Macro Theme:

Key dates ahead:

- 2/11: Powell Testimony

- 2/12: CPI

- 2/21: OPEX

- 2/26: NVDA ER

On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200).

We flip to risk-off/short delta if SPX trades <6,000.

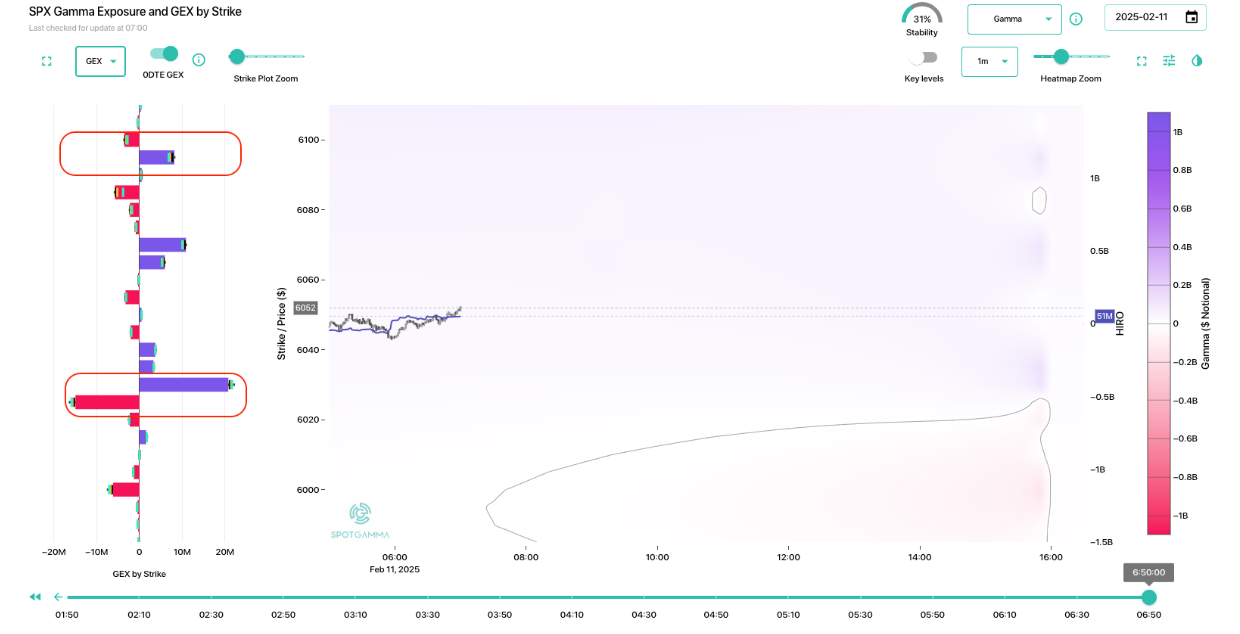

6,100 – 6,120 is a major band of resistance into 2/12 CPI.

Key SG levels for the SPX are:

- Resistance: 6,100, 6,120

- Support: 6,050, 6,025, 6,000

Founder’s Note:

Futures are -25bps ahead of Powell’s testimony in front of Congress (10AM ET).

Resistance: 6,100

Support: 6,050, 6,025, 6,000

Captain Condor is back, with a 0DTE position at our major support & resistance lines (their position reinforces these key levels):

Call Spread: 6,095 x 6,100

Put Spread: 6,030 x 6,025

Things are rather quiet as the SPX remains stuck in the 6,000-6,100 box. Vol is stuck as well due to Powell and CPI tomorrow.

On this topic of volatility, the market is pricing in a ~1.5 vol pt premium, with an expected market move of ~50bps. Not much.

When we look under the hood, we that current SPX IV rank is a lowly 12%, with skew rank also quiet low near 17%. So, SPX options are “cheap” and a bit skewed towards puts. This (cheap calls), we think presents an opportunity to hedge a right tail move out of these upcoming events in lieu of trying to play with long stock.

Long stock has been often whipsawed by tariff/AI headlines several times over the last few days/weeks, which has dashed our breakout thesis. We like call positions here because it covers that upside chance, and we are getting those calls at (what we think is) a good price. Calls also limit risk should our breakout thesis prove incorrect.

The idea below is that the names on the bottom left have low IV and low skew, favoring long calls. As skew rank gets higher & IV rank increases (i.e. top right of the chart) it suggests calls are expensive, and moves are stretched to the upside (ex: BIDU). Any single stock with an IV rank near 50 that does not have earnings coming up may be a bit rich (single stock IV’s are always elevated into earnings). We also can’t help but note that IBIT (bitcoin) IV & skew…how long can BTC “do nothing”?

If Powell & CPI prove to be benign it could crush a bit short dated event vol premium (noted above), providing a vanna-pop to equities.

To the downside, should the SPX break <6,000 we would look to have short delta positions.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6090.95 | $6066 | $604 | $21756 | $529 | $2287 | $227 |

| SG Gamma Index™: |

| 0.544 | -0.19 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6079.95 | $6055 | $603 | $21440 | $529 | $2280 | $227 |

| Absolute Gamma Strike: | $6024.95 | $6000 | $600 | $21450 | $530 | $2300 | $220 |

| Call Wall: | $6224.95 | $6200 | $620 | $21450 | $535 | $2285 | $235 |

| Put Wall: | $6024.95 | $6000 | $600 | $21000 | $510 | $2200 | $215 |

| Zero Gamma Level: | $6055.95 | $6031 | $603 | $21217 | $528 | $2299 | $230 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.067 | 0.828 | 1.606 | 0.873 | 0.836 | 0.599 |

| Gamma Notional (MM): | $191.755M | ‑$365.427M | $12.681M | ‑$135.144M | ‑$17.479M | ‑$598.77M |

| 25 Delta Risk Reversal: | -0.042 | 0.00 | -0.052 | -0.028 | -0.031 | -0.011 |

| Call Volume: | 340.977K | 991.62K | 7.007K | 517.162K | 15.63K | 145.138K |

| Put Volume: | 627.158K | 1.871M | 8.507K | 820.85K | 19.698K | 179.503K |

| Call Open Interest: | 6.726M | 5.426M | 61.899K | 2.525M | 242.894K | 3.032M |

| Put Open Interest: | 12.413M | 12.101M | 72.031K | 4.731M | 393.782K | 7.022M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6150, 6050] |

| SPY Levels: [600, 605, 595, 610] |

| NDX Levels: [21450, 22000, 21400, 21500] |

| QQQ Levels: [530, 520, 525, 510] |

| SPX Combos: [(6352,86.30), (6327,75.02), (6303,97.04), (6273,80.21), (6248,95.55), (6224,85.00), (6218,87.06), (6200,99.16), (6188,75.47), (6182,72.54), (6176,93.75), (6170,88.90), (6164,96.66), (6157,91.57), (6151,98.88), (6145,77.29), (6139,87.15), (6133,70.34), (6127,97.52), (6121,93.26), (6115,84.23), (6109,87.35), (6103,99.20), (6097,94.63), (6091,86.41), (6079,75.86), (6073,75.21), (6042,85.49), (6030,87.68), (6024,88.82), (6018,92.68), (6012,75.83), (6000,97.33), (5988,82.70), (5975,88.05), (5969,88.87), (5957,72.73), (5951,89.73), (5933,80.09), (5927,85.06), (5915,80.73), (5903,96.65), (5872,81.42), (5848,88.10), (5824,78.96), (5818,80.23), (5800,93.47), (5775,73.79)] |

| SPY Combos: [618.19, 588.15, 613.39, 598.37] |

| NDX Combos: [21452, 21996, 22192, 20973] |

| QQQ Combos: [521.89, 509.87, 499.93, 530.26] |

0 comentarios