Macro Theme:

Key dates ahead:

- 3/18: VIX expiration (Tuesday)

- 3/21: OPEX

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

3/4: We see signs of a “capitulatory” downside move waiting in the wings. As such, we do not want to be short puts/short vol. Dip buyers likely want to express that view instead with call spreads.

3/10: A lot of things now seem to be lining up at the end of the month to be a material low in markets, as very large expirations (3/21, 3/31) may line up with concrete tariff announcements. Further, the price area of 5,500 comes into view as major long term support as its the last downside pocket of large put open interest, which includes the JPM Collar Strike.

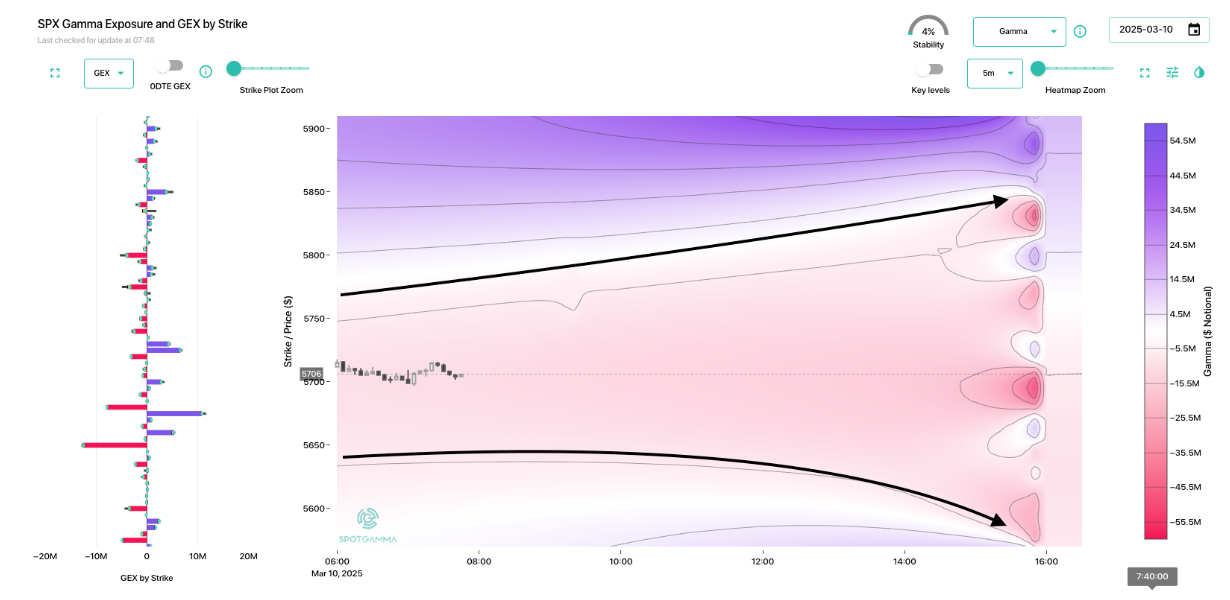

Key SG levels for the SPX are:

- Resistance: 5,800, 5,900

- Support: 5,700, 5,650, 5,600

Founder’s Note:

Futures are 1% lower, leaving SPX at key 5,700 support.

The VIX holds 26, its highest level since Dec 24. And, as we’ve been consistently warning, there is nothing to clear this volatility from the system. As a result, large, volatile swings are likely to continue.

A lot of things now seem to be lining up at the end of the month to be a material low in markets, as very large expirations (3/21, 3/31) may line up with concrete tariff announcements. Further, the price area of 5,500 comes into view as major long term support as its the last downside pocket of large put open interest, which includes the JPM Collar Strike.

The SPX is poised to move today, with only 4% stability, and negative gamma all the way up through 5,900, and down to 5,600.

Key SpotGamma levels reflect this unstable position, too, with levels spaced out at 50 – 100 handle intervals. The market is onto this theme, with today’s 0DTE straddle a high $64 or 1.1% (ref 5,690, IV 47%).

One of the highlights of Friday’s AM note was the massive 0DTE IV, with the straddle priced at ~$80. This huge pricing occurred on the same day as (or because of?) the very large +30k 0DTE Condor. The end result of that session was a giant “nothing”, as the SPX was essentially unchanged on the day, resulting in a big payday for the short vol community (and Captain Condor).

The condor is gone today, and our data shows that on days following a +10k condor realized volatility expands. That is true on 12/12 occasions – meaning todays move is not likely to be like the “pinny” Friday.

Below we have SPY dealer delta estimates, with the idea that as the S&P500 trades lower, dealers long SPY exposure gets higher (and vice versa). This suggests that dealers have to sell futures into weaker markets, and buy them back into higher markets (aka negative gamma hedging). What you can see is that this dealer hedging flow seems to wane sharply if the SPY trades <550, suggesting a reduction in dealer shorting activity/downside pressure. As suggested above, the SPX has a very similar downside position.

Obviously any positive news that is concrete could spark a massive sustained rally higher, with dealers not only having to buy because of “price” impact to delta but also “vanna/vol drop” impact to delta. In that upside scenario 5,900 – 6k is major resistance into March OPEX.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5777.56 | $5770 | $575 | $20201 | $491 | $2075 | $205 |

| SG Gamma Index™: |

| -3.109 | -0.695 |

|

|

|

|

| SG Implied 1-Day Move: | 0.69% | 0.69% | 0.69% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5732.24 | $5724.68 | $571.61 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5653.78 | $5646.22 | $563.77 |

|

|

|

|

| SG Volatility Trigger™: | $5947.56 | $5940 | $591 | $21030 | $510 | $2150 | $220 |

| Absolute Gamma Strike: | $6007.56 | $6000 | $580 | $19000 | $500 | $2100 | $215 |

| Call Wall: | $6207.56 | $6200 | $610 | $21950 | $506 | $2210 | $240 |

| Put Wall: | $5707.56 | $5700 | $565 | $19000 | $480 | $2000 | $200 |

| Zero Gamma Level: | $5919.56 | $5912 | $592 | $20455 | $506 | $2215 | $227 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.622 | 0.440 | 0.615 | 0.575 | 0.526 | 0.296 |

| Gamma Notional (MM): | ‑$937.714M | ‑$2.016B | ‑$8.115M | ‑$584.104M | ‑$56.531M | ‑$1.694B |

| 25 Delta Risk Reversal: | -0.068 | 0.00 | -0.046 | 0.00 | -0.05 | 0.00 |

| Call Volume: | 626.298K | 2.36M | 9.357K | 1.214M | 18.638K | 388.466K |

| Put Volume: | 1.17M | 3.292M | 10.572K | 1.254M | 36.509K | 1.276M |

| Call Open Interest: | 7.156M | 6.603M | 71.889K | 3.264M | 284.966K | 3.653M |

| Put Open Interest: | 12.66M | 12.118M | 82.832K | 5.089M | 449.395K | 8.107M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5000, 5800, 5900] |

| SPY Levels: [580, 570, 565, 575] |

| NDX Levels: [19000, 20000, 21000, 21500] |

| QQQ Levels: [500, 480, 490, 510] |

| SPX Combos: [(5897,70.83), (5851,72.01), (5822,71.27), (5811,83.65), (5799,96.32), (5782,69.09), (5776,73.46), (5747,94.56), (5741,77.69), (5730,74.49), (5724,89.68), (5712,91.97), (5701,99.01), (5689,72.61), (5678,94.77), (5672,68.76), (5661,91.85), (5649,97.96), (5632,68.27), (5626,86.79), (5609,87.70), (5603,97.88), (5574,82.16), (5562,93.91), (5551,92.61), (5528,83.85), (5511,82.65), (5499,96.78)] |

| SPY Combos: [564.23, 568.81, 559.07, 548.76] |

| NDX Combos: [19717, 20121, 19515, 19919] |

| QQQ Combos: [480.02, 489.78, 469.76, 464.88] |

0 comentarios