Macro Theme:

Key dates ahead:

- 9/26 GDP & Powell Speaking

- 9/30 Quarter End OPEX

TLDR: We continue to maintain long positions >5,700, and would flip to neutral if the SPX goes <5,700. We expect more chop today, with eyes remaining on time & price: 5,750 & Monday 9/30. 9/30, being quarter end, likely unlocks market movement.

Key SG levels for the SPX are:

- Support: 5,700

- Resistance: 5,750

- As of 9/20/24:

- We are long >5,700, with 5,750 key upside target (9/30 JPM collar strike)

- We position flat equities <5,700

- Risk-off on a break <5,650

QQQ:

- Support: 485, 480

- Resistance: 490

IWM:

- Support: 220, 218

- Resistance: 225, 230

- As of 9/20/24:

- 225 failed yesterday, we now eye very large gamma at 220 implies major support

- A break <218 implies a test of 210

Founder’s Note:

Futures are mildly lower to start. For today, S&P support remains at 5,700 and resistance at 5,750. Further, the S&P holds a mild positive gamma environment, which infers dips should be bought, and rips should be sold.

TLDR: We continue to maintain long positions >5,700, and would flip to neutral if the SPX goes <5,700. We expect more chop today, with eyes remaining on time & price: 5,750 & Monday 9/30. 9/30, being quarter end, likely unlocks market movement.

The predominant way to frame this current market is “call selling”. Its an expression of lack of an upside catalyst, but at the same time no reason to bet on down side. At the same time, you likely don’t want to be materially short >1-month puts/volatility due to the upcoming election.

Not only that, we have the big JPM short call position weighing just above (~40k contracts of 5,750 9/30 exp).

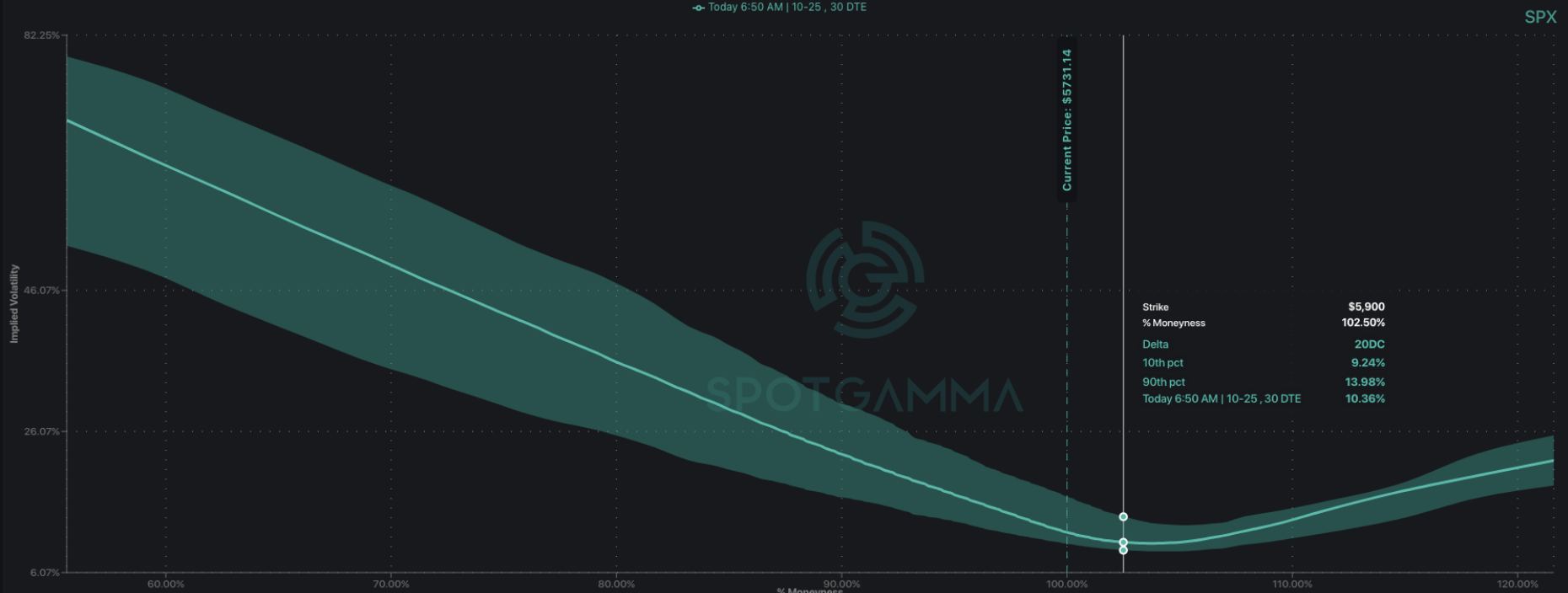

This “short call” theme is seen in very low upside SPX IV, as highlighted in the 1-month vol skew, below. At ~10% IV these pre-election calls seem to cheap to sell…but does “cheap” mean you want to buy ’em?

For that we’re going to need a catalyst…a raison d’être.

Here is IWM term structure. This reflects a bit of event vol for next Friday’s NFP (10/3), but prior to that its the lowest at-the-money vol we’ve seen in months. Traders apparently see no real catalyst. It seems the 50bps cut was a wet-blanket thrown on volatility.

But wait, there’s (apparently) more…lack of vol.

NVDA, a name we flagged for possible upside due to: 1) the removal of huge $2bn OPEX gamma at 120, and 2) statistically low call IV, has sunk even more into the depths of volatility lows. That low IV is pretty remarkable, and we note the stock caught a nice +4% bid yesterday due to news that the CEO was done with his pre-planned share selling (netting a cool $700mm). Is the close >120 yesterday a sign of more NVDA upside?

Well, our feeling is this: the upside resistance was removed due to OPEX, and as a great trader once said to us “sometimes you just buy options because they’re cheap.” If the market gets back into bullish gear, we’d anticipate NVDA leading the charge.

As far as catalysts, we’ve got our eyes squarely on quarter end. Its not a particularly large OPEX – just the one big JPM collar SPX position at 5,750. The removal of that position could signal a shift in SPX prices (i.e. volatility), given it pulls away positive gamma at 5,750.

Additionally, we suspect quarter end could be a trigger for a lot of equity (and assets generally) rebalances – particularly given that Powell just cut rates last week. This generally may start to trigger larger directional moves into the start of October. Does this mean equity vol expresses to the upside? Well, no…but we see no risk flags at the moment.

That changes into the end of October, where we think focus will start to shift to election risks.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5788.9 | $5732 | $571 | $19944 | $485 | $2223 | $221 |

| SG Gamma Index™: |

| 2.362 | -0.025 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5741.9 | $5685 | $569 | $19575 | $484 | $2220 | $219 |

| Absolute Gamma Strike: | $5806.9 | $5750 | $570 | $19725 | $480 | $2200 | $220 |

| Call Wall: | $5806.9 | $5750 | $575 | $19725 | $490 | $2245 | $225 |

| Put Wall: | $5456.9 | $5400 | $560 | $18500 | $450 | $2145 | $210 |

| Zero Gamma Level: | $5713.9 | $5657 | $570 | $19450 | $484 | $2218 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.398 | 0.975 | 1.777 | 0.934 | 1.071 | 0.999 |

| Gamma Notional (MM): | $930.358M | $436.07M | $15.24M | $20.076M | $4.966M | $92.076M |

| 25 Delta Risk Reversal: | -0.04 | -0.02 | -0.04 | -0.017 | -0.023 | -0.018 |

| Call Volume: | 364.966K | 1.224M | 6.592K | 641.726K | 8.118K | 293.718K |

| Put Volume: | 753.158K | 1.677M | 8.241K | 823.234K | 11.793K | 351.254K |

| Call Open Interest: | 6.348M | 5.021M | 55.995K | 2.879M | 281.086K | 3.983M |

| Put Open Interest: | 12.913M | 13.695M | 72.508K | 5.78M | 488.903K | 7.694M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5750, 5700, 5600, 5000] |

| SPY Levels: [570, 571, 575, 560] |

| NDX Levels: [19725, 20000, 19900, 20500] |

| QQQ Levels: [480, 485, 490, 475] |

| SPX Combos: [(6002,97.94), (5951,88.25), (5928,76.96), (5899,97.99), (5876,86.15), (5871,75.36), (5848,98.27), (5836,79.97), (5830,74.09), (5825,88.05), (5819,88.12), (5807,80.83), (5802,99.54), (5790,89.35), (5785,79.16), (5779,93.40), (5773,96.46), (5767,99.31), (5762,95.41), (5756,92.33), (5750,99.99), (5744,86.08), (5739,97.91), (5733,81.17), (5727,98.03), (5721,90.19), (5699,94.29), (5681,78.04), (5676,73.31), (5670,80.15), (5618,83.74), (5601,85.19), (5549,80.49), (5521,76.61), (5498,88.86), (5452,75.47)] |

| SPY Combos: [574.67, 579.24, 571.81, 569.53] |

| NDX Combos: [20144, 20005, 19725, 20543] |

| QQQ Combos: [482.44, 487.29, 486.32, 492.14] |

0 comentarios