Macro Theme:

Key dates ahead:

- 3/19: FOMC

- 3/21: OPEX

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

3/19: Into FOMC downside seems exhausted, and OPEX may bring some relief. We prefer to express the next week as a “short put” scenario, meaning we think downside is pretty limited, but there may not be enough juice to spark a strong rally until 4/2 tariffs pass. That being said, there are a few sectors offering some relatively low longer dated upside (+1-month cost calls), namely chips (ex: NVDA, AMD).

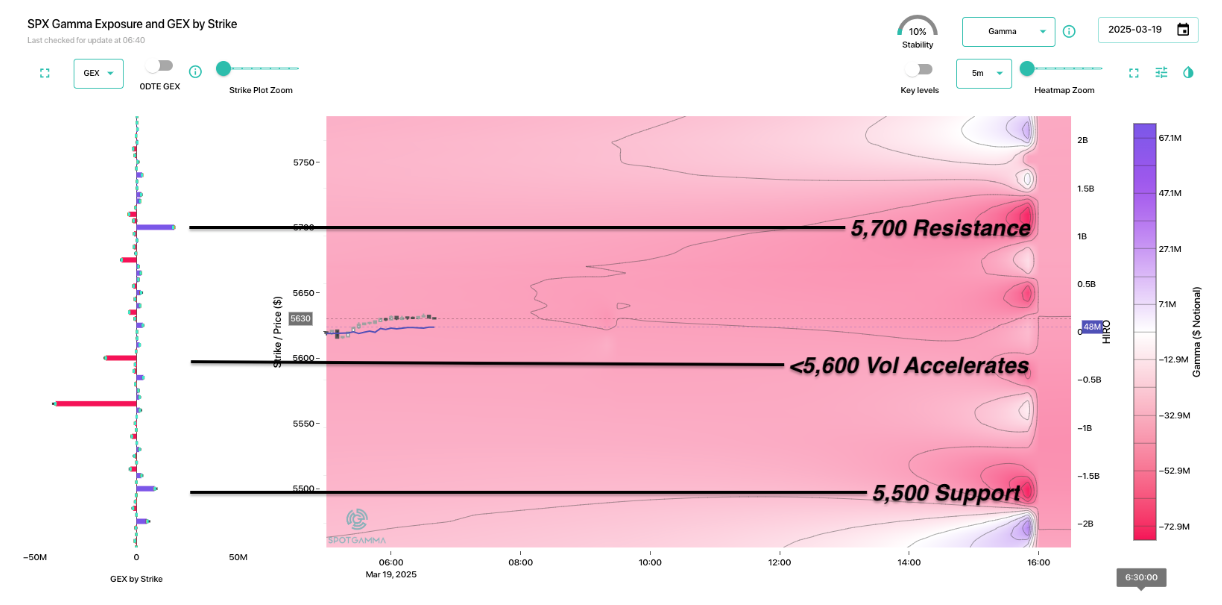

3/19 SPX update: We view 5,700 as resistance into Friday OPEX, with 5,500-5,565 being a potential low into the 4/2 tariff deadline.

Key SG levels for the SPX are:

- Resistance: 5,700, 5,800

- Support: 5,565, 5500

Founder’s Note:

Futures are +30bps ahead of FOMC.

The 0DTE straddle is $55 or 97bps (ref 5,630), suggesting traders are looking for a fairly light move out of FOMC. Remember, SPX 1-month realized is ~19% (120bps daily moves).

Per TRACE, the SPX maintains a negative gamma position into FOMC. We see the potential move as likely larger than 1% (ref 5,630), mapped out as follows:

- Major resistance remains at 5,700 due to positive gamma at that strike. If FOMC proves benign, that should remove some event-vol, which adds to an equity rally. That places 5,700 in play for today.

- First support is 5,565, but the more material support is 5,500. This is due to positive gamma strikes <=5,500. We still view this 5,500 – 5,565 as major support into EOM.

The market read into FOMC is pretty unconcerned (as tipped off by the ~1% straddle). Shown below is 1-month SPX skew from last week vs today, and as you can see the entire curve is lower, implying lower volatility expectations. From this point, we really need some incremental bad news to re-ignite put buyers and force the downside issue. Bears seem tired. Powell could certainly deliver that type of regenerative bad news, but we don’t think thats likely (vol historically contracts after FOMC).

FOMC feeds right into Friday OPEX, which should clear some heavy put positions, bringing additional (potential) relief. Most top names still hold put-skewed prices, resulting in low skew ranks. We are seeing the IV ranks broaden out/reduce as certain sectors have found support (bottom left), namely chips (NVDA, AMD, ETC). These may be interesting long calls plays into April, as their IV’s are relatively lower than other sectors. Other top names like AAPL, NFLX, TSLA carry both high IV ranks and high skew ranks (bottom right), suggesting puts are relatively expensive. For put holders in these names, the risk is these stocks failing to realize the heavy downside being priced in.

If you are particularly worried about tariffs & the April 2 deadline, you likely want to play more of the fixed risk, long call upside. If you are comfortable with tariff risk, selling puts/put spreads gets the extra benefit of (potential) vol contraction.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5669.24 | $5614 | $561 | $19483 | $474 | $2049 | $203 |

| SG Gamma Index™: |

| -3.264 | -0.829 |

|

|

|

|

| SG Implied 1-Day Move: | 0.65% | 0.65% | 0.65% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5880.24 | $5825 | $607 | $20010 | $480 | $2070 | $220 |

| Absolute Gamma Strike: | $5655.24 | $5600 | $550 | $20000 | $480 | $2000 | $205 |

| Call Wall: | $6555.24 | $6500 | $650 | $21500 | $479 | $2120 | $240 |

| Put Wall: | $5555.24 | $5500 | $550 | $20000 | $470 | $2000 | $200 |

| Zero Gamma Level: | $5851.24 | $5796 | $581 | $19877 | $492 | $2123 | $224 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.627 | 0.409 | 0.643 | 0.562 | 0.627 | 0.326 |

| Gamma Notional (MM): | ‑$1.157B | ‑$2.781B | ‑$7.748M | ‑$697.042M | ‑$48.305M | ‑$1.745B |

| 25 Delta Risk Reversal: | -0.054 | -0.048 | -0.06 | -0.045 | -0.04 | -0.022 |

| Call Volume: | 538.107K | 1.568M | 9.455K | 904.506K | 19.174K | 241.126K |

| Put Volume: | 831.873K | 1.782M | 7.037K | 719.829K | 20.078K | 496.484K |

| Call Open Interest: | 8.056M | 7.45M | 77.078K | 3.743M | 322.42K | 4.128M |

| Put Open Interest: | 13.685M | 13.268M | 78.034K | 5.638M | 466.024K | 8.424M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5700, 6000, 5000] |

| SPY Levels: [550, 560, 565, 570] |

| NDX Levels: [20000, 19500, 19000, 19800] |

| QQQ Levels: [480, 470, 475, 490] |

| SPX Combos: [(5800,82.88), (5699,96.33), (5676,92.33), (5648,96.68), (5643,75.77), (5626,91.00), (5603,90.18), (5598,98.68), (5592,78.75), (5575,89.15), (5570,68.48), (5564,94.41), (5553,85.14), (5547,96.01), (5542,76.48), (5525,87.65), (5502,99.63), (5474,89.68), (5452,95.85), (5424,77.80), (5407,78.32), (5401,96.66), (5373,71.94), (5356,70.40), (5351,88.01)] |

| SPY Combos: [559.78, 564.88, 549.57, 539.93] |

| NDX Combos: [19289, 19094, 19698, 19503] |

| QQQ Combos: [479.87, 464.91, 470.22, 475.05] |

0 comentarios