Macro Theme:

Key dates ahead:

- 1/29: FOMC

We are risk off (short delta+long vol) if SPX <6,000.

Key SG levels for the SPX are:

- Support: 6,060, 6,050, 6,000

- Resistance: 6,100, 6,110

Founder’s Note:

ES futures are flat, NQ -40bps.

Resistance: 6,100, 6,110

Support: 6,060, 6,050, 6,020, 6,000

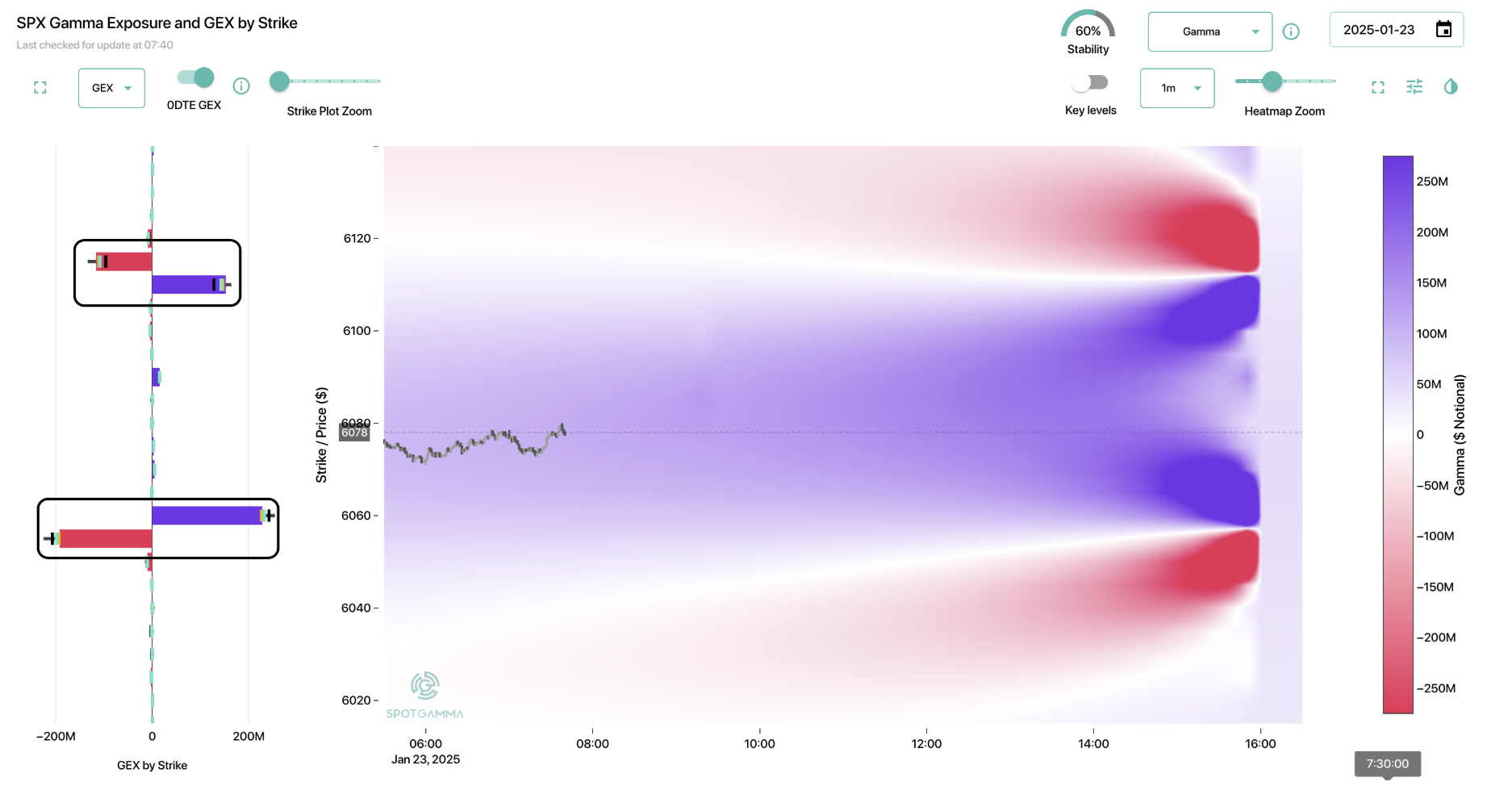

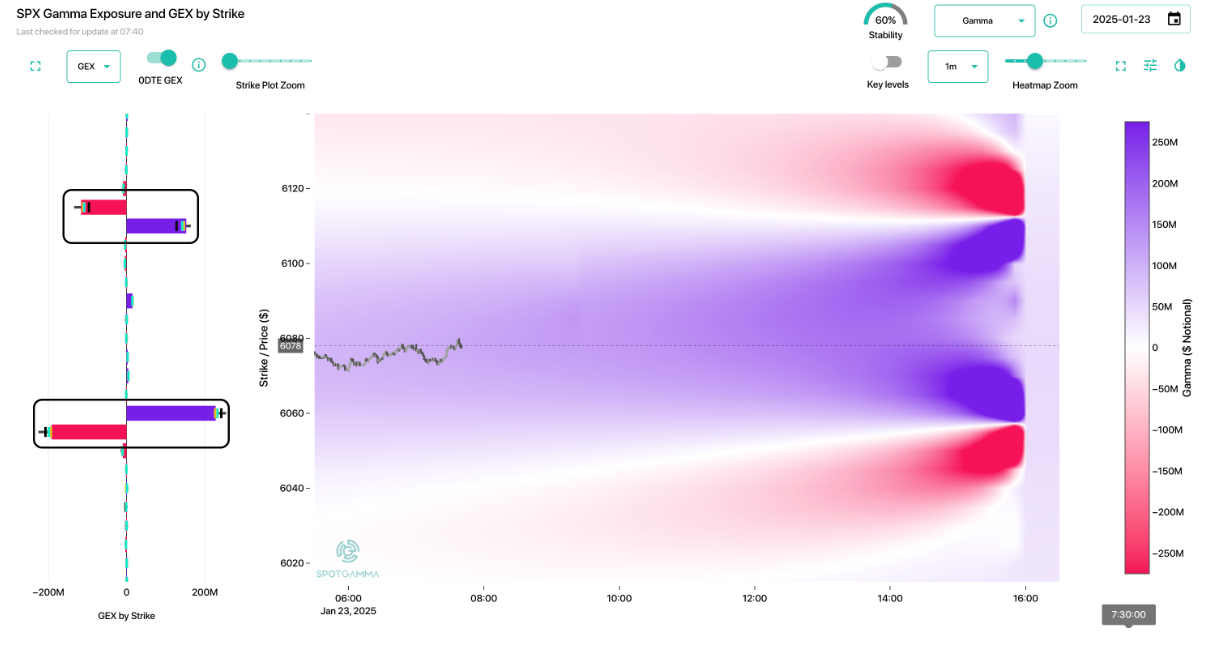

We start today in a stronger positive gamma stance vs recent sessions, resulting in TRACE stability at 60%. This syncs with the idea that there is now more resistance in the 6,100

Call Wall

area, and we should see tighter trading ranges relative to the 75-100 bps daily ranges over the past week(s).

Betting on tighter ranges is Captain Condor, who is back, doubling down from yesterday’s loss (on 12k contracts) with a 30k condor at:

- 6,110 x 6,115 call spread

- 6,060 x 6,055 put spread

As we stated yesterday, we believe this spread is dynamically hedged which, if true, forms these spread levels as support and resistance. We’d also note that the last time this position was ~30k the Captain “won”. Losing on these 30k contracts could generate losses of $10.5mm (thats on the spread going OTM, not considering any hedging PNL).

We note that Nasdaq is down 40bps vs flat ES as some top tech stocks are retreating due to cooling Stargate Sentiment. With this, VIX is creeping back above 15, which indicates IV’s are a bit sticky vs their appearance of being sold off, yesterday. Due to next weeks FOMC, we suspect that vol will remain sticky, too (i.e. VIX >15).

The aforementioned Stargate project is re-stoking AI sentiment, driving the lines of NVDA back toward all time highs (+4% yesterday, -2% pre-market).

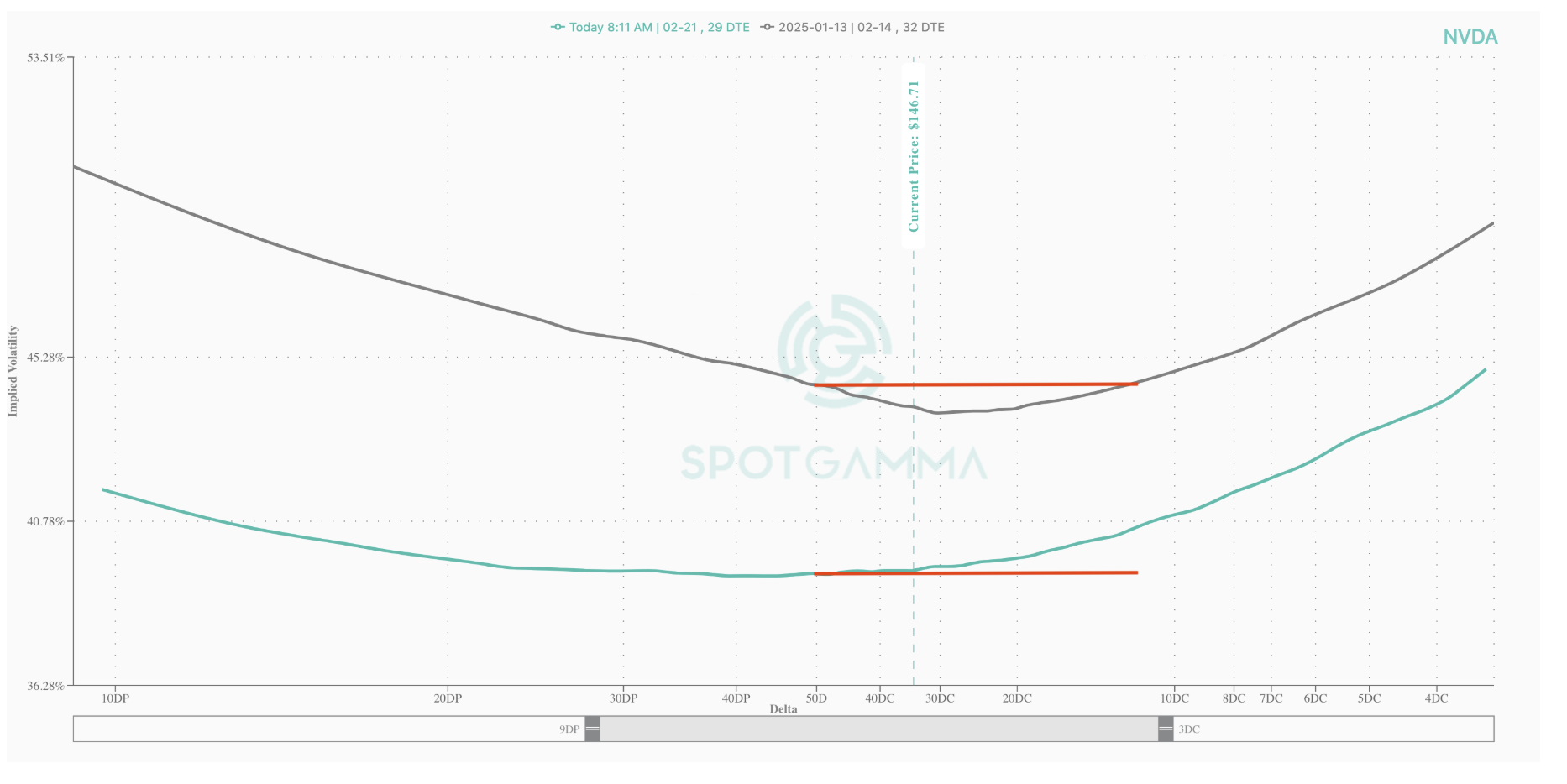

Accordingly, traders were piling into call options, which is generating a high call skew for NVDA. Below is 1-month skew pre-CPI (gray), where skew rank was in the 20’s vs a rank of 67, today (teal). Rising call skews are a great signal of forward volatility. In this regime, stocks can rip higher, but also give up those gains very quickly.

We can’t help but to think back to the beginning of the year when NVDA was blasting higher to 150, before reversing hard the following day.

We’re not saying that NVDA retreats +10% as it did in early Jan, but we are saying that we think stocks need an “all clear” from Powell at 1/29 FOMC before longer dated options come in to help bulls with larger directional hedging flows (i.e. material support). Until then, we think moves are likely to be driven by 0DTE/short dated options, and therefore very transient (here one day, gone the next).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6121.84 | $6086 | $606 | $21853 | $531 | $2303 | $228 |

| SG Gamma Index™: |

| 2.344 | -0.117 |

|

|

|

|

| SG Implied 1-Day Move: | 0.63% | 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6095.84 | $6060 | $606 | $21440 | $529 | $2280 | $227 |

| Absolute Gamma Strike: | $6035.84 | $6000 | $600 | $21450 | $530 | $2300 | $230 |

| Call Wall: | $6145.84 | $6110 | $610 | $21450 | $540 | $2285 | $230 |

| Put Wall: | $6095.84 | $6060 | $600 | $20500 | $500 | $2250 | $220 |

| Zero Gamma Level: | $6086.84 | $6051 | $605 | $21310 | $526 | $2298 | $228 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.329 | 0.895 | 1.733 | 1.111 | 0.983 | 0.827 |

| Gamma Notional (MM): | $669.224M | ‑$313.985M | $13.024M | $192.386M | ‑$1.088M | ‑$143.128M |

| 25 Delta Risk Reversal: | -0.029 | -0.009 | -0.032 | -0.014 | -0.019 | -0.003 |

| Call Volume: | 673.982K | 1.427M | 11.625K | 877.587K | 8.791K | 286.953K |

| Put Volume: | 1.177M | 2.131M | 12.205K | 1.075M | 23.657K | 450.711K |

| Call Open Interest: | 6.254M | 4.982M | 54.859K | 2.467M | 230.147K | 2.95M |

| Put Open Interest: | 11.629M | 12.523M | 65.14K | 4.329M | 385.35K | 6.309M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6110, 6115] |

| SPY Levels: [600, 605, 610, 590] |

| NDX Levels: [21450, 22000, 22500, 21400] |

| QQQ Levels: [530, 525, 540, 535] |

| SPX Combos: [(6372,82.29), (6348,88.88), (6324,86.47), (6299,97.32), (6275,85.84), (6251,97.28), (6226,90.98), (6202,99.40), (6190,72.42), (6178,93.75), (6172,87.67), (6165,94.90), (6159,83.29), (6147,99.39), (6141,93.15), (6135,79.37), (6129,88.53), (6123,99.57), (6117,99.95), (6111,99.98), (6105,90.42), (6099,99.40), (6092,90.27), (6074,93.51), (6068,71.88), (6062,99.85), (6056,99.75), (6038,69.21), (6032,71.17), (6026,86.71), (6019,75.81), (6001,79.08), (5977,71.77), (5952,76.89), (5922,93.21), (5910,71.59), (5898,88.42), (5873,77.85), (5849,84.12), (5825,85.41), (5800,91.46)] |

| SPY Combos: [607.87, 605.46, 606.07, 618.13] |

| NDX Combos: [22203, 22006, 21460, 22618] |

| QQQ Combos: [530.05, 522.18, 524.8, 500.13] |

0 comentarios