Macro Theme:

Key dates ahead:

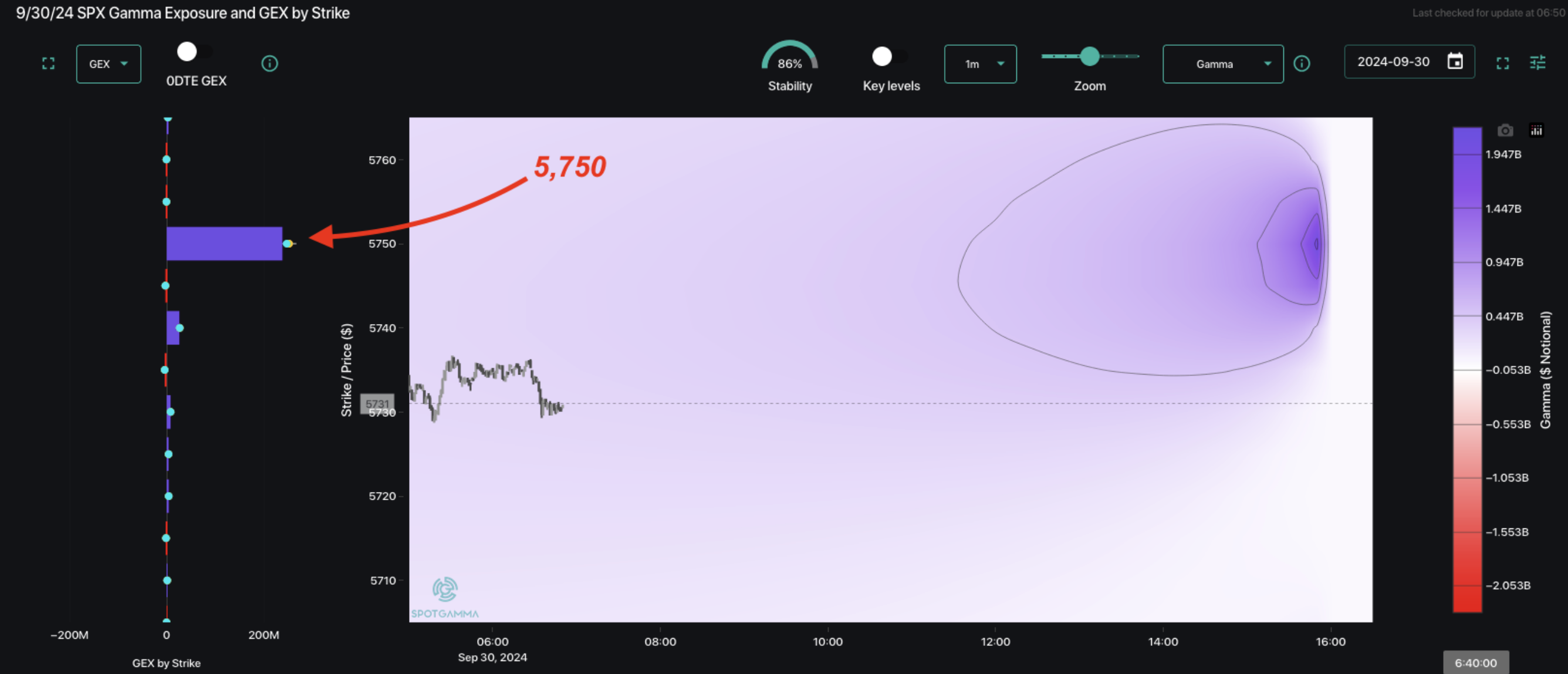

- 9/30 Quarter End OPEX

Key SG levels for the SPX are:

- Support: 5,700

- Resistance: 5,750, 5,800

- As of 9/30/24:

- We remain long >5,700

- We position flat equities <5,700

- Risk-off on a break <5,650

QQQ:

- Support: 487, 485, 480

- Resistance: 490, 495

IWM:

- Support: 220, 218

- Resistance: 225, 230

- As of 9/20/24:

- 225 failed yesterday, we now eye very large gamma at 220 implies major support

- A break <218 implies a test of 210

Founder’s Note:

Futures are off fractionally today, which is quarter end. For the options market, that means one thing: the JPM collar roll. Its not every quarter that this position matters, but this quarter it matters – significantly.

The JPM position has pinned the SPX down over the last week, due to the huge positive gamma the position supplies to dealers. The rolling of that position today will reduce positive gamma, which should unpin the SPX (see Friday AM’s note for more). Note we’ll be live for Member Q&A at 1PM ET covering the roll, and any other questions.

The rolling of this position means equities should start moving more (i.e. volatility expands) starting today, and into the rest of this week. Said another way: the S&P500 is positioned for “un-pinning” the 5,700-5,750 range, a range which has locked down the SPX for ~10 days.

On this point, if the SPX breaks <5,700 we would look to be short equities/long VIX, with an initial target of 5,650. From there we will need to see if traders respond with buying puts (bearish) or selling them (bullish).

To the upside, if >5,760 clears, we will be looking for a quick move to 5,800. Into 5,800 we’d look for positive gamma to fill in, which would stabilize/pin equity prices. In this environment the SPX often has a low volatility, “grind” higher, and that theme could continue into OPEX.

Adding to these OPEX moves, are quarter end flows coming from large asset managers which could exacerbate movement across the board. This could be particularly true this week, given the 50bps cut less than 2 weeks ago.

Zooming out, if there is a bullish equity response today, it may have a limited life span, maxing into mid October (Oct 18th OPEX). This is because of the upcoming election (37 days out), which is going to keep implied volatility elevated. IV holding reduces “vanna” as an upside driver of stock prices.

You can see this elevated vol in the SPX term structure, below. The closer we get to the election, the more traders are likely to focus on related election risks. These risks range from “political” (i.e. “how long will it take to determine the winner”) to more tactical (i.e. “how do I invest for Harris vs Trump”). In that environment traders will likely be more focused on protecting the left tail (downside), instead of their right (upside).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5793.98 | $5738 | $571 | $20008 | $486 | $2224 | $220 |

| SG Gamma Index™: |

| 1.592 | -0.084 |

|

|

|

|

| SG Implied 1-Day Move: | 0.62% | 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5750.98 | $5695 | $569 | $19720 | $486 | $2220 | $219 |

| Absolute Gamma Strike: | $5805.98 | $5750 | $570 | $20000 | $490 | $2200 | $220 |

| Call Wall: | $5805.98 | $5750 | $575 | $19725 | $500 | $2245 | $225 |

| Put Wall: | $5355.98 | $5300 | $560 | $18500 | $450 | $2145 | $210 |

| Zero Gamma Level: | $5717.98 | $5662 | $570 | $19659 | $486 | $2219 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.248 | 0.916 | 1.462 | 0.914 | 0.927 | 0.817 |

| Gamma Notional (MM): | $581.875M | ‑$67.854M | $9.729M | ‑$35.726M | ‑$3.433M | ‑$156.308M |

| 25 Delta Risk Reversal: | -0.043 | 0.00 | -0.037 | -0.018 | -0.022 | -0.003 |

| Call Volume: | 451.869K | 1.163M | 7.262K | 630.638K | 19.63K | 408.705K |

| Put Volume: | 890.128K | 1.90M | 8.939K | 897.512K | 27.244K | 474.897K |

| Call Open Interest: | 6.545M | 5.10M | 56.138K | 2.904M | 285.121K | 4.068M |

| Put Open Interest: | 13.20M | 13.996M | 75.368K | 5.771M | 489.183K | 7.903M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5750, 5800, 5700, 5000] |

| SPY Levels: [570, 572, 560, 575] |

| NDX Levels: [20000, 19725, 20500, 19500] |

| QQQ Levels: [490, 480, 475, 485] |

| SPX Combos: [(6002,98.03), (5973,71.11), (5950,89.47), (5928,83.35), (5899,98.35), (5876,92.69), (5853,98.29), (5841,70.37), (5836,83.10), (5830,72.09), (5824,96.51), (5819,89.49), (5813,81.73), (5807,79.54), (5801,99.09), (5796,82.90), (5790,88.04), (5784,86.56), (5778,98.40), (5773,96.21), (5767,89.68), (5761,84.27), (5755,91.10), (5750,99.98), (5744,84.48), (5727,91.20), (5721,79.22), (5704,74.35), (5681,77.98), (5675,82.20), (5664,71.60), (5623,93.05), (5600,86.03), (5549,82.77), (5526,83.11), (5503,90.63), (5474,80.70)] |

| SPY Combos: [571.98, 577.12, 574.27, 581.7] |

| NDX Combos: [19728, 20549, 20149, 20969] |

| QQQ Combos: [477.53, 497.49, 492.13, 487.27] |

0 comentarios