Macro Theme:

Key dates ahead:

- 12/2 ISM Manufacturing PMI

- 12/4 ISM Servives PMI, Powell

- 12/5 Jobless Claims

- 12/6 NFP

- 12/11 CPI

Our primary risk signals signal long of equities while SPX >6,000 with an upside target of 6,050. We are neutral 5,900-6,000& <5,900 we flip to risk-off.

11/28: We prefer IWM/DIA to SPX/QQQ due to higher anticipated volatility into year end, but we still use SPX 6,000 as our equity risk on/off barometer.

11/22: Should there be a significant geopolitical escalation, we are on watch for an increase in put buying, and negative dealer gamma. That could invoke higher downside volatility on a break <5,900. In this scenario, we see 5,500 as major long term support.

Key SG levels for the SPX are:

- Support: 6,000, 5,965, 5,950

- Resistance: 6,050

- As of 11/22:

- Long equities if >6,000

- Short equities if SPX <5,900

QQQ:

- Support: 505, 500

- Resistance: 510, 520

IWM:

- Support: 240, 235

- Resistance: 245

Founder’s Note:

Futures are off 15 bps as we enter December.

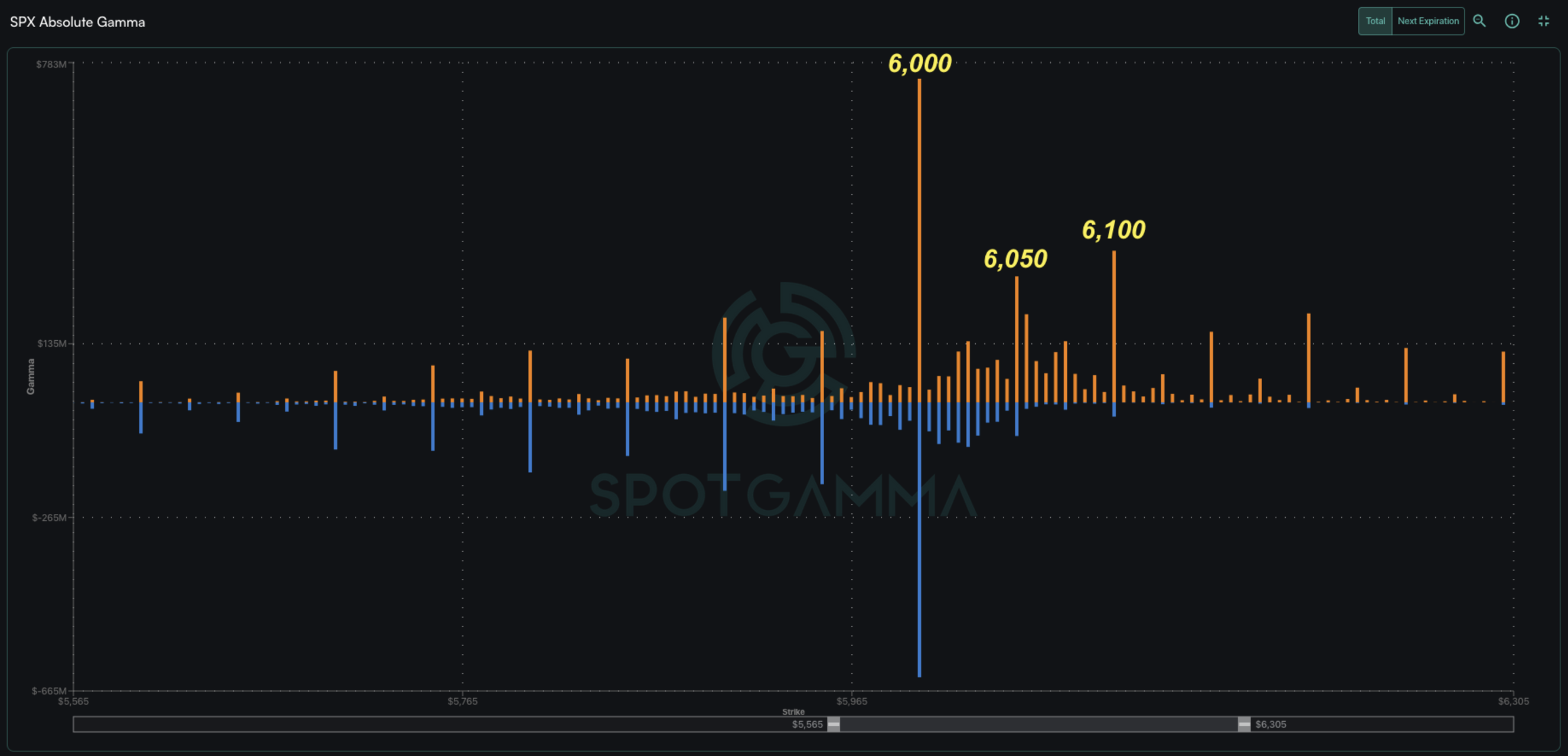

Support is at the massive 6,000 gamma strike, which is far-and-away the largest strike on the board. Resistance is at 6,050, which is our initial upside target. There are also positions building up at 6,100, which we read as constructive for bulls.

There is, quite frankly, “little to see here” as we look to remain long of equities while the SPX is >6,000, letting upside drift maintain our course. We’d currently flip to a neutral stance if the SPX breaks <6,000.

There are a few negative gamma strikes <6,000 which could make for some slipper downside. Additionally, with IV’s at lows, there is some room for vol to break higher if traders shift their stance to risk-off.

On the IV topic, volatility dynamics remain quite interesting. This morning we have ISM PMI, which is often a trigger for some market movement. However, the 0DTE straddle is just $20 (!!!!) or 35 bps – pricing in essentially no market movement. We’ve recently gone on (and on) about the “jump risk” embedded in the low IV of short dated options.

This jump risk is more of a “day traders” problem, as 0DTE prices could have to quickly reshuffle due to an unexpected trigger, which could exacerbate intraday moves. However, for those with longer term views, the low IV’s scream “risk on”, and we wouldn’t counter that stance until/unless SPX loses the key 6,000 strike. At that point we’d likely to elect to add downside protection.

Is this low vol simply the entry into a new regime? Below is a plot of VOLI, which measures at-the-money SPY IV. At current levels, this indicator flags current vols are at post-covid lows, but vols were lower in the Trump era (i.e. pre-’20). Many of you may recall that the lowest realized vol ever was in Oct ’17, when RV hit 3.4% (vs ~13% now), and VIX went <10 (that eventually led to Volmageddon).

We’re not ready to declare “regime shift”, but we do see positive gamma building at DEC OPEX strikes >=6,050, which suggests vol dampening should be a theme into end-of-year.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6046.99 | $6032 | $602 | $20930 | $509 | $2434 | $241 |

| SG Gamma Index™: |

| 5.325 | 0.437 |

|

|

|

|

| SG Implied 1-Day Move: | 0.59% | 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6009.99 | $5995 | $602 | $20470 | $509 | $2445 | $239 |

| Absolute Gamma Strike: | $6014.99 | $6000 | $600 | $21000 | $510 | $2400 | $240 |

| Call Wall: | $6114.99 | $6100 | $605 | $20475 | $520 | $2500 | $250 |

| Put Wall: | $5814.99 | $5800 | $601 | $20970 | $465 | $2320 | $225 |

| Zero Gamma Level: | $5966.99 | $5952 | $597 | $20411 | $508 | $2410 | $239 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.378 | 1.25 | 1.649 | 1.019 | 1.085 | 1.046 |

| Gamma Notional (MM): | $1.694B | $1.729B | $34.285M | $205.969M | $12.081M | $263.995M |

| 25 Delta Risk Reversal: | -0.031 | 0.00 | -0.033 | -0.022 | -0.018 | -0.019 |

| Call Volume: | 762.074K | 1.727M | 15.232K | 892.926K | 18.22K | 433.316K |

| Put Volume: | 1.312M | 2.386M | 14.83K | 1.154M | 33.342K | 376.58K |

| Call Open Interest: | 14.688M | 11.677M | 132.982K | 6.436M | 631.612K | 7.65M |

| Put Open Interest: | 26.391M | 23.231M | 167.586K | 11.655M | 1.042M | 16.02M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 6100, 6050] |

| SPY Levels: [600, 605, 610, 603] |

| NDX Levels: [21000, 20475, 20500, 20800] |

| QQQ Levels: [510, 500, 505, 490] |

| SPX Combos: [(6328,75.35), (6310,71.57), (6298,99.56), (6274,82.20), (6256,75.46), (6250,99.65), (6225,92.17), (6207,89.56), (6201,99.95), (6189,82.85), (6177,97.92), (6171,82.79), (6159,98.41), (6147,99.88), (6141,80.76), (6129,87.48), (6123,99.18), (6117,83.41), (6111,88.36), (6105,99.23), (6099,99.99), (6093,98.81), (6087,94.27), (6081,97.65), (6075,99.78), (6069,99.79), (6063,99.84), (6057,99.98), (6050,99.96), (6044,96.66), (6038,97.98), (6032,92.49), (6026,89.49), (6020,88.09), (6014,85.81), (6008,94.33), (6002,98.53), (5996,74.41), (5990,87.64), (5984,90.30), (5978,76.24), (5972,82.76), (5948,94.40), (5936,75.11), (5930,74.94), (5924,70.35), (5918,78.60), (5906,74.26), (5888,82.69), (5876,79.17), (5851,87.12), (5827,84.81), (5809,82.25), (5797,95.12), (5749,89.81)] |

| SPY Combos: [604.22, 598.83, 609.01, 601.23] |

| NDX Combos: [20470, 21349, 21140, 20951] |

| QQQ Combos: [498.73, 509.85, 506.82, 519.95] |

0 comentarios