Macro Theme:

Key dates ahead:

- 9/26 GDP & Powell Speaking

- 9/30 Quarter End OPEX

We’re looking for OPEX-related price consolidation as call-heavy positions adjust, which could extend into Monday. <5,700 we flip from net long to neutral. <5,650 we flip from neutral to net short.

Key SG levels for the SPX are:

- Support: 5,720, 5,700

- Resistance: 5,750

- As of 9/20/24:

- We are long >5,700, with 5,750 key upside target (9/30 JPM collar strike)

- We position flat equities <5,700

- Risk-off on a break <5,650

QQQ:

- Support: 480, 474

- Resistance: 485

IWM:

- Support: 220, 218

- Resistance: 225, 230

- As of 9/20/24:

- 225 failed yesterday, we now eye very large gamma at 220 implies major support

- A break <218 implies a test of 210

Founder’s Note:

Futures are sliding higher today, indicating an ES/SPX open near yesterday’s (and all-time) highs.

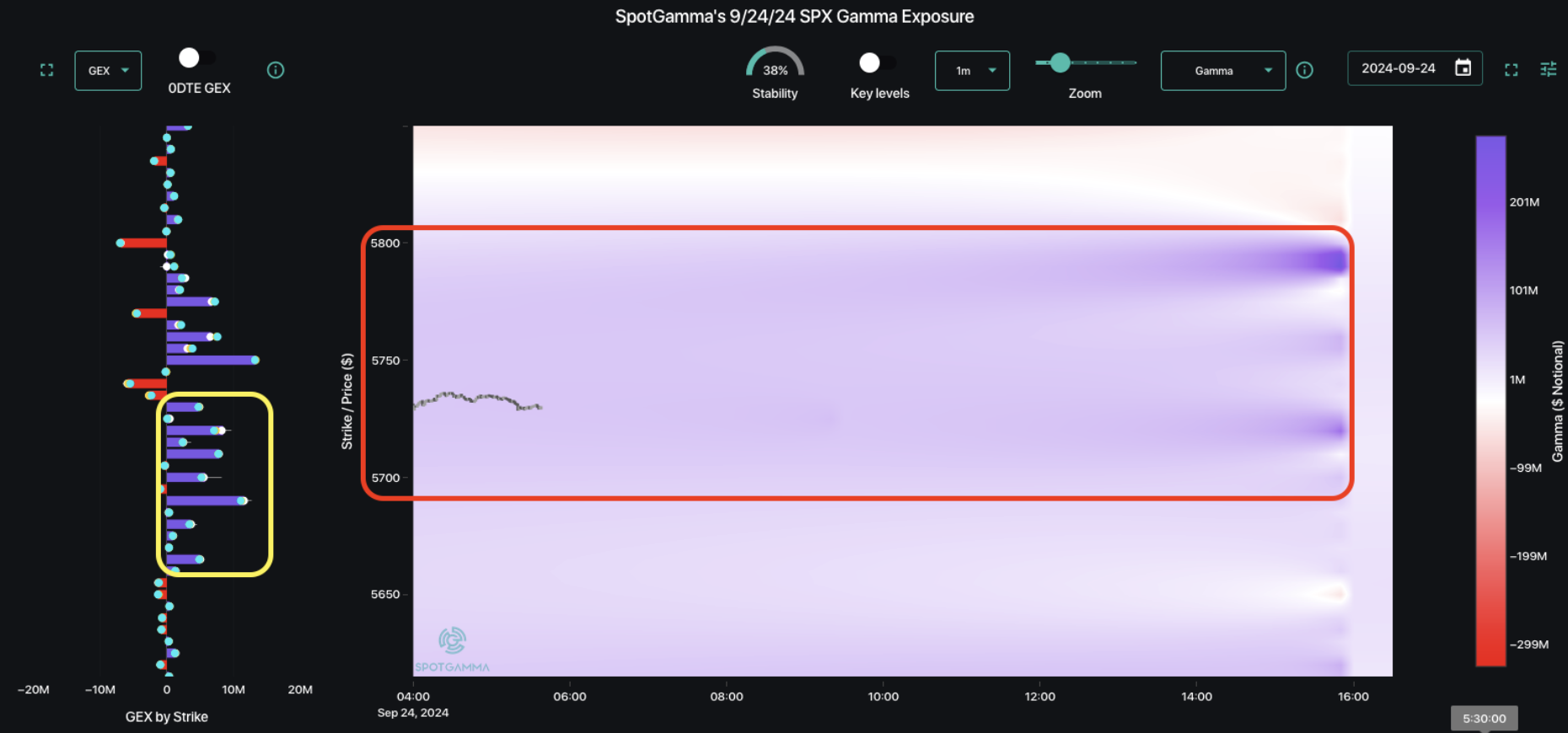

Support today is at 5,720 & 5,700. Heavy resistance is at 5,750. The S&P remains in a positive gamma position, as indicated in Trace by the blue gamma map, below. Further, you can see there are a fair number of short put positions, providing support into and around 5,700 (yellow box). Said another way – its looking a bit dull today (like yesterday).

Now that Monday has cleared, we think any lingering OPEX flows are cleared, too. There remains a big quarterly expiration on Monday 9/30, which is as much or more about equity rebalances than options-related flows (ex: AAPL on Friday). While quarterly equity rebalances can drive some unusual flows, we know the 9/30 OPEX strike to watch is 5,750 – and its big.

5,750 is the call strike for the infamous JPM collar trade – a strike which has a current open interest of 45k. Thats a lot of gamma, which only increases if the SPX lingers around that strike over the coming days.

Zooming out/away from dynamics over the next few days, the bigger risk signal seems to be “on”.

We make this statement due to the implied volatility picture. Shown below is the SPX term structure from post-FOMC (last Wed, gray) vs today. As you can see, vol has sunk, with pre-election IV pressing down near 90-day lows (gray shaded cone). Post-election IV’s are comparatively higher, and will remain so until a president is elected.

There are still 4-5 weeks before then, which allows 0DTE traders and short-term vol sellers to “do their thing”. That “thing” is to pound (lower) the front end of the SPX vol curve, while searching for relative long vol positions in top single stocks.

That brings us to TSLA. TSLA has had a very strong move since the Fed cut – up 9% into last night and up another 1.7% pre-market, today. We have admittedly been in favor of selling 9/27 exp TSLA calls/call calendar spreads, with the idea that TSLA has received an extra kick from those rate cuts (vs other Mag 7’s with more cash).

Why 9/27? Because TSLA has a Q2 deliveries on 10/2, a robo-taxi event on 10/10, and then earnings on 10/16. This has the term structure “all jacked up”, as you can see below. Given all these events, >=Oct exp vol is going to be higher & stickier.

TSLA is always interesting to us because it was the “OG” gamma squeeze, with massive options volumes starting in early ’20 (pre-meme mania), and persisting to this day. Therefore we can’t help but wonder that, if these events are bullish, this name can slide back into the 0DTE lead as it replaces NVDA as the momentum-trade du jour.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5775.48 | $5718 | $569 | $19852 | $483 | $2220 | $220 |

| SG Gamma Index™: |

| 2.201 | -0.066 |

|

|

|

|

| SG Implied 1-Day Move: | 0.69% | 0.69% | 0.69% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5824.62 | $5767.14 | $574.01 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5745.57 | $5688.1 | $566.15 |

|

|

|

|

| SG Volatility Trigger™: | $5727.48 | $5670 | $569 | $19590 | $483 | $2220 | $219 |

| Absolute Gamma Strike: | $5807.48 | $5750 | $570 | $19725 | $480 | $2200 | $220 |

| Call Wall: | $5807.48 | $5750 | $570 | $19725 | $490 | $2245 | $225 |

| Put Wall: | $5457.48 | $5400 | $560 | $18500 | $450 | $2145 | $210 |

| Zero Gamma Level: | $5699.48 | $5642 | $568 | $19359 | $482 | $2215 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.382 | 0.932 | 1.641 | 0.888 | 1.021 | 0.941 |

| Gamma Notional (MM): | $832.376M | $131.142M | $12.552M | ‑$33.076M | $239.029K | $11.773M |

| 25 Delta Risk Reversal: | -0.04 | -0.021 | -0.042 | -0.019 | -0.024 | -0.019 |

| Call Volume: | 412.174K | 1.206M | 6.004K | 543.021K | 17.923K | 273.233K |

| Put Volume: | 782.947K | 1.925M | 7.945K | 712.694K | 22.922K | 270.751K |

| Call Open Interest: | 6.313M | 4.912M | 55.214K | 2.831M | 280.313K | 4.012M |

| Put Open Interest: | 12.753M | 13.506M | 71.303K | 5.667M | 488.749K | 7.606M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5750, 5700, 5600, 5000] |

| SPY Levels: [570, 569, 560, 565] |

| NDX Levels: [19725, 20000, 19500, 19900] |

| QQQ Levels: [480, 485, 475, 490] |

| SPX Combos: [(5999,97.82), (5953,87.38), (5924,80.46), (5902,97.71), (5873,91.84), (5850,97.65), (5833,88.23), (5827,86.48), (5822,85.13), (5810,71.10), (5799,99.33), (5793,90.47), (5787,74.26), (5781,90.54), (5776,95.72), (5770,96.90), (5764,90.56), (5759,90.70), (5753,99.98), (5747,81.55), (5741,97.76), (5736,85.91), (5730,92.96), (5724,98.99), (5719,89.63), (5713,89.75), (5701,98.60), (5684,72.64), (5650,72.22), (5621,84.88), (5598,77.58), (5553,79.94), (5524,80.11), (5501,89.54), (5473,80.49), (5450,78.52)] |

| SPY Combos: [574.16, 579.28, 569.6, 573.59] |

| NDX Combos: [19733, 19932, 19892, 20130] |

| QQQ Combos: [481.57, 485.44, 490.75, 500.41] |

0 comentarios