Macro Theme:

Key dates ahead:

- 1/29: FOMC + META, MSFT, TSLA earnings

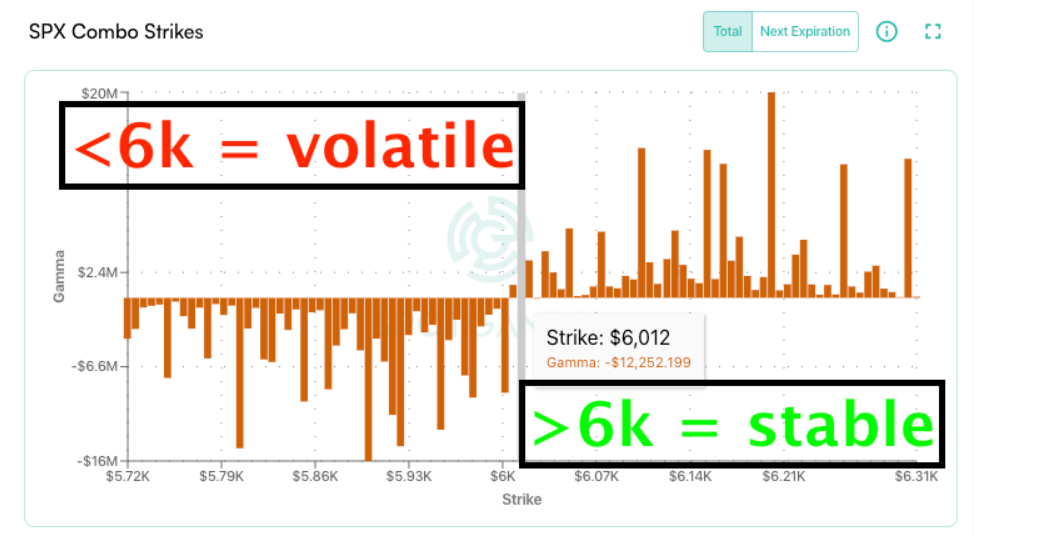

We flip to risk-off if SPX trades <6,000.

Upside may be limited into the 6,050 – 6,100 before Thursday’s critical session.

Key SG levels for the SPX are:

- Resistance: 6,050, 6,100

- Support: 6,020, 6,000, 5,950, 5,900, 5,800

Founder’s Note:

Futures are 30-50bps higher after yesterdays AI-spasms.

Support: 6,020, 6,000, 5,950, 5900

Resistance: 6,050, 6,100

As far as yesterday goes, the latest notes from banks seems to suggest that the DeepSeek news has caused a fundamental AI re-think, and that occurred into crowded/stretched (i.e. levered, call heavy) positioning, and so what would normally be a “negative” headline turned into something more voracious. The bulls hope here is that this just leads to a rotation out of chips/energy (AI-production/supply i.e. NVDA, VST) and into the likes of software (AI-demand AAPL, CRM). This, vs a rotation out of equities and into cash/bonds (which would be much more bearish).

This all makes Thursday hugely important: ~4PM ET earnings reports that land just a few hours after 2PM FOMC.

Through to Friday, 6k is the critical line that needs to hold. Below that level, we see predominantly puts in control which is linked to high volatility & risk off.

With FOMC on Wednesday and mega-tech reporting on Thursday, the upside for now, we believe, is limited. This is because implied volatility is unlikely to release from current levels before Thursday, zapping a major vanna-bump. Additionally, there is material positive gamma resistance (supplied by call sellers) into 6,100.

Regardless of what direction the market takes in the next few days, yesterday’s volatility jump leap has put us on notice.

Liquidity seems like absolute trash, resulting in the VIX (chart below) blasting from 15->21 as stocks in the AM went “no bid” per GS/ZH. This led semis down -10%, their worst single session since March 2020! Goldman also flags those levered ETF’s which traded massive notional: NVDA’s 2x long ETF “$10bn in the underlier … and its largest value traded day ever by a wide margin.”

That is nasty, nasty stuff and it smelled a lot like August of ’24 wherein months of gains puked back in hours/days. This type of movement may signal more forward put demand, particularly into Thursday as traders remain weary of the trap-door underneath.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6042.88 | $6012 | $599 | $21127 | $514 | $2284 | $226 |

| SG Gamma Index™: |

| -0.804 | -0.431 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6030.88 | $6000 | $600 | $21320 | $515 | $2280 | $227 |

| Absolute Gamma Strike: | $6030.88 | $6000 | $600 | $21450 | $510 | $2300 | $220 |

| Call Wall: | $6230.88 | $6200 | $620 | $21450 | $530 | $2285 | $235 |

| Put Wall: | $5930.88 | $5900 | $590 | $20500 | $500 | $2100 | $215 |

| Zero Gamma Level: | $6052.88 | $6022 | $602 | $21233 | $521 | $2313 | $231 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.895 | 0.643 | 0.851 | 0.644 | 0.792 | 0.598 |

| Gamma Notional (MM): | ‑$160.422M | ‑$975.41M | ‑$3.125M | ‑$487.779M | ‑$18.275M | ‑$482.23M |

| 25 Delta Risk Reversal: | -0.047 | -0.028 | -0.06 | -0.042 | 0.00 | -0.01 |

| Call Volume: | 558.721K | 1.509M | 10.666K | 1.162M | 8.908K | 302.673K |

| Put Volume: | 1.035M | 2.244M | 14.961K | 1.558M | 34.874K | 521.055K |

| Call Open Interest: | 6.324M | 5.256M | 57.317K | 2.675M | 232.311K | 2.845M |

| Put Open Interest: | 11.891M | 12.472M | 69.458K | 4.507M | 391.752K | 6.335M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6050, 5950] |

| SPY Levels: [600, 590, 605, 595] |

| NDX Levels: [21450, 21000, 21400, 22000] |

| QQQ Levels: [510, 520, 500, 515] |

| SPX Combos: [(6301,94.85), (6277,69.03), (6253,94.50), (6223,82.92), (6217,76.55), (6199,97.73), (6175,83.92), (6169,72.86), (6163,94.52), (6151,95.42), (6133,69.60), (6127,85.66), (6121,73.91), (6108,71.64), (6102,95.52), (6072,85.36), (6048,86.17), (6030,78.40), (6018,73.03), (6000,90.74), (5976,91.35), (5970,87.94), (5958,76.05), (5952,94.37), (5940,70.82), (5928,72.88), (5922,95.44), (5916,93.16), (5910,84.70), (5904,75.23), (5898,96.20), (5892,80.94), (5880,68.38), (5874,78.91), (5868,90.24), (5850,91.77), (5838,68.95), (5826,84.83), (5820,84.05), (5802,95.57), (5778,83.71), (5748,88.44), (5718,75.29)] |

| SPY Combos: [617.67, 612.8, 614.02, 628] |

| NDX Combos: [21444, 20958, 20557, 20747] |

| QQQ Combos: [521.71, 534.95, 540.24, 510.05] |

0 comentarios