Macro Theme:

Key dates ahead:

- 11/26 FOMC Mins

- 11/27 CORE PCE

- 11/28 Thanksgiving Holiday

- 11/29 Holiday 1/2 day

We are long of equities while SPX >6,000 with an upside target of 6,050. We are neutral 5,900-6,000& <5,900 we flip to risk-off.

11/22: Should there be a significant geopolitical escalation, we are on watch for an increase in put buying, and negative dealer gamma. That could invoke higher downside volatility on a break <5,900. In this scenario, we see 5,500 as major long term support.

Key SG levels for the SPX are:

- Support: 5,965, 5,950

- Resistance: 6,000, 6,050

- As of 11/22:

- Long equities if >6,000

- Short equities if SPX <5,900

QQQ:

- Support: 505, 500

- Resistance: 510

IWM:

- Support: 240, 235

- Resistance: 245

Founder’s Note:

Futures are flat, with FOMC Mins on tap for 2pm ET.

Critically for today, we are moving to a net neutral stance on equities until/unless the SPX closes >6,000.

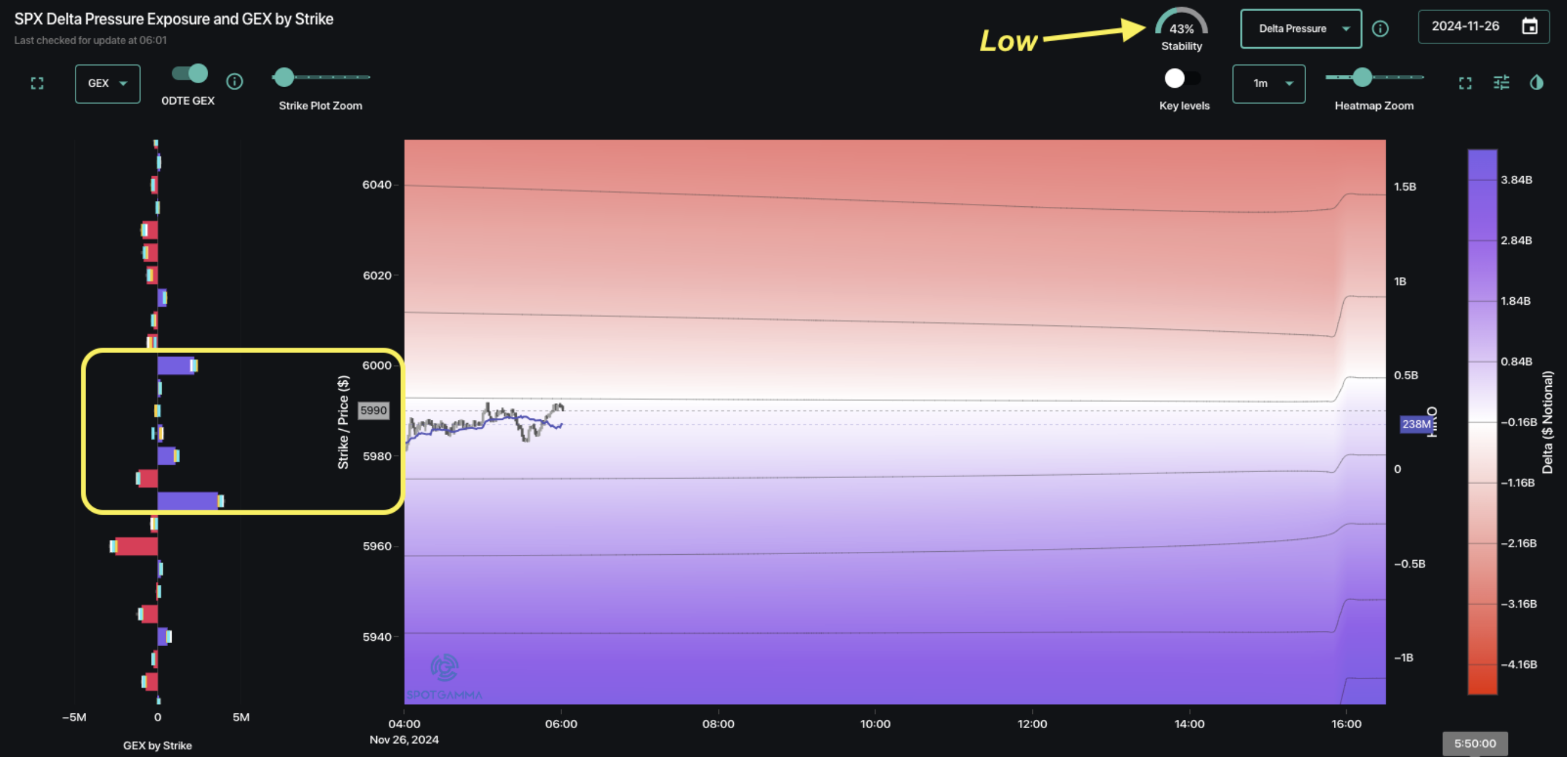

The SPX is pressing up against the large 6,000 strike, which should be a major area of attraction. While this implies equity stability, Trace distinctly reflects low stability this AM – as it did yesterday. We in particular note the zones >6,000 and <5,970 wherein there are small net negative gamma positions in play. Should the SPX feed into one of those two zones we would expect volatility to increase.

In regards to FOMC Mins today, and PCE tomorrow, we see the term structure as both flat & low (traders see low risk). We note today’s 0DTE straddle is a lowly $24 or 40bps. This pricing is as low as it gets, and the last time we saw pricing like this was on Thu 11/14, when Powell’s somewhat hawkish comments sparked a selloff into Fri OPEX. If you go back and read this note, we cover why this “riskless” pricing is an issue for equities, and therefore volatility really only has two options:

1) Expand – which is a viable option given FOMC mins + PCE tomorrow

2) Stay flat – this is also a viable option considering the holiday week

The suggestion here is that shorting vol (i.e. short dated SPX options) doesn’t seem like a great risk/reward. We also point back to the negative gamma zones (mentioned above) as high volatility zones.

Lastly, there are signs of deterioration in leading sectors:

First we note Bitcoin, which is -7% over the last two sessions. We view crypto as a proxy for risk assets – but its also currently linked to the rampant speculation in major equity options names like MSTR (-6% premarket).

Second, and arguably more important, is the total lack of bid in NVDA (-7% since 11/20 earnings) and the semi complex. In particular we noted sizable call selling (orange) through most of yesterdays session. Call selling is a mildly bearish bet (vs put buying), but is none-the-less not a bullish expression. Maybe this has to do with “tariff talk“, which heated up overnight – in the end its hard for broader markets to stage a large rally when the top sector is stalled out.

Third is TSLA – which looked ready to ramp yesterday AM (>360) but both call sellers and put buyers came into push the stock back to 340.

For these reasons we are now hold a neutral stance (flat delta) from 5,900 to 6,000. We’d push to net short only on a break <5,900, as we think 5,900 would offer strong support.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6005.93 | $5987 | $597 | $20804 | $506 | $2442 | $242 |

| SG Gamma Index™: |

| 1.912 | 0.242 |

|

|

|

|

| SG Implied 1-Day Move: | 0.61% | 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5983.93 | $5965 | $597 | $20470 | $505 | $2425 | $239 |

| Absolute Gamma Strike: | $6018.93 | $6000 | $600 | $21000 | $510 | $2400 | $240 |

| Call Wall: | $6018.93 | $6000 | $600 | $20475 | $510 | $2500 | $250 |

| Put Wall: | $5518.93 | $5500 | $580 | $18500 | $465 | $2425 | $225 |

| Zero Gamma Level: | $5926.93 | $5908 | $591 | $20442 | $505 | $2399 | $240 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.253 | 1.255 | 1.486 | 0.952 | 1.265 | 1.128 |

| Gamma Notional (MM): | $708.024M | $1.243B | $13.053M | $63.499M | $15.704M | $153.586M |

| 25 Delta Risk Reversal: | -0.032 | -0.025 | -0.04 | -0.027 | -0.016 | -0.014 |

| Call Volume: | 445.114K | 1.672M | 7.278K | 801.502K | 48.657K | 736.739K |

| Put Volume: | 898.477K | 1.833M | 8.449K | 741.152K | 51.972K | 679.623K |

| Call Open Interest: | 7.322M | 6.221M | 65.812K | 3.28M | 324.223K | 3.817M |

| Put Open Interest: | 13.397M | 12.413M | 85.829K | 5.944M | 529.882K | 7.984M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5950, 5800] |

| SPY Levels: [600, 595, 590, 605] |

| NDX Levels: [21000, 20475, 20500, 20800] |

| QQQ Levels: [510, 500, 505, 490] |

| SPX Combos: [(6251,95.87), (6227,72.95), (6203,98.51), (6173,87.22), (6161,88.24), (6149,97.04), (6125,87.25), (6113,86.73), (6101,99.58), (6089,71.69), (6077,96.54), (6071,88.97), (6065,94.12), (6059,83.71), (6053,98.05), (6047,99.38), (6041,90.72), (6035,87.25), (6029,89.19), (6023,96.22), (6017,97.33), (6011,98.27), (6005,89.19), (5999,99.79), (5993,86.48), (5987,90.61), (5963,72.31), (5957,88.04), (5945,73.02), (5927,85.05), (5874,70.43), (5850,82.89), (5838,69.24), (5814,71.43), (5802,86.67), (5748,83.96), (5700,86.75)] |

| SPY Combos: [603.83, 598.47, 608.59, 600.25] |

| NDX Combos: [20951, 20472, 20992, 21367] |

| QQQ Combos: [498.73, 490.13, 509.86, 508.84] |

0 comentarios