Macro Theme:

Key dates ahead:

- 10/18 OPEX

5,875 is peak positive gamma, and major resistance this week. We look for VIX expiration on 10/16 to mark a period of higher equity volatility, as VIX Exp & 10/18 OPEX clear out short vol/positive gamma positions. This implies a mild equity correction is on tap starting in the second half of this week, with 5,700 a major support zone.

Key SG levels for the SPX are:

- Support: 5,850, 5,820, 5,800

- Resistance: 5,875, 5,900

- As of 10/16/24:

- Long while >5,800

- Risk-off on a break <5,800

QQQ:

- Support: 490, 485

- Resistance: 500

IWM:

- Support: 220, 218

- Resistance: 225

Founder’s Note:

Futures are ~30bps higher ahead of today’s OPEX.

5,800 is major support both for today, and into next week. A break <5,800 is our risk-off trigger, wherein we’d be watching for a 1-2% pullback in the SPX, and a shift higher in IV/VIX.

Resistance above is at 5,860 (SPY 585) and 5,900.

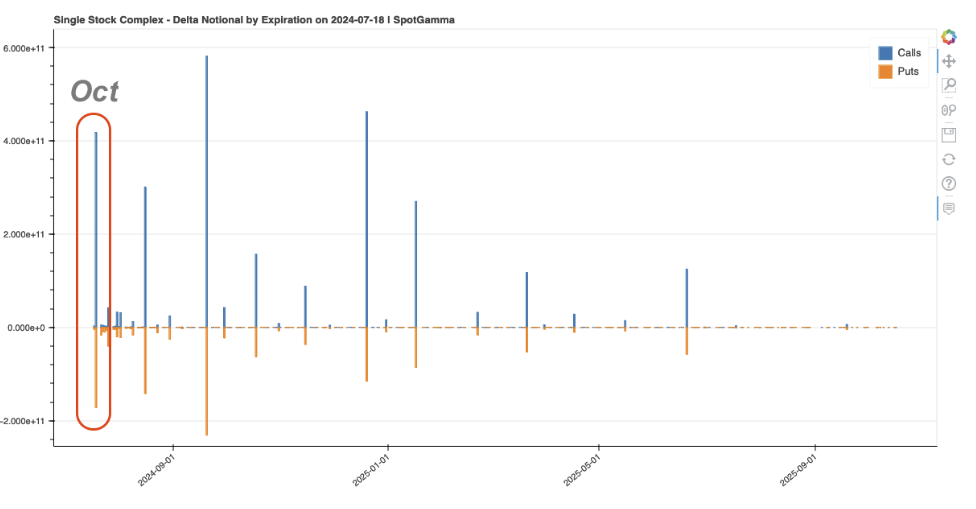

This OPEX size is in line with other monthly expirations like August & July. The most notable feature is that it is quite call-heavy, as you can see below in the plot of single stock

call delta

(blue) vs puts (orange). We think the expiration of these calls will lead to a reduction in associated hedging flows, which may lead to a mild pullback in equity prices.

Trace also shows the estimated impact of OPEX for SPX, by adjusting the heatmap for the removal of expiring options. This creates a “ripple” in the map at 9:30AM ET, when the bulk of SPX Oct OPEX positions expire (SPX AM). That is then followed by a second expiration for SPX, and all other stocks, at 4PM. In this case the map is inferring that things should remain stable for today, following the AM Exp.

If we look at gamma through a standard GEX curve, you can see that following todays expiration (orange curve), gamma will remain positive down through ~5,750. This ties in with the light blue color remaining in the Trace map to the right of 4pm ET expiration. The takeaway from this is that if there is a drawdown, we would initially not expect a move much lower than 5,750. We invoke “initially” because that estimate is based on current positioning, and we can’t help but feel traders do not want to be net short of puts/vol into the election.

However, the election is still 2-3 weeks away, which is a lifetime for 0DTE traders. On this point, if you want to hedge the election event itself, why carry that protection until closer to the event? Those who put on election protection have likely had some very negative carry!

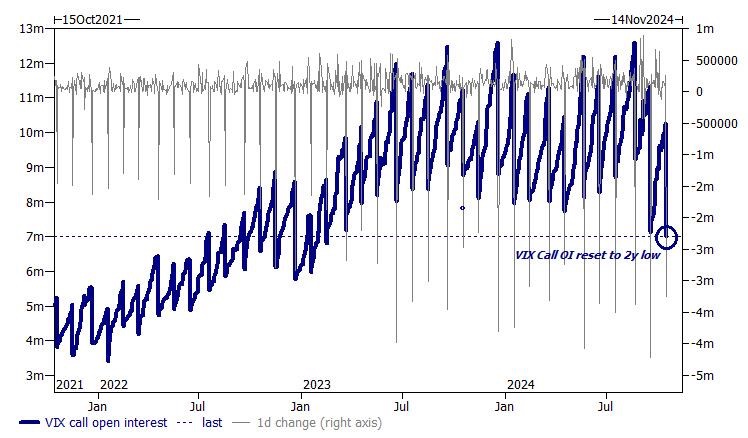

One last item of interest: VIX. Goldman via ZH notes that VIX call OI moved to a 2 year low following Wednesday’s VIX Exp. This suggests that dealer short vol exposure is lower due to fewer VIX contracts. Its also interesting given the upcoming election.

The big VIX positions we currently see on appear to be large VIX put positions, likely betting on a VIX drop after the election. Our beta VIX model suggests that dealers are still short upside convexity (i.e. “short VIX”), with the recent VIX exp having reduced that upside dealer risk by ~1/2.

We can’t help but think that this reduction in VIX positions, today’s OPEX, low realized SPX vol, several new ATH’s in stocks & upcoming elections all converge here to temper equity prices. TBD.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5885.47 | $5841 | $582 | $20190 | $491 | $2280 | $226 |

| SG Gamma Index™: |

| 1.603 | -0.044 |

|

|

|

|

| SG Implied 1-Day Move: | 0.62% | 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5938.73 | $5894.27 | $587.62 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5866.1 | $5821.63 | $580.38 |

|

|

|

|

| SG Volatility Trigger™: | $5859.47 | $5815 | $582 | $20230 | $491 | $2240 | $219 |

| Absolute Gamma Strike: | $5894.47 | $5850 | $580 | $20200 | $490 | $2300 | $225 |

| Call Wall: | $5944.47 | $5900 | $585 | $20500 | $500 | $2300 | $230 |

| Put Wall: | $5794.47 | $5750 | $560 | $18500 | $485 | $2220 | $210 |

| Zero Gamma Level: | $5808.47 | $5764 | $581 | $19988 | $490 | $2224 | $222 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.197 | 0.957 | 1.118 | 0.940 | 1.422 | 1.483 |

| Gamma Notional (MM): | $497.935M | $25.339M | $3.37M | ‑$49.867M | $43.052M | $727.32M |

| 25 Delta Risk Reversal: | -0.049 | -0.027 | -0.056 | -0.039 | -0.026 | -0.005 |

| Call Volume: | 632.936K | 1.374M | 16.082K | 852.136K | 34.671K | 362.526K |

| Put Volume: | 1.07M | 1.892M | 11.527K | 865.708K | 44.084K | 336.748K |

| Call Open Interest: | 7.207M | 5.788M | 60.02K | 3.314M | 319.455K | 4.289M |

| Put Open Interest: | 14.717M | 15.955M | 89.905K | 6.391M | 519.234K | 8.503M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5850, 5800, 5900, 5750] |

| SPY Levels: [580, 585, 575, 583] |

| NDX Levels: [20200, 20000, 20500, 20300] |

| QQQ Levels: [490, 485, 480, 495] |

| SPX Combos: [(6098,95.35), (6075,77.65), (6058,89.47), (6052,91.76), (6023,82.70), (5999,99.19), (5976,79.40), (5970,74.14), (5952,97.11), (5941,89.38), (5929,78.58), (5923,92.64), (5917,95.26), (5912,87.10), (5906,74.96), (5900,99.82), (5894,81.06), (5888,94.29), (5882,96.40), (5877,97.13), (5871,95.67), (5865,83.05), (5859,87.10), (5853,69.92), (5847,99.78), (5836,75.28), (5824,81.57), (5812,90.51), (5806,76.66), (5801,91.79), (5748,90.96), (5725,69.71), (5719,73.26), (5701,84.27), (5649,80.66), (5625,72.47), (5619,80.18), (5602,85.63)] |

| SPY Combos: [588.12, 582.88, 585.79, 598.02] |

| NDX Combos: [20554, 20372, 20332, 19928] |

| QQQ Combos: [500.24, 493.86, 485.02, 494.84] |

0 comentarios