Macro Theme:

Key dates ahead:

- 2/19: VIX Exp, FOMC Mins

- 2/21: OPEX

- 2/26: NVDA ER

On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200).

We flip to risk-off/short delta if SPX trades <6,000.

Key SG levels for the SPX are:

- Resistance: 6,150, 6,164, 6,200

- Support: 6,100, 6,050, 6,025, 6,000

Founder’s Note:

Futures were flat overnight, with VIX expiration at 9:30 AM ET & FOMC Mins at 2pm ET.

Resistance: 6,150, 6,164, 6,200

Support: 6,120, 6,100, 6,060

In yesterday’s AM note we focused on the loss of vol suppression with this AM’s VIX expiration. In our view this VIX expiration is/was rather small, but it was set to remove some suppressive VIX flows. Given that, we still have eyes more on 2/26 NVDA earnings as the major catalyst vs today’s VIX exp + Friday OPEX.

These expirations/events are occurring at a time when SPX IV’s are on the floor (10%ish) and some metrics, like correlation, are nearing worrying lows. The emphasis is on nearing, because its at these almost-fully-squished vol levels that a final large blowoff can occur (a la July ’24). So while we have one toe in the “final squeeze” pool, we acknowledge the sanity of owning +3-6 month put options as SPX IV’s are tracking near lows.

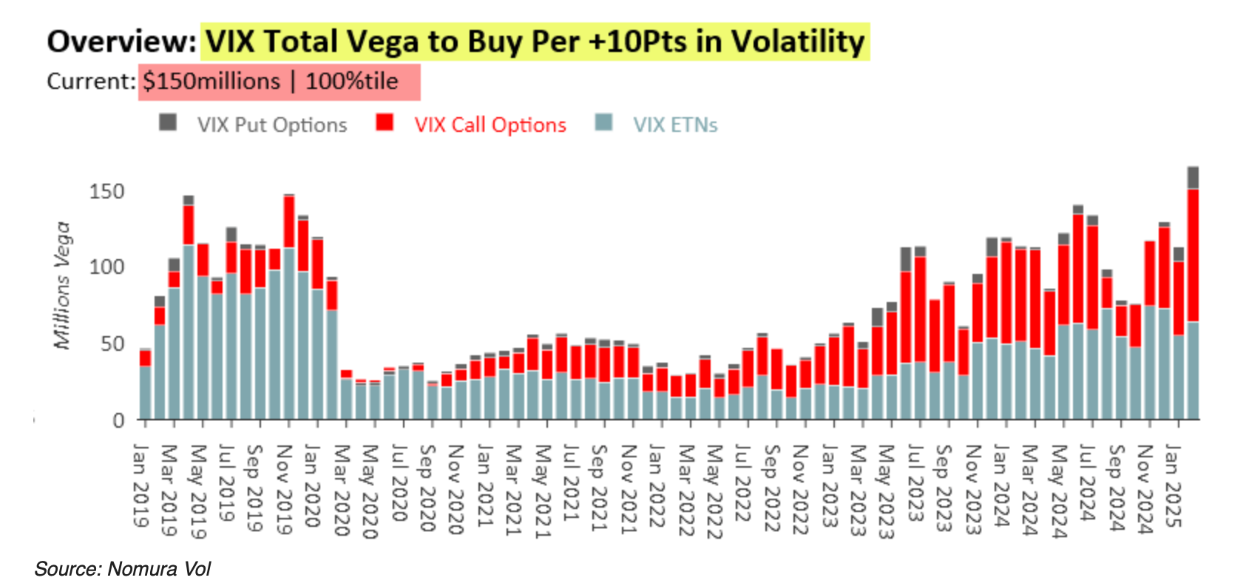

After yesterday’s close, Nomura fired out an excellent note highlighting some potential volatility fireworks ahead due dealer positioning. The highlighted some massive VIX call buyers active in Tuesday’s session: 125k a piece of March 24/25 calls.

These trades added to a total VIX vega supply that is now massive, as shown in their chart below. The impact of this is that dealers are essentially short convexity, and so if VIX/volatility does “wake up” there could be a lot downside equity pressure/upside vol pressure. They finish with pointing out that the VIX tends to shift higher from positions like this, backing the idea that this next week may indeed open a window of weakness.

The trouble here is that the equity market had every reason to post serious declines over the past month but lacked follow through. We argue for a vol spike to “stick”, there needs to be an actual catalysts – not just rumors or threats of a catalyst (i.e. stamp the tariffs, NVDA ER’s, or as Nomura points out the 3/14 Debt Ceiling).

The aforementioned vega supply is indeed large, but it is innocuous unless provoked. With correlation stretched and IV’s at lows, there is the potential for an SPX index short vol cover/single stock spasm to push into this upside vega convexity – something that we think a sharp NVDA ER miss could spark.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6138.95 | $6114 | $611 | $22114 | $539 | $2279 | $227 |

| SG Gamma Index™: |

| 1.528 | -0.065 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | In PM note | In PM note | In PM note |

|

|

|

|

| SG Implied 1-Day Move Low: | In PM note | In PM note | In PM note |

|

|

|

|

| SG Volatility Trigger™: | $6119.95 | $6095 | $609 | $21440 | $537 | $2280 | $227 |

| Absolute Gamma Strike: | $6024.95 | $6000 | $610 | $22000 | $535 | $2285 | $230 |

| Call Wall: | $6224.95 | $6200 | $620 | $21450 | $540 | $2285 | $230 |

| Put Wall: | $6024.95 | $6000 | $600 | $21000 | $510 | $2150 | $215 |

| Zero Gamma Level: | $6103.95 | $6079 | $605 | $21404 | $534 | $2274 | $228 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.181 | 0.946 | 1.643 | 1.052 | 0.979 | 0.602 |

| Gamma Notional (MM): | $539.032M | $717.831M | $16.614M | $374.101M | ‑$8.326M | ‑$537.154M |

| 25 Delta Risk Reversal: | -0.039 | 0.00 | -0.045 | -0.023 | -0.026 | -0.018 |

| Call Volume: | 397.208K | 1.193M | 8.498K | 665.162K | 14.961K | 188.104K |

| Put Volume: | 734.77K | 1.453M | 11.665K | 789.248K | 23.90K | 306.15K |

| Call Open Interest: | 6.87M | 5.633M | 65.617K | 2.704M | 254.489K | 3.153M |

| Put Open Interest: | 12.969M | 12.319M | 77.465K | 4.919M | 410.041K | 7.384M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6150, 6050] |

| SPY Levels: [610, 605, 600, 615] |

| NDX Levels: [22000, 21450, 22200, 22500] |

| QQQ Levels: [535, 540, 530, 520] |

| SPX Combos: [(6384,95.52), (6359,74.25), (6335,89.69), (6323,72.51), (6310,75.70), (6286,98.04), (6261,82.06), (6237,98.21), (6212,93.99), (6200,92.70), (6194,69.04), (6188,99.75), (6182,70.39), (6176,84.34), (6170,73.70), (6164,88.37), (6157,99.19), (6151,99.43), (6145,91.58), (6139,92.39), (6133,99.87), (6127,91.09), (6121,89.67), (6115,91.75), (6109,95.71), (6102,91.85), (6084,97.08), (6078,88.40), (6047,88.29), (6041,73.91), (6035,88.76), (6029,82.28), (6023,83.29), (6017,69.42), (6011,87.01), (5998,90.70), (5986,94.71), (5968,76.51), (5962,82.76), (5950,79.27), (5943,73.04), (5937,87.00), (5913,81.15), (5901,70.99), (5888,94.90), (5858,81.62), (5833,87.17)] |

| SPY Combos: [618.24, 613.36, 608.48, 614.58] |

| NDX Combos: [22137, 22336, 22557, 21407] |

| QQQ Combos: [539.73, 545.12, 521.98, 549.96] |

0 comentarios