Macro Theme:

Key dates ahead:

- 1/17: OPEX

- 1/20: MLK (market closed) + Inauguration

- 1/29: FOMC

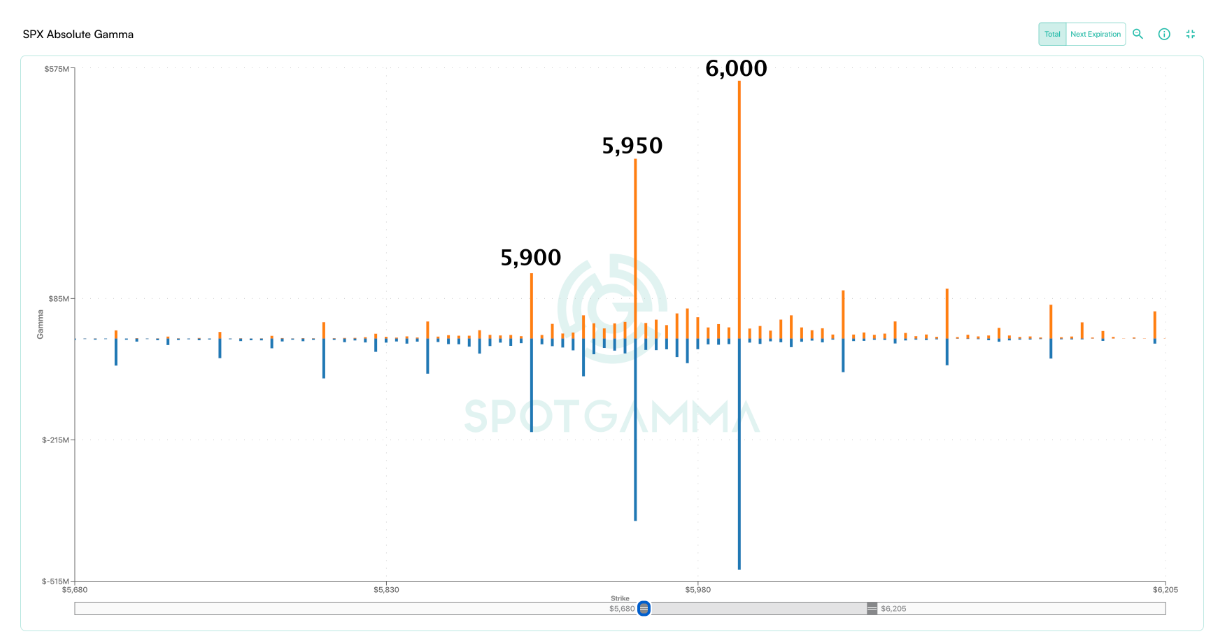

5,950 – 6,000 is likely major resistance into 1/17 OPEX.

We are risk off (short delta+long vol) if SPX <5,900.

Key SG levels for the SPX are:

- Support: 5,900

- Resistance: 5,950, 6,000

Founder’s Note:

Futures are higher by nearly 50 bps ahead of the 3-day weekend (MLK observance on Monday).

As you can see below, the biggest strikes are at 5,950 & 6,000 which creates the “sticky zone” for today. The three day weekend is a deterrent for short term traders to carry long positions, particularly puts, which should create additional support for today.

The easy gains have likely been made (playing the short cover rally), as this gamma-induced sticky zone will likely be removed next week. Further, vols are likely hitting a near term lower bound.

While we do not have a “cause-du-jour” for markets to start selling off, IV/put prices have now declined substantially from pre-CPI. Further, with Trump taking office many are wondering when/if “Tariff Talk” picks up, and we have a heavily anticipated FOMC on 1/29. These factors are likely to support current levels of IV.

We can see the anticipation of these upcoming events by looking at forward vol (light teal) in the SPX term structure (dark teal). This backs the idea that IV’s may bump higher as we get into those dates (red boxes).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5976.34 | $5937 | $591 | $21091 | $513 | $2266 | $224 |

| SG Gamma Index™: |

| 0.113 | -0.229 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5969.34 | $5930 | $592 | $21170 | $515 | $2245 | $227 |

| Absolute Gamma Strike: | $6039.34 | $6000 | $600 | $21275 | $520 | $2250 | $225 |

| Call Wall: | $6039.34 | $6000 | $600 | $21275 | $518 | $2250 | $230 |

| Put Wall: | $5939.34 | $5900 | $590 | $21050 | $510 | $2000 | $215 |

| Zero Gamma Level: | $5986.34 | $5947 | $590 | $20880 | $516 | $2244 | $227 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.012 | 0.818 | 1.767 | 0.900 | 1.018 | 0.709 |

| Gamma Notional (MM): | ‑$178.987M | ‑$946.086M | $10.423M | ‑$323.496M | $3.16M | ‑$610.249M |

| 25 Delta Risk Reversal: | -0.037 | -0.018 | -0.043 | -0.023 | -0.027 | -0.008 |

| Call Volume: | 586.547K | 1.48M | 14.233K | 908.698K | 20.906K | 348.952K |

| Put Volume: | 931.526K | 2.178M | 12.853K | 828.838K | 34.968K | 780.245K |

| Call Open Interest: | 6.971M | 6.172M | 66.436K | 3.286M | 261.383K | 3.835M |

| Put Open Interest: | 13.04M | 13.801M | 77.093K | 5.261M | 420.222K | 7.447M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5950, 5900, 6050] |

| SPY Levels: [600, 590, 595, 585] |

| NDX Levels: [21275, 21000, 21400, 21200] |

| QQQ Levels: [520, 510, 515, 500] |

| SPX Combos: [(6222,78.35), (6199,95.39), (6175,70.38), (6163,92.76), (6151,90.49), (6127,82.60), (6098,95.98), (6074,88.51), (6068,82.07), (6062,68.74), (6050,91.66), (6038,81.00), (6032,92.12), (6026,90.98), (6020,97.21), (6015,70.16), (6009,86.37), (6003,98.52), (5997,72.65), (5991,87.49), (5985,70.76), (5979,89.20), (5973,87.18), (5961,84.07), (5925,90.98), (5920,94.14), (5902,97.75), (5890,79.38), (5878,88.46), (5872,89.91), (5848,93.93), (5842,78.99), (5825,82.46), (5819,85.40), (5813,69.30), (5801,96.16), (5777,85.87), (5771,76.72), (5747,90.78), (5718,80.19), (5700,94.40), (5676,69.68), (5652,86.50)] |

| SPY Combos: [588.02, 597.5, 599.87, 577.94] |

| NDX Combos: [21281, 20965, 21302, 20564] |

| QQQ Combos: [517.56, 529.96, 518.08, 524.79] |

0 comentarios