Macro Theme:

Key dates ahead:

- 10/31 CORE PCE

- 11/1 PMI

- 11/6 Election

- 11/7 FOMC

We remain long of equities while SPX >5,800, and neutral <5,800. Currently we do note see a material negative gamma SPX position until <5,700, suggesting a lack of strong “risk off” positioning. This prevents us from looking to go short <5,800 until/unless those negative gamma dynamics change.

5,850 is pre-election resistance.

Jan NVDA and/or QQQ calls are our preferred way to hedge the election/FOMC right tail, as call skews are statistically cheap, and the coupling of higher equity prices with call demand could lead to a sharp increase in call values.

Key SG levels for the SPX are:

- Support: 5,700

- Resistance: 5,790, 5,800, 5,820

- As of 10/16/24:

- Long while >5,800

- Risk-off on a break <5,800

QQQ:

- Support: 490, 480

- Resistance: 494, 500

IWM:

- Support: 220, 218

- Resistance: 225

Founder’s Note:

Futures are +40bps, after yesterday’s ~2% decline.

Earnings: AMZN +8%, AAPL -1.5%

Eyes are on NFP, at 8:30 ET this AM. Interestingly, today’s 0DTE straddle is priced at just $44.5, or 84 bps (ref 5,725, IV 28.6%). That strikes us as rather low, given the 2% move, and NFP catalyst.

In regards to yesterday’s selling, the major thing of note was put buying in single stocks. This was a persistent and dominant flow, as discussed in our PM note.

For today we see support at 5,720, 5,700 then 5,650, with no material resistance above until 5,800. You may recall that yesterday AM, when the SPX was near 5,775, there was no material support on our list from 5,780 to 5,700 – well this is the same “empty” range. With that, if NFP is within expectations we could see a sharp move higher, back into the 5,800 zone as short dated “pre-election” IV is sold.

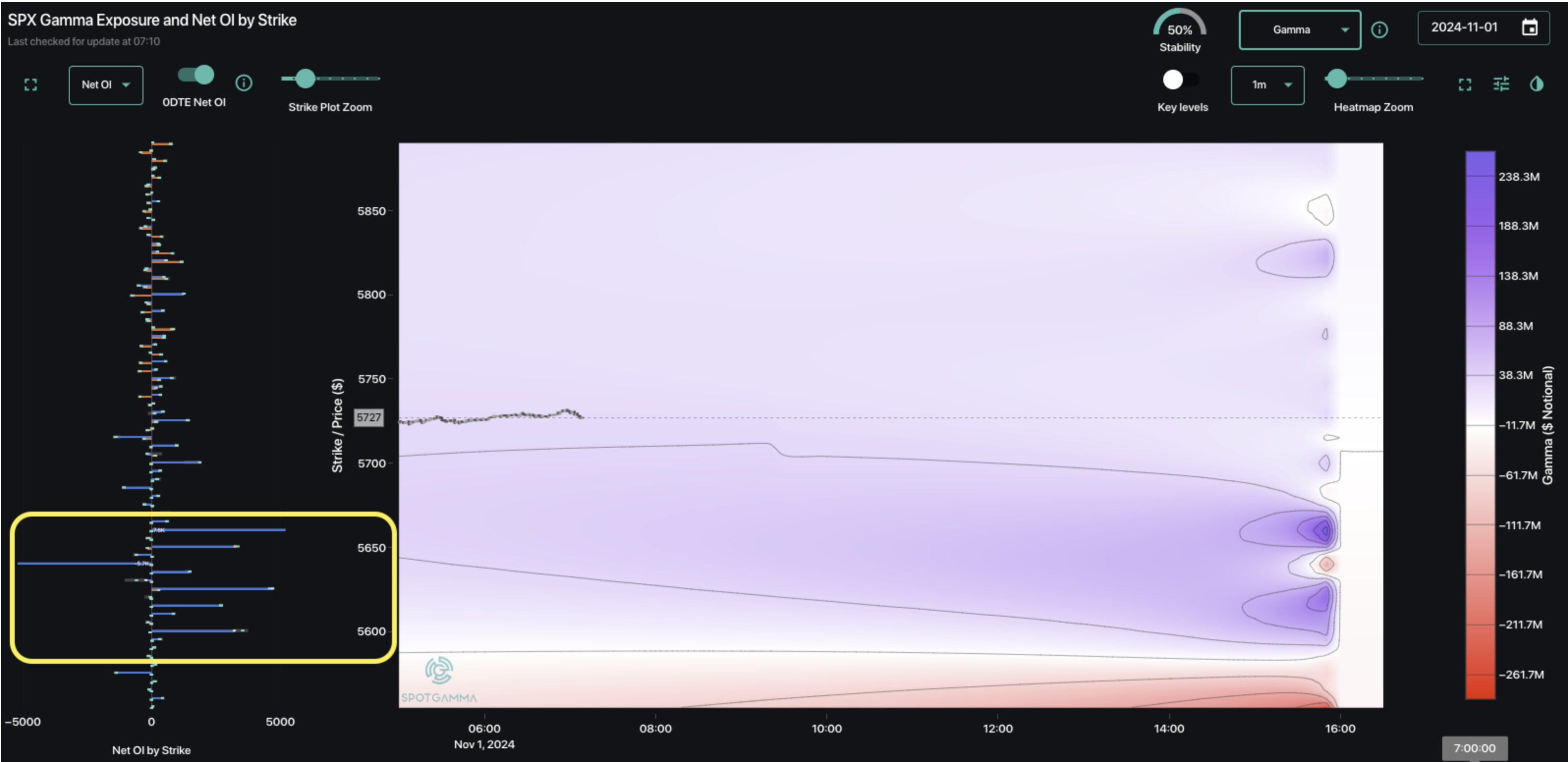

The striking thing we note about today’s market structure is the large amount of 0DTE short put positions traders layered on. This results in dealers long those positions from 5,600 – 5,650 (positive blue GEX bars, yellow box). These puts provide positive gamma support into the 5,650 price area. Should NFP come in hot today, we look at that 5,650 area as support.

The pricing of today’s straddle informs us that traders are not too worried about something that was just triggered in markets yesterday – its more of a heightened focus on next week. You can see this via the Fixed Strike Matrix, wherein fixed strike IV for Monday & Tuesday (pre-election) is lower that on 10/30 (when SPX was >5,800).

A bad NFP today (one that ironically reflects more people have a job…) would likely serve to jack up post-FOMC volatility, as it suggests that rates may be higher for longer.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5738.65 | $5705 | $568 | $19890 | $483 | $2196 | $217 |

| SG Gamma Index™: |

| -1.711 | -0.417 |

|

|

|

|

| SG Implied 1-Day Move: | 0.62% | 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5828.65 | $5795 | $573 | $20090 | $485 | $2240 | $220 |

| Absolute Gamma Strike: | $5833.65 | $5800 | $570 | $20300 | $490 | $2200 | $220 |

| Call Wall: | $6033.65 | $6000 | $590 | $20300 | $500 | $2280 | $230 |

| Put Wall: | $5733.65 | $5700 | $570 | $18500 | $480 | $2220 | $210 |

| Zero Gamma Level: | $5791.65 | $5758 | $576 | $19840 | $490 | $2258 | $222 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.776 | 0.618 | 0.982 | 0.692 | 0.741 | 0.610 |

| Gamma Notional (MM): | ‑$769.502M | ‑$1.631B | ‑$2.489M | ‑$627.433M | ‑$32.628M | ‑$700.055M |

| 25 Delta Risk Reversal: | -0.066 | -0.043 | -0.072 | -0.046 | -0.033 | -0.013 |

| Call Volume: | 583.782K | 1.894M | 10.216K | 1.174M | 13.284K | 314.464K |

| Put Volume: | 1.223M | 2.45M | 13.442K | 1.253M | 28.511K | 665.728K |

| Call Open Interest: | 6.797M | 5.714M | 61.357K | 3.228M | 295.496K | 3.697M |

| Put Open Interest: | 13.176M | 13.063M | 83.554K | 5.939M | 492.925K | 7.486M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5850, 5700, 5000] |

| SPY Levels: [570, 580, 575, 560] |

| NDX Levels: [20300, 20500, 20000, 19500] |

| QQQ Levels: [490, 480, 485, 500] |

| SPX Combos: [(5974,74.61), (5962,70.53), (5951,92.51), (5939,72.88), (5922,90.57), (5899,94.80), (5877,70.91), (5848,87.00), (5802,77.24), (5751,89.61), (5740,81.08), (5723,97.43), (5711,82.81), (5700,97.99), (5688,85.17), (5683,77.94), (5677,88.71), (5671,86.79), (5660,89.26), (5648,96.07), (5643,88.96), (5631,75.12), (5626,84.92), (5620,87.74), (5603,95.05), (5574,81.80), (5569,74.30), (5551,92.78), (5523,72.56), (5517,81.95), (5500,95.41), (5477,81.29), (5472,74.91), (5449,92.86), (5426,72.53)] |

| SPY Combos: [598.52, 588.66, 593.3, 608.38] |

| NDX Combos: [20308, 19731, 19115, 19930] |

| QQQ Combos: [494.39, 499.85, 509.78, 484.96] |

0 comentarios