Macro Theme:

Key dates ahead:

- 10/16 VIX Exp

- 10/18 OPEX

5,875 is peak positive gamma, and major resistance this week. We look for VIX expiration on 10/16 to mark a period of higher equity volatility, as VIX Exp & 10/18 OPEX clear out short vol/positive gamma positions. This implies a mild equity correction is on tap starting in the second half of this week, with 5,700 a major support zone.

Key SG levels for the SPX are:

- Support: 5,800, 5,785

- Resistance: 5,850, 5,875, 5,900

- As of 10/16/24:

- Long while >5,800

- Risk-off on a break <5,785

QQQ:

- Support: 490, 485

- Resistance: 500

IWM:

- Support: 220, 218

- Resistance: 225

Founder’s Note:

Resistance today is at 5,850. Support is at 5,800, 5,790, then 5,750. If the SPX breaks 5,785 we flip to a “risk-off” stance, wherein we look to be net short.

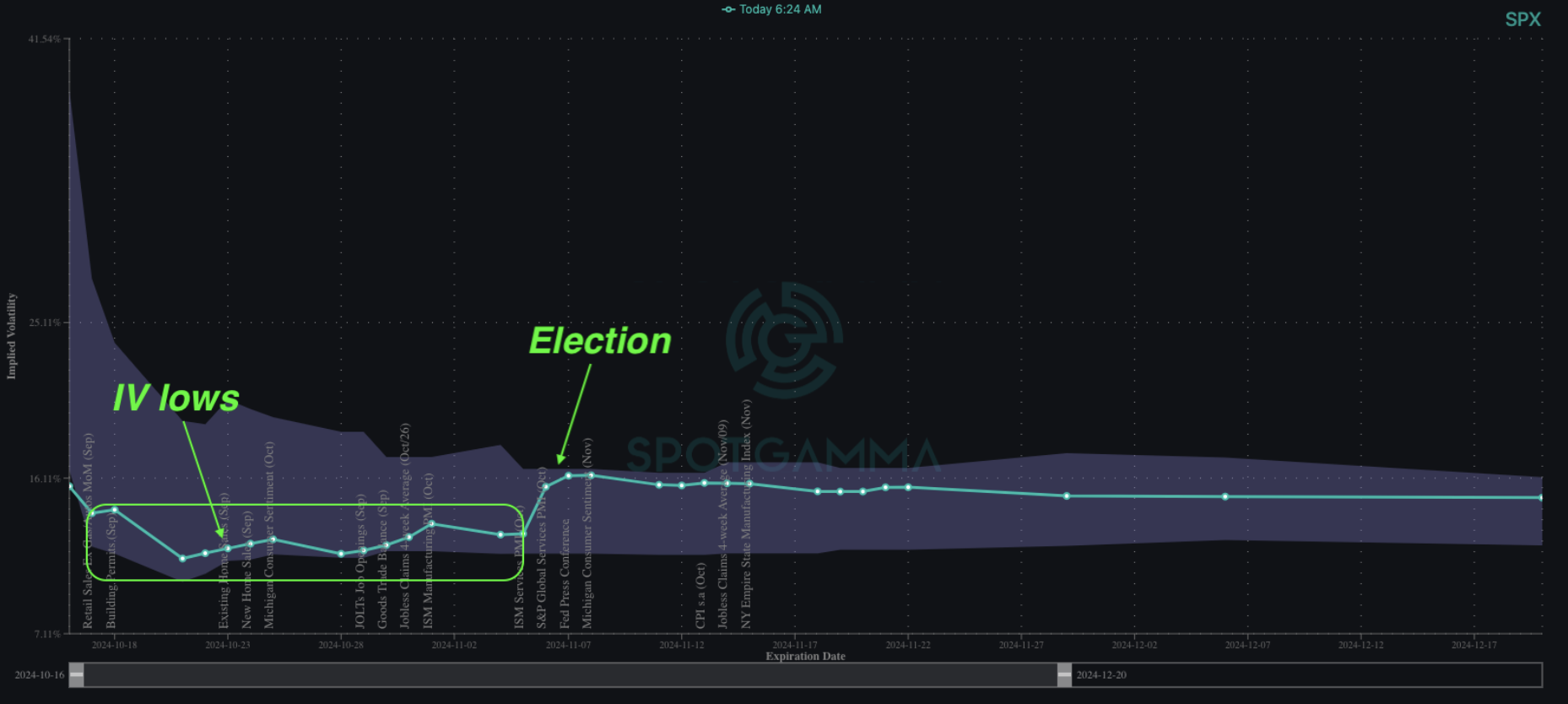

Futures are flat ahead of this mornings 9:30AM ET VIX expiration. This expiration marks the start of what could be an uptick in volatility, as VIX expiration + Friday’s OPEX serve to remove the options positions which have been suppressing market volatility.

Statistically, we see that the SPX tends to reverse course into and out of OPEX week (we’ve rallied strongly into this week). Second, realized volatility, and ultra-short dated options positions, are at major lows (1-month RV = 10%, & todays 0DTE straddle is just $24 or 41bps).

There is quite frankly no where else for volatility to go, but up. That does not mean vol has to go up (it can remain low), but the shifting of large OPEX positions, we think, adds pressure to the vol & equities. We eye 5,700 as longer term support.

Moving on, “Captain Condor” is back at it. This trader (likely a fund) persistently trades large SPX 0DTE iron condors. Yesterday the market traded through the put wing on their 0DTE condor, and so today they have doubled down by selling +20k of the:

-call spread: 5,845/5,850

-put spread: 5,790/5,785

Why does this 0DTE condor matter? Because its increasing size makes it a primary control mechanism on an intraday basis (see y’days note). Reviewing yesterday’s price action, we spent the majority of the session bouncing along the put wing (red square), and then around 2PM ET we started to break < that 5,830 dealer short strike. From that point, in through 3PM ET, we see that put spread (red box) started to close up, which coincides with sharp drops in

HIRO

(purple line) and the SPX. We recommend you review yesterday’s price action in the Net OI setting, using the time-slider to replay market action (green bar at bottom of Trace app).

This trader seems to be using a martingale system – they double down every time their previous trade loses. With today’s +20k contracts on the line, the fund stands to lose $2mm per point when the SPX goes through a wing of their 5-point wide spread. So, lets say they traded this condor for a max of $2 credit – that means they risk $6mm (3pts * $2mm per point) to make $4mm ($2 initial credit * 20k contracts).

On the other side of this condor is a dealer, long the condor, with the opposite PNL.

The dealer seems to have a tremendous advantage here. #1, they can incentive other trades to come in to help offset their risk (we see distorted 0DTE prices around these condor wings), or #2, they can push the market through one of funds spreads.

Further, every time the fund doubles down, it seems like its a 2x incentive for the dealer-counterparty to move the market through one of the condors wings.

For the fund, this feels a lot like doubling down at roulette, only the casino is allowed to put their finger on roulette wheel.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5862 | $5815 | $579 | $20159 | $490 | $2249 | $223 |

| SG Gamma Index™: |

| 1.03 | -0.115 |

|

|

|

|

| SG Implied 1-Day Move: | 0.61% | 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5842 | $5795 | $579 | $20190 | $490 | $2240 | $219 |

| Absolute Gamma Strike: | $5847 | $5800 | $580 | $19725 | $490 | $2250 | $220 |

| Call Wall: | $5897 | $5850 | $585 | $19725 | $500 | $2245 | $225 |

| Put Wall: | $5837 | $5790 | $560 | $18500 | $460 | $2220 | $210 |

| Zero Gamma Level: | $5828 | $5781 | $578 | $19808 | $490 | $2227 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.125 | 0.891 | 1.166 | 0.871 | 1.351 | 1.136 |

| Gamma Notional (MM): | $435.324M | ‑$37.115M | $5.569M | ‑$7.706M | $26.033M | $211.693M |

| 25 Delta Risk Reversal: | -0.057 | -0.036 | -0.066 | -0.041 | 0.00 | -0.013 |

| Call Volume: | 577.702K | 1.351M | 8.839K | 982.344K | 18.332K | 462.214K |

| Put Volume: | 1.248M | 2.136M | 11.397K | 1.08M | 17.172K | 495.902K |

| Call Open Interest: | 7.055M | 5.692M | 59.955K | 3.316M | 306.183K | 4.132M |

| Put Open Interest: | 14.276M | 15.30M | 87.579K | 6.28M | 507.284K | 8.33M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5850, 5750, 5900] |

| SPY Levels: [580, 575, 585, 570] |

| NDX Levels: [19725, 20000, 20200, 20500] |

| QQQ Levels: [490, 480, 485, 495] |

| SPX Combos: [(6100,94.36), (6077,73.38), (6054,87.45), (6048,88.28), (6019,76.08), (6001,98.91), (5972,77.36), (5949,95.38), (5937,88.65), (5926,90.13), (5920,88.92), (5908,81.35), (5902,99.68), (5897,76.61), (5891,85.06), (5885,81.07), (5879,89.34), (5873,96.79), (5868,97.03), (5862,83.17), (5856,83.07), (5850,99.97), (5844,99.75), (5839,89.48), (5833,96.31), (5827,94.57), (5798,95.34), (5792,99.78), (5786,99.68), (5780,71.78), (5769,71.74), (5751,86.89), (5745,73.40), (5740,76.27), (5722,89.18), (5716,82.94), (5699,86.16), (5652,84.53), (5623,75.14), (5618,84.82), (5600,89.67), (5548,84.55)] |

| SPY Combos: [588.38, 586.04, 583.12, 587.21] |

| NDX Combos: [19716, 20543, 19918, 20321] |

| QQQ Combos: [499.99, 498.99, 504.96, 509.94] |

0 comentarios