Macro Theme:

Key dates ahead:

- 11/13 CPI

We are long of equities while SPX is >5,900, with an initial upside target of 6,000 (Call Wall).

From pre-election: “Jan NVDA and/or QQQ calls are our preferred way to hedge the election/FOMC right tail, as call skews are statistically cheap, and the coupling of higher equity prices with call demand could lead to a sharp increase in call values.”

With Trump’s victory, we will be looking for further TSLA upside, with a target of 300.

Key SG levels for the SPX are:

- Support: 5,950

- Resistance: 6,000, 6,050

- As of 11/7:

- Long equities if >5,900

- Neutral equities from 5,900 to 5,800

- Short equities if SPX <5,800

QQQ:

- Support: 510, 509, 500

- Resistance: 515

IWM:

- Support: 235, 230

- Resistance: 240

Founder’s Note:

Futures are 15 bps lower overnight, and 16bps off from yesterday’s FOMC.

Key support is at 5,950 today, with major resistance at 5,600. Overall, gamma is quite positive, which invokes a “High Stability” regime: dips are likely to be bought, and rallies sold.

And, while the equity market isnt markedly higher post FOMC, equity vol has slumped. Shown here is fixed strike SPX vol comparing the close of 11/6, vs this morning. This informs us that Powell has invoked “risk on” sentiment.

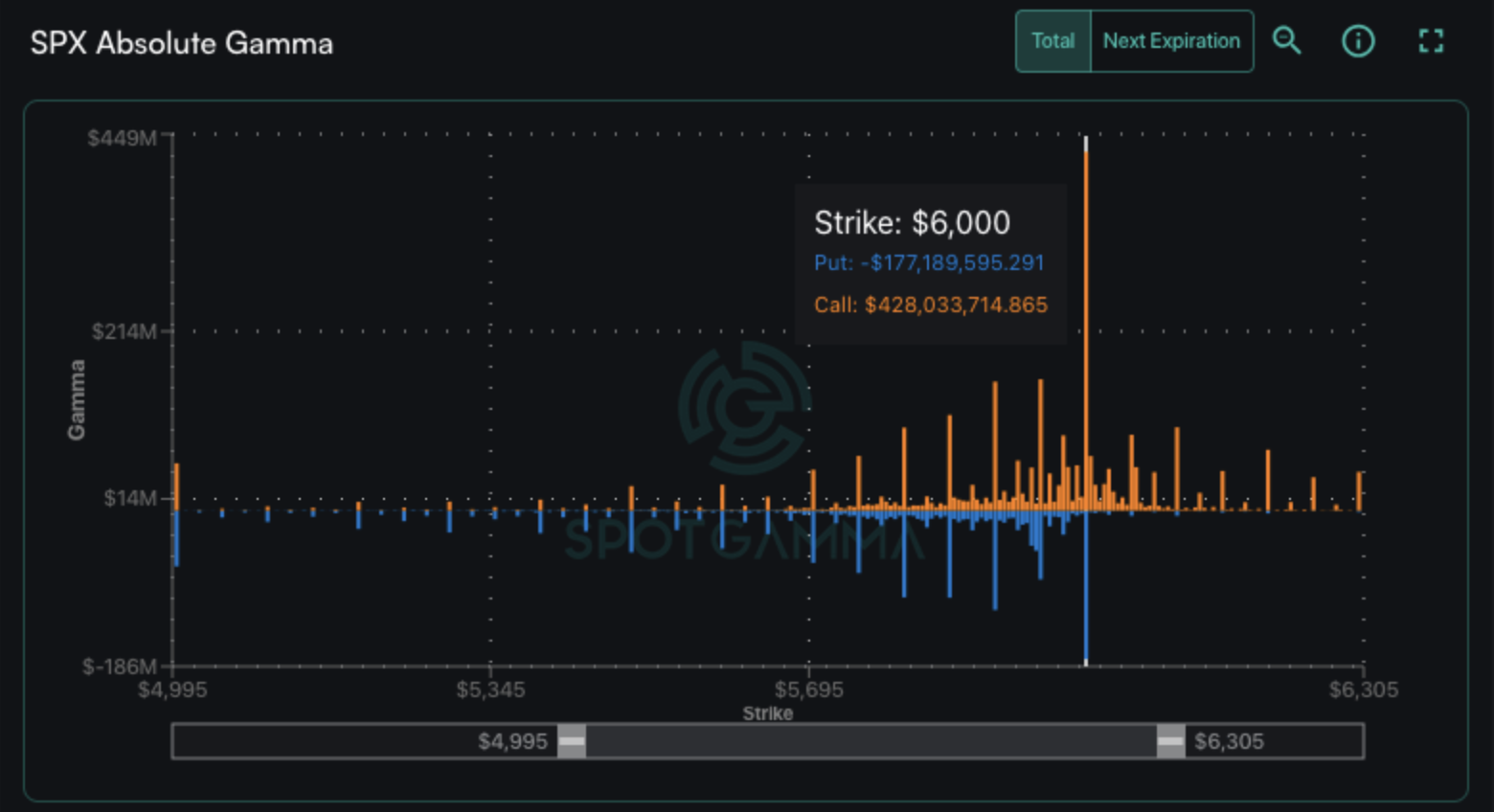

6,000 is the major magnet area, as it is an absolute monster level. Shown below is “absolute” total gamma (i.e. not netted), and its impossible to miss the size of that 6k strike. 20k calls of the 300k total calls at 6k expire today.

That’s decent size expiring, certainly making it “the” level to watch, today. However, next weeks Monthly OPEX is a much more impactful expiration, and therefore 6,000 likely remains a key level into next week as another ~30k calls (at 6,000) expire.

Gamma peaks into OPEX, and that should result in lower realized volatility for the indexes. Accordingly, the prime range we are likely set to digest next week is the 6,000 – 6,050.

Lining up with key levels for today is Captain Condor, who is back – again! Today we see this trader has sold ~8k Iron Condors at the: 6,000/6,005 vs 5,945/5,940.

Finally, TSLA. We wrote on a longer piece here on why we think there is a lot more upside for TSLA after it hit our short-term upside target of 300.

300 is a massive level for today, as you can see in the EquityHub plot:

While 300 is the big level for today, we see traders adding long calls to strikes >300. This results in a GEX curve that now has a minima near 310 (black line) vs 300, yesterday (yellow line). We do think that 300 is sticky for today, but this updated data does seem to support our longer term rally thesis.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6001.78 | $5973 | $595 | $21101 | $513 | $2382 | $236 |

| SG Gamma Index™: |

| 3.364 | 0.287 |

|

|

|

|

| SG Implied 1-Day Move: | 0.63% | 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5863.78 | $5835 | $593 | $20270 | $509 | $2250 | $225 |

| Absolute Gamma Strike: | $6028.78 | $6000 | $600 | $21000 | $510 | $2250 | $230 |

| Call Wall: | $6028.78 | $6000 | $600 | $20300 | $515 | $2400 | $240 |

| Put Wall: | $5973.78 | $5945 | $560 | $18500 | $465 | $2250 | $210 |

| Zero Gamma Level: | $5877.78 | $5849 | $590 | $19967 | $508 | $2272 | $230 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.542 | 1.355 | 2.241 | 1.177 | 1.511 | 1.323 |

| Gamma Notional (MM): | $1.092B | $1.139B | $19.99M | $322.938M | $35.186M | $404.487M |

| 25 Delta Risk Reversal: | -0.028 | -0.006 | -0.031 | -0.009 | -0.007 | 0.016 |

| Call Volume: | 703.222K | 1.864M | 11.869K | 942.617K | 26.055K | 607.876K |

| Put Volume: | 996.29K | 1.993M | 10.044K | 1.194M | 25.248K | 817.554K |

| Call Open Interest: | 7.257M | 6.085M | 65.061K | 3.341M | 312.955K | 3.977M |

| Put Open Interest: | 13.57M | 13.722M | 87.015K | 6.353M | 508.112K | 8.095M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5950, 5850] |

| SPY Levels: [600, 595, 590, 580] |

| NDX Levels: [21000, 20300, 20500, 21500] |

| QQQ Levels: [510, 500, 515, 490] |

| SPX Combos: [(6248,93.92), (6200,98.15), (6170,81.40), (6152,95.46), (6122,87.84), (6116,79.55), (6099,99.21), (6075,95.03), (6069,83.93), (6063,76.69), (6057,96.76), (6051,99.09), (6039,85.62), (6033,91.19), (6027,96.94), (6021,91.05), (6015,96.68), (6009,93.38), (6003,99.99), (5997,84.14), (5991,95.74), (5985,80.02), (5979,94.84), (5973,97.47), (5967,92.27), (5961,88.87), (5949,98.09), (5943,93.98), (5925,92.92), (5907,69.01), (5901,92.84), (5752,69.31), (5698,78.38)] |

| SPY Combos: [598.13, 593.4, 595.77, 608.18] |

| NDX Combos: [21165, 21355, 20954, 20300] |

| QQQ Combos: [510.13, 493.95, 508.11, 511.14] |

0 comentarios