Macro Theme:

Key dates ahead:

- 12/31 OPEX Q-end

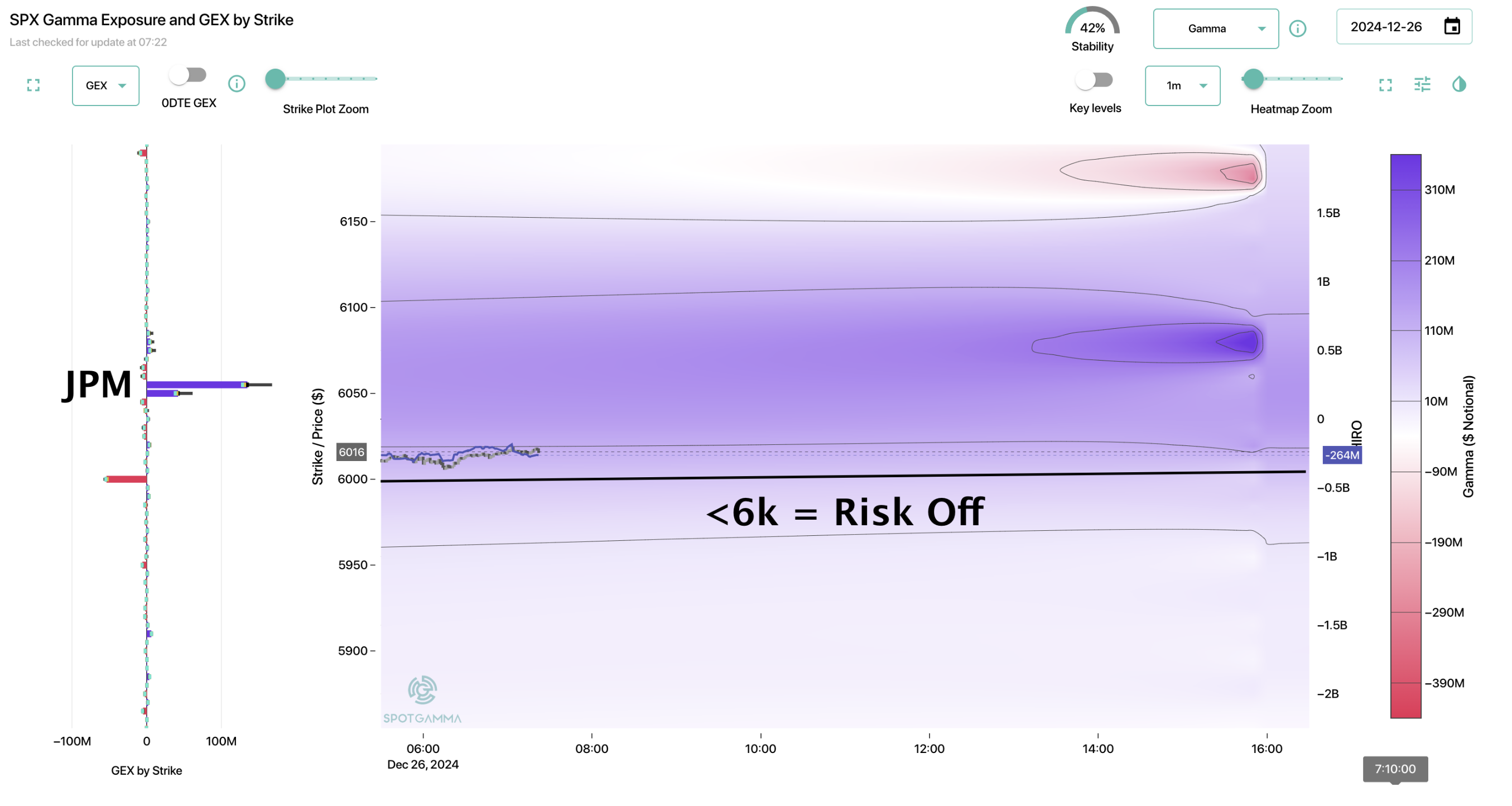

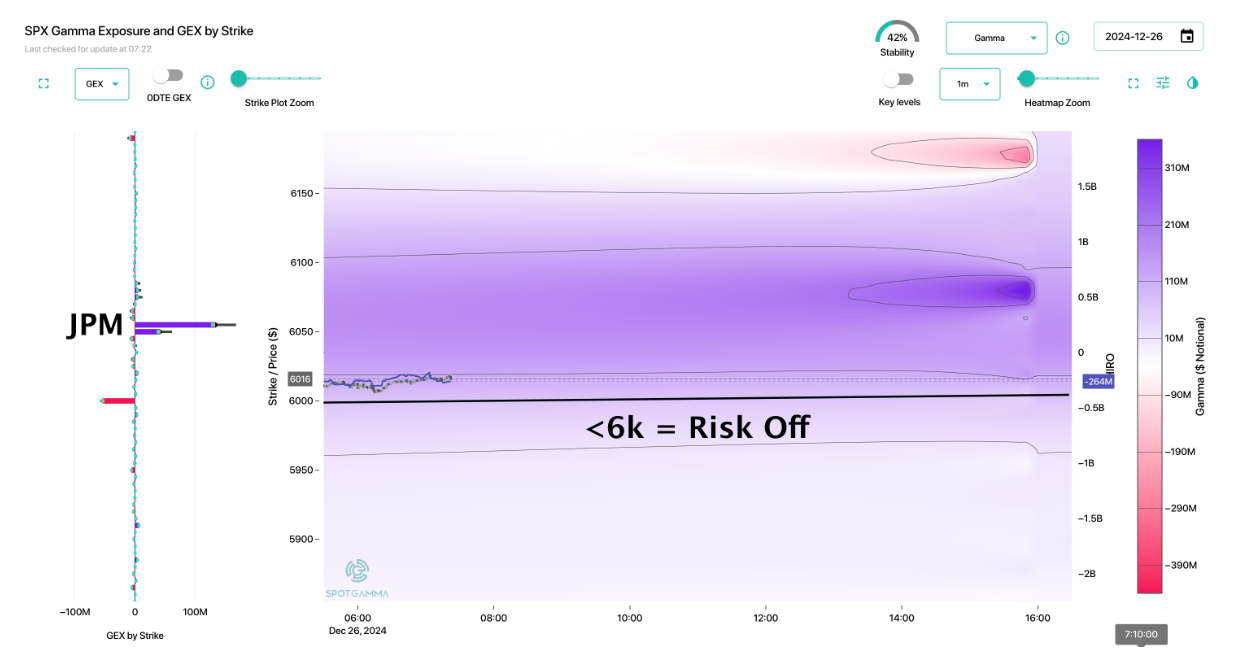

6k was recovered on 12/24, which invokes the JPM collar pin into 6,055 by 12/31 expiration. Should the SPX break <5,990 our view of pinning 6,055 would be removed, and we’d flip to risk off.

Into 12/31 we will be looking to hold longer dated (1 or 2 month) S&P500 puts as equities approach all time highs, and IV’s are pressed back to lows.

Key SG levels for the SPX are:

- Support: 6,000, 5,990, 5,950, 5,900

- Resistance: 6,055

Founder’s Note:

Futures are consolidating Tuesdays big gains: ES &NQ -20bps.

Resistance: 6,055

Support: 6,000, 5,990, 5,960, 5,950

Jobless claims 8:30AM ET

TLDR: We remain long while the SPX is >6,000, with an upside target of 6,055 into 12/31. If the SPX breaks <5,990 we will flip to a short position, with a target of 5,960. A move to 5,960 would likely break any JPM EOY pin (see Tues Note).

Tuesday’s rally was one of the biggest Christmas Ever rallies ever, as vol was crushed and a pocket of 6k negative gamma helped to ramp the SPX to 6,040 (see Tues note).

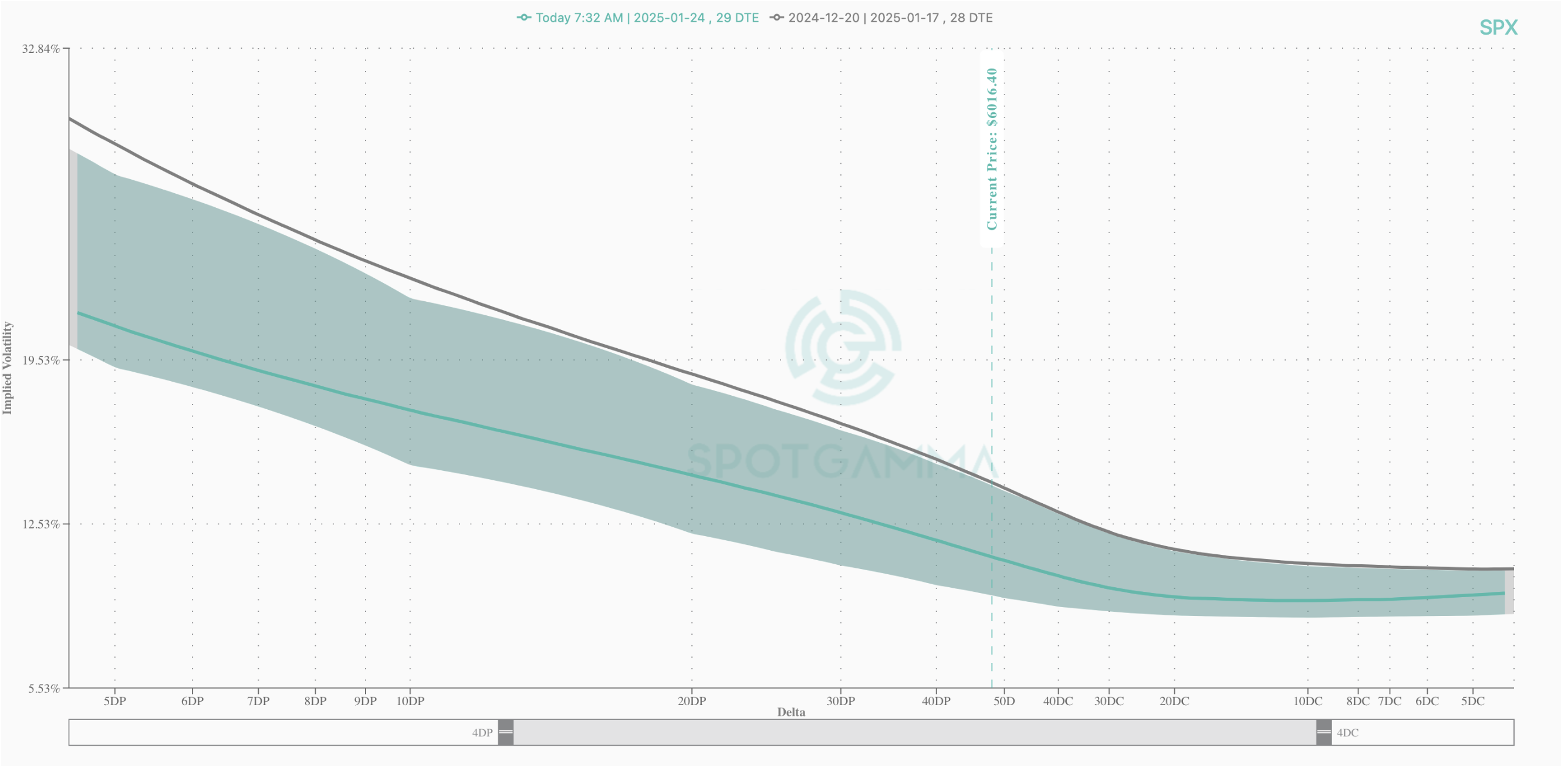

We get a nice depiction of the vol crush via SPX 1-month skew, showing Friday’s night (gray) vs today (teal). This implies that vanna was a key fuel for the aforementioned rally.

Looking forward, the weekend lies just ahead, and that feeds into the New Year’s holiday – not the best time to carry puts. This should keep downside pressure on the bit of vol thats left, which should keep a bid under stocks. That, along with the big gamma at 6,055 for 12/31 keeps us in a bullish stance.

It was only ~1 week ago that Powell took a hawkish turn, which served to dent frothy extremes. With that, traders turned very bearish. However, we suddenly seem to have an equity chase higher back in play, with the likes of TSLA, BTC, “Quantum Computing” all ripping back to highs. With that, index vol (above) is getting smashed.

This is all pushing bullish extremes back to pre-FOMC levels, right into New Years. New Years extremes would line up with the removal of the huge stabilizing gamma at 6,055 for 12/31 exp.

The expiring 12/31 positions do not have to themselves cause a bearish response, but they would likely remove SPX stability. The removal of that stability would happen at a time when SPX IV’s are back at lows, likely making puts pretty cheap.

We also can’t shake how similar this is to December ’21. Today, we have rates driving higher after Powell’s FOMC comments (10 year +20bps to 4.6%), which initially triggered a bearish equity response. Equities have since shaken those lows, and are now broadly back near all time highs.

This was very similar to 2021, wherein Powell sparked an equity decline by suggesting higher rates ahead on 12/15 (gray vertical line, left). Equities recovered to all time highs by Jan 1 ’22, then quickly gave up those gains into mid-Jan.

We’re not macro gurus, and we realize the relative level of rates and forward guidance today differ from ’22. But, at a base level, markets were just delivered a hawkish message that was arguably not priced in, and the equity response 1-week ago backs that idea.

Second, there was incredibly strong seasonality which could delay the “reaction” to changing rates (flows > fundamentals). Accordingly, well be looking to play the bull side for another ~week, but will start to have a much more neutral view as the New Year starts, and will likely add a few downside hedges.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6101.48 | $6040 | $601 | $21797 | $529 | $2259 | $223 |

| SG Gamma Index™: |

| 2.666 | 0.111 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6051.48 | $5990 | $599 | $21270 | $528 | $2320 | $232 |

| Absolute Gamma Strike: | $6061.48 | $6000 | $600 | $22000 | $530 | $2250 | $225 |

| Call Wall: | $6116.48 | $6055 | $605 | $22000 | $535 | $2250 | $240 |

| Put Wall: | $5961.48 | $5900 | $598 | $20800 | $520 | $2220 | $220 |

| Zero Gamma Level: | $6021.48 | $5960 | $595 | $21097 | $525 | $2323 | $231 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.361 | 1.098 | 1.667 | 1.125 | 0.618 | 0.546 |

| Gamma Notional (MM): | $955.07M | $782.85M | $15.777M | $274.998M | ‑$39.82M | ‑$739.518M |

| 25 Delta Risk Reversal: | -0.039 | -0.019 | -0.044 | -0.026 | -0.023 | 0.003 |

| Call Volume: | 494.075K | 1.319M | 9.588K | 564.07K | 10.795K | 266.824K |

| Put Volume: | 723.531K | 1.907M | 6.877K | 580.158K | 15.485K | 418.287K |

| Call Open Interest: | 6.254M | 5.607M | 59.619K | 2.831M | 255.332K | 3.693M |

| Put Open Interest: | 11.863M | 11.433M | 68.456K | 5.34M | 370.302K | 6.615M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6050, 6100, 6055] |

| SPY Levels: [600, 605, 598, 595] |

| NDX Levels: [22000, 21275, 21800, 21900] |

| QQQ Levels: [530, 520, 535, 525] |

| SPX Combos: [(6300,96.09), (6276,77.45), (6251,96.38), (6227,89.49), (6197,98.88), (6191,70.52), (6179,84.73), (6173,84.81), (6149,97.47), (6143,85.05), (6137,70.99), (6125,96.24), (6119,79.33), (6113,80.19), (6106,77.80), (6100,99.17), (6094,92.06), (6088,91.23), (6082,98.75), (6076,99.64), (6070,84.48), (6064,93.93), (6058,97.16), (6052,99.99), (6046,90.55), (6040,87.42), (6034,84.72), (6028,93.74), (6022,82.48), (6010,83.90), (5998,91.33), (5980,84.37), (5974,74.71), (5949,87.86), (5937,73.98), (5925,91.98), (5901,96.97), (5883,70.85), (5877,86.95), (5853,90.42), (5829,73.70), (5823,81.46), (5798,93.11), (5774,78.75), (5750,81.80)] |

| SPY Combos: [603.02, 587.55, 597.07, 617.29] |

| NDX Combos: [21798, 21994, 22016, 21275] |

| QQQ Combos: [517.12, 534.9, 509.8, 505.09] |

0 comentarios