Macro Theme:

Key dates ahead:

- 10/4 NFP

- 10/9 FOMC Mins

- 10/10 CPI

- 10/18 OPEX

Key SG levels for the SPX are:

- Support: 5,700, 5,675, 5,650, 5,600

- Resistance: 5,720, 5,750 5,765, 5,800

- As of 10/2/24:

- Long with close >5,720

- We position flat equities <5,700

- Risk-off on a break <5,675

QQQ:

- Support: 480, 473

- Resistance: 484

IWM:

- Support: 210

- Resistance: 220

- As of 10/2/24:

- The break <218 on 10/1 implies a test of 210

- Bullish with close >220

Founder’s Note:

Futures are up 20-30bps overnight, ahead of 8:30AM ET NFP. The 0DTE straddle is trading at $47 (82bps) with an IV of 30%. This “warm” price suggests there is a bit of event vol tied to this mornings print – meaning NFP is a decent catalyst, but not a huge deal.

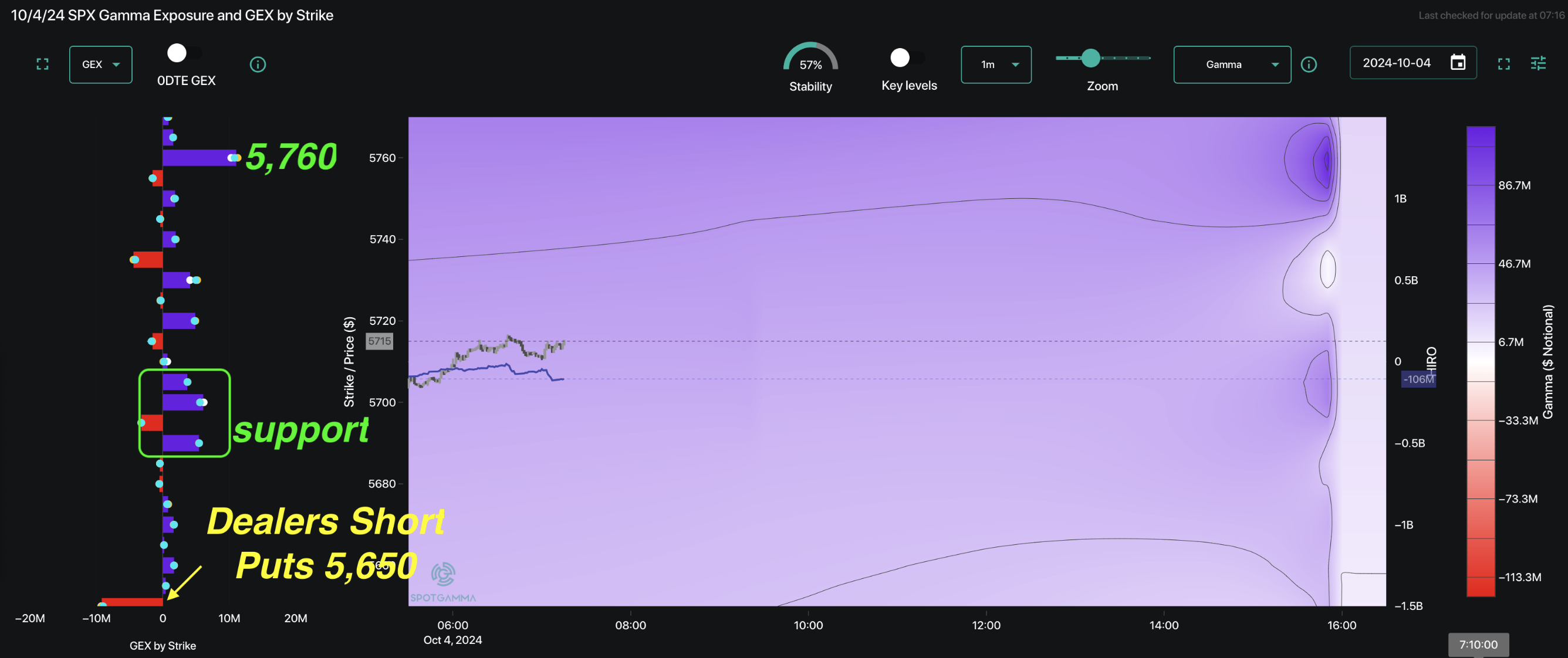

Accordingly, the big 0DTE strike on the board is 5,760, with support at 5,700 & 5,675.

An “in line” NFP will likely lead to an initial market pop, and we suspect the 0DTE crew will be looking to sell 0DTE calls in the 5,750-5,760 area today. That in turn forms resistance.

A NFP miss may lead SPX to pressure that 5,675 area – an area which has been met with 0DTE put sellers (& support) each day this week (ex: yesterday afternoon).

Under that 5,675 zone we see a ~10k net dealer short put position (buyside is long puts), which suggests that downside could pick up through that strike. For this reason, <5,675 remains a “risk off” area.

The problem with a larger rally today is that we do not think traders want to be short vol into this weekend due to geopolitical risks.

Some pundits are citing the dock workers deal as a bullish trigger. We can “fact check” that through SPX fixed strike vol, shown below. This is comparing last nights closing IV vs this AM, and what we see is IV’s <=1week out are higher, while longer dated IV’s are a few ticks lower. On net, the reaction means “not much”, vs the IV change we may see around NFP. NFP is probably keeping a small bid to these shortest dated IV’s. Even if NFP is a non-event we do not think vol can contract very much given the Middle East situation & upcoming elections (see Wed note).

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5750.35 |

$5700 |

$567 |

$19802 |

$481 |

$2195 |

$216 |

|

SG Gamma Index™: |

|

-0.363 |

-0.495 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.67% |

0.67% |

0.67% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$5745.35 |

$5695 |

$570 |

$19720 |

$480 |

$2220 |

$218 |

|

Absolute Gamma Strike: |

$5750.35 |

$5700 |

$560 |

$19725 |

$480 |

$2200 |

$210 |

|

Call Wall: |

$5850.35 |

$5800 |

$580 |

$19725 |

$500 |

$2245 |

$225 |

|

Put Wall: |

$5650.35 |

$5600 |

$560 |

$19750 |

$460 |

$2000 |

$210 |

|

Zero Gamma Level: |

$5717.35 |

$5667 |

$575 |

$19456 |

$484 |

$2206 |

$221 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.945 |

0.571 |

1.292 |

0.733 |

0.691 |

0.609 |

|

Gamma Notional (MM): |

$13.86M |

‑$1.322B |

$7.88M |

‑$275.156M |

‑$20.168M |

‑$606.502M |

|

25 Delta Risk Reversal: |

-0.068 |

-0.046 |

-0.065 |

-0.043 |

-0.044 |

-0.021 |

|

Call Volume: |

415.942K |

1.188M |

6.524K |

504.837K |

13.496K |

332.679K |

|

Put Volume: |

840.388K |

2.075M |

6.236K |

757.02K |

24.595K |

596.931K |

|

Call Open Interest: |

6.564M |

5.166M |

57.573K |

3.026M |

290.257K |

4.106M |

|

Put Open Interest: |

13.344M |

13.972M |

78.317K |

5.867M |

503.234K |

7.971M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5700, 5750, 5000, 5600] |

|

SPY Levels: [560, 550, 570, 565] |

|

NDX Levels: [19725, 20000, 20500, 19750] |

|

QQQ Levels: [480, 475, 460, 470] |

|

SPX Combos: [(5951,87.43), (5922,80.00), (5899,97.26), (5877,83.25), (5871,73.06), (5848,97.53), (5842,76.86), (5837,77.34), (5831,77.96), (5825,93.74), (5820,72.69), (5803,98.20), (5791,83.03), (5780,89.38), (5774,94.79), (5768,71.94), (5763,89.25), (5757,74.89), (5751,92.15), (5723,84.77), (5700,80.91), (5694,76.59), (5672,86.95), (5649,82.06), (5643,73.33), (5637,71.71), (5632,69.48), (5626,84.38), (5620,93.57), (5603,72.01), (5597,94.98), (5592,70.78), (5575,71.86), (5569,82.61), (5563,78.71), (5558,73.54), (5552,85.90), (5523,89.31), (5500,94.13), (5478,83.15), (5472,69.56), (5449,91.96), (5426,78.01), (5421,79.57)] |

|

SPY Combos: [576.84, 581.95, 586.5, 574.01] |

|

NDX Combos: [19743, 18911, 19327, 20554] |

|

QQQ Combos: [459.42, 479.64, 469.53, 499.39] |

0 comentarios