Macro Theme:

Key dates ahead:

- 1/29: FOMC + META, MSFT, TSLA earnings

We flip to risk-off if SPX trades <6,000.

Key SG levels for the SPX are:

- Resistance: 6,100

- Support: 6,020, 6,000, 5,900, 5,800

Founder’s Note:

Futures are flat, and vol is stable ahead of 2pm ET FOMC.

Resistance: 6,100

Support: 6,018, 6,000

TLDR: Bulls have the baton while the SPX is >6,000. A break of 6,000 flips us back to a risk-off stance. If Powell is today benign, we’d look for a move to 6,100, wherein the SPX would then likely wait for tonights PM earnings before engaging in a larger directional move.

Ahead of the FOMC we see the 0DTE straddle priced at a tepid $37.75, or 62bps (ref 6,070 IV 24%). That’s not much for the first FOMC under the new Presidential regime, and after Powell spooked traders in December.

And, sure, it feels nice that the SPX has rallied back to nearly unchanged from Friday’s close – but that sharp illiquid drop should command some extra vol premium into these next two days.

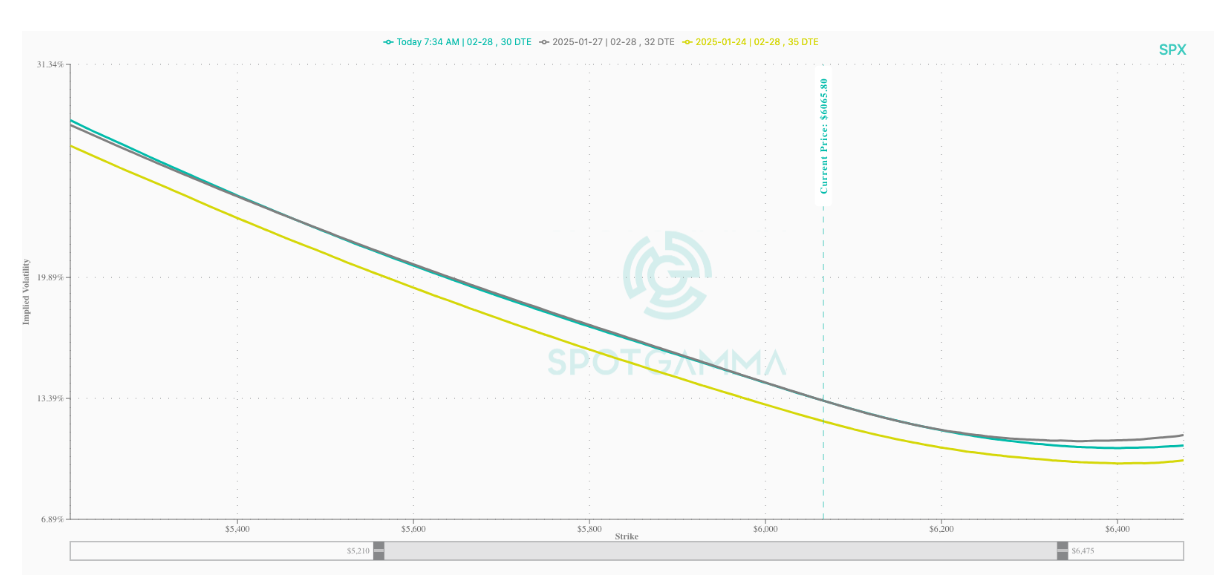

On the topic of vols, they are actually little changed per our Fixed Strike models despite the SPX rally. You can see this below wherein 2/28 skew (1-month) is exactly unchanged from Monday’s (gray) close vs this AM (teal). Vols are higher vs Friday’s pre-spasm close (yellow). Monday was of course that nasty session wherein the SPX closed down nearly 2%.

IV not dropping after a market rally suggests that traders still expect choppiness or another potential move lower – this makes sense given the FOMC today, and big tech earnings tomorrow. We’d also argue that today’s 60bps 0DTE straddle is light, as first major support for the SPX is 6,018 – 6,000 (-50 handles from current SPX levels).

Digesting FOMC is only battle 1, with battle 2 after the close, with earnings updates from the likes of TSLA, META & MSFT.

The importance of these earnings appear to be unusually big given the equity dependence on the AI story. In this case, we see that even NVDA has a bump in ATM IV’s due to tonights earnings. The major arguments being made by bulls is that cheaper AI is good for AI users, resulting in bumps for AI-agent co’s like CRM to offset selling in chips/energy. However, there is major leverage tied to the huge market-cap of NVDA & related components through options (NVDA is the #1 options volume stock) and ETF’s (billions in things like 2x long NVDA ETF’s).

Therefore we’d argue that negative NVDA sentiment is a short term negative for US stocks, until the leverage unwinds.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6096.99 | $6067 | $604 | $21463 | $521 | $2288 | $226 |

| SG Gamma Index™: |

| 0.921 | -0.144 |

|

|

|

|

| SG Implied 1-Day Move: | 0.63% | 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6054.99 | $6025 | $603 | $21320 | $521 | $2280 | $229 |

| Absolute Gamma Strike: | $6029.99 | $6000 | $600 | $21450 | $520 | $2300 | $230 |

| Call Wall: | $6229.99 | $6200 | $620 | $21450 | $535 | $2285 | $235 |

| Put Wall: | $5829.99 | $5800 | $590 | $20500 | $510 | $2100 | $215 |

| Zero Gamma Level: | $6061.99 | $6032 | $603 | $21248 | $524 | $2300 | $230 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.134 | 0.864 | 1.273 | 0.849 | 0.890 | 0.656 |

| Gamma Notional (MM): | $300.718M | ‑$364.444M | $6.086M | ‑$198.423M | ‑$11.815M | ‑$465.219M |

| 25 Delta Risk Reversal: | -0.04 | -0.02 | -0.05 | -0.029 | -0.026 | -0.006 |

| Call Volume: | 431.53K | 1.339M | 9.735K | 888.885K | 9.528K | 221.219K |

| Put Volume: | 655.749K | 1.522M | 9.754K | 868.045K | 12.53K | 191.522K |

| Call Open Interest: | 6.37M | 5.322M | 60.232K | 2.646M | 234.419K | 2.881M |

| Put Open Interest: | 11.934M | 12.687M | 71.666K | 4.611M | 392.741K | 6.376M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6150, 6050] |

| SPY Levels: [600, 605, 590, 610] |

| NDX Levels: [21450, 22000, 21400, 21000] |

| QQQ Levels: [520, 510, 525, 530] |

| SPX Combos: [(6353,87.73), (6323,86.97), (6298,96.79), (6274,86.10), (6250,96.43), (6225,93.91), (6207,70.49), (6201,99.10), (6183,80.29), (6177,90.25), (6171,85.40), (6165,95.84), (6159,75.11), (6153,98.85), (6147,69.25), (6141,84.26), (6134,78.76), (6128,82.81), (6122,96.96), (6116,76.02), (6110,87.24), (6104,88.68), (6098,98.50), (6092,90.13), (6074,87.01), (6068,77.07), (6049,72.24), (6025,89.91), (6001,92.05), (5983,73.83), (5977,81.63), (5971,83.84), (5952,90.61), (5922,93.93), (5910,73.68), (5898,92.83), (5874,82.20), (5849,88.17), (5825,77.23), (5819,73.72), (5801,93.09)] |

| SPY Combos: [617.99, 588.02, 578.43, 608.4] |

| NDX Combos: [21442, 22000, 20969, 21806] |

| QQQ Combos: [521.76, 509.94, 500.17, 504.8] |

0 comentarios