Macro Theme:

Key dates ahead:

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

3/24: We are looking to lock in some long call/short put gains (see 3/19 note) into the strong stock rally on into 3/24 because a signed tariff deal has not been reached (ref SPX 5,730). Tariffs remain a major “known-uknown” even though equities are set at open at ~3-week highs, and VIX at 3 week lows (VIX 19). Further, we now view S&P puts as relatively cheap, and so we will be looking to add downside protection into 3/31 exp (around JPM 5,565 strike), and or for >4/2 exp “no tariff deal” outcomes.

3/21: OPEX Update: We continue our view of wanting to own “cheap” long calls/call spreads >=1-month exp, which show in names like: semis (SMH, NVDA, AMD), and dare we say it: crypto (COIN, MSTR). The view here is that the market is not pricing in a solid upside move, much less an early (pre-4/2) positive tariff deal. The price to express this upside view with fixed-risk calls reads as low, which both benefits us if the trade becomes consensus(skew shift from puts to calls), and reduces the penalty for being wrong. ✅

3/19: Into FOMC downside seems exhausted, and OPEX may bring some relief. We prefer to express the next week as a “short put” scenario, meaning we think downside is pretty limited, but there may not be enough juice to spark a strong rally until 4/2 tariffs pass. That being said, there are a few sectors offering some relatively low longer dated upside (+1-month cost calls), namely chips (ex: NVDA, AMD). ✅

Key SG levels for the SPX are:

- Resistance: 5,750

- Support: 5,700, 5,600

- Under 5,700 is primarily negative gamma, and high risk.

Founder’s Note:

TLDR: There could be a bit of an OPEX effect this AM, which has helped push SPX +1% into a mild positive gamma position. While this rally feels good, there is not really any stability. No tariff deal has been signed, and one bad tariff-tweet ruins this entire move in one fell swoop. Accordingly, we want to take advantage of this move to monetize some gains in long calls (ex: roll or turn calls to spreads) and/or short puts entered the last 2 weeks.

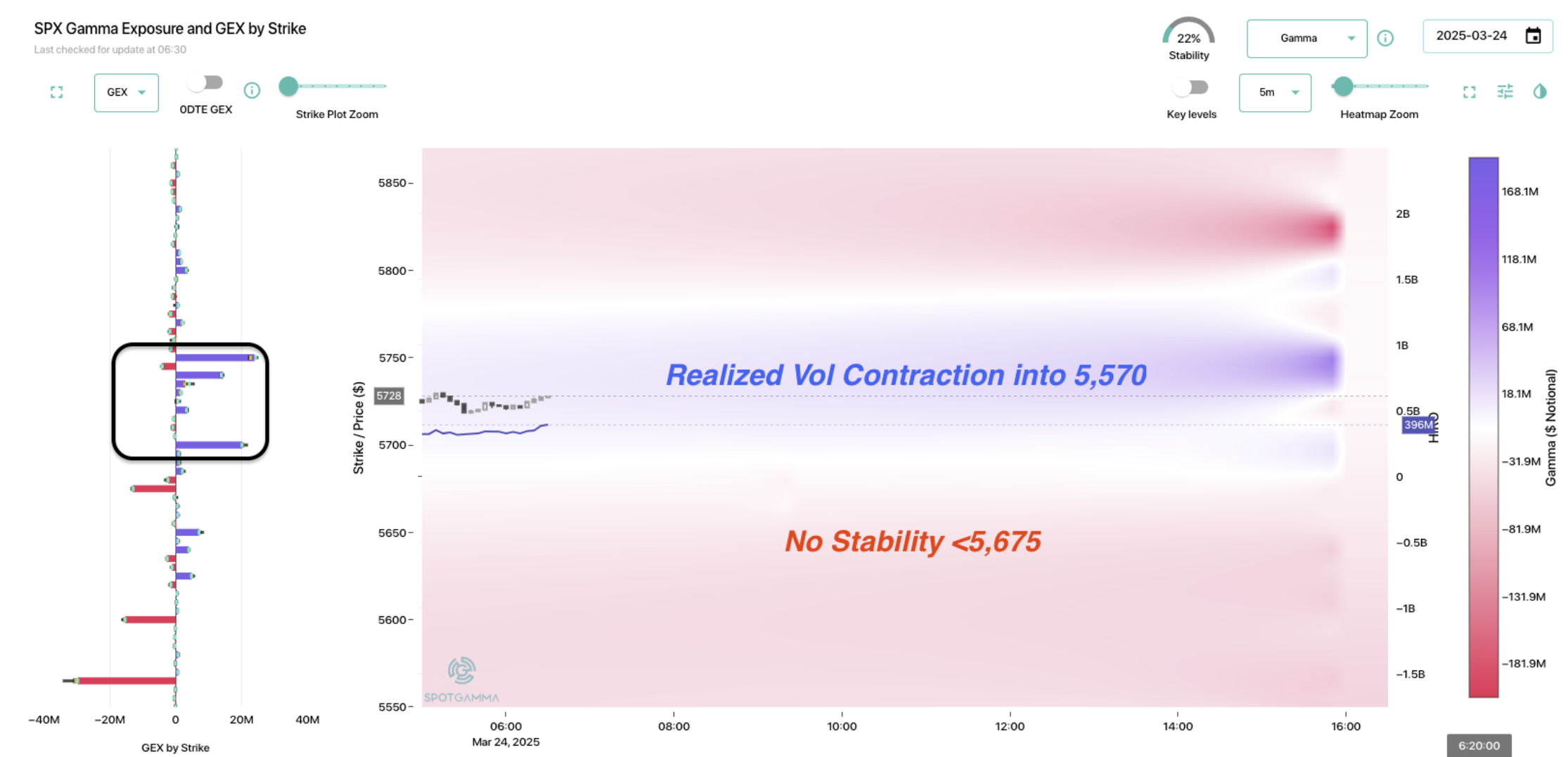

Futures are a full 1% higher today, the morning after OPEX. This pushes the SPX into some mild positive gamma positioning, as seen in TRACE (blue area). We are particularly focused on the cluster of blue strikes, which are not massive, but are clustered together in such a fashion that they should offer resistance into 5,750. Further, we believe traders will enter today’s market looking to sell short dated SPX calls in the 5,750 – 5,800 area. This would add to overhead resistance.

In theory, the positive gamma at 5,700 should offer some decent support, but under there is primarily negative gamma. However, any negative tariff tweet could easily shove SPX back into the negative gamma slipstream <5,700. Further, from this point, not only is there negative gamma below 5,700, but the implied volatility premium has been absolutely demolished (plotted below) – so equity downside would likely lead to a quick re-inflation of IV (i.e. VIX spikes).

A few points on the notes above:

- We do not think single stocks have this same overhead damper, which is why we liked long single stock calls last week.

- Due to the instability of this rally, we think gains should be actively managed: ex: roll calls up and out, or turn calls into spreads. We don’t want to eliminate upside exposure in case an early deal comes in, but we also are weary of fleeting gains.

- SPX Put flies/put spreads or other put hedges into 3/31 exp and/or 4/2 tariff deadlines are much more attractive today vs last week.

Those of you that read the Friday PM or Sunday note would know that markets were pricing very low vol for today. In fact, the 1DTE IV was near 10%, which calculates to ~65bps of SPX movement. Well, the SPX is already up 1%, suggesting those short vol/equity upside may be under pressure this AM. When you combine the 5,750 positive gamma resistance along with this 1% AM move over the implied move of 65 bps – well we think today may already be nearly maxed out in equity indexes (i.e. we don’t expect a larger SPX move today than, 5750). In other words, there is probably a bit of a “chase” this AM because vol was underpriced.

0DTE IV has “repriced” to ~22% as you can see in the SPX term structure below. But the more important thing is that traders are still heavily focused on the 4/2 tariff deadline, as shown. This suggests that this equity market rally is not because of a tariff deal, even though Trump signaled some leniency last week. That saga clearly remains a known-unknown, and one bad headline could easily pop SPX below 5,675, which would re-spike equity downside/volatility.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5717.85 | $5667 | $564 | $19753 | $481 | $2056 | $203 |

| SG Gamma Index™: |

| -2.529 | -0.444 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5750.85 | $5700 | $565 | $19590 | $480 | $2050 | $220 |

| Absolute Gamma Strike: | $6050.85 | $6000 | $560 | $19600 | $480 | $2000 | $205 |

| Call Wall: | $6550.85 | $6500 | $600 | $19600 | $485 | $2055 | $240 |

| Put Wall: | $5650.85 | $5600 | $550 | $18000 | $470 | $2000 | $200 |

| Zero Gamma Level: | $5813.85 | $5763 | $571 | $19556 | $487 | $2099 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.634 | 0.540 | 0.985 | 0.664 | 0.705 | 0.391 |

| Gamma Notional (MM): | ‑$714.28M | ‑$1.12B | $2.69M | ‑$305.537M | ‑$25.55M | ‑$1.04B |

| 25 Delta Risk Reversal: | -0.042 | 0.00 | -0.053 | 0.00 | 0.00 | 0.00 |

| Call Volume: | 538.016K | 1.689M | 17.311K | 796.902K | 24.414K | 249.824K |

| Put Volume: | 880.974K | 1.763M | 12.325K | 740.596K | 32.435K | 678.009K |

| Call Open Interest: | 6.174M | 5.891M | 60.425K | 2.926M | 245.50K | 3.215M |

| Put Open Interest: | 11.152M | 9.74M | 60.377K | 4.943M | 375.34K | 6.625M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5000, 5700, 5600] |

| SPY Levels: [560, 550, 565, 570] |

| NDX Levels: [19600, 19500, 20000, 19800] |

| QQQ Levels: [480, 490, 470, 500] |

| SPX Combos: [(5702,87.37), (5673,94.96), (5651,95.89), (5628,96.79), (5600,98.43), (5588,71.45), (5583,71.95), (5577,92.99), (5571,69.78), (5566,95.78), (5549,93.30), (5543,70.38), (5532,68.04), (5526,93.60), (5503,98.16), (5475,90.27), (5452,89.71), (5424,86.83), (5401,95.31)] |

| SPY Combos: [559.27, 564.36, 549.09, 569.45] |

| NDX Combos: [19596, 19082, 19300, 19497] |

| QQQ Combos: [464.88, 474.95, 470.15, 480.22] |

0 comentarios