Macro Theme:

Key dates ahead:

- 1/30: Jobless Claims/GDP, AAPL/INTC earnings

We flip to risk-off if SPX trades <6,000.

Key SG levels for the SPX are:

- Resistance: 6,100

- Support: 6,020, 6,000, 5,900, 5,800

Founder’s Note:

Jobless claims & GDP 8:30AM ET

Tonights earnings: AAPL & INTC

Futures are +30bps after FOMC & big tech earnings:

TSLA: +2.3%

META: +1.3%

MSFT: -4%

Treasury yields are lower after FOMC: US10Y 4.49%

UPS reported this morning, and is down a massive -12%.

CAT also reported this AM, down -4%.

We remain bullish of the S&P500 while it is >6,000. We shift to a risk-off stance <6,000.

Resistance: 6,100

Support: 6,018, 6,000

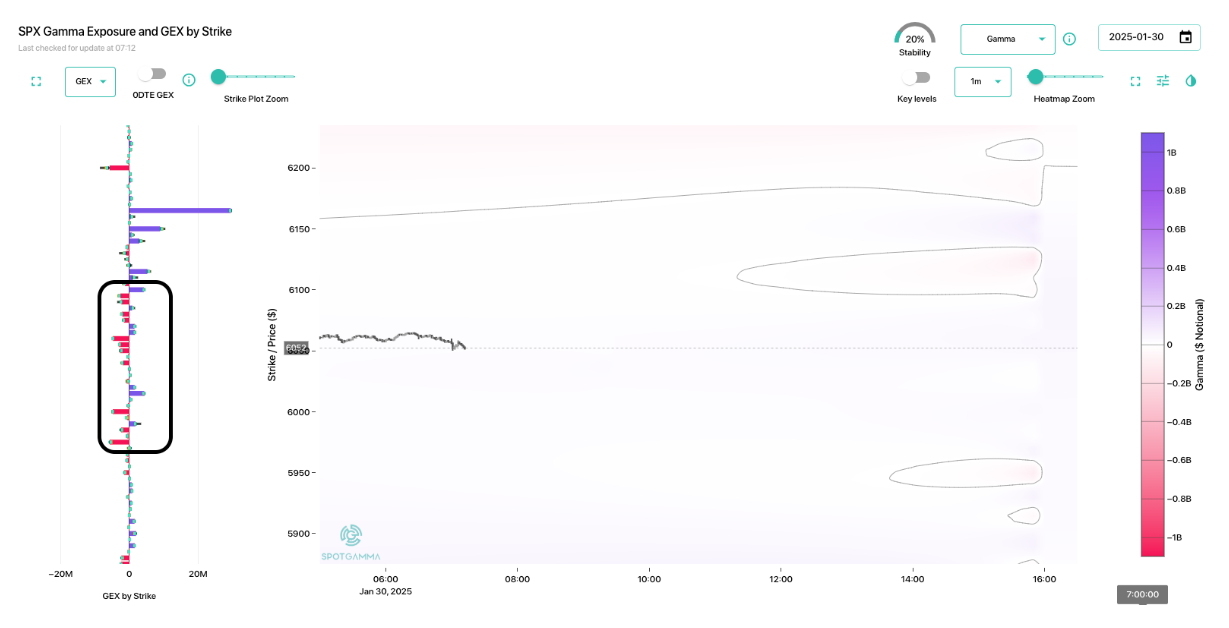

We start today in a very flat gamma, low stability position, with net negative gamma strikes from ~5,975 all the way through 6,100. This informs us that the S&P500 is poised to move today, and therefore we look for a quick move to either 6k or 6,100.

We give edge to 6,100 here as there is some vol to compress, which could add a lift to equity prices.

Normally we’d expect the FOMC to release some SPX implied volatility as the event passes. That didn’t really appear to happen, as fixed strike vols are down about 1/4 pt across the board.

Below is 1-month SPX fixed strike vol (teal) – it looks a lot like it did on Tuesday night (gray). We again compare these dates vs Friday, which was pre the DeepSeek spasm (yellow).

Given that yields are lower, one would anticipate equities to respond higher. We note that Bitcoin is at $105k, just a shade off of ATH’s. Vols could be a bit sticky if traders are waiting for the jobless/GDP data to pass this AM.

We also see that semis are +1% pre-market, with DeepSeek comments from MSFT & META being fairly benign (i.e. DeepSeek hasn’t destroyed AI CAPEX/chip demand).

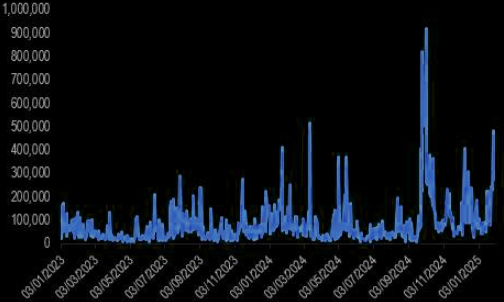

The area drawing most call attention is China. We noted lots of KWEB/BABA volume in TAPE yesterday, which is tied to record “China tech

call volumes

” (below, h/t ZH JPM). We show KWEB skew ranks are near 90% (via EquityHub), suggesting that these call prices are quite high – but that can often open up sets of interesting options trades. It also generally suggests that people are looking for places to deploy risk capital, not hide it away.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6068.25 | $6039 | $601 | $21411 | $520 | $2283 | $226 |

| SG Gamma Index™: |

| 0.344 | -0.282 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6044.25 | $6015 | $602 | $21320 | $521 | $2280 | $227 |

| Absolute Gamma Strike: | $6029.25 | $6000 | $600 | $21450 | $510 | $2300 | $230 |

| Call Wall: | $6229.25 | $6200 | $620 | $21450 | $535 | $2285 | $230 |

| Put Wall: | $5929.25 | $5900 | $590 | $21000 | $510 | $2250 | $215 |

| Zero Gamma Level: | $6033.25 | $6004 | $605 | $21197 | $523 | $2294 | $229 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.048 | 0.760 | 1.166 | 0.813 | 0.861 | 0.642 |

| Gamma Notional (MM): | $91.509M | ‑$737.841M | $3.812M | ‑$241.067M | ‑$13.599M | ‑$476.393M |

| 25 Delta Risk Reversal: | -0.041 | -0.022 | -0.048 | -0.029 | -0.023 | -0.004 |

| Call Volume: | 378.985K | 1.305M | 7.222K | 664.259K | 7.783K | 335.277K |

| Put Volume: | 594.215K | 1.467M | 9.202K | 770.245K | 17.326K | 283.962K |

| Call Open Interest: | 6.405M | 5.52M | 60.383K | 2.683M | 235.083K | 2.924M |

| Put Open Interest: | 11.937M | 12.84M | 72.656K | 4.685M | 396.228K | 6.431M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6050, 6150] |

| SPY Levels: [600, 590, 605, 595] |

| NDX Levels: [21450, 21000, 22000, 21400] |

| QQQ Levels: [510, 520, 525, 530] |

| SPX Combos: [(6323,84.05), (6299,96.53), (6275,84.28), (6251,95.68), (6227,83.97), (6220,85.61), (6202,98.98), (6172,94.46), (6166,94.61), (6160,74.56), (6148,97.89), (6142,71.80), (6130,82.65), (6124,93.83), (6118,81.68), (6112,80.60), (6100,97.93), (6088,83.40), (6076,84.76), (6070,74.77), (6051,73.27), (5997,93.04), (5979,70.58), (5973,95.38), (5949,91.81), (5943,70.05), (5925,81.58), (5919,91.42), (5912,83.54), (5900,95.42), (5882,70.30), (5876,69.82), (5870,79.49), (5852,90.64), (5828,83.69), (5822,75.67), (5798,94.06), (5768,68.50), (5749,85.65)] |

| SPY Combos: [617.82, 612.98, 607.54, 609.96] |

| NDX Combos: [21454, 21990, 20962, 20555] |

| QQQ Combos: [521.29, 534.86, 509.81, 530.16] |

0 comentarios