Macro Theme:

Key dates ahead:

- 2/26: NVDA ER

- 2/27: GDP

- 2/28: PCE

On 2/11 we recommended buying SPX ~1-month calls as a way to hedge a right tail move. Our data suggests calls are cheap (ex: 3/13 exp 25 delta call = 10.6% IV ref 6,200).

Update (2/20): We flip to risk-off/short delta if SPX trades <6,100.

Key SG levels for the SPX are:

- Resistance: 6,000, 6,020, 6,050

- Support: 5,953, 5,900

Founder’s Note:

Futures are off 10-20bps. We note BTC is down 10% in the last 24 hours, losing the 90k level.

VIX is approaching 20, with a break of 20 generating an “extra” level of risk due to negative dealer via >=24. This highlights the key risk for this market: dealers appear to be “short vol” more than “short delta”. While we can’t predict an August style volatility event (we need a trigger a la Yen carry), we can say this setup feels quite similar.

ES futures suggest the SPX is set to open near 5,980, which is clearly “risk off” territory. However, the SPX has tested this area several times over the last month, and equities have bounced sharply higher.

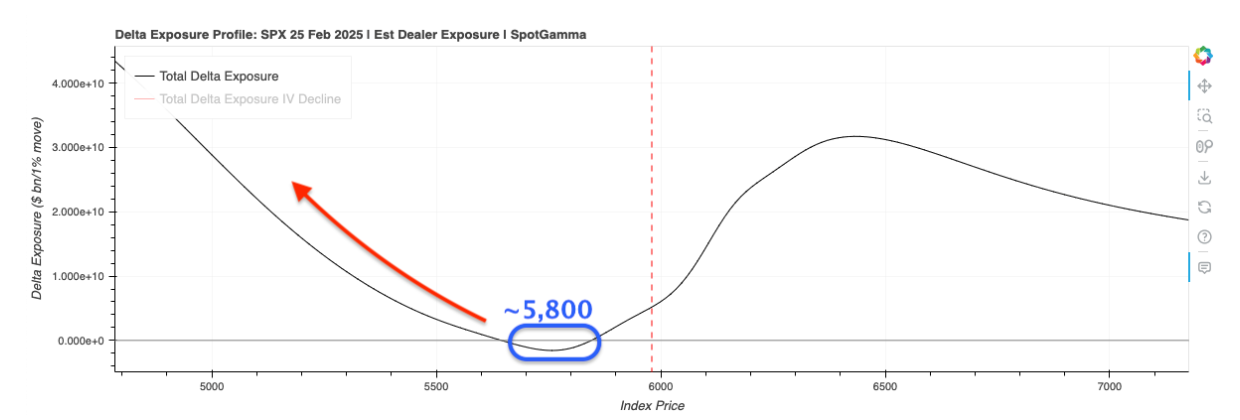

Our SPX positioning model (which powers TRACE) actually shows that dealers have decreasing SPX long exposure into 5,800, which infers they don’t have much, if any, negative deltas to sell if markets decline. Under 5,800 is where that changes, as their options portfolio is short puts, which would require downside hedging.

The lack of near-the-money dealer short puts could explain the sleepy shift in SPX vols, as despite this jumpy feeling, SPX vols are only mildly higher.

You can see this lack of IV response in the 3/27 (1-month) skew below, which shows a ~1 vol pt shift from Thursday night, when the SPX closed >6,100 (SPX now -2.6% from there). This suggests that the ~20 VIX is just a function of the “fixed strike slide” (i.e. strikes with a higher vol are the input to the VIX calc) and not a lift/bid in fixed strike vols. In other words: the fear really hasn’t kicked in.

Our beta VIX models show the aforementioned negative dealer convexity which accelerates into VIX 40. The idea here is that this exposure leads to downside equity exposure & hedging. The SPX downside also contains a fair amount of short vega for dealers, suggesting that the current risk for equity downside is not so much “being short stock” but being “short vol”.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5999.29 | $5983 | $597 | $21352 | $519 | $2178 | $216 |

| SG Gamma Index™: |

| -2.048 | -0.431 |

|

|

|

|

| SG Implied 1-Day Move: | 0.61% | 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6066.29 | $6050 | $600 | $21540 | $523 | $2230 | $221 |

| Absolute Gamma Strike: | $6016.29 | $6000 | $600 | $21950 | $520 | $2300 | $215 |

| Call Wall: | $6216.29 | $6200 | $620 | $21950 | $550 | $2235 | $235 |

| Put Wall: | $5916.29 | $5900 | $595 | $21200 | $520 | $2100 | $215 |

| Zero Gamma Level: | $6054.29 | $6038 | $600 | $21458 | $526 | $2273 | $231 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.775 | 0.650 | 0.857 | 0.661 | 0.522 | 0.357 |

| Gamma Notional (MM): | ‑$859.771M | ‑$1.555B | ‑$8.228M | ‑$672.481M | ‑$65.779M | ‑$1.40B |

| 25 Delta Risk Reversal: | -0.058 | -0.048 | -0.049 | -0.049 | -0.047 | -0.033 |

| Call Volume: | 577.022K | 1.567M | 10.527K | 989.597K | 17.269K | 386.32K |

| Put Volume: | 999.10K | 2.679M | 18.603K | 1.195M | 42.208K | 768.485K |

| Call Open Interest: | 6.521M | 5.525M | 64.283K | 2.662M | 252.111K | 2.964M |

| Put Open Interest: | 12.287M | 11.566M | 79.854K | 4.659M | 420.87K | 6.882M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6050, 6100, 6150] |

| SPY Levels: [600, 595, 590, 605] |

| NDX Levels: [21950, 22000, 21400, 21550] |

| QQQ Levels: [520, 525, 510, 530] |

| SPX Combos: [(6252,94.21), (6223,83.14), (6211,80.33), (6199,97.37), (6193,69.92), (6175,85.74), (6163,96.70), (6151,93.37), (6133,71.27), (6127,72.22), (6121,70.91), (6109,81.33), (6103,92.01), (6025,76.24), (6013,75.69), (6007,75.26), (6001,98.47), (5995,95.68), (5989,78.54), (5983,72.56), (5977,97.75), (5971,86.36), (5959,96.94), (5953,74.41), (5947,98.49), (5941,79.37), (5929,73.77), (5923,85.22), (5917,77.52), (5911,93.92), (5899,98.64), (5888,79.10), (5876,80.09), (5870,82.25), (5864,79.13), (5852,93.35), (5828,85.41), (5810,86.91), (5798,96.83), (5774,74.58), (5762,80.39), (5750,90.69), (5726,70.14), (5708,77.18), (5702,92.49)] |

| SPY Combos: [594, 598.8, 588.6, 618.6] |

| NDX Combos: [21352, 21950, 20946, 21160] |

| QQQ Combos: [534.52, 519.79, 509.79, 525.05] |

0 comentarios