Macro Theme:

Key dates ahead:

- 1/29: FOMC

We are risk off (short delta+long vol) if SPX <5,975.

Key SG levels for the SPX are:

- Support: 6,000

- Resistance: 6,050, 6,075, 6,100

Founder’s Note:

Futures are +40 bps.

Resistance: 6,050, 6,075, 6,100

Support: 6,000, 5,975

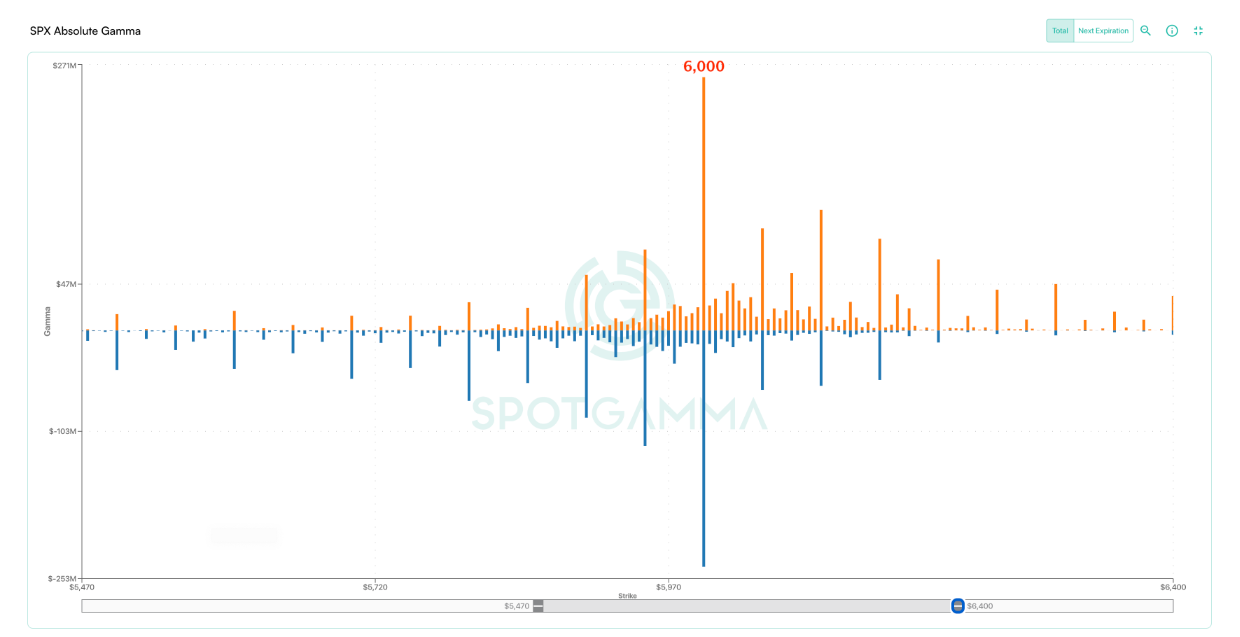

6,000 is the major level here, as it contains the most gamma by strike. We are in a “risk on” while the SPX is >6,000, with an upside target at 6,050.

The other critical piece here is that we are looking for realized volatility to contract sharply over the next week as we approach FOMC on 1/29. IV will likely only contract slightly with lower realized vol, as IV will likely hold a premium due to FOMC. In other words: the market ranges should start to tighten, but IV will remain sticky.

We also note that our “risk off” level is now 5,975, from 5,900 last week.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6032.57 | $5996 | $597 | $21441 | $521 | $2275 | $225 |

| SG Gamma Index™: |

| 0.694 | -0.154 |

|

|

|

|

| SG Implied 1-Day Move: | 0.61% | 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6011.57 | $5975 | $597 | $21230 | $520 | $2260 | $224 |

| Absolute Gamma Strike: | $6036.57 | $6000 | $600 | $21450 | $530 | $2300 | $230 |

| Call Wall: | $6136.57 | $6100 | $600 | $21450 | $530 | $2285 | $230 |

| Put Wall: | $5836.57 | $5800 | $590 | $20500 | $500 | $2250 | $215 |

| Zero Gamma Level: | $5997.57 | $5961 | $596 | $21067 | $520 | $2287 | $228 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.108 | 0.844 | 1.597 | 1.038 | 0.911 | 0.699 |

| Gamma Notional (MM): | $200.542M | ‑$384.873M | $10.329M | $85.041M | ‑$5.862M | ‑$309.353M |

| 25 Delta Risk Reversal: | -0.036 | -0.018 | -0.039 | 0.00 | -0.026 | -0.01 |

| Call Volume: | 816.665K | 1.54M | 19.476K | 692.459K | 18.333K | 364.103K |

| Put Volume: | 1.253M | 2.241M | 11.093K | 952.943K | 36.105K | 541.33K |

| Call Open Interest: | 5.939M | 4.916M | 53.287K | 2.336M | 224.764K | 2.787M |

| Put Open Interest: | 11.085M | 11.311M | 60.668K | 4.008M | 372.287K | 6.127M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5950, 6100, 6050] |

| SPY Levels: [600, 590, 595, 605] |

| NDX Levels: [21450, 21400, 21500, 22000] |

| QQQ Levels: [530, 520, 510, 525] |

| SPX Combos: [(6273,81.06), (6249,93.36), (6225,84.63), (6201,97.30), (6177,81.00), (6171,69.65), (6165,92.94), (6153,95.02), (6123,93.30), (6111,77.83), (6099,98.21), (6093,92.43), (6081,85.21), (6075,95.63), (6069,90.53), (6063,92.58), (6051,95.79), (6045,70.38), (6039,90.18), (6033,94.98), (6027,91.11), (6021,94.39), (6009,80.90), (6003,91.09), (5973,71.92), (5949,93.62), (5925,78.53), (5919,91.34), (5901,92.87), (5871,85.39), (5853,92.27), (5823,93.29), (5799,94.80), (5775,73.06), (5769,70.05), (5751,87.40), (5721,74.60), (5703,93.46)] |

| SPY Combos: [598.21, 588.15, 599.98, 578.09] |

| NDX Combos: [21784, 21441, 21570, 20541] |

| QQQ Combos: [517.69, 509.99, 518.2, 500.24] |

0 comentarios