Macro Theme:

Key dates ahead:

- 1/9: Market Closed: President Carter

- 1/10: NFP

As of 1/3: We remain in “risk off” positioning until/unless the SPX is >=5,900. Traders met recent downside by selling puts, which suggests a short term rally/bounce is in play.

Any rally which doesn’t break 5,900 is subject to quick reversals.

Key SG levels for the SPX are:

- Support: 5,850, 5,822, 5,800

- Resistance: 5,900, 5,923, 6,000

Founder’s Note:

Futures are +25bps.

Resistance: 5,900, 5,923, 6,000

Support: 5,850, 5,822, 5,800

TLDR: Yesterday’s drawdown was met with put selling, which infers the market has some support underneath. We think that support is transient, and so we treat this as “in longs for a trade” until there is a more material build in positive gamma support. We think that would now come if the SPX recaptures 5,900 (vs our longer term “risk on” @ 6k yesterday). Said another way: Rallies into 5,900 should be considered “short covers” and subject to quick reversal. >5,900 we think the rally has legs.

We start today with a look at vol. A less sophisticated analysis here would be: “VIX is unchanged despite SPX 1% lower”.

Fixed strike vol can show us whats actually happening under the hood. In a real crash setup we’d expect to see longer dated & deep downside vol catch a bid. What we see here is that, since Tuesday’s close, shorted dated vols are +1 pt across the board, but the change for strikes out past Feb are much more flat. This informs us that there are some short dated hedges/bets in play, which makes sense given the high realized vol, but traders are not bracing for any type of protracted down-draft.

Simply stated: traders are not worried.

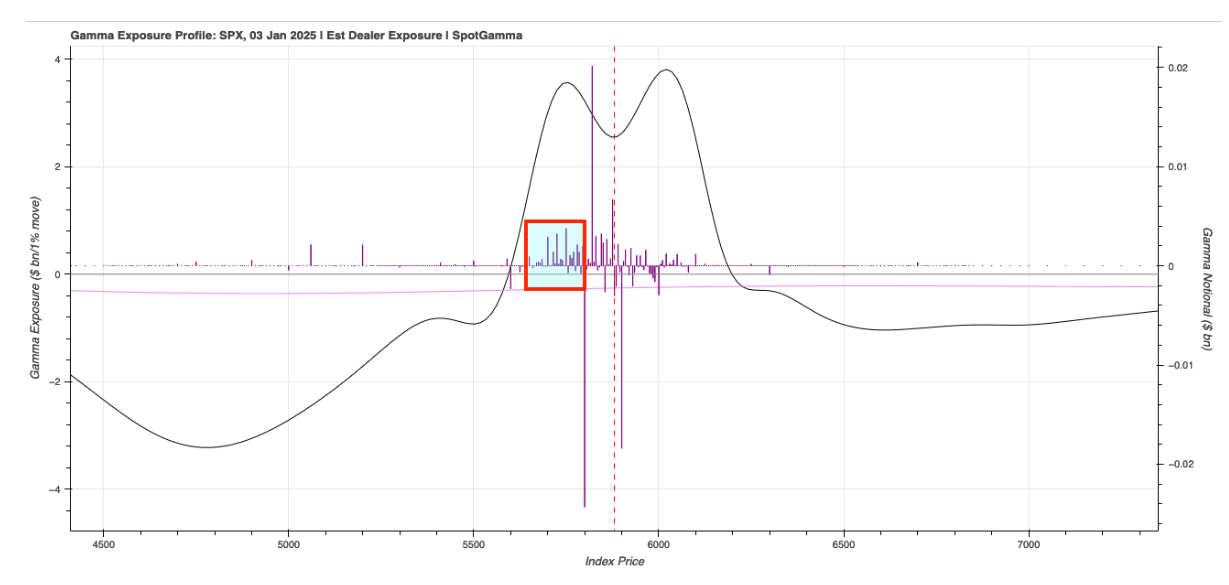

This syncs up with what we see in our SPX position changes, wherein we see traders have sold puts into the drawdown. This shows as positive gamma strikes in the plot below (this is the same data that powers Trace). We can also see that gamma in this model reflects as generally positive all the way down through 5,500.

Not only are traders not worried, they are selling puts into the downside.

We also see much of the extreme that was present into mid/late December as gone. Into Dec FOMC/OPEX it was the Mag 7’s and Trump memes, and then into end of Dec it was a few “last men standing” in things like MSTR & TSLA. That means we don’t really have a bone to pick with options “valuations” (IV, skew, etc).

Further, with that positive gamma below we can’t see the same negative-gamma downdraft that was present into yesterday (<5,900 was risk-off).

When looking at yields, they are also flat over the last few days & bitcoin, one of our favorite risk-off proxies, is holding near 97k. In other words: “Macro” seems pretty calm.

This also somewhat forces us into a neutral stance, but seeing that traders want to sell vol, it could lead to a stab higher in SPX if IV contracts – which is our current belief. If the SPX does rally to 5,900, it would likely clear out the positive gamma support below and contract the vol premium, which would lead us to reassess downside opportunity. If the SPX recovers 5,900, we think chances of further downside are greatly reduced.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5916.22 | $5868 | $584 | $20975 | $510 | $2231 | $221 |

| SG Gamma Index™: |

| -2.387 | -0.514 |

|

|

|

|

| SG Implied 1-Day Move: | 0.69% | 0.69% | 0.69% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5998.22 | $5950 | $590 | $21120 | $511 | $2245 | $232 |

| Absolute Gamma Strike: | $6048.22 | $6000 | $585 | $21275 | $510 | $2250 | $220 |

| Call Wall: | $6248.22 | $6200 | $615 | $21275 | $535 | $2250 | $240 |

| Put Wall: | $5848.22 | $5800 | $580 | $20800 | $500 | $2220 | $210 |

| Zero Gamma Level: | $5971.22 | $5923 | $592 | $20922 | $513 | $2311 | $233 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.689 | 0.562 | 0.984 | 0.677 | 0.527 | 0.446 |

| Gamma Notional (MM): | ‑$762.27M | ‑$1.483B | $589.117K | ‑$447.973M | ‑$50.754M | ‑$1.001B |

| 25 Delta Risk Reversal: | -0.047 | -0.026 | -0.052 | -0.031 | -0.032 | -0.013 |

| Call Volume: | 470.029K | 1.749M | 9.362K | 1.028M | 11.454K | 385.289K |

| Put Volume: | 875.418K | 1.987M | 9.837K | 998.132K | 17.968K | 374.178K |

| Call Open Interest: | 6.218M | 5.546M | 60.309K | 2.925M | 235.78K | 3.308M |

| Put Open Interest: | 11.875M | 11.112M | 68.871K | 4.826M | 373.344K | 6.714M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5950, 5800] |

| SPY Levels: [585, 590, 600, 580] |

| NDX Levels: [21275, 21000, 21400, 22000] |

| QQQ Levels: [510, 500, 520, 505] |

| SPX Combos: [(6150,79.92), (6127,72.67), (6097,87.13), (6074,71.68), (6021,78.47), (5998,77.57), (5927,82.25), (5921,71.99), (5898,97.94), (5880,70.67), (5874,92.62), (5869,71.94), (5863,87.14), (5851,96.62), (5845,78.51), (5833,74.18), (5827,95.10), (5822,96.57), (5810,78.56), (5804,81.69), (5798,99.19), (5792,89.51), (5781,84.94), (5775,94.69), (5763,81.53), (5751,93.81), (5728,87.65), (5722,80.00), (5698,96.26), (5675,84.67), (5651,91.32), (5622,90.91), (5599,87.59)] |

| SPY Combos: [577.8, 580.14, 587.76, 583.07] |

| NDX Combos: [21269, 20556, 20766, 20976] |

| QQQ Combos: [517.83, 510.16, 505.05, 499.93] |

0 comentarios