Macro Theme:

Key dates ahead:

- 3/21: OPEX

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

3/21: OPEX Update: We continue our view of wanting to own “cheap” long calls/call spreads >=1-month exp, which show in names like: semis (SMH, NVDA, AMD), and dare we say it: crypto (COIN, MSTR). The view here is that the market is not pricing in a solid upside move, much less an early (pre-4/2) positive tariff deal. The price to express this upside view with fixed-risk calls reads as low, which both benefits us if the trade becomes consensus(skew shift from puts to calls), and reduces the penalty for being wrong.

3/19: Into FOMC downside seems exhausted, and OPEX may bring some relief. We prefer to express the next week as a “short put” scenario, meaning we think downside is pretty limited, but there may not be enough juice to spark a strong rally until 4/2 tariffs pass. That being said, there are a few sectors offering some relatively low longer dated upside (+1-month cost calls), namely chips (ex: NVDA, AMD). ✅

3/19 SPX update: We view 5,700 as resistance into Friday OPEX, with 5,500-5,565 being a potential low into the 4/2 tariff deadline. ✅

Key SG levels for the SPX are:

- Resistance: 5,700

- Support: 5,565

Founder’s Note:

Futures are 30bps lower ahead of today’s OPEX.

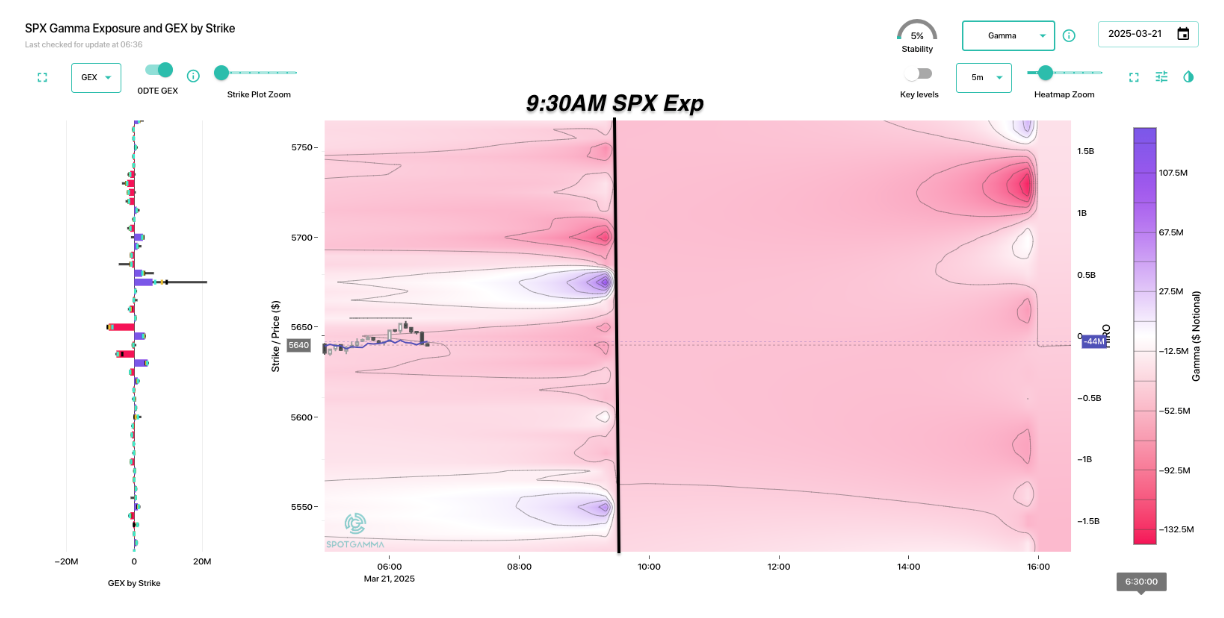

A large portion of SPX options expire at 9:30AM ET, with all other positions expiring at 4PM ET.

From the SPX perspective, you can see VIA TRACE the impact of SPX AM expiry. It serves to clear out the positive gamma nodes at 5,700 and 5,500, which have been offering relative resistance/support in those areas over the past week(s). Accordingly, the map is 100% red after 9:30AM, which infers fluid movement is available across the board. In all likelihood we will see some quick 0DTE options come in after the open, along with some new longer dated positions to fill in what has expired (i.e. fresh support/resistance levels).

What is left below is the big 5,565 JPM put that expires on 3/31, which we still think combines with 5,500 to offer support into end of March.

We’ve been trying to talk down the impact of March OPEX as it shifted from a put/vol heavy expiration last week, to now rather neutral. Backing this idea is our IV Rank vs Skew Rank plot, which shows IV’s reducing for top single stocks. Compare this plot to the one on Wednesday AM, and you will see that plot points are shifting from bottom right (high IV/expensive puts) to bottom left (low IV/cheap calls).

This also highlights the suggestion that the expression for this past week was indeed “short puts” as vols could come in a bit, but there wasn’t necessarily going to be a big a rally (long calls need a rally & don’t like the IV decline).

Clearly IV’s are still somewhat high depending on the name/tenor you select, but OPEX may serve to zap another tranche of elevated IV’s, pushing plot points more left.

As far as “the play” going forward, we think the available risk to play is right tail. This is because we see & like cheap calls/call spreads that are available into April OPEX, and these calls should do well if stocks bounce higher. While the world waits for 4/2, we are concerned that a sneaky, positive tariff tweet could spark an early move.

We of course have no real reason to materially believe such an early deal happens, we just see some call positions seem cheap “here and now”, which suggests that the cost of carry for >=1-month calls is minimal (particularly if you go call spreads). Semis seem particularly attractive from this aspect: SMH, NVDA or AMD as highlighted last night.

If you are worried about downside, puts have certainly gotten cheaper over the past week, but nothing that reads “cheap”. There is also a difference between if you are hedging something (like long stocks), or just looking to initiate a trade. If you are in the former camp (hedging), then adding some protection via SPY/QQQ put spreads is reasonable at these prices. If you are not hedging then we’d argue nothing looks particularly attractive. Its likely that over the next week this put-price dynamic changes.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5714.23 | $5662 | $565 | $19677 | $479 | $2068 | $206 |

| SG Gamma Index™: |

| -2.898 | -0.732 |

|

|

|

|

| SG Implied 1-Day Move: | 0.62% | 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5752.23 | $5700 | $607 | $19690 | $480 | $2080 | $213 |

| Absolute Gamma Strike: | $5752.23 | $5700 | $570 | $19500 | $480 | $2070 | $205 |

| Call Wall: | $6552.23 | $6500 | $570 | $19700 | $490 | $2120 | $215 |

| Put Wall: | $5652.23 | $5600 | $560 | $20000 | $480 | $2070 | $200 |

| Zero Gamma Level: | $5854.23 | $5802 | $577 | $19925 | $489 | $2110 | $217 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.726 | 0.487 | 0.811 | 0.624 | 0.739 | 0.454 |

| Gamma Notional (MM): | ‑$1.022B | ‑$2.407B | ‑$5.822M | ‑$623.84M | ‑$47.08M | ‑$1.244B |

| 25 Delta Risk Reversal: | -0.054 | -0.046 | -0.053 | 0.00 | 0.00 | -0.019 |

| Call Volume: | 634.306K | 1.967M | 11.525K | 866.555K | 29.523K | 263.029K |

| Put Volume: | 1.011M | 2.197M | 11.577K | 1.082M | 35.654K | 1.219M |

| Call Open Interest: | 8.364M | 7.421M | 82.286K | 3.824M | 343.082K | 4.467M |

| Put Open Interest: | 14.272M | 13.296M | 83.814K | 5.877M | 490.168K | 8.134M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5700, 5650, 5600, 6000] |

| SPY Levels: [570, 560, 565, 550] |

| NDX Levels: [19500, 19600, 19800, 20000] |

| QQQ Levels: [480, 475, 485, 470] |

| SPX Combos: [(5799,73.92), (5703,96.92), (5680,77.43), (5674,91.94), (5663,74.82), (5657,81.77), (5652,98.89), (5646,78.29), (5640,74.22), (5629,74.98), (5623,93.43), (5618,74.42), (5606,93.45), (5601,99.08), (5589,75.09), (5578,92.34), (5572,71.31), (5567,95.16), (5555,86.46), (5550,94.62), (5538,68.20), (5533,70.41), (5527,84.14), (5510,87.10), (5499,98.16), (5476,82.33), (5459,84.19), (5448,89.17), (5425,70.65), (5408,76.45), (5402,95.08)] |

| SPY Combos: [559.76, 564.86, 549.55, 569.4] |

| NDX Combos: [19087, 19501, 19304, 19717] |

| QQQ Combos: [479.83, 464.92, 475.02, 470.21] |

0 comentarios