Macro Theme:

Key dates ahead:

- 10/3 Jobless claims, PMI

- 10/4 NFP

- 10/9 FOMC Mins

- 10/10 CPI

- 10/18 OPEX

Key SG levels for the SPX are:

- Support: 5,675, 5,650, 5,600

- Resistance: 5,700, 5,720, 5,750

- As of 10/2/24:

- Long with close >5,720

- We position flat equities <5,700

- Risk-off on a break <5,675

QQQ:

- Support: 480, 473

- Resistance: 484

IWM:

- Support: 210

- Resistance: 220

- As of 10/2/24:

- The break <218 on 10/1 implies a test of 210

- Bullish with close >220

Founder’s Note:

Equity futures are flat to slightly lower, indicating the SPX is set to open back at the big gamma strike of 5,700. Support below remains at 5,675, & 5,650. Resistance at 5,720 & 5,750.

As we covered yesterday, the problem bulls have is that implied volatility remains elevated, and there is nothing to yet allow for that to release (read here).

The issue for bears is that buying puts when the IV is high (ex: VIX 20) is generally not fruitful, so that throttles additional, impactful downside hedging pressure.

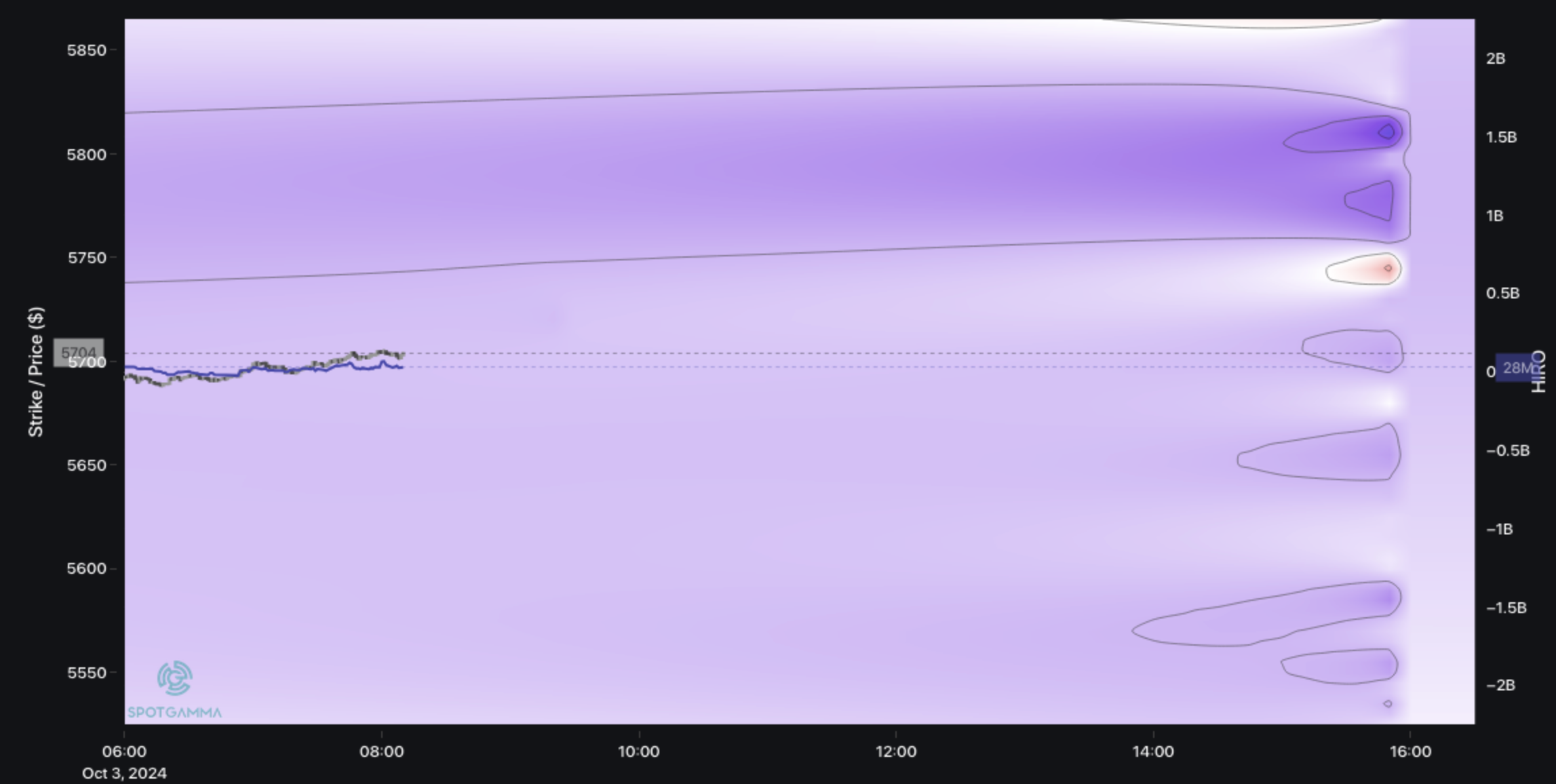

The other issue is that while positive gamma was greatly reduced after Monday’s OPEX – its still positive. And, its positive all the way down to 5,500. This is reflected when you zoom all the way out in our Trace map, as shown, with nothing but positive gamma (in blue-violet color (IYKYK)).

So, as traders sit on their hands directionally, IV also can’t fully release, which mitigates vanna as a source of equity strength. Positive gamma options hedging flow is left as the main source of flow, leaving price circling 5,700.

The other thing to note here is the 5,750-5,800 is filling in as a larger zone of positive gamma (darker blue-violet), suggesting that moves up in SPX may be slow-going due to larger positive gamma above.

The trick here is that there is not a lot in terms of long dated positions. You get a sense of this in the GEX curve below, with today (black) vs tomorrow (pink). As you can see, the at-the-money gamma drops sharply due to so much gamma tied to today’s expiration.

Accordingly, the map can change rather quickly. However, without a material realized risk (ex: not the threat of war, but actual escalation), what we see is 0DTE traders usually come in to sell calls, and/or sell puts. This reloads the local positive gamma, for the next 1-2 days. This positive gamma brings stability to SPX prices.

Looking ahead, tomorrow’s NFP does appear to have a bit of event-vol associated with it, which means that it can spark some short term directional change. Overall, it again reads like a pretty dull equity index environment for today, with maybe some small sparks for tomorrow.

Where things remain interesting, particularly for options traders, in with Chinese names. While we can’t comment on long term fundamentals, we can say that implied vol (and call skew) is incredibly high as Chinese stocks have been ripping higher. You get a sense of this with the 1-month FXI skew, below. We have been looking at structures to bet on lower implied vol ahead, like calendar spreads. We like calendar spreads here as we do not want to be materially exposed to big underlying prices moves, particularly upside.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5751.61 | $5700 | $568 | $12900 | $481 | $1600 | $217 |

| SG Gamma Index™: |

| 0.316 | -0.361 |

|

|

|

|

| SG Implied 1-Day Move: | 1.24% | 1.24% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5746.61 | $5695 | $570 | $19710 | $482 | $2220 | $218 |

| Absolute Gamma Strike: | $5801.61 | $5750 | $550 | $19725 | $480 | $2200 | $220 |

| Call Wall: | $5851.61 | $5800 | $580 | $19725 | $500 | $2245 | $225 |

| Put Wall: | $5451.61 | $5400 | $560 | $18500 | $460 | $2000 | $210 |

| Zero Gamma Level: | $5718.61 | $5667 | $572 | $14190 | $484 | $1760 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.05 | 0.661 | 1.397 | 0.780 | 0.798 | 0.689 |

| Gamma Notional (MM): | ‑$6.406M | ‑$1.086B | ‑$3.273M | ‑$314.941M | ‑$29.658M | ‑$461.502M |

| 25 Delta Risk Reversal: | -0.061 | -0.039 | -0.06 | -0.034 | -0.039 | -0.015 |

| Call Volume: | 414.732K | 1.051M | 7.298K | 516.167K | 10.347K | 292.497K |

| Put Volume: | 901.691K | 2.078M | 7.566K | 765.299K | 14.205K | 234.602K |

| Call Open Interest: | 6.518M | 5.095M | 57.642K | 3.007M | 286.776K | 4.024M |

| Put Open Interest: | 13.133M | 13.669M | 78.196K | 5.845M | 497.475K | 7.823M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5750, 5800, 5700, 5000] |

| SPY Levels: [550, 560, 570, 565] |

| NDX Levels: [19725, 20000, 20500, 19500] |

| QQQ Levels: [480, 475, 460, 485] |

| SPX Combos: [(5939,89.19), (5917,70.18), (5888,97.99), (5865,85.90), (5860,77.11), (5842,98.26), (5831,74.69), (5825,80.05), (5820,79.79), (5814,95.46), (5808,77.26), (5803,89.36), (5791,98.58), (5780,85.86), (5774,75.43), (5768,93.07), (5763,97.42), (5751,92.74), (5746,79.23), (5740,92.74), (5734,81.74), (5728,71.55), (5717,71.73), (5683,72.73), (5672,82.65), (5660,87.63), (5643,85.23), (5614,94.34), (5603,76.52), (5592,92.81), (5563,86.90), (5540,84.41), (5512,84.03), (5489,92.96), (5466,72.54), (5444,91.59)] |

| SPY Combos: [577.96, 583.08, 587.63, 575.12] |

| NDX Combos: [12307, 12848, 12578, 13377] |

| QQQ Combos: [460.75, 481, 470.87, 487.74] |

0 comentarios