Macro Theme:

Key dates ahead:

- 3/18: VIX expiration (Tuesday)

- 3/19: FOMC

- 3/21: OPEX

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

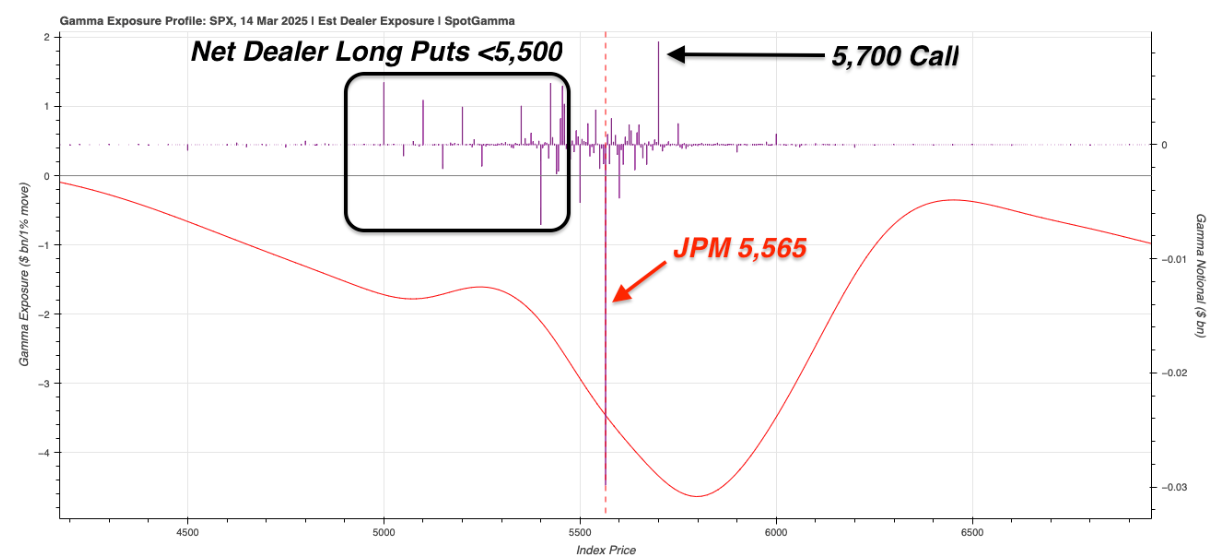

3/11: Having now seen some capitulation into 3/11 and SPX 5,565, we are looking for a short term oversold bounce into the ±5,750 area. Call credit spreads & call 1×2’s are our preferred way to play a market recovery.

3/10: A lot of things now seem to be lining up at the end of the month to be a material low in markets, as very large expirations (VIX: 3/18, OPEX 3/21, Q End EXP 3/31) may line up with concrete tariff announcements (4/2). Further, the price area of 5,500 comes into view as major long term support as its the last downside pocket of large put open interest, which includes the JPM Collar Strike.

Key SG levels for the SPX are:

- Resistance: 5,600, 5,700, 5,800 (wide levels!)

- Support: 5,565, 5500

Founder’s Note:

ES futures are +85 bps as the US government shutdown as (allegedly) been avoided.

This has the SPX back in an indicative level of 5,565 (there’s that number again…)

The SPX is showing net positive gamma strike support <5,500 from traders selling puts (dealers long). In between there we have that one massive 3/31 exp JPM strike (5,565), then to the upside the “Last strike standing” is a large 5,700 positive gamma call (dealers long, amx upside target into OPEX).

The net on this is that we continue to think a probe higher into 5,650 – 5,700 area is in the cards. As we said last night, we fully admit this has been our view since Tuesday, and this chart (rally into >5,650 then back to 5,565 into 3/31) from yesterday’s note still makes the most sense.

If the positioning and/or volatility picture deteriorates we will admit defeat, but so far things seem to be in line with expectations. This was the chart we posted Tuesday AM, wherein we discussed the divergence of time (expirations) meeting price (large positions at 5,500-5,565). Again, this is way to early to claim any type of market-forecasting victory, more of a statement that SPX price movement & IV changes are in line with expectations.

In much of last nights note we framed how sluggish the options market was, both

HIRO/

deltas and vol, despite the SPX making fresh lows into 5,500. Simply stated: vol wasn’t “buying” the new lows.

As the vol surface is deflating, we are seeing some early evidence of skew rotation: put IV coming in and calls heading up. To be clear, we are far from out of the woods until some type of tariff stability comes in, but so far, options indicators are supporting this idea that 5,500 will be an interim low into the end of March. Past then, who knows.

On this point those of you with TRACE access may also note that Stability is +30% this AM, as local gamma is now showing as flat, vs being persistently negative the last few weeks. Like with the vol change this is a mild, but “flaggable” divergence.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5526.85 | $5521 | $551 | $19225 | $468 | $1993 | $198 |

| SG Gamma Index™: |

| -4.151 | -0.835 |

|

|

|

|

| SG Implied 1-Day Move: | 0.75% | 0.75% | 0.75% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5930.85 | $5925 | $598 | $20475 | $490 | $2150 | $228 |

| Absolute Gamma Strike: | $5005.85 | $5000 | $550 | $19000 | $480 | $2000 | $200 |

| Call Wall: | $6505.85 | $6500 | $650 | $21500 | $477 | $2210 | $240 |

| Put Wall: | $5505.85 | $5500 | $550 | $19000 | $450 | $2000 | $195 |

| Zero Gamma Level: | $5835.85 | $5830 | $580 | $19763 | $492 | $2177 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.489 | 0.346 | 0.497 | 0.467 | 0.381 | 0.243 |

| Gamma Notional (MM): | ‑$1.469B | ‑$2.867B | ‑$10.984M | ‑$825.605M | ‑$80.33M | ‑$1.917B |

| 25 Delta Risk Reversal: | -0.064 | -0.058 | -0.068 | -0.057 | -0.049 | -0.043 |

| Call Volume: | 645.715K | 2.062M | 9.249K | 1.216M | 18.815K | 315.469K |

| Put Volume: | 1.139M | 2.906M | 7.075K | 1.232M | 37.316K | 668.458K |

| Call Open Interest: | 7.841M | 7.761M | 76.759K | 3.786M | 304.945K | 4.151M |

| Put Open Interest: | 13.481M | 12.416M | 77.579K | 5.639M | 474.028K | 8.648M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5600, 5500, 6000] |

| SPY Levels: [550, 560, 555, 545] |

| NDX Levels: [19000, 20000, 19500, 18500] |

| QQQ Levels: [480, 470, 475, 460] |

| SPX Combos: [(5748,82.75), (5698,95.80), (5676,89.37), (5649,95.54), (5626,81.10), (5604,79.42), (5599,96.52), (5577,85.97), (5566,90.08), (5555,71.24), (5549,96.14), (5527,91.20), (5522,70.09), (5505,89.53), (5499,99.38), (5488,72.10), (5477,95.78), (5461,76.99), (5455,90.14), (5450,95.38), (5439,76.43), (5428,90.24), (5406,84.24), (5400,98.44), (5372,84.03), (5356,77.94), (5350,92.16), (5323,81.13), (5306,83.25), (5301,95.25), (5256,78.45), (5251,87.61)] |

| SPY Combos: [548.86, 558.92, 568.98, 538.8] |

| NDX Combos: [18879, 18476, 19302, 19091] |

| QQQ Combos: [469.92, 479.94, 459.91, 465.15] |

0 comentarios