Macro Theme:

Key dates ahead:

- 1/2: Jobs data

- 1/3: NFP

- 1/9: Market Closed: President Carter

As of 12/31: We remain in “risk off” positioning until/unless the SPX is >=6,000. This means we look to hold longer dated downside hedges, while tactically trading two-way short term movement (i.e. we are day trading around a core short to flat delta portfolio). If the SPX breaks <5,900 we would look to hold a core short position.

Key SG levels for the SPX are:

- Support: 5,900, 5,848, 5800

- Resistance: 5,950, 5,960, 6,000

Founder’s Note:

Futures are up 1% to start 2025.

Jobs data out at 8:30 AM ET.

Resistance: 5,936, 5,950, 6,000

Support: 5,900, 5,850

We start the new year in a slightly negative gamma stance, with IV’s elevated – but not “over valued”. This infers short term volatility should remain high, and we do not see a return to longer-term stability (and lower IV) until/unless the SPX recovers >=6,000.

We are currently neutral in terms of our directional view with SPX in the 5,9xx’s, and would flip to a short stance if the SPX breaks <5,900. A break of 5,900 would have us on watch for a test of the 5,800

Put Wall.

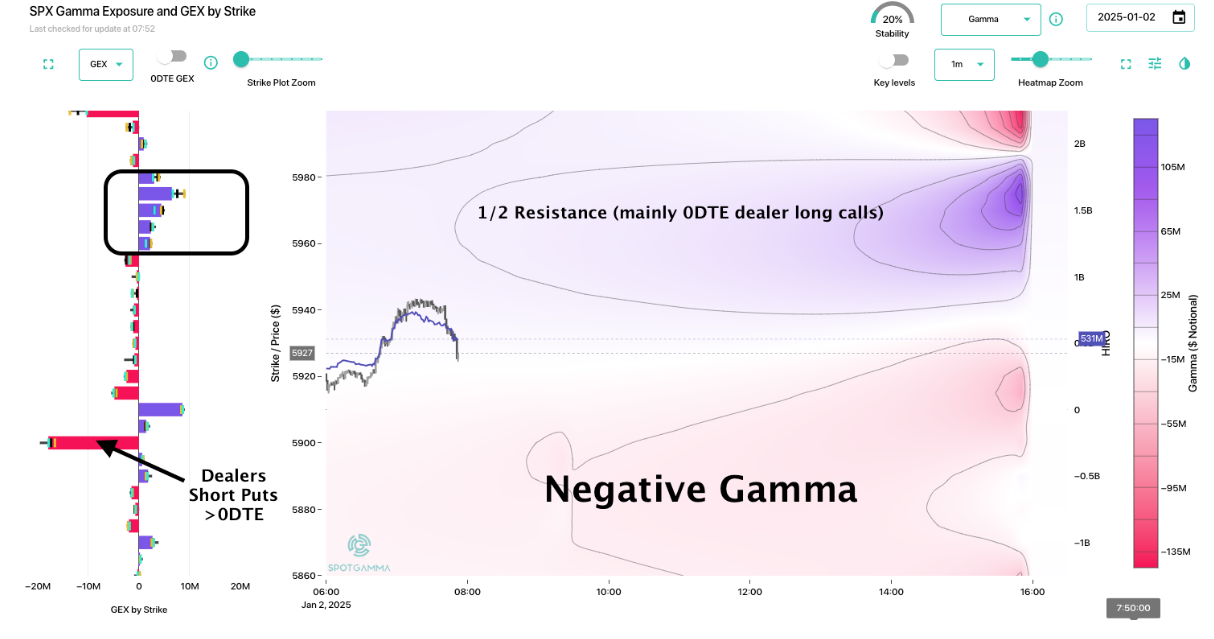

TRACE breaks this all down rather neatly. You see the swath of 0DTE positive gamma resistance above 5,950, and negative gamma (high volatility) <5,900. That high volatility <5,900 is driven by a large, longer dated put position (dealers short).

For the market, short term focus, as indicated by elevated by 0/1 DTE IV’s, appears to be on today’s Jobs data, and tomorrow’s NFP. Should that data all come in line, it could contract volatility which would quickly return the SPX back to 6k Friday/Monday. On this point IV’s are a bit rich, but not an obvious sale (i.e. massive vol premium). 1-month SPX realized vol is 15%, and so the current VIX of 17 is “fairly valued”.

If near term data is benign, that may signal the “all clear” to take VIX to 15 in anticipation of lower volatility ahead.

Into 6k we’d estimate that vol premium would be sharply contracted, and SPX call sellers would likely step up, adding positive gamma to dealers books. This benefits bulls as positive gamma could slow gains, but add to stability into Jan OPEX (1/17).

Conversely, as noted above, a drop <5,900 is also a signal that things may remain volatile though to Jan OPEX. As IV is only “fairly valued” there is plenty of room for vol to jump if SPX shifts lower, and jumps in IV would likely add to downside SPX pressure.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5929.88 | $5881 | $586 | $21012 | $511 | $2230 | $220 |

| SG Gamma Index™: |

| -2.001 | -0.443 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5998.88 | $5950 | $590 | $21260 | $515 | $2245 | $232 |

| Absolute Gamma Strike: | $6048.88 | $6000 | $590 | $21275 | $510 | $2250 | $220 |

| Call Wall: | $6248.88 | $6200 | $615 | $21275 | $535 | $2250 | $240 |

| Put Wall: | $5848.88 | $5800 | $580 | $20800 | $510 | $2160 | $210 |

| Zero Gamma Level: | $5984.88 | $5936 | $593 | $20959 | $518 | $2310 | $234 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.730 | 0.610 | 1.066 | 0.742 | 0.568 | 0.462 |

| Gamma Notional (MM): | ‑$732.972M | ‑$1.367B | ‑$252.904K | ‑$442.802M | ‑$48.511M | ‑$985.871M |

| 25 Delta Risk Reversal: | -0.046 | 0.00 | -0.051 | -0.026 | -0.028 | 0.00 |

| Call Volume: | 562.515K | 1.722M | 7.516K | 829.054K | 30.232K | 349.472K |

| Put Volume: | 881.17K | 1.626M | 8.333K | 777.944K | 58.158K | 417.183K |

| Call Open Interest: | 6.131M | 5.463M | 57.80K | 2.859M | 239.334K | 3.283M |

| Put Open Interest: | 11.66M | 10.969M | 66.09K | 4.761M | 369.054K | 6.69M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5950, 6050] |

| SPY Levels: [590, 585, 600, 580] |

| NDX Levels: [21275, 21000, 22000, 21400] |

| QQQ Levels: [510, 520, 500, 515] |

| SPX Combos: [(6164,88.16), (6152,83.56), (6123,79.08), (6099,89.49), (6052,77.87), (6040,71.61), (6023,87.75), (5999,78.29), (5952,70.71), (5923,92.89), (5917,73.37), (5899,98.10), (5888,69.50), (5882,75.99), (5876,88.16), (5870,89.71), (5864,77.95), (5858,71.48), (5852,97.37), (5840,82.66), (5835,75.81), (5829,77.98), (5823,98.26), (5811,74.36), (5799,98.94), (5793,72.32), (5788,78.37), (5782,76.35), (5776,84.43), (5770,83.53), (5752,92.51), (5723,89.32), (5699,95.30), (5676,69.14), (5670,70.57), (5652,90.56), (5623,89.49), (5599,85.71)] |

| SPY Combos: [587.68, 582.39, 577.68, 590.03] |

| NDX Combos: [21285, 20970, 20760, 20550] |

| QQQ Combos: [517.61, 509.88, 505.24, 535.14] |

0 comentarios