Macro Theme:

Key dates ahead:

- 1/7: PMI, NVDA CES Analyst Day

- 1/8: Jobless claims, FOMC Mins

- 1/9: Market Closed: President Carter

- 1/10: NFP

- 1/14: PPI

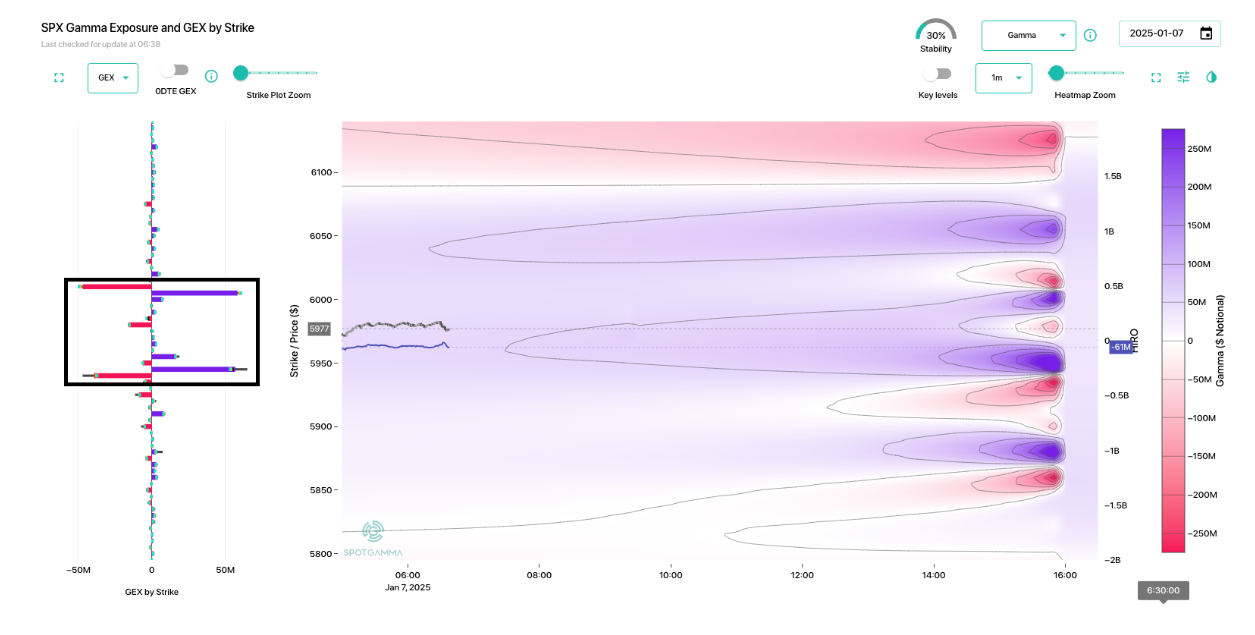

As of 1/6: With SPX near 6,000 resistance we shift to a neutral stance, as IV fuel has been drained off. Upcoming data 1/7-1/10 will likely signal the next directional move, which comes into soft support underneath and building positive gamma stickiness >=6k.

A bit of bad news >=1/7 could quickly invoke a retest of 5,900.

6,050 – 6,100 is likely major resistance into 1/17 OPEX.

Key SG levels for the SPX are:

- Support: 5,950, 5,900

- Resistance: 6,000, 6,050

Founder’s Note:

Futures are flat, with JOLTS & ISM on the docket (10AM ET).

SPX failed to hold the key SPX 6k level yesterday, and is currently poised in a flat gamma zone. The map did change overnight, as we yesterday we saw negative gamma <5,950, but that negative gamma zone now appears <5,900, which suggests traders met yesterday’s weakness by selling puts. This suggests that we should have a bit more support today in/around 5,950 – however we think there is some tech-induced risk (discussed below). To the upside we still see resistance at 6k, and then again at 6,050.

Today we get the first bit of macro data which could stir the pot, thats followed by further key data prints tomorrow (Jobless Claims, FOMC Mins) & Friday (NFP).

We also note that Captain Condor, the 0DTE condor seller, is back with a big 12k contract spread at the 6,005 / 6,100 call spread vs 5,945 / 5,940 put spread. 12k is one of the larger sizes we’ve seen, and we watch these levels as key support/resistance lines.

Yesterday was quite a strange market day. There was some very large, “chasey” moves higher in tech, particularly NVDA. From a more macro perspective, these chasey equity moves wherein call skew gets bid almost always breed instability. This is because those call IV’s go higher as the stocks go up – its a “crash up”. Then when momentum stalls or calls are sold things “crash down”. Its just like the mirror image of the bounce we saw in SPX last week, where vol is bid as stocks drop sharply, and then all that unwinds violently higher.

What it seems like we have to watch for here is a rosy picture out of NVDA, and “clean” economic data this week, which could re-ignite animal spirits – which were clearly on display. If getting long we think you have to focus on long tech vs SPX due to the upside positive gamma sticky/pressure in SPX around 6,050-6,100. QQQ or SMH has much less positive (or even negative) gamma.

If data isn’t good, then the tech/mag7 call IV decline could be enough to “vanna-drop” (deltas dropping due to IV decline) us more quickly into to a negative gamma type reaction (stock getting sold as stock prices decline) then the map above suggests. Simply said: a soft underbelly in stock prices remains.

Re: NVDA

Into the AM highs of ~151, NVDA was up +10% in the first week of 2025, and that has/had clearly put a bid into call skew, as discussed in yesterday’s Q&A.

However, despite those call IV’s lifting, there was some monstrous call selling, particularly on the open. In fact

HIRO

shows >$1.5bn of calls being sold (orange line), with a lot of that concentrated at the Feb 160 strike. From one perspective, selling calls into a 10% rally with elevated call skew makes sense. However, the current IV rank is 25%, and skew rank 50%, which informs us that NVDA is “warmed up” but not really “over-pumped”. On this point NVDA has its CES Analyst discussion today, and if all-is-well with that conversation (i.e. NVDA ends the day > 150) then we will have eyes on a move to 160, and is suggests tech writ large has room to go higher.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6021.08 | $5975 | $595 | $21559 | $524 | $2266 | $224 |

| SG Gamma Index™: |

| -0.515 | -0.25 |

|

|

|

|

| SG Implied 1-Day Move: | 0.66% | 0.66% | 0.66% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6021.08 | $5975 | $595 | $21490 | $523 | $2280 | $232 |

| Absolute Gamma Strike: | $6046.08 | $6000 | $600 | $21275 | $520 | $2250 | $230 |

| Call Wall: | $6051.08 | $6005 | $602 | $21275 | $530 | $2250 | $240 |

| Put Wall: | $5946.08 | $5900 | $590 | $21250 | $520 | $2150 | $220 |

| Zero Gamma Level: | $5986.08 | $5940 | $594 | $21343 | $523 | $2313 | $233 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.935 | 0.783 | 1.187 | 0.956 | 0.723 | 0.542 |

| Gamma Notional (MM): | ‑$46.607M | ‑$354.193M | $6.928M | $83.774M | ‑$25.068M | ‑$837.202M |

| 25 Delta Risk Reversal: | -0.042 | 0.00 | -0.047 | 0.00 | -0.03 | -0.008 |

| Call Volume: | 668.939K | 1.719M | 8.20K | 912.28K | 11.292K | 339.799K |

| Put Volume: | 961.536K | 2.824M | 16.08K | 1.024M | 25.787K | 565.417K |

| Call Open Interest: | 6.323M | 5.447M | 58.436K | 2.872M | 233.748K | 3.337M |

| Put Open Interest: | 11.856M | 12.415M | 71.303K | 4.974M | 368.323K | 6.856M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5950, 6050, 5900] |

| SPY Levels: [600, 590, 585, 595] |

| NDX Levels: [21275, 22000, 21500, 21400] |

| QQQ Levels: [520, 530, 510, 500] |

| SPX Combos: [(6250,92.21), (6202,96.50), (6173,84.29), (6167,90.75), (6149,92.53), (6125,87.60), (6113,69.28), (6101,95.27), (6083,79.29), (6077,87.12), (6071,79.56), (6053,80.98), (6047,94.68), (6041,92.33), (6035,74.82), (6029,90.78), (6023,92.44), (6017,93.90), (6011,97.41), (6005,96.67), (5999,88.66), (5981,76.71), (5951,88.84), (5946,97.78), (5940,98.01), (5934,75.99), (5928,94.17), (5922,92.37), (5916,71.69), (5898,98.73), (5892,73.79), (5880,84.56), (5874,94.09), (5868,84.73), (5862,80.15), (5850,93.60), (5838,79.79), (5826,83.08), (5820,84.89), (5802,97.41), (5772,90.59), (5748,88.81), (5724,68.70), (5701,93.24)] |

| SPY Combos: [587.72, 577.66, 617.31, 594.82] |

| NDX Combos: [21775, 21991, 21279, 21365] |

| QQQ Combos: [517.52, 529.97, 535.15, 505.08] |

0 comentarios