Macro Theme:

Key dates ahead:

- 11/5 – 11/6 Election

- 11/7 FOMC

We are currently neutral of equities until/unless SPX recovers >=5,800

5,850 is pre-election resistance.

Jan NVDA and/or QQQ calls are our preferred way to hedge the election/FOMC right tail, as call skews are statistically cheap, and the coupling of higher equity prices with call demand could lead to a sharp increase in call values.

Key SG levels for the SPX are:

- Support: 5,720, 5,700, 5,650

- Resistance: 5,760, 5,800

- As of 11/1:

- Long equities if >5,800

- Neutral equities <5,800

- We do not currently see a strong “short” signal due to lack of negative gamma.

QQQ:

- Support: 485, 480

- Resistance: 490, 494, 500

IWM:

- Support: 210

- Resistance: 220, 225

Founder’s Note:

Futures are 25bps higher, as we await elections (tomorrow night, 11/5) & FOMC (Thursday, 11/7).

Dealer gamma opens today as flat to mildly positive, which results in our TRACE Stability Indicator flagging a “low stability” position (i.e. ~1% swings are in play today). Resistance is at 5,750, 5,760, then 5,800. Support is at 5,720 & 5,700.

As we move forward to the key events this week, the TLDR is quite simple:

<5,800 we are bullish

<5,800 we are bearish

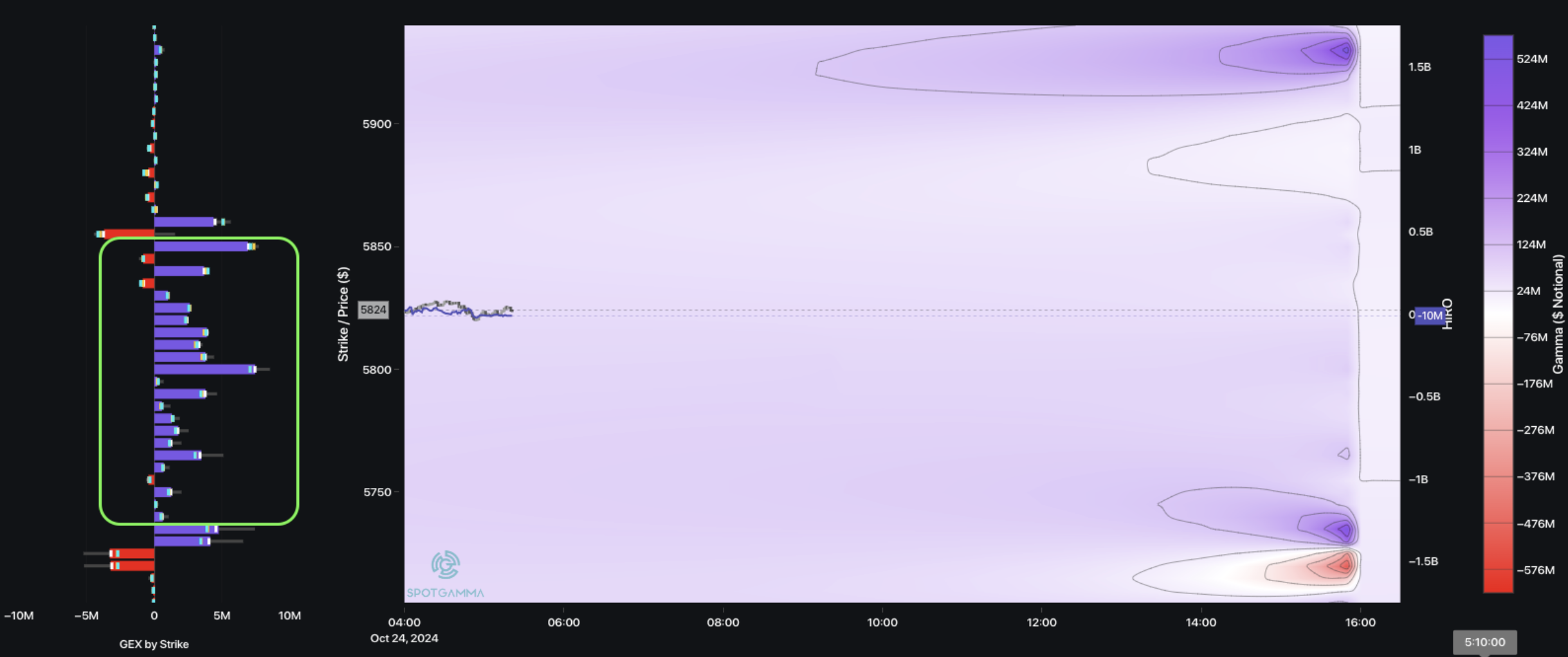

This is because the prevailing positions above 5,800 are calls, and positive dealer gamma, which inherently drives equity support. The gamma curve from our proprietary dealer positioning reflects positive gamma >5,800, with peak positive gamma near 5,900 (red dashed line = 5,750)

Further, a rally above 5,800 signals traders are “risk-on” following the election & FOMC, which should result in a volatility crush. That generates a vanna-thrust, which can drive equities higher. Accordingly, we look at 6,000 – 6,050 as an upside target, due to large open interest in that area. As noted many times, our preferred way to play a move higher is with tech calls (see here).

There is plenty of room for volatility to crush, too. 1-month SPX realized vol (RV) is ~10.7%, vs 1-month implied vol at ~25%.

The spread between VIX (~22) vs SPX RV of ~10.7% is near its 90th percentile, as you can see below. The mean of this spread is 3.5pts, which implies VIX “fair value” is closer to 14. Should elections go off without a hitch, and Powell is benign – 14 VIX is our target.

Below 5,800 the positions are primarily puts. We’ve not yet felt the sting of negative dealer gamma on last weeks break <5,800, because short dated, pre-election/FOMC put sellers have stepped in. That put selling has locally stabilized equities, and its a reason we have been neutral on the break of 5,800, not short (review our “Macro Themes” at the top of Daily Notes).

Even removing that short dated put selling, the truth is we do not currently see a lot of negative dealer gamma until <5,500, as can be seen above. 5,500 is another 4% lower from current levels, and an area we view as major support level, out of FOMC.

Powell and/or the elections could quickly change the existing negative gamma dynamic, and it seems that traders are going to be more reactive to hawkish actions as opposed to hedging into a hawkish tone. The big thing in positioning is that if Powell does trigger a risk-off move, that 0DTE/short dated put selling that has been “catching” markets is likely to disappear, which forms a liquidity hole. With that, a move down to 5,500 could happen much more quickly than the GEX curve implies.

To play downside we like Nov OPEX put structures which generate short deltas into the 5,500 strike. This can be put spreads (more aggressive), put calendars, or put flies (ex: 5,500 x 5,400 x 5,300) – the key being an avoidance of naked long puts due to the currently elevated IV (If the equity market rallies, long puts will be a painful position).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5757.85 | $5728 | $571 | $20033 | $487 | $2210 | $218 |

| SG Gamma Index™: |

| -1.166 | -0.343 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5789.85 | $5760 | $572 | $20025 | $490 | $2240 | $220 |

| Absolute Gamma Strike: | $5829.85 | $5800 | $580 | $20300 | $490 | $2200 | $210 |

| Call Wall: | $6029.85 | $6000 | $590 | $20300 | $510 | $2280 | $230 |

| Put Wall: | $5729.85 | $5700 | $570 | $18500 | $465 | $2220 | $210 |

| Zero Gamma Level: | $5767.85 | $5738 | $574 | $19832 | $490 | $2238 | $225 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.838 | 0.653 | 1.179 | 0.733 | 0.767 | 0.610 |

| Gamma Notional (MM): | ‑$449.566M | ‑$1.106B | $3.337M | ‑$385.597M | ‑$21.726M | ‑$520.411M |

| 25 Delta Risk Reversal: | -0.06 | 0.00 | -0.066 | -0.05 | -0.033 | -0.013 |

| Call Volume: | 435.718K | 1.243M | 7.841K | 626.146K | 10.113K | 245.602K |

| Put Volume: | 1.022M | 2.07M | 9.021K | 826.679K | 17.22K | 535.712K |

| Call Open Interest: | 6.749M | 5.502M | 60.25K | 3.054M | 288.557K | 3.544M |

| Put Open Interest: | 12.983M | 12.005M | 80.943K | 5.683M | 478.937K | 7.344M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5750, 5850, 5000] |

| SPY Levels: [580, 570, 575, 560] |

| NDX Levels: [20300, 20500, 20000, 21000] |

| QQQ Levels: [490, 480, 500, 485] |

| SPX Combos: [(5998,98.17), (5975,74.65), (5952,92.95), (5941,73.83), (5924,84.16), (5918,80.89), (5901,95.27), (5878,79.58), (5849,88.91), (5798,72.77), (5752,79.83), (5740,73.93), (5729,74.52), (5723,79.48), (5717,91.10), (5700,97.28), (5689,82.20), (5677,91.33), (5666,70.64), (5649,93.53), (5626,82.61), (5620,88.25), (5603,94.85), (5574,82.03), (5568,70.94), (5551,89.87), (5523,76.22), (5517,78.44), (5500,94.53), (5477,76.45), (5448,93.09)] |

| SPY Combos: [568, 570.28, 562.88, 548.1] |

| NDX Combos: [20294, 19112, 19733, 19933] |

| QQQ Combos: [494.05, 480.02, 465.02, 484.86] |

0 comentarios