Macro Theme:

Key dates ahead:

- 3/18: VIX expiration (Tuesday)

- 3/19: FOMC

- 3/21: OPEX

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

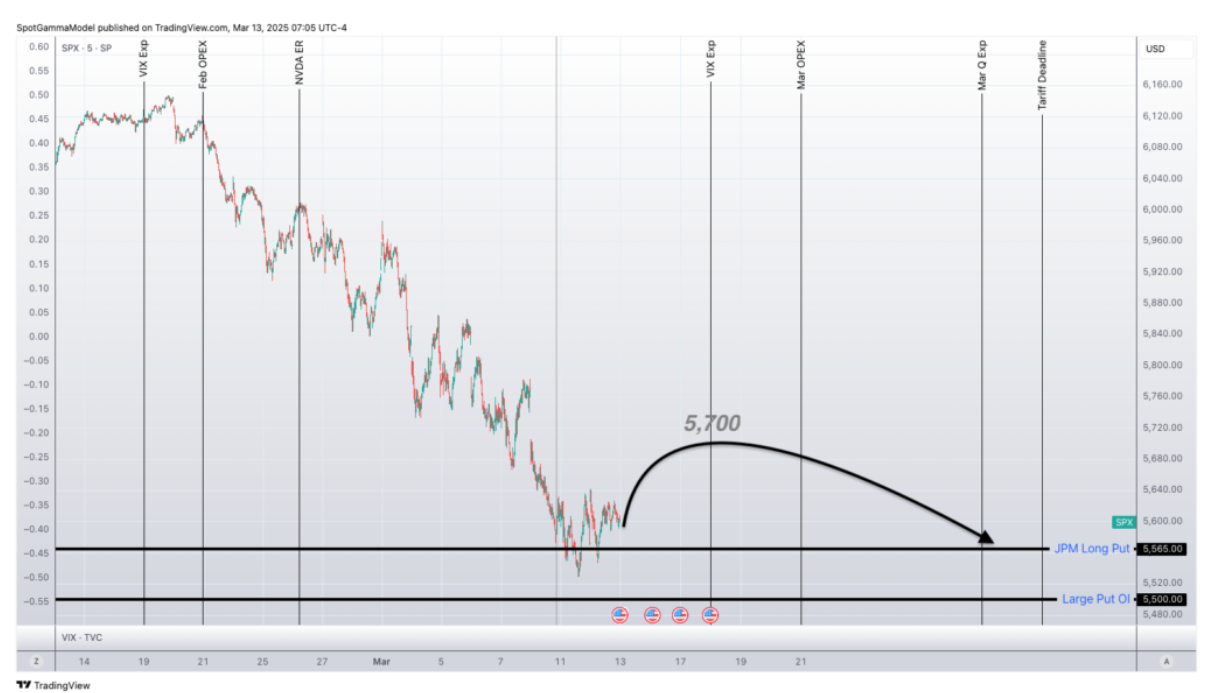

3/18: We look for short term equity weakness after this mornings VIX expiration (ref 5,675), with a target area of 5,565. Should that target hit, we want to look for April exp upside trades via call spreads/call flies, and or short term (end of March) short put spreads or broken wing put flies.

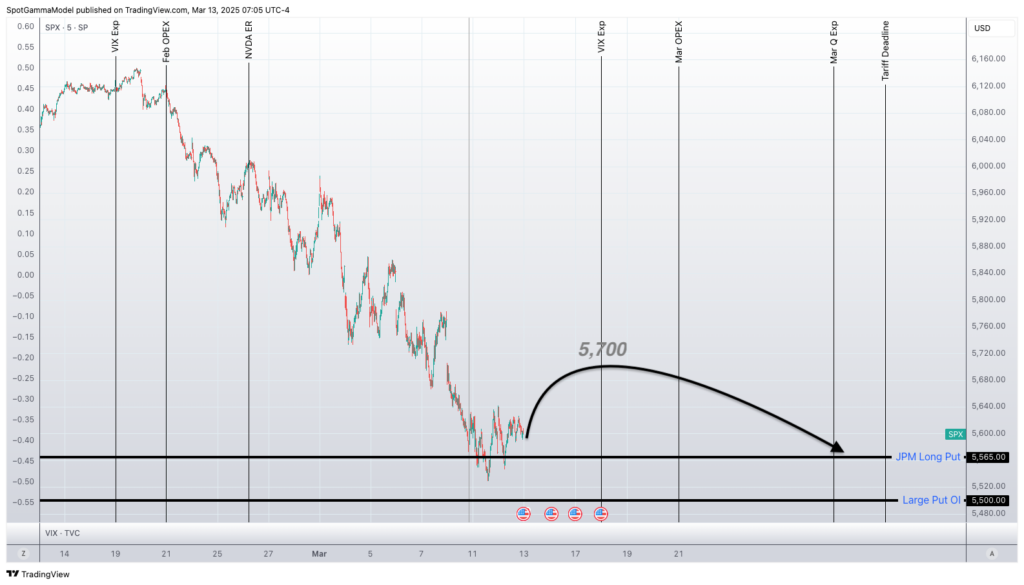

3/11: Having now seen some capitulation into 3/11 and SPX 5,565, we are looking for a short term oversold bounce into the ±5,750 area. Call credit spreads & call 1×2’s are our preferred way to play a market recovery. NOTE: This view is now closed as the target was achieved on VIX exp

Key SG levels for the SPX are:

- Resistance: 5,700, 5,800

- Support: 5,652, 5,600, 5,565, 5500

Founder’s Note:

Futures are flat ahead of 9:30AM ET VIX expiration. NVDA CEO gives a keynote at 1pm ET.

Things are thus far unfolding according to plan, with the SPX lows of 5,500-5,565 giving way to a VIX expiration rally into 5,700 (chart from Thursday AM). Accordingly, we are now looking for this mornings VIX expiration to mark a local high in equities, as VIX calls are cleared out and traders shift their attention back to macro: FOMC 3/19 and tariffs 4/2. The target/major downside support zone this week remains 5,500-5,565.

Last night we covered how the drop in VIX was not an actual volatility decline, as fixed strike vol was flat on the day. This syncs up with this mornings VIX expiration being a potential stock topping point into tomorrows FOMC + Friday OPEX.

We also see sticky-skew in the single stock space, as shown below, with most large stocks holding <20 skew ranks. This implies that put IV is still elevated vs call IV. We would expect skew ranks to lift if/when traders have bullish views.

Views out of this week feel a bit more tricky. Our most comfortable view is that 5,500 – 5,565 remain a likely low into the end of the month – unless Powell comes with a strongly hawkish view.

Obviously this Friday’s expiration is also going to clean up a lot of the large short call/long put positions weighing on equities, which could sync with a short term rally.

The looming threat to a rally remains the known-unknown of tariff deals, with an alleged deal deadline on 4/2.

With that, we think those that have shorter term time frames may want to meet further weakness by positioning into end-of-month short put spreads or broken wing put flies, with the idea that a relief rally could come next week.

If you have a longer term view, we think (into fresh equity weakness) looking for >=April Exp call spreads and or re-entering 1×2’s is one sensible way to position.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5730.28 | $5675 | $567 | $19812 | $482 | $2068 | $205 |

| SG Gamma Index™: |

| -2.313 | -0.645 |

|

|

|

|

| SG Implied 1-Day Move: | 0.69% | 0.69% | 0.69% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5755.28 | $5700 | $580 | $20000 | $481 | $2075 | $228 |

| Absolute Gamma Strike: | $5655.28 | $5600 | $570 | $20000 | $480 | $2050 | $205 |

| Call Wall: | $6055.28 | $6000 | $650 | $21500 | $488 | $2095 | $240 |

| Put Wall: | $5655.28 | $5600 | $560 | $20000 | $480 | $2050 | $200 |

| Zero Gamma Level: | $5869.28 | $5814 | $583 | $19911 | $493 | $2142 | $226 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.730 | 0.529 | 0.918 | 0.710 | 0.706 | 0.351 |

| Gamma Notional (MM): | ‑$938.98M | ‑$2.349B | ‑$3.757M | ‑$518.368M | ‑$41.608M | ‑$1.823B |

| 25 Delta Risk Reversal: | -0.056 | 0.00 | -0.061 | -0.048 | -0.042 | -0.033 |

| Call Volume: | 534.443K | 1.669M | 10.476K | 879.022K | 20.544K | 287.751K |

| Put Volume: | 871.123K | 2.588M | 11.135K | 979.75K | 40.014K | 415.809K |

| Call Open Interest: | 7.958M | 7.35M | 76.541K | 3.62M | 315.087K | 4.083M |

| Put Open Interest: | 13.541M | 13.115M | 77.075K | 5.612M | 463.695K | 8.782M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 6000, 5700, 5000] |

| SPY Levels: [570, 580, 550, 565] |

| NDX Levels: [20000, 19800, 19500, 20500] |

| QQQ Levels: [480, 500, 490, 485] |

| SPX Combos: [(5800,86.85), (5749,78.30), (5738,71.06), (5698,96.34), (5681,77.18), (5675,92.90), (5652,98.24), (5641,74.17), (5635,68.33), (5624,92.07), (5613,72.19), (5601,98.89), (5573,85.41), (5567,93.54), (5556,77.02), (5550,92.38), (5528,84.43), (5505,87.31), (5499,97.20), (5476,81.58), (5454,77.80), (5448,86.59), (5425,69.69), (5403,96.49)] |

| SPY Combos: [548.74, 558.87, 539.17, 563.94] |

| NDX Combos: [19693, 19079, 19297, 19495] |

| QQQ Combos: [464.79, 474.86, 470.07, 480.14] |

0 comentarios