Macro Theme:

Key dates ahead:

- 12/31 OPEX Q-end

6k was recovered on 12/24, which invokes the JPM collar pin into 6,055 by 12/31 expiration. Should the SPX break <5,990 our view of pinning 6,055 would be removed, and we’d flip to risk off.

Into 12/31 we will be looking to hold longer dated (1 or 2 month) S&P500 puts as equities approach all time highs, and IV’s are pressed back to lows.

Key SG levels for the SPX are:

- Support: 5,900

- Resistance: 6,000, 6,055

Founder’s Note:

Futures are +30bps into the final day of trading for 2024.

- Key event: JPM Collar Roll

Support: 5,925, 5,900, 5,848, 5,800

Resistance: 5,950, 5,960, 6,000

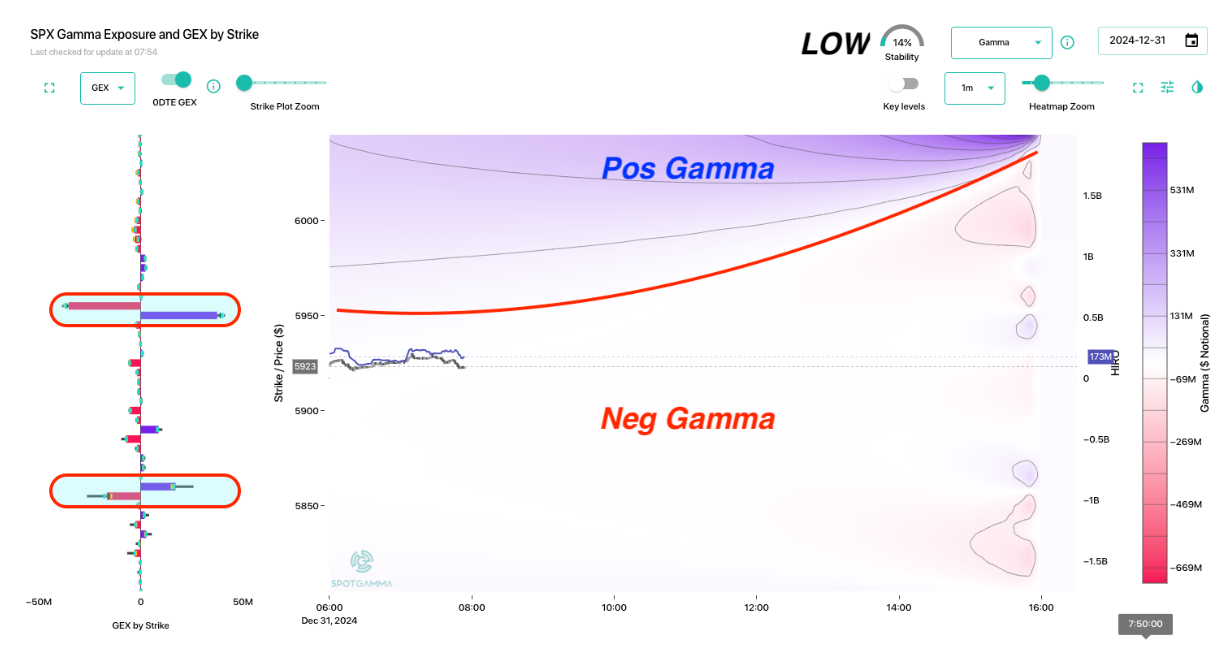

We start today in a negative gamma stance, and we see negative gamma reigning as long as the SPX is <=6,000. This infers high volatility/large trading ranges – things aren’t stable and there are several flows to push things.

Seemingly betting against the idea of large trading ranges is “Captain Condor” – a fund that persistently sells 0DTE iron condors. In this case they appear to have on 9k contracts of the 5,950/5,955 call spread & 5,860/5,855 puts spread.

9k contracts is sizable, which makes these key levels to watch.

Adding to the intrigue is the infamous JPM collar roll. The 6,055 calls (45k of them) likely expire today with 0 value, and the fund will enter into a new collar for March 31st OPEX. This means selling a 3/31 exp ~6,100 area call to fund a 3/31 put spread.

The new position doesn’t matter much for the next week, but the entry into that new position could cause some jumpiness today. Case-in-point 9/30 OPEX, wherein the SPX dropped nearly 1% in minutes, only to rally back above the days highs (white line chart below, read the 10/1 AM note review here). The new collar roll on 9/30 was printed exactly at the days lows, after huge 0DTE put flow shoved the market lower.

We do not know what time the print will go up, nor do we have a great forecast of market impact (impact hasn’t been consistent across rolls). However, if you see heavy S&P500

HIRO

flows – thats the bat-signal. Second, we can now watch TAPE for the big print, which should be +40k SPX contracts per leg.

Stepping past today, the equity market is going to be holding nearly 0 positive gamma <6,050, with IV’s simmering but not rich. For this reason, risk is high as both of these factors (negative gamma, elevated IV’s) provide a platform for market declines. We do not have a great reason for stocks to simply start selling off into January, but we do believe that if selling starts there is plenty of options fuel to drive prices lower. There is also a huge inflection point near the end of January with a large single stock OPEX, FOMC, inauguration & earnings.

That being said, one can’t help but feel that this looks a lot like Dec ’21, wherein Powell was hawkish at Dec FOMC but the market didn’t really react until Jan ’22.

The fact is that leadership is today quite narrow (below from Bofa vs ZeroHedge), and the recovery after Dec FOMC was led by a big vol crush & time decay + end of year seasonal flows.

Yields have come down a bit the last few days (10Y -10bps to 4.52%) but the market is pricing in no cut for Jan. The point is that the macro situation is murky, and the options structure is quite frankly a mess (i.e. hard to read).

On the later point, bulls could argue that vol premium had been squeezed out until Friday’s selling, and there is some premium now available to sell. This could lift the SPX back into the 6k area rather easily, where we’d likely see SPX call selling resistance at previous ATH’s.

Lastly – Jan 9 will be a market holiday for President Carter. The OCC informs us that Jan 9 expiry options will be moved to Jan 8. “Pour one out” for Jan 9 long index/etf options holders as the seemingly lost a trading day.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5957.33 | $5906 | $588 | $21197 | $515 | $2227 | $220 |

| SG Gamma Index™: |

| -1.701 | -0.398 |

|

|

|

|

| SG Implied 1-Day Move: | 0.65% | 0.65% | 0.65% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5996.33 | $5945 | $590 | $21250 | $520 | $2245 | $232 |

| Absolute Gamma Strike: | $6051.33 | $6000 | $590 | $21275 | $520 | $2250 | $220 |

| Call Wall: | $6251.33 | $6200 | $600 | $21275 | $535 | $2250 | $240 |

| Put Wall: | $5951.33 | $5900 | $590 | $20800 | $510 | $2160 | $210 |

| Zero Gamma Level: | $6012.33 | $5961 | $591 | $20984 | $518 | $2307 | $232 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.787 | 0.665 | 1.229 | 0.753 | 0.556 | 0.459 |

| Gamma Notional (MM): | ‑$733.168M | ‑$1.418B | $3.658M | ‑$505.47M | ‑$54.907M | ‑$1.055B |

| 25 Delta Risk Reversal: | -0.045 | 0.00 | -0.053 | -0.036 | 0.00 | 0.00 |

| Call Volume: | 574.849K | 1.812M | 11.483K | 926.087K | 11.619K | 362.451K |

| Put Volume: | 865.412K | 2.007M | 11.062K | 883.686K | 32.14K | 526.178K |

| Call Open Interest: | 6.419M | 5.829M | 61.637K | 2.994M | 252.367K | 3.594M |

| Put Open Interest: | 12.127M | 11.729M | 70.725K | 5.132M | 375.627K | 6.80M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5950, 5900, 6050] |

| SPY Levels: [590, 600, 585, 595] |

| NDX Levels: [21275, 21000, 22000, 21400] |

| QQQ Levels: [520, 510, 515, 500] |

| SPX Combos: [(6173,72.17), (6149,87.01), (6125,81.83), (6102,90.96), (6072,87.05), (6055,90.51), (6049,78.31), (6043,80.30), (6037,69.72), (6025,83.51), (6019,80.76), (6001,72.86), (5954,90.43), (5925,96.11), (5913,75.39), (5907,69.35), (5901,98.94), (5889,82.66), (5883,77.90), (5877,93.47), (5871,91.35), (5866,76.59), (5860,91.89), (5854,90.93), (5848,97.62), (5842,82.03), (5836,88.30), (5830,75.81), (5824,94.96), (5812,87.31), (5801,97.41), (5783,78.07), (5777,80.62), (5771,81.77), (5747,90.67), (5724,85.48), (5700,92.11), (5653,88.43), (5623,86.38)] |

| SPY Combos: [587.85, 603.32, 590.23, 577.74] |

| NDX Combos: [21282, 20964, 20773, 22003] |

| QQQ Combos: [517.87, 510.03, 504.8, 515.25] |

0 comentarios