Macro Theme:

Key dates ahead:

- 11/6 Election

- 11/7 FOMC

We remain long of equities while SPX >5,800, and neutral <5,800. Currently we do note see a material negative gamma SPX position until <5,700, suggesting a lack of strong “risk off” positioning. This prevents us from looking to go short <5,800 until/unless those negative gamma dynamics change.

5,900 remains a strong Call Wall resistance point above.

Key SG levels for the SPX are:

- Support: 5,820, 5,800

- Resistance: 5,850, 5860, 5,900

- As of 10/16/24:

- Long while >5,800

- Risk-off on a break <5,800

QQQ:

- Support: 490, 485

- Resistance: 500

IWM:

- Support: 220, 218

- Resistance: 225

Founder’s Note:

Futures are 25bps higher. S&P gamma remains positive, with support at 5,820 & 5,800. Resistance is at 5,850. There is little changed in SPX positions to expect a sharp move away from the prevailing 5,800-5,850 trading range.

The reaction to TSLA’s earnings have been interesting (and amazing), and could be indicative of what we start seeing in other names.

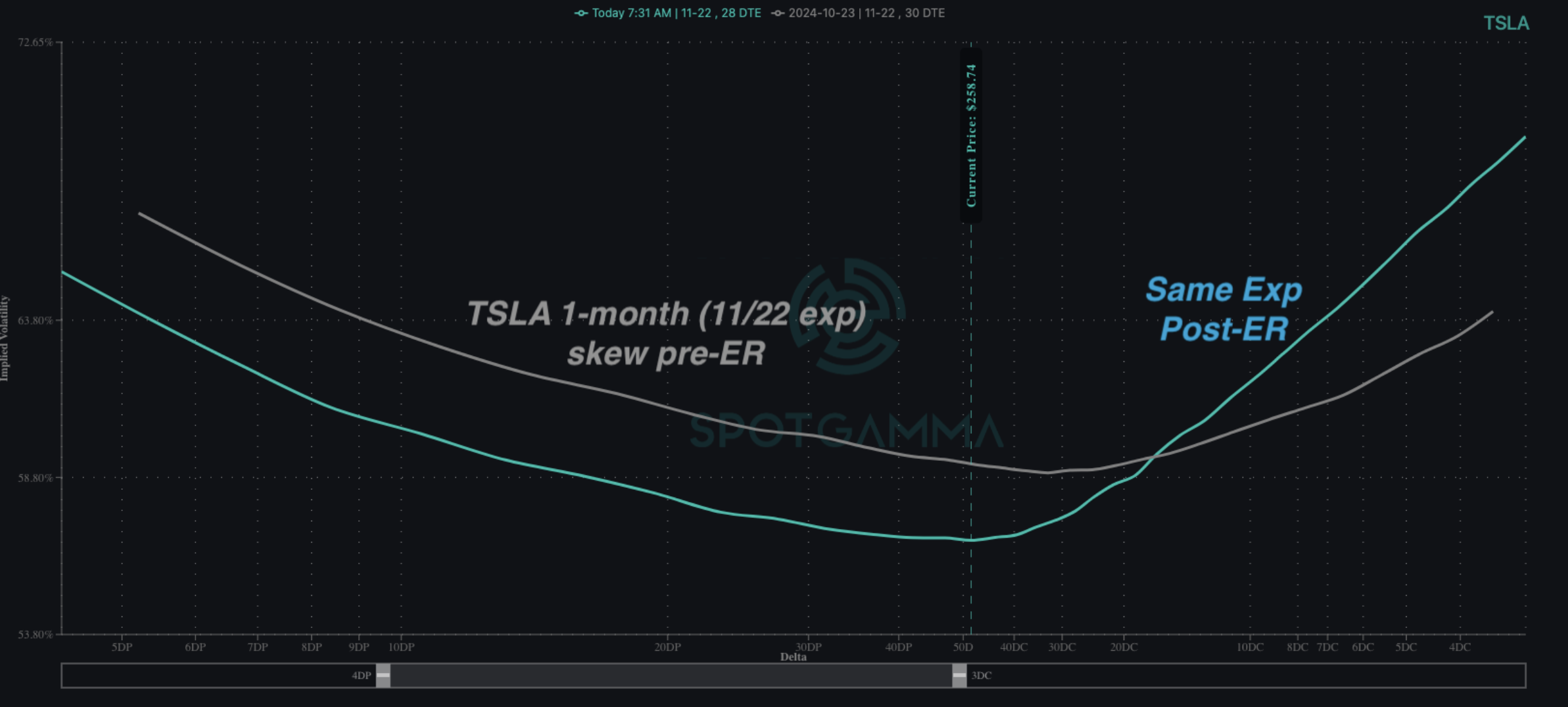

TSLA was up 20% yesterday, with a noticeable shift in call skew (11/22 exp below. Gray = Wed PM, teal = last night). The shift in call skew seems linked to new long call demand, more so than a short call cover into the TSLA rally. We state this as our data showed traders were already net long calls into earnings.

A side note on TSLA: call positions seemed to have been rolled yesterday, with the peak negative gamma shifting from ~260 up toward ~280. This suggests the stock is not yet overbought, but the upside momentum has reduced. Into next week we see support we see at 250, with resistance at 270.

Shifting away from TSLA, we’ve obviously been tagging the NVDA Jan skew over the past several weeks as our favorite election-rally play. Call IV’s are only mildly lifting, signaling that these options remain on the cheap side. If the market rallies then we think NVDA leads the pack.

The thing is, this low call IV is not only a single stock phenomenon. Below is QQQ Jan skew, with <=30 delta calls at their lowest IV’s in 90 days (green shaded cone). Similar S&P500 skew is not as low as this – but in the S&P in particular you could make the argument that systematic call overwriting is responsible for squashing call skews…no so much in QQQ.

Our takeaway here is that if the market does indeed start to rally out of 11/6 elections & 11/7 FOMC, calls would go bid and that could really drive upside momentum – particularly when combined with the election/FOMC event-vol contraction. The nice thing about these low call IV’s is that it suggests hedging that upside is relatively cheap, and we like calendar spreads (short pre-election calls vs long post-election calls) as a way to play upside into year end.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5848.31 | $5809 | $579 | $20232 | $492 | $2218 | $219 |

| SG Gamma Index™: |

| -0.112 | -0.204 |

|

|

|

|

| SG Implied 1-Day Move: | 0.62% | 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5869.31 | $5830 | $579 | $20190 | $492 | $2240 | $221 |

| Absolute Gamma Strike: | $5839.31 | $5800 | $580 | $20300 | $490 | $2200 | $220 |

| Call Wall: | $6039.31 | $6000 | $585 | $20300 | $500 | $2280 | $230 |

| Put Wall: | $5789.31 | $5750 | $570 | $18500 | $485 | $2220 | $210 |

| Zero Gamma Level: | $5815.31 | $5776 | $578 | $20030 | $491 | $2247 | $223 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.985 | 0.817 | 1.367 | 0.839 | 0.757 | 0.639 |

| Gamma Notional (MM): | ‑$44.502M | ‑$435.584M | $8.447M | ‑$185.749M | ‑$25.448M | ‑$521.281M |

| 25 Delta Risk Reversal: | -0.057 | -0.035 | -0.064 | -0.038 | -0.036 | -0.014 |

| Call Volume: | 451.346K | 1.172M | 7.002K | 675.21K | 15.019K | 230.86K |

| Put Volume: | 701.461K | 1.467M | 7.753K | 875.974K | 20.288K | 300.35K |

| Call Open Interest: | 6.674M | 5.565M | 59.725K | 3.071M | 297.491K | 3.637M |

| Put Open Interest: | 13.28M | 13.963M | 82.356K | 5.839M | 501.392K | 7.263M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5850, 5900, 6000] |

| SPY Levels: [580, 575, 585, 570] |

| NDX Levels: [20300, 20000, 20200, 20400] |

| QQQ Levels: [490, 495, 480, 500] |

| SPX Combos: [(6077,79.98), (6054,88.92), (6048,91.65), (6025,70.84), (6019,77.21), (6002,98.90), (5973,89.28), (5949,95.38), (5938,80.56), (5926,92.26), (5920,88.80), (5909,71.64), (5903,98.66), (5891,80.05), (5880,82.37), (5874,89.50), (5868,91.33), (5862,86.61), (5856,86.33), (5851,96.50), (5845,70.85), (5839,85.61), (5833,90.58), (5792,82.23), (5787,83.11), (5781,90.28), (5769,91.88), (5758,90.55), (5752,95.57), (5746,73.35), (5740,84.86), (5723,84.51), (5717,85.16), (5711,76.47), (5699,94.59), (5688,75.60), (5670,74.93), (5647,88.20), (5624,77.66), (5618,82.28), (5601,90.07), (5577,72.55), (5548,86.24)] |

| SPY Combos: [598.16, 588.33, 603.36, 570.99] |

| NDX Combos: [20294, 20557, 19929, 19727] |

| QQQ Combos: [494.23, 484.95, 480.07, 500.09] |

0 comentarios