Macro Theme:

Key dates ahead:

- 9/26 GDP 8:30AM ET & Powell Speaking 9:20AM ET

- 9/30 Quarter End OPEX

TLDR: We continue to maintain long positions >5,700, and would flip to neutral if the SPX goes <5,700. We expect more chop today, with eyes remaining on time & price: 5,750 & Monday 9/30. 9/30, being quarter end, likely unlocks market movement.

Key SG levels for the SPX are:

- Support: 5,750, 5,700

- Resistance: 5,780, 5,800

- As of 9/20/24:

- We are long >5,700, with 5,750 key upside target (9/30 JPM collar strike)

- We position flat equities <5,700

- Risk-off on a break <5,650

QQQ:

- Support: 490

- Resistance: 495

IWM:

- Support: 220, 218

- Resistance: 225, 230

- As of 9/20/24:

- 225 failed yesterday, we now eye very large gamma at 220 implies major support

- A break <218 implies a test of 210

Founder’s Note:

GDP 8:30AM ET, Powell 9:20AM ET.

ES futures are +80bps, with NQ +144bps after solid earnings from MU.

This overnight move presents an interesting position for the SPX vs NDX/tech.

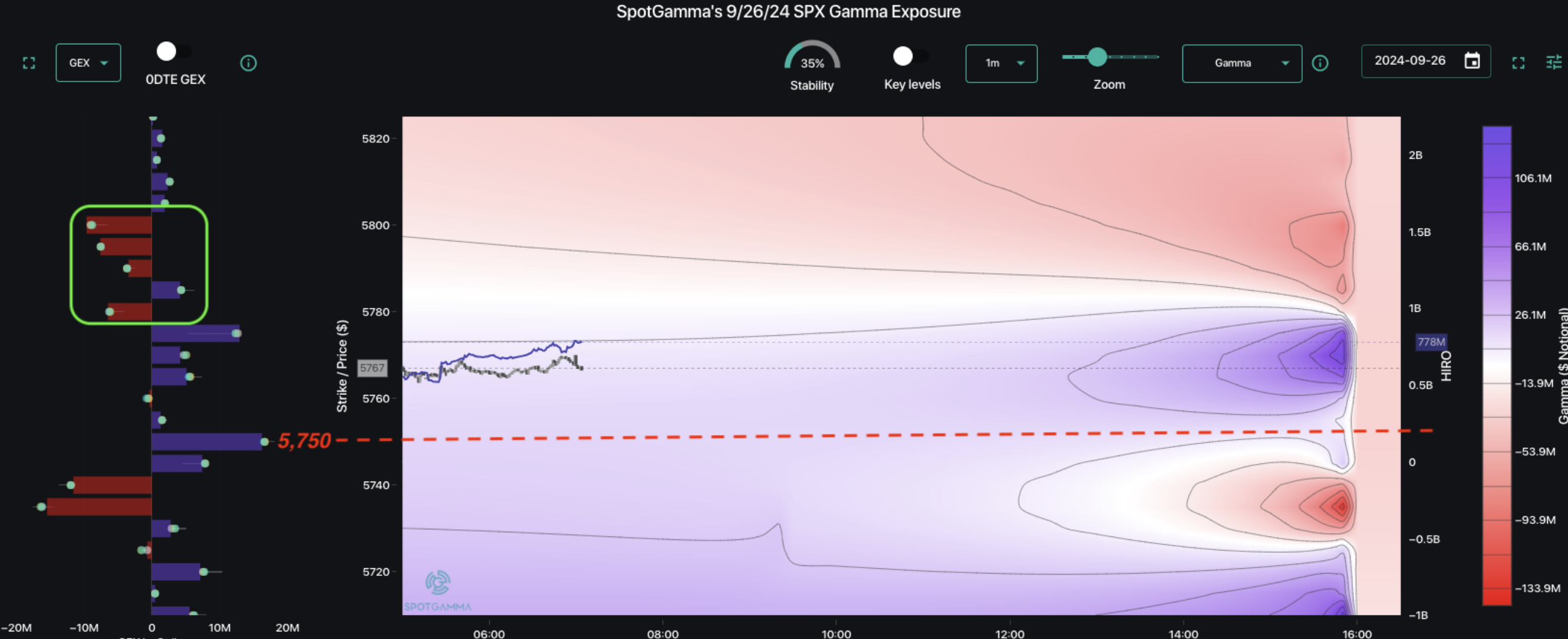

We have been focused on the big gamma at 5,750 as a resistance/pinning point into Monday, 9/30. Futures are indicating a cash open above that level, as you can see in Trace (gray candles), and so we now watch 5,750 as key support. With that, we are set to open in a positive gamma position, which is seen by the blue zone on the map between 5,750 & 5,780.

Above 5,780 SPX levels we see negative dealer gamma, as highlighted in the red box, and red color on the gamma map. This infers that, should the SPX move >=5,780, dealers may need to start buying futures, which could quickly ramp the SPX higher to 5,800.

Our hunch is that the SPX market sticks to the positive at-the-money gamma (blue zone <=5,780), and 0DTE call sellers are likely to step in in size which will erase the negative gamma above.

In other words: despite the giddy futures, today may quickly transition to another sleepy, sideways SPX session.

What’s not sleepy, is the semi-cap space. MU, which has been bid-less the last several weeks, is +17% this AM. This has SMH +3% & NVDA +2% premarket. On NVDA: In accordance with our recent NVDA long views, we watch NVDA 130 as a major resistance point due to heavy positive dealer gamma at that strike.

Semis are of course the most dominant sector of the equity market, and if they re-start higher then it has very bullish implications. However, its semis & tech which will likely outperform everything else, including SPX. What does this look like? Essentially traders selling S&P vol to buy semi vol. And that is the dynamic that brought us record low correlation, and a whole bunch of other “never seen this before” moves earlier this year (videos here for more on this).

The hitch with going “all in” on this plan, for now, is the upcoming election.

We generally think that this market has a much higher probability of a tail event vs what the market is pricing – and we think most would agree. Here is Nov SPX skew, which looks…pretty average. Yes, at/near-the-money is a bit elevated, but the tails seem uninspired. We think some time of vol bid starts to form into November, which may drag on equity performance as investing/trading takes a back seat to politics.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5779.45 | $5722 | $570 | $19972 | $485 | $2197 | $217 |

| SG Gamma Index™: |

| 1.837 | -0.061 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5752.45 | $5695 | $569 | $19690 | $484 | $2220 | $218 |

| Absolute Gamma Strike: | $5807.45 | $5750 | $570 | $20000 | $480 | $2200 | $220 |

| Call Wall: | $5807.45 | $5750 | $570 | $19725 | $490 | $2245 | $225 |

| Put Wall: | $5457.45 | $5400 | $560 | $18500 | $450 | $2145 | $210 |

| Zero Gamma Level: | $5703.45 | $5646 | $569 | $19477 | $485 | $2208 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.292 | 0.941 | 1.657 | 0.940 | 0.827 | 0.704 |

| Gamma Notional (MM): | $746.433M | $261.504M | $13.808M | $36.662M | ‑$18.703M | ‑$430.904M |

| 25 Delta Risk Reversal: | -0.042 | -0.022 | -0.04 | -0.015 | -0.028 | -0.008 |

| Call Volume: | 403.623K | 1.122M | 6.974K | 572.009K | 11.944K | 355.705K |

| Put Volume: | 732.914K | 1.905M | 7.895K | 1.142M | 18.916K | 519.225K |

| Call Open Interest: | 6.412M | 5.102M | 56.353K | 2.924M | 284.838K | 4.064M |

| Put Open Interest: | 13.029M | 14.153M | 74.23K | 5.863M | 495.414K | 7.809M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5750, 5700, 5600, 5000] |

| SPY Levels: [570, 560, 565, 569] |

| NDX Levels: [20000, 19725, 20500, 19500] |

| QQQ Levels: [480, 490, 485, 475] |

| SPX Combos: [(6003,97.86), (5951,87.71), (5923,83.12), (5900,97.67), (5877,85.19), (5871,73.97), (5848,97.73), (5837,79.01), (5831,71.46), (5825,90.24), (5820,87.89), (5802,99.30), (5791,86.35), (5785,74.75), (5779,91.27), (5774,98.08), (5768,93.94), (5762,98.04), (5757,85.28), (5751,99.98), (5745,82.55), (5739,98.28), (5734,95.38), (5722,99.05), (5711,82.05), (5699,89.00), (5694,75.76), (5682,92.52), (5671,84.60), (5659,80.36), (5642,70.70), (5619,88.48), (5602,88.23), (5573,80.71), (5551,82.00), (5522,78.53), (5499,90.49), (5448,79.71)] |

| SPY Combos: [571.72, 576.85, 573.43, 581.41] |

| NDX Combos: [20152, 19733, 20552, 19993] |

| QQQ Combos: [490.79, 487.39, 480.58, 500.51] |

0 comentarios