Macro Theme:

Key dates ahead:

- 11/21 Jobless Claims

NVDA ER, on 11/20 is our major EOY catalyst. Jan SMH calls are our preferred way to play upside post NVDA ER.

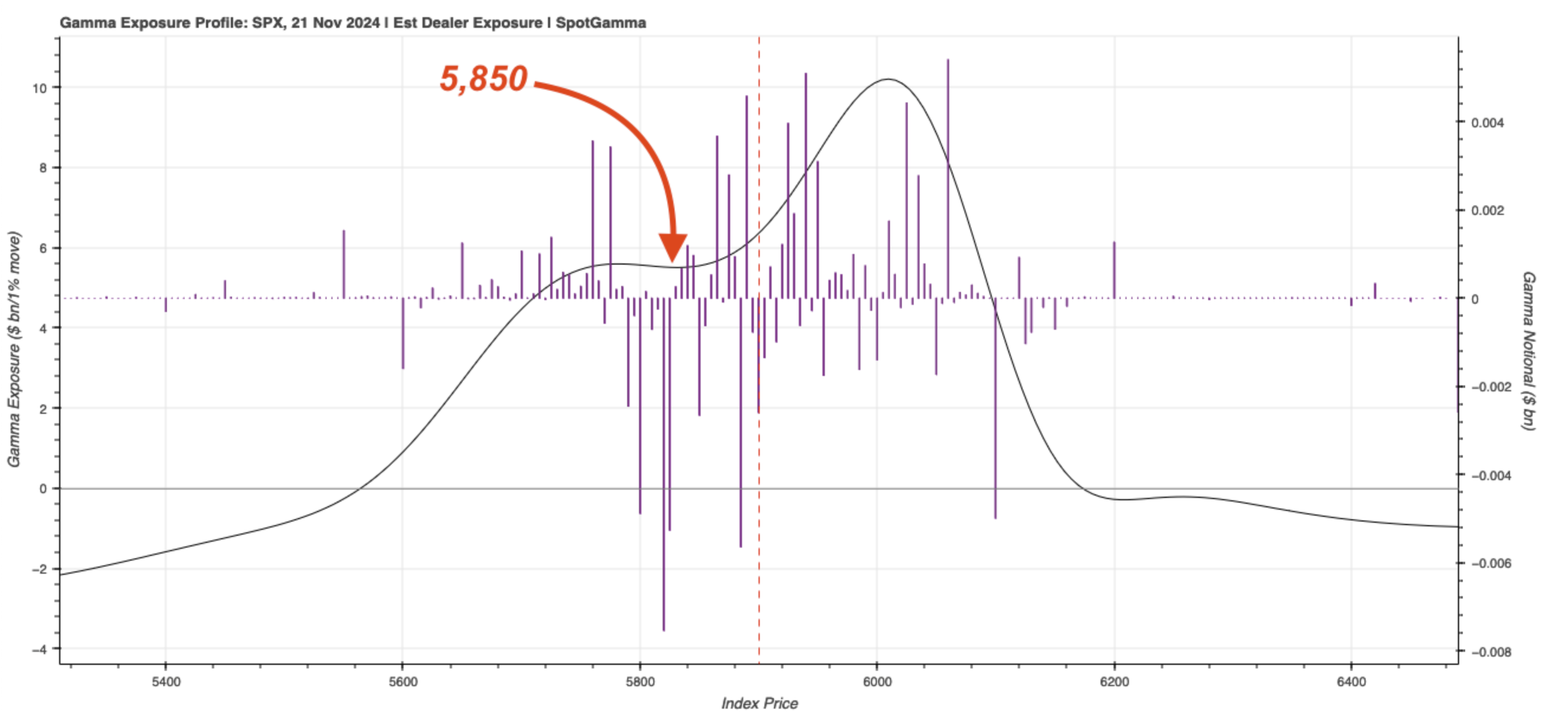

We are flat in the S&P500 until the SPX recovers 5,900. <5,850 we would flip back to a net short position.

11/19: Should there be a significant geopolitical escalation, we are on watch for an increase in put buying, and negative dealer gamma. That could invoke higher downside volatility on a break <5,800. In this scenario, we see 5,500 as major long term support.

Key SG levels for the SPX are:

- Support: 5,900, 5,875, 5,850

- Resistance: 6,000

- As of 11/19:

- Long equities if >5,900

- Neutral equities from 5,850-5,900

- Short equities if SPX <5,850

QQQ:

- Support: 500, 495

- Resistance: 505

IWM:

11/15: OPEX may mark the end of IWM consolidation (after very rich call skews), with lines up with 230 support. We currently have no view on small caps.

- Support: 230, 228, 225

- Resistance: 235

Founder’s Note:

Futures are off 20bps after NVDA earnings last night. NVDA is -3% premarket to 141.

The initial reaction to NVDA earnings is ambiguous, which (initially) gives volatility sellers the upper hand. We remain of the view that a longer term directional move will start today, and we’ll be on

HIRO

watch to see how things with NVDA develop. Strong long term call buying is the bullish signal bulls want to see. Conversely, heavy put buying, and a break <140 is the likely long term downside trigger.

For SPX, gamma shows as mildly positive, with 5,900 as the key support/resistance ”

pivot”

. We look to remain long of equities if/when SPX > 5,900, with no major resistance to 6,000.

To the downside, support is at 5,875 & 5,850. We shift to risk-off <5,850.

Along with NVDA we are eyeing the geopolitical risk premium, which has grown over the last several sessions. This is resulting in the VIX >17, along with a jump in vol indicies like the SDEX, below. This index measures the value of a ~30DTE SPY 1 std dev OTM put vs an ATM put. While we are not geopolitical analysts, we do think that this risk premium is going to be tough to extract over the coming days, which may hamper equity upside.

This, combined with a NVDA move <140 could be the downside bat-signal.

We have seen the downside gamma picture deteriorate over the last several sessions. There is now a clear pocket of negative gamma <5,850, which infers downside volatility could spike into that zone. Further, if equities do start to slide, the geopolitical risks may hamper short-vol sellers response(s) – or even induce put buying, which would add to negative gamma.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5938.25 | $5917 | $590 | $20667 | $503 | $2325 | $230 |

| SG Gamma Index™: |

| 0.391 | -0.041 |

|

|

|

|

| SG Implied 1-Day Move: | 0.61% | 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5896.25 | $5875 | $589 | $20470 | $500 | $2300 | $230 |

| Absolute Gamma Strike: | $6021.25 | $6000 | $600 | $20475 | $500 | $2330 | $230 |

| Call Wall: | $6021.25 | $6000 | $600 | $20475 | $520 | $2500 | $240 |

| Put Wall: | $5821.25 | $5800 | $580 | $18500 | $490 | $2220 | $225 |

| Zero Gamma Level: | $5903.25 | $5882 | $585 | $20306 | $506 | $2337 | $236 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.052 | 0.957 | 1.337 | 0.786 | 0.885 | 0.670 |

| Gamma Notional (MM): | $231.935M | $321.403M | $9.597M | ‑$215.184M | ‑$11.918M | ‑$397.256M |

| 25 Delta Risk Reversal: | -0.044 | -0.032 | -0.049 | -0.026 | -0.027 | -0.024 |

| Call Volume: | 445.869K | 1.528M | 7.196K | 807.641K | 13.488K | 248.011K |

| Put Volume: | 817.731K | 1.627M | 8.987K | 962.012K | 19.647K | 405.999K |

| Call Open Interest: | 7.213M | 6.225M | 65.962K | 3.346M | 320.932K | 3.707M |

| Put Open Interest: | 13.172M | 12.19M | 83.785K | 6.17M | 533.581K | 7.848M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5800, 5850] |

| SPY Levels: [600, 590, 595, 580] |

| NDX Levels: [20475, 21000, 20500, 20000] |

| QQQ Levels: [500, 510, 490, 505] |

| SPX Combos: [(6201,97.03), (6177,77.48), (6166,78.53), (6148,93.75), (6124,80.13), (6112,80.40), (6101,98.54), (6077,87.78), (6071,77.50), (6065,81.11), (6059,77.07), (6053,94.96), (6047,96.68), (6041,75.89), (6030,73.24), (6024,87.77), (6018,88.67), (6012,92.23), (6000,99.36), (5994,78.48), (5982,86.15), (5976,78.80), (5970,77.85), (5964,87.59), (5953,95.71), (5941,86.54), (5935,75.02), (5923,82.50), (5876,75.27), (5870,72.19), (5864,77.62), (5858,79.40), (5852,89.21), (5840,86.97), (5834,71.02), (5822,93.91), (5811,88.68), (5799,94.70), (5793,80.44), (5775,76.07), (5763,80.33), (5757,72.71), (5751,90.77), (5728,72.59), (5710,70.56), (5698,91.10), (5675,75.05), (5651,85.40), (5627,75.51)] |

| SPY Combos: [598.54, 608.58, 618.61, 603.27] |

| NDX Combos: [20481, 20130, 19923, 19716] |

| QQQ Combos: [498.37, 489.81, 484.77, 505.92] |

0 comentarios