Macro Theme:

Key dates ahead:

- 1/29: FOMC + META, MSFT, TSLA earnings

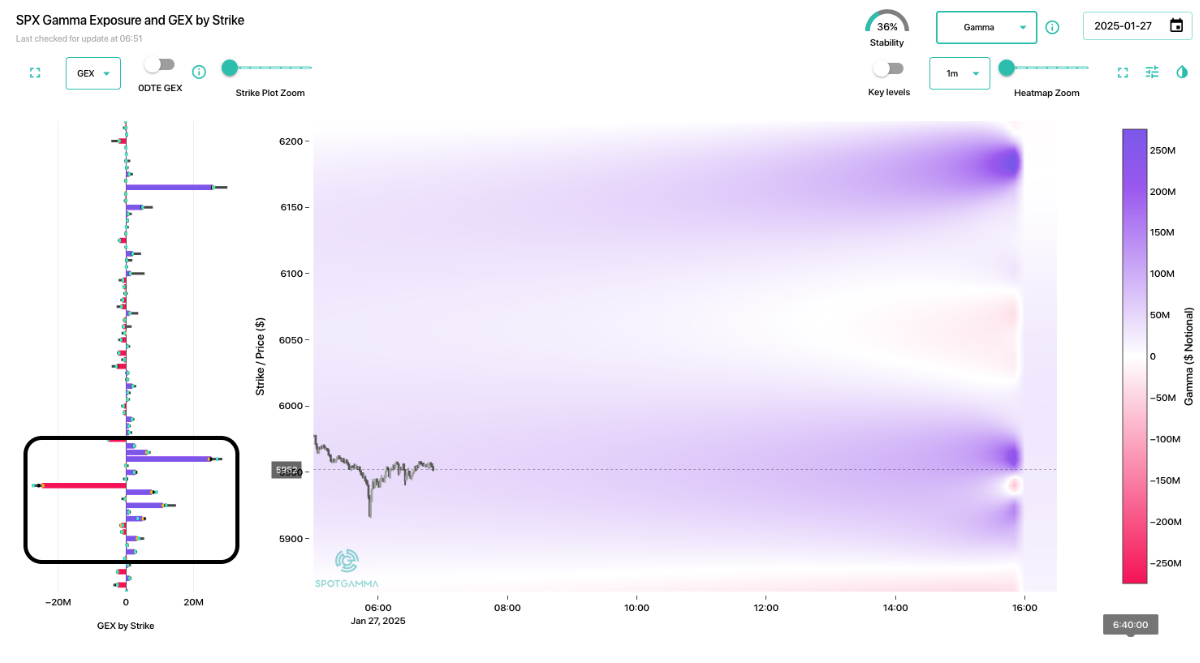

Update: 1/27: We are looking to buy the SPX dip near 5,950, with a stop at 5,900.

A break of 5,900 implies a test of the 5,800 Put Wall.

Key SG levels for the SPX are:

- Resistance: 6,020, 6,100

- Support: 5,900, 5,800

Founder’s Note:

Futures are being wrecked, with ES -2.3% & NQ -4%.

The blame is being assigned to DeepSeek, a Chinese AI platform that is producing ChatGPT-like results with much less compute. This has the likes of NVDA -11%(!!) pre-market.

TLDR: This seems a bit extreme, and we are looking for a bounce at these levels. We can’t help but feel this was a “news trigger” unwinding some bad/stretched positioning a la August ’24.

Support: 5,900, 5,800

Resistance: 6,000, 6,020, 6,100

Regardless, the SPX plunged from 6,100 down below our risk-off level of 6,000, with the SPX overnight low at 5,900. We see that 0DTE put sellers have come out around that 5,900, and so we watch that level as support. Should 5,900 break, we would look for a test of the 5,800

Put Wall.

We see little major resistance above until 6,020 (SPY 600).

This equity drop has obviously jacked IV higher, with the VIX at 21.5.

Under the hood we see that SPX vols at downside strikes are +3 vol points – that’s big. This also presents plenty of vol to squash if traders feel like this overnight move was indeed an overreaction. The problem for bears here is that put prices have gone from reasonably cheap last week, to now quite expensive. We think from this point (& in the short term) its likely only margin calls and/or “forced trades” that can push vol higher.

Why do we think this is something of a positional spasm as opposed to an AI-apocalypse? We find it best summed in COR1M, the CBOE index that measures 1-month correlation (specifically comparing IV’s of S&P500 components).

When this index declines its telling us that the top components of the S&P500 are not moving in sync, as the likes of NVDA & top stocks break ahead of the broader index. As you can see, the COR1M into Friday touched 1-year lows, matching the lows of 2017. There is indeed some ebb & flow to this index due to earnings, but the relative level of correlation was reflective of stretched breadth, and some bullish excess.

The way this index normalizes is almost always with a market crash, wherein all components of the S&P500 decline in unison.

While we talked about correlation with LaDuc Trading on Thursday, we thought it would be a hawkish FOMC and/or bad earnings that pulled the trigger on a positioning recalibration.

Accordingly we look for a market bounce here, and then we turn to a larger directional signal with FOMC & earnings later this week.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6134.72 | $6101 | $607 | $21774 | $529 | $2307 | $228 |

| SG Gamma Index™: |

| 0.931 | -0.154 |

|

|

|

|

| SG Implied 1-Day Move: | 0.59% | 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6123.72 | $6090 | $607 | $21440 | $529 | $2280 | $229 |

| Absolute Gamma Strike: | $6033.72 | $6000 | $600 | $21450 | $530 | $2300 | $230 |

| Call Wall: | $6233.72 | $6200 | $610 | $21450 | $540 | $2285 | $235 |

| Put Wall: | $5833.72 | $5800 | $600 | $20500 | $500 | $2100 | $220 |

| Zero Gamma Level: | $6053.72 | $6020 | $606 | $21394 | $528 | $2302 | $232 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.136 | 0.863 | 1.328 | 0.863 | 0.941 | 0.691 |

| Gamma Notional (MM): | $472.661M | $110.635M | $9.068M | ‑$17.956M | ‑$3.289M | ‑$310.083M |

| 25 Delta Risk Reversal: | -0.03 | -0.015 | -0.034 | -0.019 | 0.00 | -0.004 |

| Call Volume: | 462.528K | 1.423M | 8.798K | 706.073K | 8.443K | 276.431K |

| Put Volume: | 859.974K | 1.89M | 10.874K | 922.079K | 24.17K | 341.154K |

| Call Open Interest: | 6.255M | 5.133M | 56.597K | 2.462M | 231.179K | 2.791M |

| Put Open Interest: | 11.673M | 12.42M | 65.165K | 4.311M | 380.125K | 6.259M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6150, 6050] |

| SPY Levels: [600, 605, 610, 608] |

| NDX Levels: [21450, 22000, 22500, 21400] |

| QQQ Levels: [530, 525, 520, 510] |

| SPX Combos: [(6400,94.16), (6376,80.02), (6351,88.85), (6327,81.32), (6303,97.34), (6272,88.27), (6248,97.23), (6223,93.28), (6217,75.23), (6199,99.16), (6193,76.55), (6181,78.37), (6174,94.93), (6168,69.95), (6162,98.25), (6150,98.93), (6144,85.25), (6138,88.75), (6132,89.10), (6126,93.41), (6120,94.30), (6113,87.14), (6107,83.52), (6101,96.39), (6071,90.90), (6065,70.47), (6052,89.97), (6040,72.20), (5998,89.56), (5973,88.91), (5949,82.13), (5924,73.73), (5918,84.34), (5900,89.80), (5869,72.39), (5851,83.18), (5827,72.21), (5821,71.22), (5802,91.90)] |

| SPY Combos: [606.66, 606.05, 611.54, 612.76] |

| NDX Combos: [21447, 21992, 22209, 20968] |

| QQQ Combos: [540.18, 521.53, 534.85, 530.06] |

0 comentarios