94.62), (5871,77.16), (5849,93.96), (5826,84.79), (5798,98.05), (5781,78.42), (5775,90.78), (5770,79.40), (5753,81.07), (5747,99.73), (5736,91.43), (5730,80.93), (5725,97.96), (5719,78.06), (5713,80.87), (5708,83.33), (5702,94.43), (5697,99.44), (5691,86.76), (5685,74.20), (5680,81.40), (5674,96.39), (5668,76.70), (5663,78.60), (5651,99.00), (5640,69.66), (5635,81.03), (5623,78.63), (5606,72.69), (5601,86.89), (5550,81.44), (5544,69.65), (5505,78.33), (5499,96.40), (5471,87.44), (5449,87.70), (5426,85.02), (5404,81.97), (5398,94.13), (5375,77.08)] |

| SPY Combos: [573.3, 568.25, 563.19, 570.49] |

| NDX Combos: [19452, 19704, 19899, 18869] |

| QQQ Combos: [472.88, 479.02, 474.3, 484.22] |

0 comentarios