Macro Theme:

Key dates ahead:

- 10/24 Jobless Claims

5,875 is peak positive gamma, and major resistance this week. We look for VIX expiration on 10/16 to mark a period of higher equity volatility, as VIX Exp & 10/18 OPEX clear out short vol/positive gamma positions. This implies a mild equity correction is on tap starting in the second half of this week, with 5,700 a major support zone.

Key SG levels for the SPX are:

- Support: 5,850, 5,820, 5,800

- Resistance: 5,875, 5,900

- As of 10/16/24:

- Long while >5,800

- Risk-off on a break <5,800

QQQ:

- Support: 490, 485

- Resistance: 500

IWM:

- Support: 220, 218

- Resistance: 225

Founder’s Note:

Support is at 5,820 & 5,800. Resistance is at 5,840, 5.870, 5,900.

OPEX is now behind us, and we’ve been clear that we think it may trigger a mild correction in equity prices. This view comes with equity indexes at all-time highs (ex small caps), and pre-election implied volatility at extreme lows.

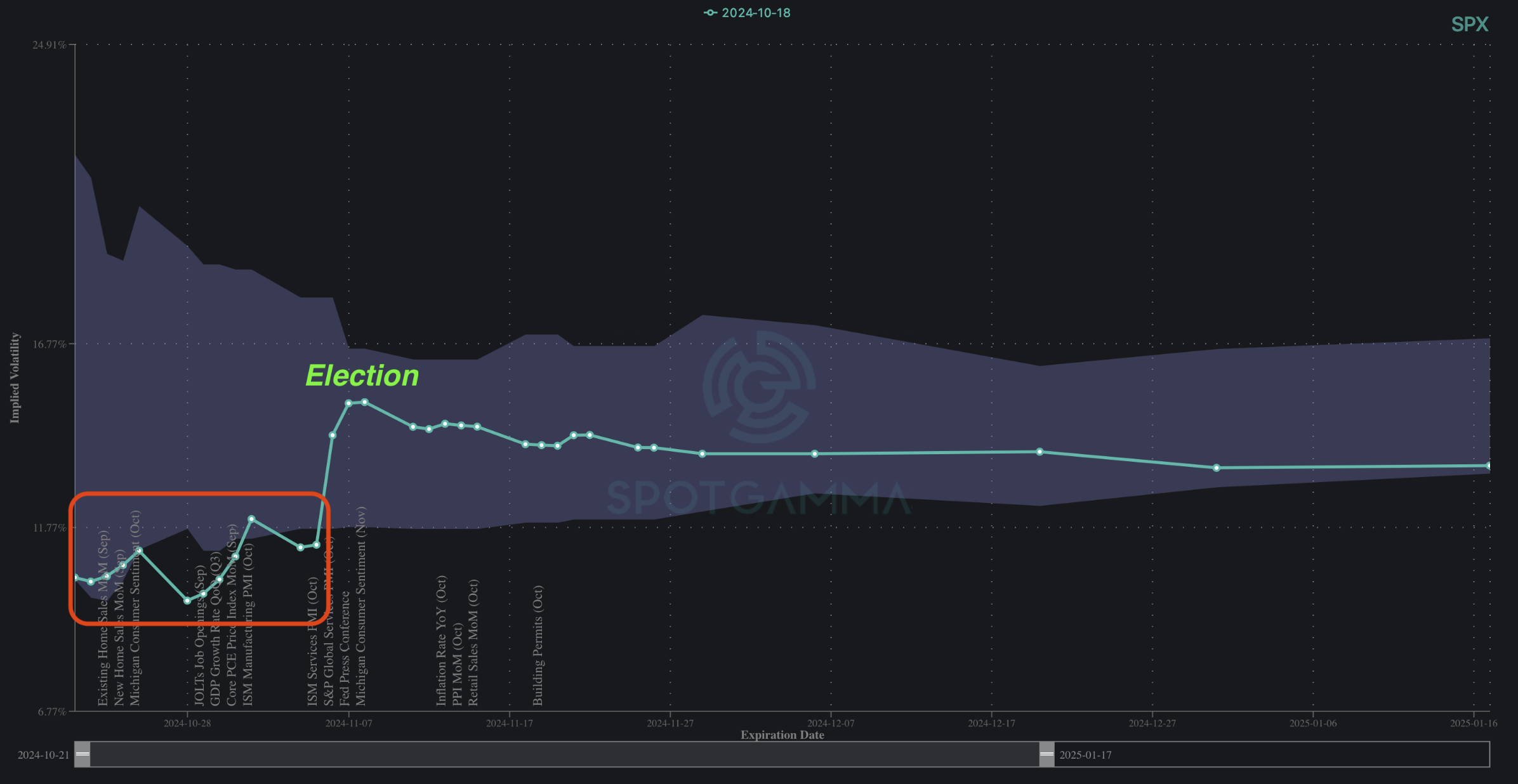

You can see this low implied vol in the SPX term structure (red box). This low is traders relaxing into a “risk free” stance with just 16 days left until the US elections.

Typically, when implied volatility is this low options prices begin to themselves invoke risk. This is because options traders are betting on tiny (<=40bps) daily moves, which can be easily breached – in either direction (i.e. market can go up or down more that 40bps). If a small realized market move breaks the move implied by the options market, it may invoke a short volatility cover trade. That short volatility trade can result in higher market volatility.

In theory, the reduction in positive gamma that came with OPEX should reduce dealers propensity to buy dips – as well as sell into strength. This, timed with implied volatility at lows is a recipe for a market pullback. All that said, we should not anticipate a change in market behavior unless the SPX <5,800. <5,800 is where the potential for negative gamma sets in (inferring dealers would short into lower equity prices).

We’re are positioning for this dynamic by owning a small Dec S&P put position against a core long equity portfolio, and we look to maintain this stance as long as the SPX is >-5,800. If the SPX moves <5,800, we would shift to a neutral stance (i.e. reduce our net long exposure).

The other issue here for markets is that if there is a risk trigger (ex: Middle East), implied volatility will likely snap violently higher due to the election (i.e. high vol-of-vol), which is commanding an event-vol premium. A large vol spike may not want to be something you bet on, but if risk does pop on a material headline, we would likely to position for a material long vol expansion (vs looking to play mean reversion) given the low short term IV & upcoming election.

Lastly, we wanted to zoom out on post-election plays, and NVDA.

NVDA is +16% this month, but longer dated IV remains unresponsive (Jan skew, below). This implies that NVDA calls remain a reasonable place for end-of-year upside exposure.

Further, we’re quite surprised that NVDA skew remains so low despite the strong stock move, and we think there is a strong chance that this bull run doesn’t ultimately end without a huge drive into long call positions, which would jack up call skews.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5905.93 | $5864 | $584 | $20324 | $494 | $2276 | $225 |

| SG Gamma Index™: |

| 1.163 | -0.121 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5933.82 | $5891.89 | $587.38 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5863.54 | $5821.61 | $580.38 |

|

|

|

|

| SG Volatility Trigger™: | $5886.93 | $5845 | $584 | $20290 | $493 | $2260 | $224 |

| Absolute Gamma Strike: | $5941.93 | $5900 | $585 | $20300 | $495 | $2200 | $220 |

| Call Wall: | $5941.93 | $5900 | $585 | $20300 | $500 | $2450 | $230 |

| Put Wall: | $5741.93 | $5700 | $560 | $18500 | $485 | $2220 | $210 |

| Zero Gamma Level: | $5828.93 | $5787 | $583 | $20120 | $493 | $2253 | $225 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.183 | 0.871 | 1.36 | 0.877 | 1.133 | 0.921 |

| Gamma Notional (MM): | $488.058M | ‑$29.514M | $9.678M | ‑$58.393M | $11.462M | ‑$9.466M |

| 25 Delta Risk Reversal: | -0.045 | -0.027 | -0.053 | -0.034 | -0.028 | -0.008 |

| Call Volume: | 473.968K | 981.656K | 17.068K | 523.41K | 28.669K | 226.494K |

| Put Volume: | 1.008M | 1.54M | 13.549K | 791.717K | 33.486K | 388.059K |

| Call Open Interest: | 6.368M | 5.122M | 57.772K | 2.746M | 285.402K | 3.457M |

| Put Open Interest: | 12.696M | 13.396M | 78.777K | 5.396M | 474.142K | 7.016M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5900, 5800, 5850, 6000] |

| SPY Levels: [585, 580, 590, 584] |

| NDX Levels: [20300, 20200, 20500, 20000] |

| QQQ Levels: [495, 490, 500, 485] |

| SPX Combos: [(6152,84.33), (6099,95.83), (6076,78.30), (6052,97.33), (6023,73.41), (6017,81.37), (6000,99.24), (5976,85.56), (5970,77.81), (5959,77.51), (5953,97.97), (5941,90.37), (5929,81.19), (5923,94.99), (5917,97.01), (5912,92.71), (5906,79.29), (5900,99.80), (5894,78.11), (5888,93.58), (5882,93.11), (5876,94.52), (5871,89.27), (5847,90.86), (5841,69.54), (5829,71.61), (5824,70.45), (5818,90.43), (5812,71.68), (5806,70.37), (5747,91.11), (5736,70.74), (5718,69.92), (5700,89.42), (5648,81.91), (5624,72.01), (5618,78.00), (5601,84.00)] |

| SPY Combos: [588.1, 582.86, 598, 585.77] |

| NDX Combos: [20304, 20548, 19938, 20954] |

| QQQ Combos: [500.19, 495.77, 494.79, 484.96] |

0 comentarios