Macro Theme:

Key dates ahead:

- 1/7: PMI, NVDA CES

- 1/8: Jobless claims, FOMC Mins

- 1/9: Market Closed: President Carter

- 1/10: NFP

- 1/14: PPI

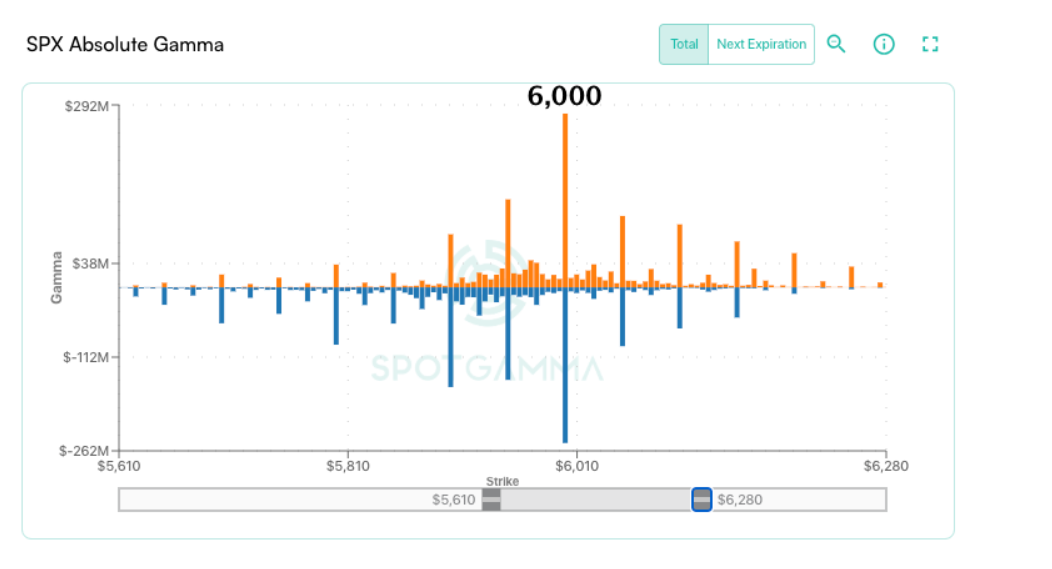

As of 1/6: With SPX near 6,000 resistance we shift to a neutral stance, as IV fuel has been drained off. Upcoming data 1/7-1/10 will likely signal the next directional move, which comes into soft support underneath and building positive gamma stickiness >=6k.

A bit of bad news >=1/7 could quickly invoke a retest of 5,900.

6,050 – 6,100 is likely major resistance into 1/17 OPEX.

Key SG levels for the SPX are:

- Support: 5,970, 5,950, 5,900

- Resistance: 6,000, 6,050

Founder’s Note:

Futures are up +65 bps.

Resistance: 6,000, 6,050

Support: 5,970, 5,950, 5,900

TLDR: as Futures indicate a test of SPX 6k, the “easy money” rally has been made, as 6k marks resistance and a drain of vanna fuel. Further, markets are likely to now shift to data dependence with PMI tomorrow, Jobless claims on 1/8, the market holiday 1/9 and then a big NFP on 1/10. Good data, and a recapture of the 6k strike, likely signals SPX to 6,050-6,100 into Jan OPEX.

The morning rally places the large 6,000 strike back in play – a level which was set to be a factor given Friday’s close back above the “risk on” 5,900 strike.

6k is resistance for today given the positive gamma >=6k. Additionally, volatility premium has now shrunk, which removes the major vanna-fuel which was built up off of end-of-year volatility. A further drain of IV is unlikely today/tomorrow given the slew of upcoming macro data points, which warrant an event-vol premium. We also note that support underneath is very soft, and so a quick retest of <=5,900 could occur with some bad data.

On this topic, 1-month SPX realized vol is currently 15%, having spiked from long term lows after Dec FOMC. This high realized vol warrants a relatively high base level of implied, or forward volatility (i.e. VIX >16), and that only changes if:

1) Traders have a concrete reason to think forward vol will contract – as often happens when markets come off of a crisis and/or data points prove benign

2) Realized vol contracts – which we’d expect if SPX recaptures 6k due to positive gamma

We’ve not come off of any type of crisis. Powell reset yield expectations at that Dec 18 FOMC, and rates have remain elevated since. These elevated rates make various short term macro datapoints sources of attention/volatility, and if these upcoming data points are bullish then IV should further contract. Ultimately, a main

pivot

window is mid-to-late January wherein we have a huge OPEX, inauguration, and another FOMC. Additionally earnings will pick up in earnest (banks start reporting 1/15).

The SPX was trading into FOMC at 6,060, having just come off of all time highs of 6,100 in early December. That is only 1-1.5% above current SPX levels, and a place wherein we see IV’s contracting into Jan OPEX. You can see this in the fixed strike vol, below (black box), and it suggests traders are short calls into that zone. That corresponds with positive gamma we see in TRACE >6k, and signals 6,050-6,100 as a major resistance area.

Second, we see that IV’s for all this upcoming data are relatively elevated (1/18-1/10, red box). Thrown into this mix was the unanticipated market closure for President Carter’s memorial (1/9). We also make a nod to NVDA’s CES analyst day, tomorrow. “NVDA up” could lead markets to ignore a lot of macro uncertainty…

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5989.44 | $5942 | $591 | $21326 | $518 | $2268 | $224 |

| SG Gamma Index™: |

| -0.675 | -0.334 |

|

|

|

|

| SG Implied 1-Day Move: | 0.68% | 0.68% | 0.68% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5987.44 | $5940 | $591 | $21160 | $516 | $2245 | $232 |

| Absolute Gamma Strike: | $6047.44 | $6000 | $590 | $21275 | $520 | $2250 | $230 |

| Call Wall: | $6247.44 | $6200 | $615 | $21275 | $535 | $2250 | $240 |

| Put Wall: | $5947.44 | $5900 | $585 | $20800 | $500 | $2150 | $210 |

| Zero Gamma Level: | $5999.44 | $5952 | $595 | $20954 | $517 | $2314 | $232 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.909 | 0.707 | 1.476 | 0.884 | 0.759 | 0.570 |

| Gamma Notional (MM): | ‑$148.278M | ‑$787.505M | $12.223M | ‑$87.151M | ‑$19.939M | ‑$723.894M |

| 25 Delta Risk Reversal: | -0.041 | 0.00 | -0.047 | 0.00 | -0.029 | 0.00 |

| Call Volume: | 524.639K | 1.186M | 12.253K | 622.074K | 11.696K | 344.736K |

| Put Volume: | 895.731K | 1.88M | 9.422K | 874.138K | 24.753K | 514.363K |

| Call Open Interest: | 6.233M | 5.317M | 60.35K | 2.784M | 231.767K | 3.30M |

| Put Open Interest: | 11.709M | 11.551M | 67.535K | 4.805M | 359.131K | 6.754M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5950, 5900, 6050] |

| SPY Levels: [590, 600, 585, 595] |

| NDX Levels: [21275, 21000, 22000, 21400] |

| QQQ Levels: [520, 510, 500, 515] |

| SPX Combos: [(6228,77.69), (6198,94.80), (6174,73.77), (6162,91.20), (6150,88.09), (6127,82.66), (6103,93.40), (6073,86.09), (6049,84.45), (6038,87.38), (6032,75.64), (6026,86.80), (6020,82.22), (6014,73.56), (6008,84.08), (6002,90.33), (5990,69.58), (5984,70.49), (5972,93.68), (5966,82.54), (5954,78.15), (5942,76.44), (5925,93.42), (5913,87.03), (5907,79.66), (5901,98.52), (5895,71.74), (5889,78.72), (5877,92.38), (5871,91.67), (5865,76.70), (5847,93.54), (5841,68.93), (5824,92.95), (5818,74.44), (5806,68.55), (5800,96.65), (5788,71.10), (5776,90.33), (5752,90.60), (5723,86.53), (5699,93.11), (5675,81.35), (5651,85.55)] |

| SPY Combos: [577.56, 587.49, 582.82, 579.89] |

| NDX Combos: [21284, 21795, 22009, 20772] |

| QQQ Combos: [517.29, 499.95, 505.05, 510.15] |

0 comentarios