Futures have pressed higher to 3980. Key SG levels remain unchanged, with a fairly tight volatility estimate of 0.89%. 4000-4010(SPY400) is large overhead resistance, with 4050 above that. Support below remains at 3960(SPY395) – 3950, with 3900 major support below there.

The 4000SPX (400SPY) level(s) continue to be the dominant strikes in terms of gamma positioning. As we discussed last night, the oscillation or grind around these big gamma levels is the behavior we forecasted for the week (although, admittedly, we anticipated a higher grind at the Call Wall).

Today poses a small threat to “the grind” as implied volatility for this session is a bit elevated due to the 8:30AM ET PMI & 10AM ET Michigan sentiment data. Interestingly the ATM straddle for today (ref 3980) is trading at $40 whereas we have been seeing that priced closer to $20-$30 eariler in the week (a.k.a market makers may be anticipating more vol today).

However, absent a multi-standard-devation print we do not anticipate much more than short term noise from these prints. Therefore we look for mean reversion on any sharp data-driven move.

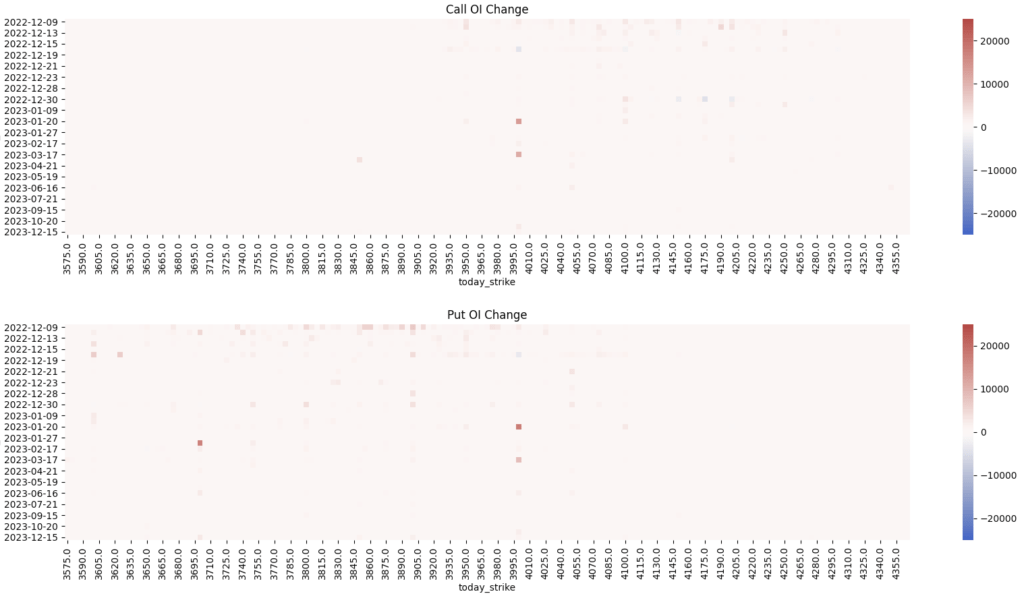

Lastly, we wanted to share this heatmap of options open interest changes for the last week in SPX. If you think of SPX as the tool for large money to hedge risks (upside or downside) then we’d see some material position changes reflected here. As you can see the downside position changes (puts, bottom) are quite light, particularly out past 12/16 expiration. The same definitely goes for upside bets too. The point is that options traders (vs stock traders) are sitting on their hands, but this likely changes next week.

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3962 | 3956 | 396 | 11637 | 283 |

| SG Implied 1-Day Move:: | 0.89%, | (±pts): 35.0 | VIX 1 Day Impl. Move:1.4% | ||

| SG Implied 5-Day Move: | 2.82% | 4071 (Monday Ref Price) | Range: 3957.0 | 4186.0 | ||

| SpotGamma Gamma Index™: | -0.16 | -0.82 | -0.14 | 0.04 | -0.04 |

| Volatility Trigger™: | 3985 | 4000 | 396 | 11490 | 285 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 400 | 11650 | 290 |

| Gamma Notional(MM): | -237.0 | -316.0 | -686.0 | 7.0 | -269.0 |

| Put Wall: | 3900 | 3900 | 380 | 11000 | 280 |

| Call Wall : | 4100 | 4100 | 400 | 11650 | 290 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3977 | 4001 | 398.0 | 10855.0 | 295 |

| CP Gam Tilt: | 0.97 | 0.87 | 0.83 | 1.49 | 0.86 |

| Delta Neutral Px: | 3959 | ||||

| Net Delta(MM): | $1,919,287 | $1,811,437 | $210,189 | $59,685 | $102,745 |

| 25D Risk Reversal | -0.05 | -0.04 | -0.05 | -0.04 | -0.05 |

| Call Volume | 436,147 | 487,298 | 2,188,367 | 7,539 | 871,268 |

| Put Volume | 648,108 | 801,544 | 2,114,193 | 6,006 | 871,673 |

| Call Open Interest | 7,010,457 | 6,966,504 | 8,803,597 | 74,273 | 5,596,808 |

| Put Open Interest | 12,302,725 | 11,875,940 | 14,250,075 | 70,879 | 7,296,073 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4100, 4000, 3950, 3900] |

| SPY: [400, 395, 390, 380] |

| QQQ: [300, 290, 285, 280] |

| NDX:[12000, 11750, 11650, 11500] |

| SPX Combo (strike, %ile): [(4149.0, 93.16), (4098.0, 94.01), (4074.0, 82.52), (4050.0, 93.56), (3999.0, 91.47), (3900.0, 95.84), (3876.0, 81.51), (3848.0, 88.51), (3836.0, 84.12), (3824.0, 76.69), (3800.0, 96.22)] |

| SPY Combo: [379.99, 389.9, 409.71, 404.96, 414.86] |

| NDX Combo: [11649.0, 11475.0, 11894.0, 11067.0, 11277.0] |