Macro Theme:

Key dates ahead:

- 12/6 NFP

- 12/11 CPI

Our primary risk metric signals being long of equities while SPX >6,000 with an upside target 6,100. <6,000 we flip to risk-off. Through to 12/20 OPEX we plan to operate in “buy the dip mode” until/unless <6,000.

12/6: We’ve added various forms of put protection due to low IV’s as a way to protect recent gains, and play any potential volatility expansion between now and year end.

Key SG levels for the SPX are:

- Support: 6,070, 6,050

- Resistance: 6,100, 6,112

- As of 12/06:

- Long equities if >6,000

- Short equities if SPX <6,000

QQQ:

- Support: 520, 510

- Resistance: 525

IWM:

- Support: 235

- Resistance: 240, 245

Founder’s Note:

Resistance: 6,100, 6,151

Support: 6,070, 6,050

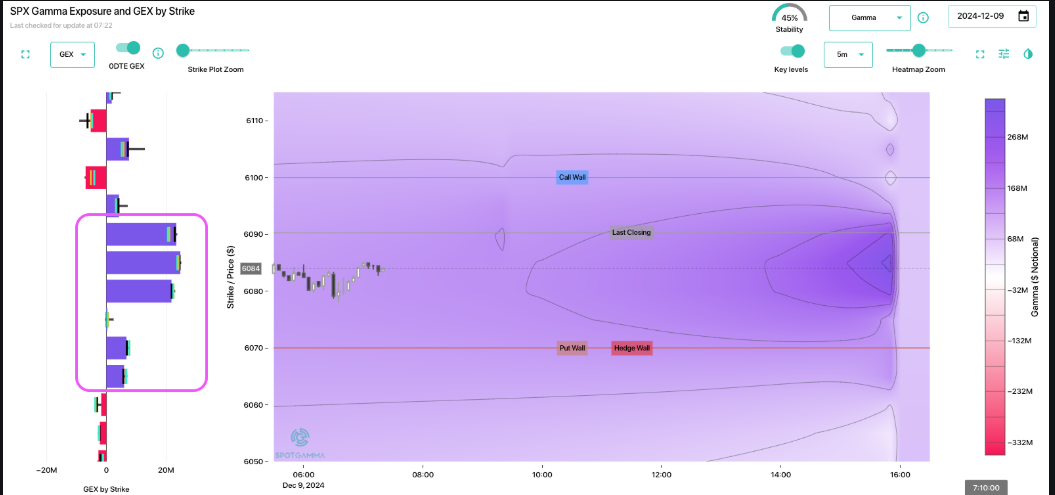

The S&P500 remains embraced by a giant amount of positive gamma, which is likely to keep the Index in a low volatility position. We’ve of course been juxtaposing that low realized expectation against forward volatility estimates (i.e. Implied Vol) that is at an extreme lower bound.

Before we dive in, we see little on the news front for today, and we note a fairly large 0DTE positive gamma cluster around 6,080 & 6,060 which should provide solid daily support.

6,100, which has been our upside S&P target, is a very

large gamma strike

not only for SPX, but 610 in SPY is a beast, too. On this point, we see that our

Call Wall

metric has failed to roll higher, due to lack of OI at high strikes. We therefore, at the moment, have no expectation of further upside.

This is not bearish as much as projecting to a tight, sleepy SPX.

“Great, we’ll “short vol”” you say…well that is tricky given the aforementioned minimum IV.

Here is the SPX term structure, wherein we see that not even the CPI can render an IV reaction. The Dec rate cut is all but guaranteed for Dec, and so any further rate/inflation concerns are likely punted to January.

We’ve spoken ad nauseum about the ramifications and tail-risk associated with this low IV. At a first level, to us, it suggests being short S&P options here makes little sense. Odd’s are we dont get a massive event before 12/20 OPEX (or possibly even year end), but the risk you are getting pays you “sub-nickels” in front of a proverbial steam roller.

We’ve also been in the camp of adding some Jan/Feb put protection given the low cost of carry, de-minimis IV, and frothy bullish sentiment.

The second effect of this is that if we want to be long of equities we want to be long the stuff that has a negative gamma & the potential for upside volatility. This is why we’ve been focused on IWM/DIA over SPY, which admittedly they have been trailing the last week.

What is not trailing is the SMH and Mag 7 (& TSLA, holy cow!), which are on a run since the start of Dec. These names should continue to have a lot more relative volatility over the next week, and present a lot more trading opportunity.

On the TSLA topic, the stock was up ~17% last week, and has a strong negative gamma position up into 420 (black line). For this reason we think the stock has a bit more upside potential, with 400 being a critical level (huge OI, previous ATH as written in our 11/7 note). If

HIRO

reflect call buying after the open, it may be a strong signal of a final push up into this 400-420 region.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6100.93 | $6090 | $607 | $21622 | $526 | $2408 | $238 |

| SG Gamma Index™: |

| 2.15 | 0.215 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6080.93 | $6070 | $607 | $21140 | $524 | $2420 | $239 |

| Absolute Gamma Strike: | $6010.93 | $6000 | $610 | $21000 | $525 | $2400 | $240 |

| Call Wall: | $6110.93 | $6100 | $610 | $21500 | $530 | $2500 | $250 |

| Put Wall: | $6080.93 | $6070 | $607 | $20800 | $524 | $2300 | $225 |

| Zero Gamma Level: | $6019.93 | $6009 | $602 | $20927 | $521 | $2403 | $238 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.265 | 1.203 | 1.606 | 1.149 | 0.968 | 0.938 |

| Gamma Notional (MM): | $852.792M | $1.13B | $15.066M | $368.833M | ‑$1.943M | $5.528M |

| 25 Delta Risk Reversal: | -0.024 | -0.018 | -0.026 | -0.012 | 0.00 | -0.008 |

| Call Volume: | 443.464K | 1.137M | 6.598K | 614.301K | 25.917K | 344.701K |

| Put Volume: | 982.636K | 1.531M | 10.433K | 922.372K | 48.907K | 505.108K |

| Call Open Interest: | 7.736M | 6.079M | 67.932K | 3.49M | 327.526K | 3.938M |

| Put Open Interest: | 14.083M | 12.047M | 95.802K | 6.384M | 540.271K | 8.203M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6050, 5900] |

| SPY Levels: [610, 605, 608, 600] |

| NDX Levels: [21000, 21500, 22000, 20800] |

| QQQ Levels: [525, 520, 530, 510] |

| SPX Combos: [(6352,91.17), (6297,98.15), (6273,79.86), (6261,73.55), (6249,98.81), (6224,88.41), (6212,86.44), (6200,99.77), (6188,84.38), (6182,75.97), (6176,93.87), (6169,89.36), (6163,95.85), (6157,91.40), (6151,99.51), (6145,89.48), (6139,89.08), (6133,97.39), (6127,96.93), (6121,93.99), (6115,98.40), (6109,94.27), (6102,99.96), (6090,86.57), (6084,84.03), (6072,89.35), (6066,91.76), (6060,81.30), (6054,94.73), (6048,87.17), (6042,84.89), (6035,77.78), (6029,87.78), (6023,78.13), (6011,79.25), (5993,80.48), (5975,74.03), (5962,79.33), (5950,86.18), (5926,71.32), (5901,79.63), (5853,81.00), (5798,87.96)] |

| SPY Combos: [609.04, 619.35, 613.89, 610.25] |

| NDX Combos: [21774, 21968, 21990, 21493] |

| QQQ Combos: [524.93, 523.37, 530.15, 534.84] |

0 comentarios