Macro Theme:

Key dates ahead:

- 10/16 VIX Exp

- 10/18 OPEX

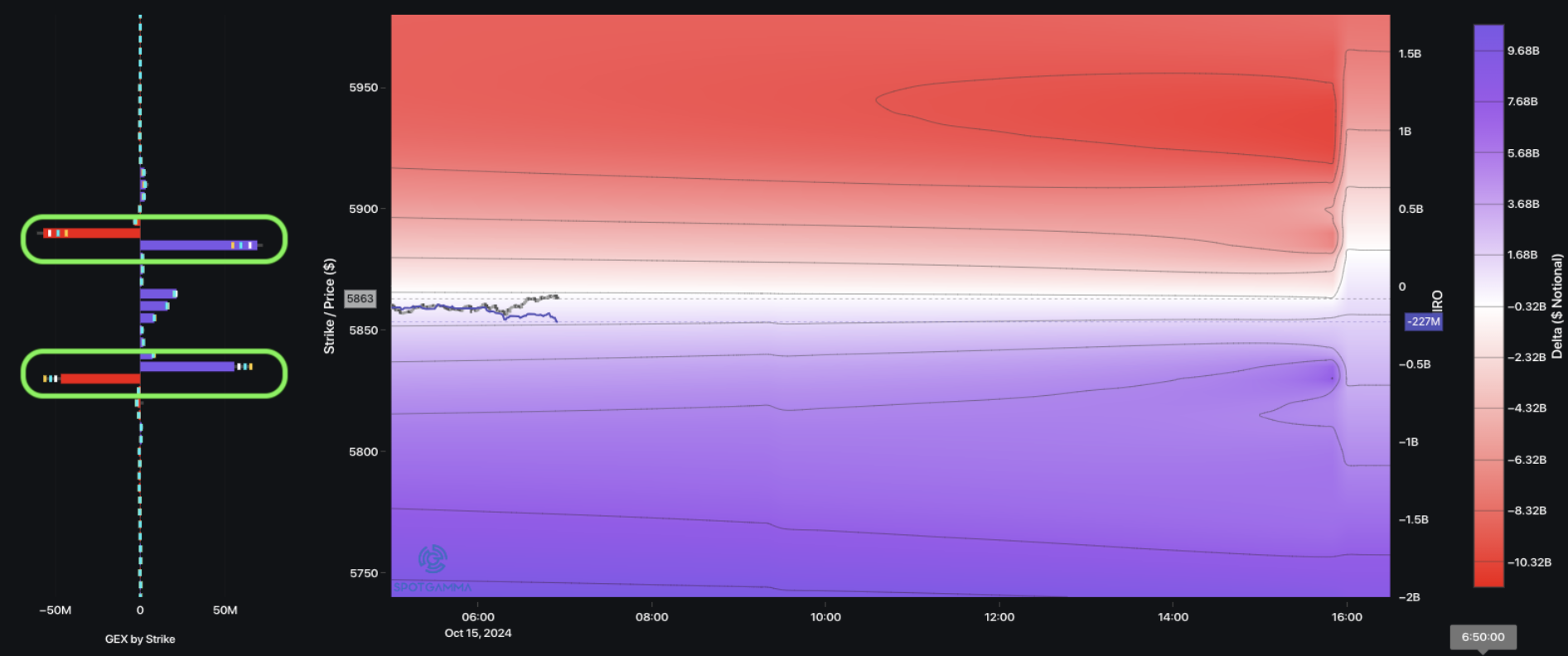

5,875 is peak positive gamma, and major resistance this week. We look for VIX expiration on 10/16 to mark a period of higher equity volatility, as VIX Exp & 10/18 OPEX clear out short vol/positive gamma positions. This implies a mild equity correction is on tap starting in the second half of this week, with 5,700 a major support zone.

Key SG levels for the SPX are:

- Support: 5,850, 5,830, 5,800

- Resistance: 5,880, 5,900

- As of 10/15/24:

- Long while >5,800

- Risk-off on a break <5,775

QQQ:

- Support: 494

- Resistance: 500

IWM:

- Support: 220, 218

- Resistance: 225

- As of 10/7/24:

- Bullish with close >220

Founder’s Note:

Futures are flat this morning, after stocks logged another record close, yesterday, and added 2.5% in the last 4 sessions. Today the S&P500 remains wrapped in positive gamma, which should keep equities supported.

Resistance today is at 5,885 & 5,900. Support: 5,850, 5,830, 5,800.

Note that we’ve raised our long-stop to 5,800, and would flip to net short with a break <5,775 (see Macro Theme at the top of this note).

We start today noting that “Captain Condor” is back. This is fund that consistently comes in to sell 0DTE iron condors – in size.

Today we see 10,300 contracts of the 5,885/5,890 call spread vs the 5,835/5,830 put spread. These strikes have proven to be support and resistance zones in the past – and so we will watch those levels carefully, today.

Zooming out, we have admittedly been of the view that the equity market would struggle to put in a large directional move before the election. This was due to:

1) Geopolitical vol

2) Rate concerns (10Y > 4%)

3) Election vol

The Middle East situation appears to be off of traders risk-radar. The 10 Y remains just >4%, but yields seem to have stabilized.

Lastly, is election IV, which remains elevated.

However, we are seeing a rotation wherein traders appear to be bidding up the right-tail (calls) and selling the left-tail (puts). You can see this “twist” in the 11/15 skew plot from today (teal) vs 2 weeks ago (gray). The “vibe” is more about missing a year end rally vs any type of serious risk-off event.

The relative level of skew remains elevated due to the election (i.e. VIX 20), and so there is plenty of vol to crush post-election. This element, the post-election vol crush, is key to generating a strong year-end rally.

The second force pushing equities up, is NVDA (below, vs SPY). Over the last 2 weeks the stock is on a tear, rallying +12% to new all-time highs. This stock has the power to move the entire market because of its heaving weighting in Indexes + its in over 500 ETF’s (see this for a full breakdown).

Overall we think this rally is playing out now as we approach a very call-heavy Oct OPEX. Therefore we are on watch for an equity market correction, starting tomorrow with VIX Expiration.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5905.63 | $5859 | $584 | $20439 | $497 | $2248 | $222 |

| SG Gamma Index™: |

| 3.012 | 0.027 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5948.96 | $5902.33 | $588.33 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5873.9 | $5827.27 | $580.85 |

|

|

|

|

| SG Volatility Trigger™: | $5801.63 | $5755 | $584 | $19720 | $493 | $2220 | $219 |

| Absolute Gamma Strike: | $5846.63 | $5800 | $585 | $20500 | $500 | $2250 | $220 |

| Call Wall: | $5946.63 | $5900 | $585 | $20500 | $500 | $2245 | $225 |

| Put Wall: | $5876.63 | $5830 | $560 | $18500 | $460 | $2220 | $210 |

| Zero Gamma Level: | $5828.63 | $5782 | $583 | $19634 | $493 | $2226 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.479 | 1.029 | 1.689 | 1.151 | 1.292 | 1.13 |

| Gamma Notional (MM): | $899.848M | $173.677M | $12.175M | $218.594M | $26.775M | $311.067M |

| 25 Delta Risk Reversal: | -0.051 | 0.00 | -0.055 | -0.04 | 0.00 | -0.013 |

| Call Volume: | 559.947K | 1.064M | 7.789K | 693.027K | 19.247K | 297.956K |

| Put Volume: | 931.411K | 1.764M | 12.239K | 812.293K | 25.549K | 486.392K |

| Call Open Interest: | 6.915M | 5.58M | 58.45K | 3.179M | 299.881K | 4.121M |

| Put Open Interest: | 14.06M | 15.275M | 85.373K | 6.155M | 502.711K | 8.215M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5900, 5850, 6000] |

| SPY Levels: [585, 580, 590, 575] |

| NDX Levels: [20500, 20000, 21000, 19725] |

| QQQ Levels: [500, 498, 490, 495] |

| SPX Combos: [(6100,95.12), (6077,78.19), (6053,88.55), (6047,90.16), (6018,79.20), (6000,99.26), (5977,80.01), (5965,71.33), (5959,74.94), (5948,98.72), (5942,92.62), (5936,69.34), (5930,81.43), (5924,95.63), (5918,96.14), (5913,97.12), (5907,92.50), (5901,99.95), (5895,93.91), (5889,99.61), (5883,99.45), (5877,99.78), (5872,91.27), (5866,95.13), (5860,87.99), (5848,99.63), (5842,74.24), (5836,92.37), (5831,90.40), (5825,88.03), (5819,69.28), (5801,96.64), (5778,83.06), (5702,77.83), (5649,76.27), (5625,72.89), (5614,78.27), (5602,87.70)] |

| SPY Combos: [583.06, 588.27, 598.13, 581.32] |

| NDX Combos: [20541, 20500, 20746, 20950] |

| QQQ Combos: [500.27, 480.04, 494.84, 510.13] |

0 comentarios