Macro Theme:

Key dates ahead:

- 3/21: OPEX

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

3/19: Into FOMC downside seems exhausted, and OPEX may bring some relief. We prefer to express the next week as a “short put” scenario, meaning we think downside is pretty limited, but there may not be enough juice to spark a strong rally until 4/2 tariffs pass. That being said, there are a few sectors offering some relatively low longer dated upside (+1-month cost calls), namely chips (ex: NVDA, AMD).

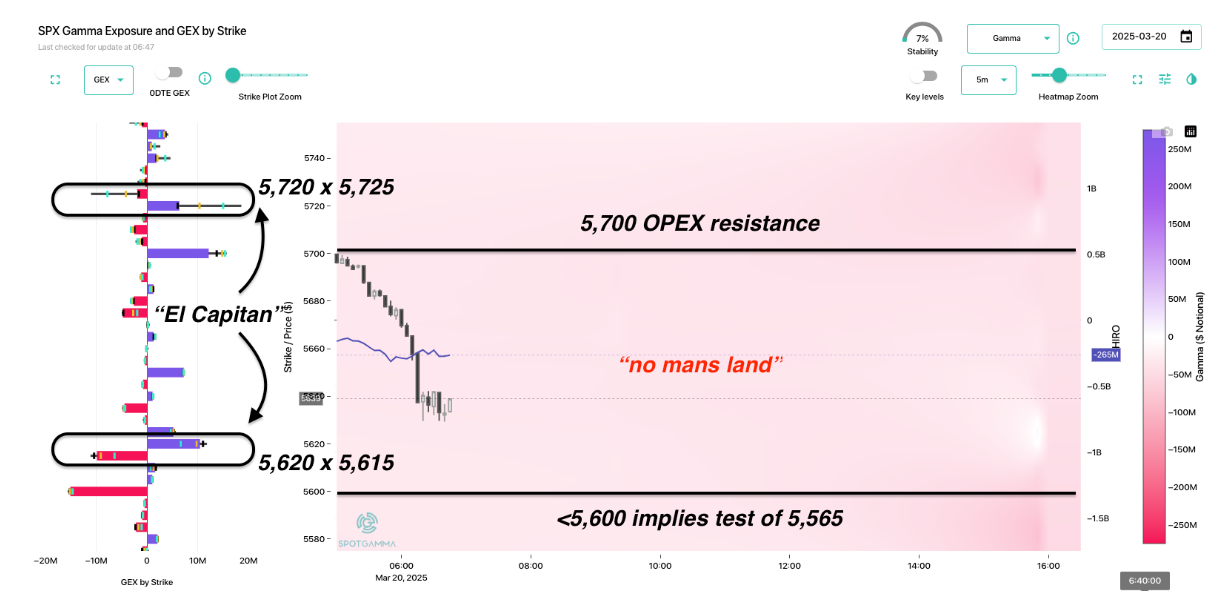

3/19 SPX update: We view 5,700 as resistance into Friday OPEX, with 5,500-5,565 being a potential low into the 4/2 tariff deadline.

Key SG levels for the SPX are:

- Resistance: 5,700, 5,720, 5,800

- Support: 5,620, 5,565

Founder’s Note:

Futures are 60 bps lower, giving up post FOMC gains after rejecting from 5,700 resistance overnight. That same 5,700 area was rejected during yesterdays cash session, too.

Before we dive into levels, the story here is that the FOMC didn’t do much to clear the air. Trump followed up with tweets about needing to cut rates ahead of 4/2 (he again marked that date). We’re not macro guys, but tweets certainly cloud the picture and reinforces 4/2 as the date to watch. This matters to us in options space because it backs the idea that implied vols cannot fully release until we clear the “known unknown” of tariffs. Sticky vols prevent a full “risk on” rally.

Ultimately post-FOMC leaves our view unchanged from the Macro Note points above, and discussed yesterday.

Levels TLDR:

- 5,700 – 5,720 resistance is reinforced for today

- 5,615 is key support (Condor, SPY 560)

- Below 5,600 is negative gamma, implying slippery downside into 5,565

- 5,500 – 5,565 remains major support into 3/31

Looking at TRACE, we see not only that big 5,700 positive gamma resistance bar, but we see Captain Condor back, too. As part of their condor they have a ~3,800 lot call spread at 5,720 x 5725 – that 5,720 is just above yesterdays intraday high and alights closely with SPY 570 (a giant SPY gamma bar).

The put spread component of the condor is at 5,620 x 5,615, and below that final support is large negative gamma into 5,565.

On net, the FOMC did serve to reduce implied vols. At last nights close we commented that it was a full smackdown of SPX IV’s, but that has moderated some this AM, as fixed strike vols now show 1/4 to 1/2 pt of vol reduction vs Tuesdays close (vs -1 to -2 pts last night). On net, this reflects FOMC passing without much to-do (i.e. event vol gone).

Lastly, in terms of tomorrow expiration we are pretty neutral. This is because put prices/positions have moderated vs calls, which reduces an imbalance to release (i.e. lots of put hedges have to be covered). As of last week the data below was showing +70-80% of delta value tied to puts vs 50-60% now.

This neutral view syncs with the idea that vols are unlikely to discharge until 4/2, and the monster JPM strike has some pull into 3/31, which ties to SPX to prices in this 5,600 area. You could also look at this as put-decay having been pulled forward by VIX expiration and FOMC.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5727.82 | $5675 | $567 | $19736 | $480 | $2082 | $206 |

| SG Gamma Index™: |

| -2.247 | -0.676 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5767.82 | $5715 | $607 | $20000 | $480 | $2100 | $218 |

| Absolute Gamma Strike: | $5752.82 | $5700 | $570 | $19500 | $480 | $2100 | $210 |

| Call Wall: | $6052.82 | $6000 | $570 | $21500 | $486 | $2120 | $240 |

| Put Wall: | $5652.82 | $5600 | $560 | $20000 | $480 | $2000 | $200 |

| Zero Gamma Level: | $5823.82 | $5771 | $579 | $19985 | $491 | $2124 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.764 | 0.530 | 0.845 | 0.682 | 0.779 | 0.462 |

| Gamma Notional (MM): | ‑$915.807M | ‑$2.449B | ‑$5.544M | ‑$610.583M | ‑$31.047M | ‑$1.438B |

| 25 Delta Risk Reversal: | -0.051 | -0.047 | -0.061 | -0.047 | -0.037 | -0.017 |

| Call Volume: | 680.53K | 1.822M | 10.935K | 898.90K | 22.083K | 551.135K |

| Put Volume: | 1.126M | 2.341M | 10.859K | 1.114M | 27.561K | 505.522K |

| Call Open Interest: | 8.272M | 7.505M | 80.222K | 3.777M | 330.275K | 4.408M |

| Put Open Interest: | 14.061M | 13.292M | 80.849K | 5.918M | 473.21K | 8.459M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5700, 5650, 5600, 6000] |

| SPY Levels: [570, 580, 565, 560] |

| NDX Levels: [19500, 20000, 19800, 19900] |

| QQQ Levels: [480, 490, 485, 475] |

| SPX Combos: [(5800,81.34), (5738,72.91), (5721,77.97), (5698,95.54), (5692,68.91), (5675,94.76), (5653,98.81), (5641,76.31), (5624,92.93), (5613,69.21), (5602,99.18), (5573,86.03), (5567,94.83), (5556,79.45), (5550,92.38), (5528,85.01), (5505,84.90), (5499,97.51), (5477,81.55), (5454,77.92), (5448,86.10), (5426,69.68), (5403,68.35), (5397,94.55)] |

| SPY Combos: [549.8, 559.34, 564.39, 539.7] |

| NDX Combos: [19697, 19085, 19500, 19302] |

| QQQ Combos: [469.96, 465.22, 479.93, 475.18] |

0 comentarios