Macro Theme:

Key dates ahead:

- 9/20 Huge Quarterly OPEX

Following FOMC, we see equities in a negative gamma stance, which implies upside volatility may remain. SPX 5,750 & IWM 230 are the major upside levels into 9/20 OPEX.

Into Friday/Monday OPEX may offer some price consolidation.

Key SG levels for the SPX are:

- Support: 5,700, 5,650

- Resistance: 5,725, 5,750, 5,800

- As of 9/19/24:

- Initial upside target of 5,750 remains in tact following the post-FOMC close >5,600 on 9/18

- Flat equities <5,700

- Risk-off on a break <5,650

QQQ:

- Support: 480, 474

- Resistance: 485

IWM:

- Support: 225, 220

- Resistance: 230

- As of 9/19/24:

- Models hold long while >225, with 230 the upside target

Founder’s Note:

Futures are off fractionally ahead of today’s large expiration. We continue to watch 5,700 as our

pivot

level: maintain net longs >5,700, and shift to a more flat/neutral position below. Ultimately we suspect that traders will be using any OPEX related weakness to buy-in, but should the SPX break <5,650 we’ll be looking to own puts.

First up for expiry are the very large SPX AM options, which settle at 9:30 AM. This is then followed by SPX PM options, major ETF’s (SPY, QQQ, etc) and single stocks settling at 4PM.

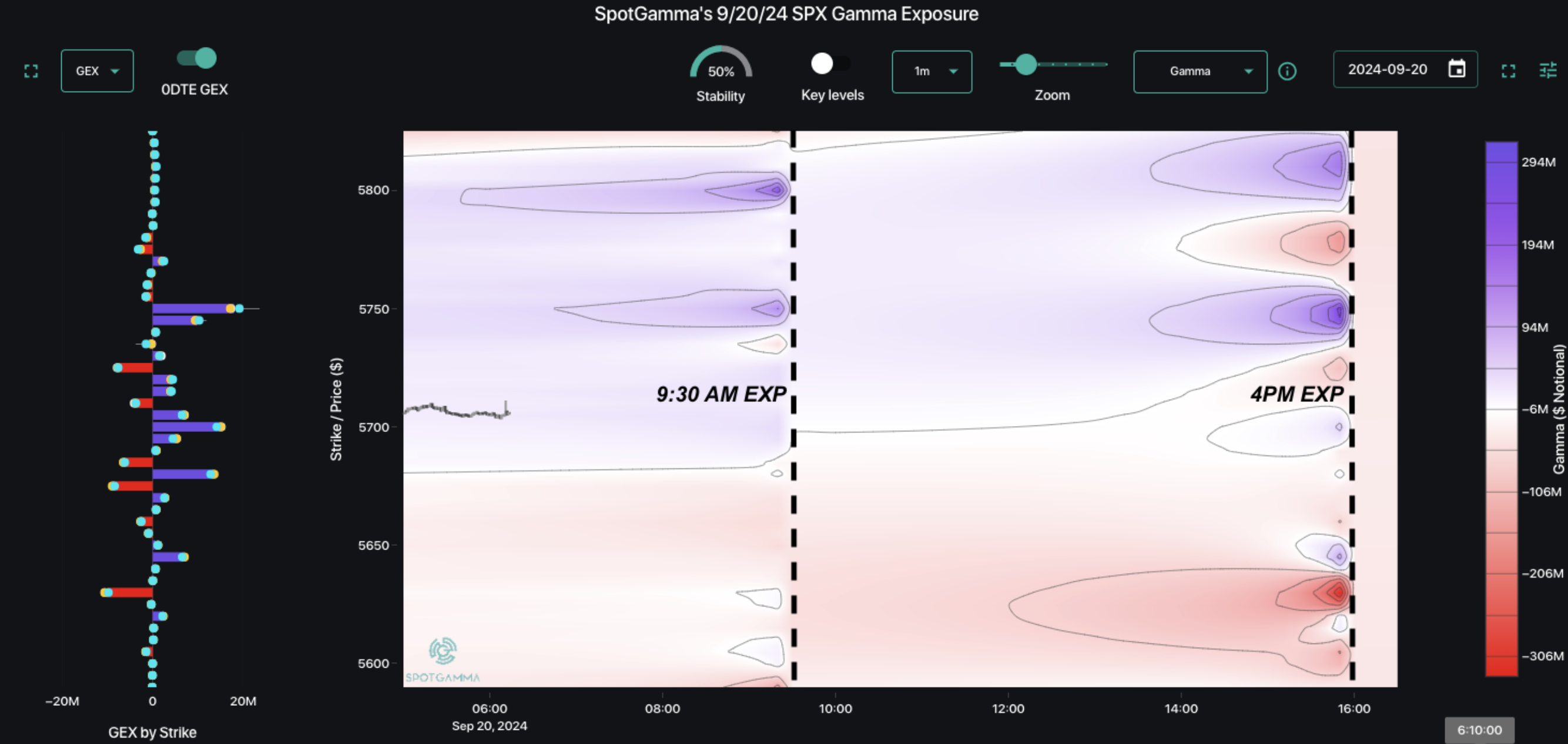

The Trace gamma map shows how these expirations impact the SPX dealer hedging position… quite frankly in a way we’ve never been able to articulate.

As you can see, the 9:30AM expiration removes some positive gamma (blue zone(s) >5,700 decrease), with the 4PM expiration serving to remove whatever positive gamma is left. For this reason our map is a light shade of red after 4PM .

This suggests that we should have some stability >5,700 for today, and we lose that pinning/stability post-OPEX.

Speaking of expiration, just how big is it?

We currently measure it as in-line with the previous June & March quarterly expirations. Goldman (and ex-Goldman) analysts will put out a number like “$5.3 TRILLION”, which is a “13F style calculation” (i.e take OI * stock price). To quote Chazz Michael Michaels: “No one knows what it means but it’s provocative.”

To better frame OPEX, we like to look at delta notional, because at OPEX it essentially signals the intrinsic value of options expiring. Accordingly, we think its a barometer for the hedge size dealers may have on.

We spent the early morning hours putting together the tree-map below. While the Christmas-color scheme is terrible (sorry), it does nicely depict just how large the S&P500 (SPX+SPY) expiry size is vs all other positions. Top right is single stocks, with ETF’s (ex SPY/IWM/QQQ), and Index (NQ, RUT) bottom right. You can also see that across the board call positions (green squares) are +3:1 vs put positions (red squares).

That +3:1 call:put ratio is what is interesting into this OPEX. The rally from 9/11 and capped off yesterday served to ramp up call values into today, and that has produced an upside-imbalance. For this reason, we think some consolidation is in the cards today and into Monday (this is what we said yesterday AM, too). The point being that the fade from yesterday’s all-time-highs could as much be due to market momentum hitting a giant OPEX wall, as it could be due to macro-mavens second guessing 50bps impacts.

We wanted to flag one interesting position today: NVDA.

There is a giant +$2bn of raw gamma at the 120 strike, and we think about 1/2 of that expires today.

NVDA has been unable to take out that 120 level the last several days, and is underperforming the SPY/QQQ & SMH by nearly 3% over the last 5 days.

This suggests that OPEX could remove some resistance. What makes this more enticing is that IV seems, well…cheap. Shown below is 1-month skew, which is at 90-day lows. TLDR: Calls may be a defined-risk way to play NVDA coming back to life.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5775.87 | $5713 | $570 | $19839 | $483 | $2252 | $223 |

| SG Gamma Index™: |

| 3.208 | 0.315 |

|

|

|

|

| SG Implied 1-Day Move: | 0.53% | 0.53% | 0.53% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5797.33 | $5734.46 | $570.85 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5736.87 | $5674 | $564.83 |

|

|

|

|

| SG Volatility Trigger™: | $5677.87 | $5615 | $568 | $19190 | $474 | $2230 | $218 |

| Absolute Gamma Strike: | $5762.87 | $5700 | $570 | $20000 | $480 | $2250 | $220 |

| Call Wall: | $5812.87 | $5750 | $570 | $20000 | $485 | $2250 | $225 |

| Put Wall: | $5462.87 | $5400 | $560 | $18500 | $450 | $2145 | $210 |

| Zero Gamma Level: | $5657.87 | $5595 | $565 | $19202 | $479 | $2197 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.406 | 1.369 | 1.463 | 1.27 | 1.226 | 1.411 |

| Gamma Notional (MM): | $1.084B | $1.312B | $13.879M | $458.635M | $32.844M | $768.348M |

| 25 Delta Risk Reversal: | -0.038 | -0.033 | -0.039 | -0.03 | -0.016 | -0.012 |

| Call Volume: | 898.107K | 2.301M | 19.787K | 980.393K | 44.621K | 594.478K |

| Put Volume: | 1.428M | 3.285M | 12.254K | 1.732M | 76.868K | 540.592K |

| Call Open Interest: | 8.137M | 5.207M | 70.084K | 3.785M | 388.011K | 5.17M |

| Put Open Interest: | 15.755M | 16.019M | 93.92K | 7.15M | 618.749K | 9.819M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5700, 5750, 5650, 5600] |

| SPY Levels: [570, 575, 572, 560] |

| NDX Levels: [20000, 19900, 19925, 19500] |

| QQQ Levels: [480, 485, 475, 470] |

| SPX Combos: [(5948,87.61), (5925,74.21), (5902,98.27), (5874,85.57), (5856,70.27), (5851,98.10), (5834,73.67), (5828,93.75), (5822,78.63), (5811,69.65), (5805,86.76), (5799,99.78), (5788,89.56), (5782,91.19), (5776,98.15), (5771,92.77), (5765,93.27), (5759,90.00), (5754,97.28), (5748,99.99), (5742,98.30), (5736,93.99), (5731,92.26), (5725,99.79), (5719,90.75), (5714,94.27), (5708,93.07), (5702,99.89), (5674,88.60), (5651,92.66), (5645,70.11), (5605,77.49), (5548,74.89), (5502,94.12), (5474,74.51), (5451,79.10)] |

| SPY Combos: [579.46, 584.03, 574.33, 581.75] |

| NDX Combos: [19899, 20118, 19701, 20514] |

| QQQ Combos: [485.83, 492.11, 487.28, 497.43] |

0 comentarios