Macro Theme:

Key dates ahead:

- 9/26 GDP

- 9/30 Quarter End OPEX

We’re looking for OPEX-related price consolidation as call-heavy positions adjust, which could extend into Monday. <5,700 we flip from net long to neutral. <5,650 we flip from neutral to net short.

Key SG levels for the SPX are:

- Support: 5,700, 5,690, 5,650

- Resistance: 5,740, 5,750

- As of 9/20/24:

- We are long >5,700, with 5,750 key upside target (9/30 JPM collar strike)

- We position flat equities <5,700

- Risk-off on a break <5,650

QQQ:

- Support: 480, 474

- Resistance: 485

IWM:

- Support: 220, 218

- Resistance: 225, 230

- As of 9/20/24:

- 225 failed yesterday, we now eye very large gamma at 220 implies major support

- A break <218 implies a test of 210

Founder’s Note:

Today we are extremely excited to introduce TRACE – our new positioning application. This week only, all SpotGamma members will have access to this amazing tool – with Alpha members receiving permanent access. Just click “TRACE” on the left navigation bar! SG Members can join us at 10:00AM ET for an Intro Webinar.

Futures are up fractionally this AM after Friday’s very large, call-heavy expiration. 5,700, the largest gamma strike is our

pivot

level, with down at 5,690 and then into 5,650. Resistance shows at 5,742 then 5,750. 5,750, if tested, will be much discussed as it is part of the JPM collar (JPM fund is short ~40k calls) which expires on Monday, 9/30.

Given the imbalance to calls expiring, our view is/was that this large expiration would generate some weakness on the equity front. Accordingly the SPX took a stab lower on Friday to 5,675 (1% from Thurs ATH), wherein it seems like traders elected to sell SPX puts. This helped to put (both literally and figuratively) a floor in the SPX on Friday which ultimately closed right on the big gamma strike at 5,700. There are likely some more positions to clean up this AM, and so we could see a bit of extra volatility this AM, accordingly.

Overall, though, we are leaning long in this environment looking for an upside target of 5,750. Per our Friday AM note we will look to buy dips until/unless 5,650 is broken. <5,650 is “risk off”.

What’s interesting about this 1-day weakness is that it is confusing many in the macro set, who are trying to read into equities failure to follow through on the Fed 50bps cut. Missing from these drawdown thesis is Friday’s huge OPEX – an event which should give analysts pause about extrapolating short term weakness as macro-related concerns.

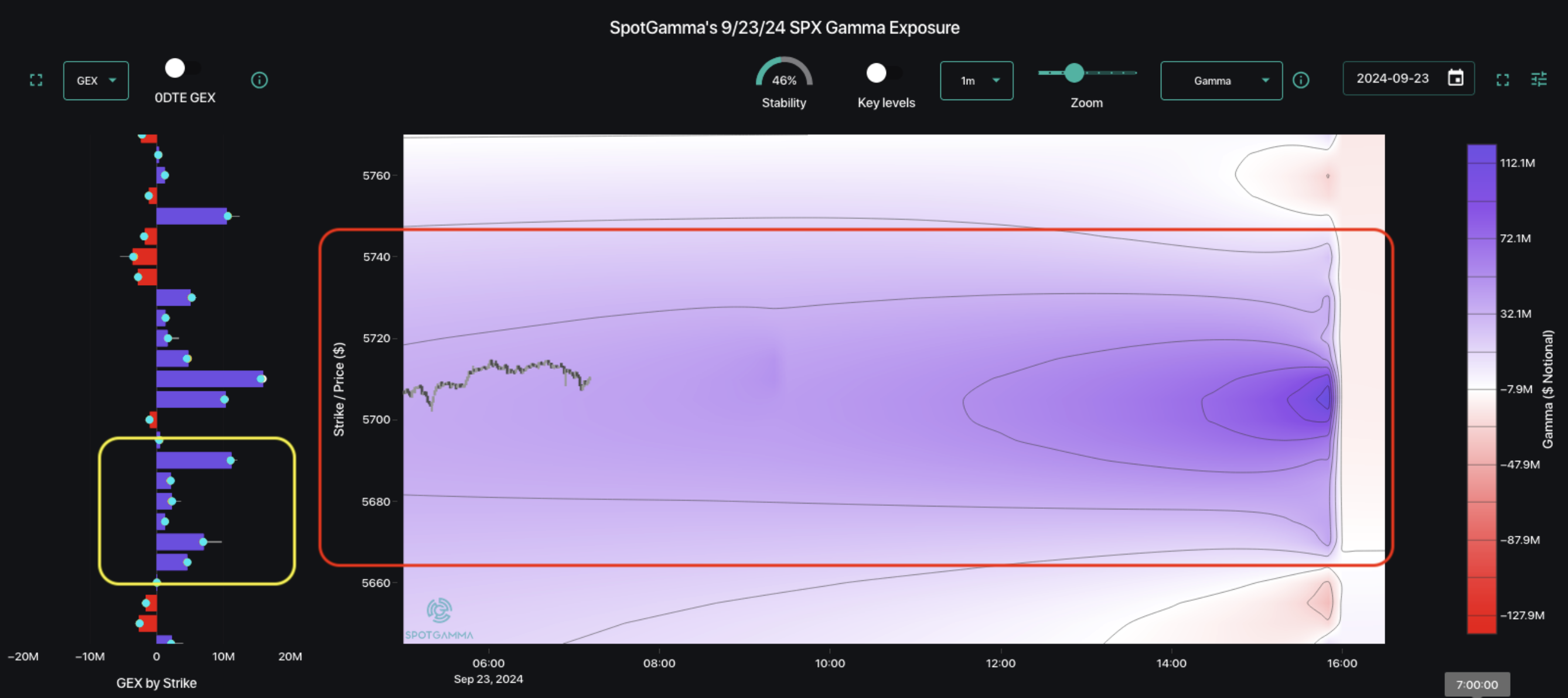

The result of traders selling those short puts, is that dealers are long puts into 5,650. That is a positive gamma position, inferring dealers should buy into any equity weakness into 5,650. You can see these put positions as blue bars in the Trace map, below (yellow box).

These new puts fit into a

gamma profile

that is overall positive, with positive gamma colored blue in our Trace maps (red box). This positive gamma position is statistically linked (using the latest Trace data) as a more stable S&P500 environment.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5761.01 | $5702 | $568 | $19791 | $482 | $2227 | $221 |

| SG Gamma Index™: |

| 2.134 | -0.002 |

|

|

|

|

| SG Implied 1-Day Move: | 0.55% | 0.55% | 0.55% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5704.01 | $5645 | $566 | $19660 | $479 | $2230 | $219 |

| Absolute Gamma Strike: | $5809.01 | $5750 | $570 | $19725 | $480 | $2200 | $220 |

| Call Wall: | $5809.01 | $5750 | $570 | $19725 | $490 | $2300 | $225 |

| Put Wall: | $5359.01 | $5300 | $560 | $18500 | $450 | $2145 | $210 |

| Zero Gamma Level: | $5686.01 | $5627 | $567 | $19446 | $481 | $2222 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.401 | 0.998 | 1.729 | 0.950 | 1.104 | 1.009 |

| Gamma Notional (MM): | $667.869M | $65.662M | $11.885M | $92.514M | $1.51M | $25.942M |

| 25 Delta Risk Reversal: | -0.037 | -0.018 | -0.04 | -0.031 | 0.00 | -0.018 |

| Call Volume: | 591.179K | 1.658M | 16.562K | 658.515K | 27.795K | 319.544K |

| Put Volume: | 1.103M | 2.401M | 11.779K | 834.046K | 45.693K | 552.919K |

| Call Open Interest: | 6.239M | 4.842M | 55.675K | 2.785M | 274.14K | 3.971M |

| Put Open Interest: | 12.675M | 12.991M | 71.187K | 5.57M | 480.33K | 7.564M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5750, 5700, 5600, 5000] |

| SPY Levels: [570, 560, 565, 550] |

| NDX Levels: [19725, 20000, 19500, 19900] |

| QQQ Levels: [480, 490, 470, 450] |

| SPX Combos: [(5948,87.65), (5925,70.99), (5902,97.59), (5874,83.04), (5868,73.46), (5851,97.71), (5834,76.63), (5828,69.73), (5822,94.88), (5811,69.69), (5799,99.37), (5788,86.71), (5782,92.04), (5777,94.42), (5771,95.96), (5765,76.23), (5760,91.00), (5754,81.67), (5748,99.96), (5742,97.94), (5737,89.19), (5731,92.75), (5725,97.39), (5720,96.21), (5714,84.71), (5708,94.09), (5703,99.06), (5691,82.22), (5674,82.31), (5663,75.50), (5651,78.90), (5617,81.63), (5600,76.96), (5549,79.83), (5520,77.99), (5497,90.14), (5452,79.41)] |

| SPY Combos: [571.51, 566.96, 569.24, 576.62] |

| NDX Combos: [19732, 19890, 20108, 20504] |

| QQQ Combos: [483.88, 489.18, 479.05, 498.83] |

0 comentarios