Macro Theme:

Key dates ahead:

- 3/13: Inflation + Jobs data

- 3/18: VIX expiration (Tuesday)

- 3/19: FOMC

- 3/21: OPEX

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

3/11: Having now seen some capitulation into 3/11 and SPX 5,565, we are looking for a short term oversold bounce into the ±5,750 area. Call credit spreads & call 1×2’s are our preferred way to play a market recovery.

3/10: A lot of things now seem to be lining up at the end of the month to be a material low in markets, as very large expirations (VIX: 3/18, OPEX 3/21, Q End EXP 3/31) may line up with concrete tariff announcements (4/2). Further, the price area of 5,500 comes into view as major long term support as its the last downside pocket of large put open interest, which includes the JPM Collar Strike.

Key SG levels for the SPX are:

- Resistance: 5,700, 5,800

- Support: 5,600, 5,565, 5500

Founder’s Note:

Futures are up fractionally ahead of 8:30AM inflation & jobs data.

The VIX has buoyed back above 24, which was our “floor” for vol (see y’day note).

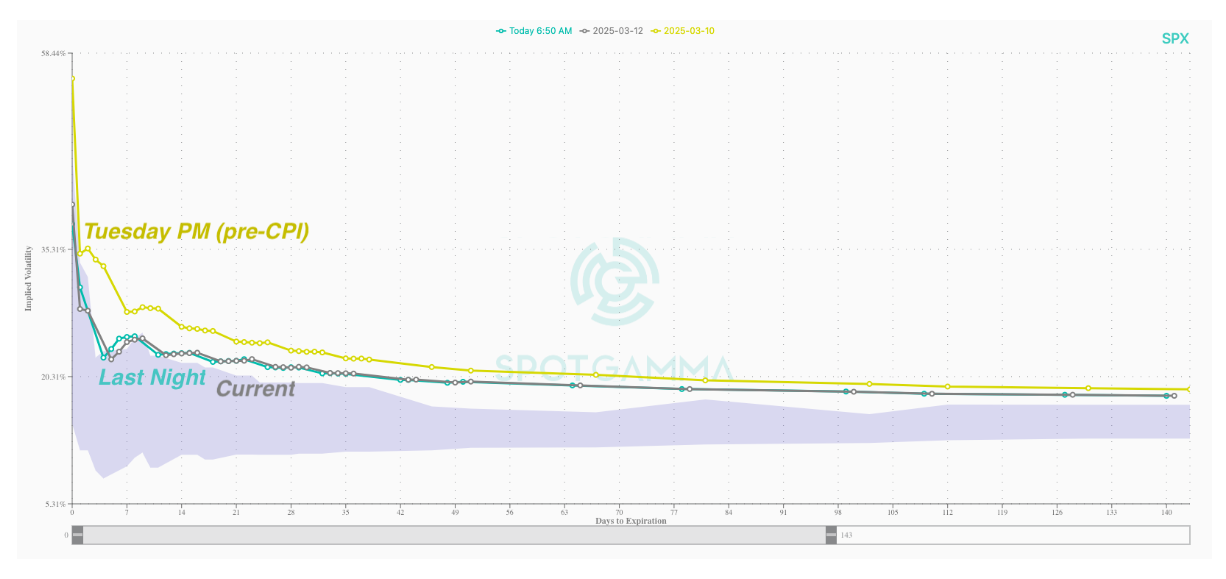

Vols have indeed contracted over the last several sessions, as shown in the SPX term structure, below. This comes with some reduction in tariff rhetoric, a benign CPI, and some oversold bounces in single stock land. The passing of today’s AM data should release a bit more event-vol, but we continue to think that the VIX has a floor in the low 20’s due to still-elevated realized vol, and tariff uncertainty.

What is critical here is that realized vol is sliding lower after the SPX has this week stalled out at 5,600. This justifies forward/implied vol to come in a bit which is why we think VIX can now move a few points lower (~22 vs ~24).

Vol declines are a good sign for bulls. We can’t help but side with them here, as we see negative gamma above – all the way up to a very large 5,700 positive gamma resistance strike.

To the downside, there is that massive 5,565 JPM strike, which while a strike of huge negative gamma, has been a big support level over the past several sessions.

Additionally there are now some positive gamma strikes from 5,500 – 5,550, adding support.

That leaves us looking for a path that mirrors the one plotted below, wherein the SPX can stage a ~2% rally into the at 5,700 area before being pulled back down into the 5,550 area into expiration(s).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5604.43 | $5599 | $558 | $19596 | $477 | $2026 | $201 |

| SG Gamma Index™: |

| -3.675 | -0.762 |

|

|

|

|

| SG Implied 1-Day Move: | 0.76% | 0.76% | 0.76% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5930.43 | $5925 | $595 | $20000 | $480 | $2150 | $228 |

| Absolute Gamma Strike: | $5005.43 | $5000 | $550 | $20000 | $480 | $2000 | $200 |

| Call Wall: | $6505.43 | $6500 | $650 | $21500 | $482 | $2210 | $240 |

| Put Wall: | $5505.43 | $5500 | $550 | $19000 | $470 | $2000 | $200 |

| Zero Gamma Level: | $5873.43 | $5868 | $583 | $19992 | $498 | $2179 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.540 | 0.405 | 0.641 | 0.554 | 0.429 | 0.293 |

| Gamma Notional (MM): | ‑$1.291B | ‑$2.585B | ‑$7.421M | ‑$679.402M | ‑$73.227M | ‑$1.784B |

| 25 Delta Risk Reversal: | -0.066 | -0.058 | -0.071 | -0.058 | -0.05 | -0.041 |

| Call Volume: | 668.853K | 2.093M | 7.327K | 1.047M | 15.76K | 354.608K |

| Put Volume: | 1.065M | 2.753M | 8.31K | 1.404M | 28.683K | 635.104K |

| Call Open Interest: | 7.704M | 7.509M | 76.514K | 3.699M | 300.724K | 4.07M |

| Put Open Interest: | 13.277M | 12.239M | 77.972K | 5.664M | 466.339K | 8.468M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5600, 5500] |

| SPY Levels: [550, 560, 565, 570] |

| NDX Levels: [20000, 19000, 19500, 20500] |

| QQQ Levels: [480, 490, 500, 470] |

| SPX Combos: [(5812,71.27), (5801,89.54), (5750,88.04), (5722,80.91), (5700,97.22), (5678,93.90), (5661,75.36), (5650,96.41), (5627,85.59), (5610,84.34), (5599,98.24), (5583,73.17), (5577,87.40), (5566,90.35), (5560,86.74), (5549,96.57), (5538,80.70), (5527,87.32), (5521,76.44), (5510,89.87), (5499,99.03), (5487,73.94), (5476,86.50), (5459,89.86), (5448,92.24), (5443,69.74), (5426,74.81), (5409,84.15), (5398,97.00), (5375,72.25), (5359,77.41), (5347,89.85), (5325,70.99)] |

| SPY Combos: [548.89, 558.9, 568.91, 538.88] |

| NDX Combos: [19302, 19714, 18891, 19106] |

| QQQ Combos: [469.78, 480.16, 459.88, 449.97] |

0 comentarios