Macro Theme:

Key dates ahead:

- 11/5 – 11/6 Election

- 11/7 FOMC

We are currently neutral of equities until/unless SPX recovers >=5,800, and short of equities if SPX <5,700.

5,850 is pre-election resistance.

Jan NVDA and/or QQQ calls are our preferred way to hedge the election/FOMC right tail, as call skews are statistically cheap, and the coupling of higher equity prices with call demand could lead to a sharp increase in call values.

To hedge downside we recommend Nov put spreads, or put flies, which are net short delta into 5,500 (our key support area). We also highlight put-buying in relatively low-IV names, like AMD.

Key SG levels for the SPX are:

- Support: 5,720, 5,700, 5,600

- Resistance: 5,760, 5,800

- As of 11/5:

- Long equities if >5,800

- Neutral equities from 5,700 to 5,800

- Short equities if SPX <5,700

QQQ:

- Support: 485, 480

- Resistance: 490, 494, 500

IWM:

- Support: 210

- Resistance: 220, 225

Founder’s Note:

Futures are mildly higher for today. ISM Services PMI are at 10:45 AM ET. This is, of course, followed by US elections which will not be impactful to markets until tomorrow.

We’ve outlined our key points for the post-election/FOMC period in yesterday’s AM note (here).

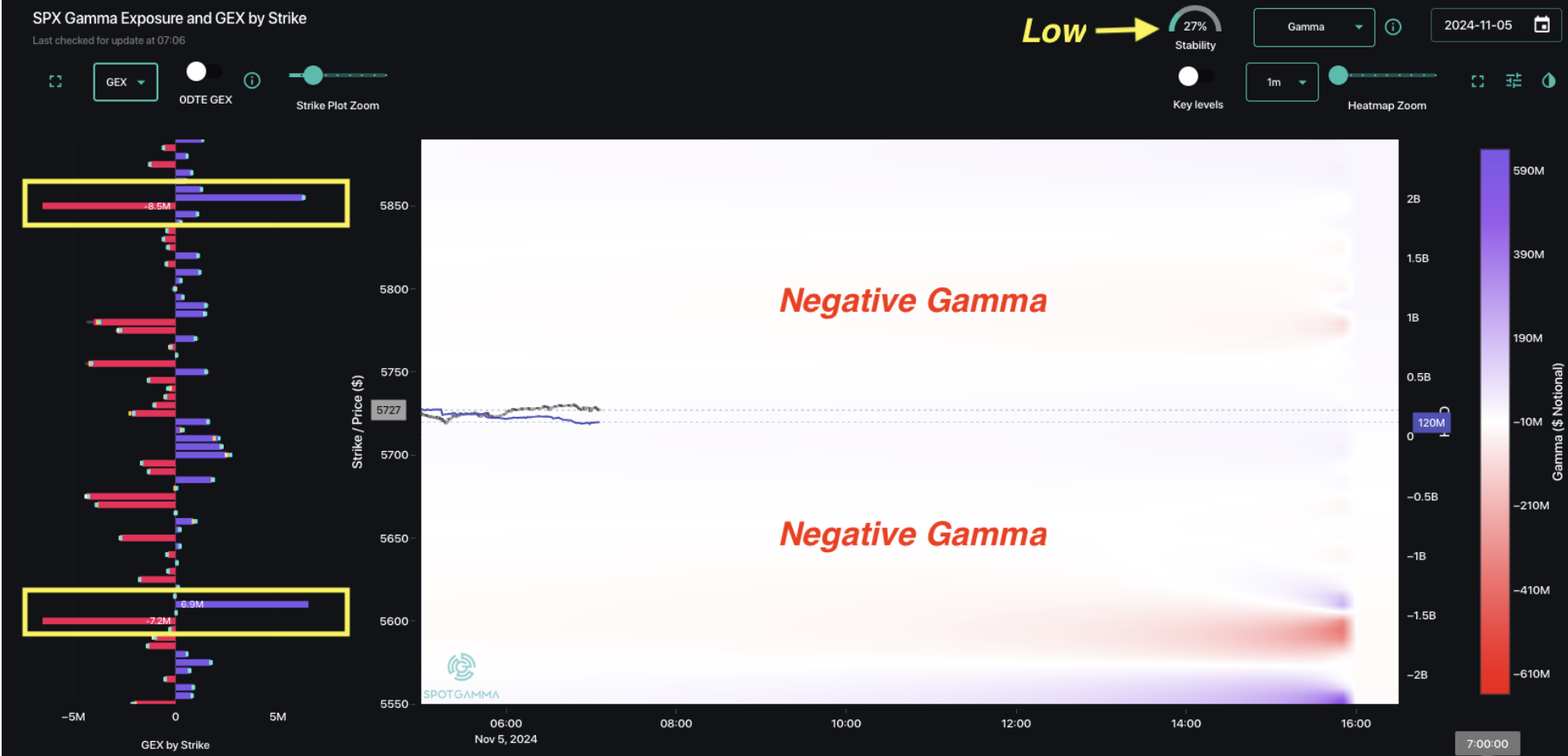

For today, support is at 5,720 & 5,700, with resistance at 5,750. Stability is low (per TRACE), suggesting equities could see large swings today. However, we would anticipate fairly active 0DTE trading, which would add stability on tests of either 5,700 (0DTE traders are likely to sell puts into that strike) or 5,750 (traders are likely to sell 0DTE calls). This 0DTE options selling is the action that took place yesterday, which turned a low-Stability open into a sleeper-session.

Outside of today, there are a few other key developments:

- First, positive gamma is now all but gone, as we see dealers facing a mildly negative gamma position on a break <5,700. For this reason, we will look to be net short SPX on a break <5,700. This, versus our previous stance that was neutral of equities while SPX <5,800.

- Second, there is also negative gamma >5,750, all the way into 5,850, which implies that a rally could quickly fill that upside void. That rally is likely not a “today” thing, but possibly tomorrow – *if* there is a clean and decisive winner tonight (good luck to us on that…).

- Third, we see looks like a fairly large iron condor trade – but this is not a 0DTE “Captain Condor” style spread. We say “this amounts to” because the various legs are netting out (vs other positions) to be different sizes & different expirations, and the “call spread” is 5 strikes wide vs 10 strikes wide for the “put spread”:

- Dealers have on:

- 5,850 (-12k) x 5,855 (+6k) calls for 11/15 exp

- 5,600 (-15kk) x 5,610 (+8k) put spread for today (11/5) exp

You can see these positions highlighted in yellow boxes, below. Because the put spread expires today, and its 150 handles OTM, its not in play. The “call spread” expires on 11/15, and may be of note in a post-FOMC rally.

Finally, AMD came up in yesterday’s SpotGamma Q&A. The question turned to an interesting idea of using low-IV stocks as an election/FOMC hedge instead of rather expensive Index options (SPX/SPY, etc).

In this case, AMD recently reported earnings, and the stock is down -16% over the last week (ouch). With that news gone, you can see 1-month AMD skew for slightly downside strikes is at 90-day lows.

AMD has a beta to the SPX of 1.7 which suggests that if the equity-market crashes, AMD should crash harder than S&P.

Was some AMD downside juice taken out by earnings and the subsequent stock drop? Probably. But, if the equity market drops we doubt AMD is immune, and buying puts at IV lows is generally more attractive than paying IV highs.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5741.37 | $5712 | $569 | $19963 | $485 | $2219 | $220 |

| SG Gamma Index™: |

| -1.236 | -0.364 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5792.98 | $5763.61 | $574.64 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5716.26 | $5686.89 | $567 |

|

|

|

|

| SG Volatility Trigger™: | $5779.37 | $5750 | $572 | $20030 | $487 | $2220 | $220 |

| Absolute Gamma Strike: | $5829.37 | $5800 | $580 | $20300 | $490 | $2200 | $210 |

| Call Wall: | $6029.37 | $6000 | $590 | $20300 | $510 | $2280 | $230 |

| Put Wall: | $5529.37 | $5500 | $560 | $18500 | $465 | $2220 | $210 |

| Zero Gamma Level: | $5794.37 | $5765 | $577 | $19763 | $492 | $2230 | $225 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.830 | 0.639 | 1.117 | 0.692 | 0.884 | 0.663 |

| Gamma Notional (MM): | ‑$441.716M | ‑$1.086B | $1.982M | ‑$464.833M | ‑$12.178M | ‑$435.593M |

| 25 Delta Risk Reversal: | -0.059 | 0.00 | -0.057 | -0.04 | -0.033 | -0.011 |

| Call Volume: | 415.165K | 1.253M | 6.996K | 709.211K | 16.795K | 277.439K |

| Put Volume: | 865.951K | 1.781M | 9.565K | 864.594K | 22.939K | 494.285K |

| Call Open Interest: | 6.823M | 5.614M | 61.368K | 3.099M | 293.486K | 3.578M |

| Put Open Interest: | 13.059M | 12.196M | 82.829K | 5.763M | 482.392K | 7.441M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5750, 5000, 5850] |

| SPY Levels: [580, 570, 560, 550] |

| NDX Levels: [20300, 20500, 20000, 19500] |

| QQQ Levels: [490, 480, 485, 460] |

| SPX Combos: [(5975,71.11), (5953,92.07), (5924,84.49), (5913,78.56), (5901,94.50), (5873,83.19), (5850,88.28), (5724,74.30), (5713,82.28), (5701,93.63), (5696,70.01), (5690,69.35), (5673,91.26), (5667,73.77), (5650,93.24), (5644,70.53), (5633,73.63), (5627,85.40), (5616,83.86), (5598,95.16), (5593,74.20), (5576,86.51), (5553,92.87), (5524,78.16), (5513,83.26), (5501,95.42), (5473,82.65), (5467,69.70), (5450,93.66)] |

| SPY Combos: [597.88, 568.18, 588.17, 558.48] |

| NDX Combos: [20303, 19105, 19724, 19504] |

| QQQ Combos: [493.77, 465.01, 480.12, 484.99] |

0 comentarios