Macro Theme:

Key dates ahead:

- 3/27: GDP + Jobs

- 3/28: Core PCE

- 3/31: Q-End OPEX

- 4/2: Tariff Deadline

3/24: We are looking to lock in some long call/short put gains (see 3/19 note) into the strong stock rally on into 3/24 because a signed tariff deal has not been reached (ref SPX 5,730). Tariffs remain a major “known-uknown” even though equities are set at open at ~3-week highs, and VIX at 3 week lows (VIX 19). Further, we now view S&P puts as relatively cheap, and so we will be looking to add downside protection into 3/31 exp (around JPM 5,565 strike), and or for >4/2 exp “no tariff deal” outcomes.

3/25: April 2 Tariff Scenario:

- In a positive outcome, we’d look for a move into 5,950, with major resistance at 6,000. This is also where we believe vanna fuel would be totally “burned off” with VIX hitting 14’s

- In a negative outcome, the immediate downside support level to watch is 5,500. We do not currently see reasons for equities shift below there, and would have to update models if/when that target zone is hit.

3/21: OPEX Update: We continue our view of wanting to own “cheap” long calls/call spreads >=1-month exp, which show in names like: semis (SMH, NVDA, AMD), and dare we say it: crypto (COIN, MSTR). The view here is that the market is not pricing in a solid upside move, much less an early (pre-4/2) positive tariff deal. The price to express this upside view with fixed-risk calls reads as low, which both benefits us if the trade becomes consensus(skew shift from puts to calls), and reduces the penalty for being wrong. ✅

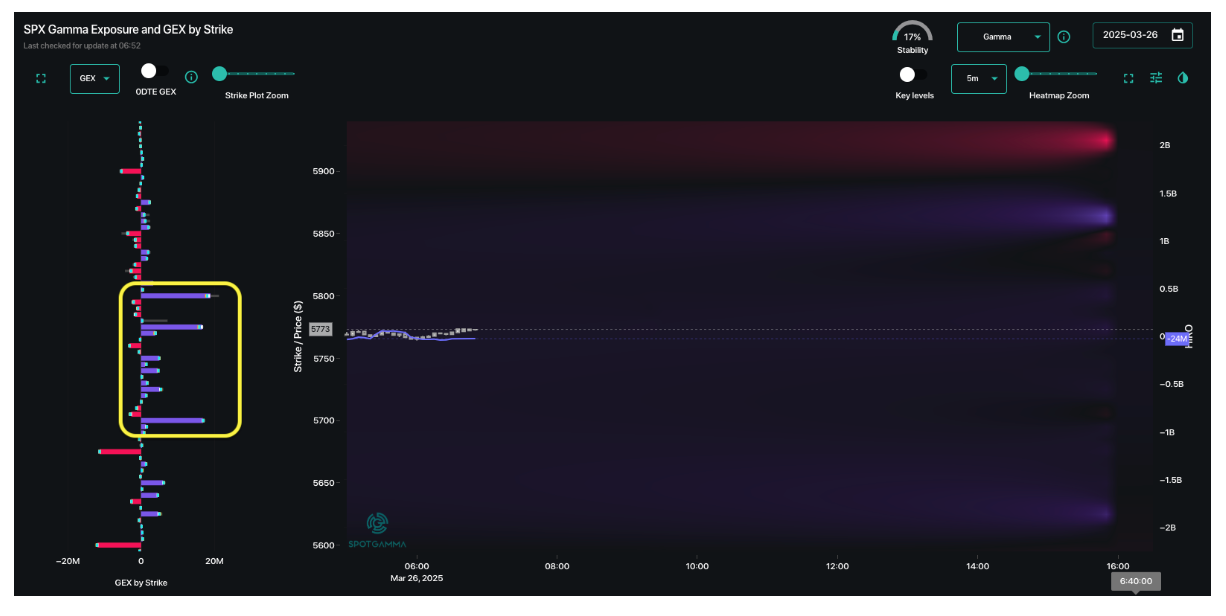

Key SG levels for the SPX are:

- Resistance: 5,800

- Support: 5,700, 5,600

- Under 5,700 is primarily negative gamma, and high risk.

Founder’s Note:

Futures are -10bps, with no major data on the tape for today.

And so, we wait….

Positive gamma continues to hold in the 5,700-5,800, which should continue to throttle volatility. This is not a massive amount of gamma, but faces off against huge 0DTE flow (60% of yesterday’s SPX flow in 0DTE), and SPY equity volume half of that seen over the past month (35mm vs +60mm). Through this lens, gamma is kind of the only flow in town. Obviously any major tariff development could break these relatively light gamma-binds.

GDP + jobs numbers tomorrow, and CORE PCE Friday could offer a bit more relative movement.

In last nights note we touched on the lack of risk/vol premium prevalent in the current market, for both this pre-4/2 period and post ~2 weeks out. Essentially it looks like 4/2 is being priced as a binary event, like a CPI or NFP.

We think that is a mistake. In recent notes we have commented that adding put structures now makes sense, as implied vols have come down, and there is sharp negative gamma <5,700 into 5,500. In yesterday’s AM note, we discussed the best-case upside target of 5,950, which is driven by gamma positioning and current IV’s. Those respective levels (5,950, 5,500) are ~3.5% away from current 5,770 SPX levels. If either of those moves comes to fruition 2-3 days after the big tariff day, that equates to an annualized IV of 20-25%.

VIX is 17.5, ATM IV’s pre & post 4/2-4/4 are ~14.5%. That’s pricing little to no movement.

Its hard to argue against the current, low volatility expectations for pre-4/2, as most traders seem to be sitting on their hands (per our opening sentence).

The other outcome is “nothing done”, meaning the whole thing just turns out to be a punt, with no material change. We suppose you could then argue that IV’s are maybe fairly priced, assuming that forward risks are greatly diminished (i.e. this market deserves no vol premium). Betting on nothing done, with IV’s at lows doesn’t seem too lucrative.

However, in a “nothing done” to “good deal” outcome, we suspect the single stock space will be the much more interesting place to play. You get a sense of this from the CBOE correlation index (blue, COR1M) and dispersion (purple, DSPX) indicies, which diverged in 2025, but have both come in over recent weeks.

Correlation highs informed us that stocks are all moving in the same direction: crashing into mid-March. Over the last week, that uniformity is breaking apart, which is typical of bullish moves wherein traders pile into specific equity themes.

Dispersion signaled that there was a lot of variance in single stock returns (some stuff crashed harder than others), but in the last week stocks are moving more with the same volatility.

As we approach earnings season, you could expect to see dispersion move higher, and correlation lower, which means we shift back to a “stock pickers” market. And we think that is true in any flat to positive tariff outcome. In other words, you may benefit from expressing “macro” equity views with select single stocks (somewhat like our view on going long semis/AMD/NVDA and/or short puts last week vs playing SPY/QQQ). And do we have a new tool (announcing later today) that is going to help you with that!

If its a bad outcome, then correlation likely spikes, and vols re-raise across the board (single stocks + index). In this case, owning index vol likely suffices.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5825.9 | $5776 | $575 | $20287 | $493 | $2095 | $207 |

| SG Gamma Index™: |

| -0.787 | -0.204 |

|

|

|

|

| SG Implied 1-Day Move: | 0.74% | 0.74% | 0.74% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5799.9 | $5750 | $574 | $19590 | $489 | $2080 | $208 |

| Absolute Gamma Strike: | $6049.9 | $6000 | $575 | $19600 | $490 | $2100 | $205 |

| Call Wall: | $5899.9 | $5850 | $580 | $19600 | $502 | $2055 | $210 |

| Put Wall: | $5649.9 | $5600 | $570 | $20000 | $480 | $2000 | $200 |

| Zero Gamma Level: | $5835.9 | $5786 | $574 | $19934 | $492 | $2106 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.887 | 0.791 | 1.268 | 0.928 | 0.869 | 0.487 |

| Gamma Notional (MM): | ‑$181.605M | ‑$358.062M | $5.977M | ‑$5.358M | ‑$12.089M | ‑$887.509M |

| 25 Delta Risk Reversal: | -0.039 | 0.00 | -0.048 | 0.00 | -0.034 | 0.00 |

| Call Volume: | 494.346K | 1.457M | 8.59K | 678.902K | 10.215K | 205.182K |

| Put Volume: | 711.877K | 1.86M | 9.021K | 784.448K | 14.355K | 323.033K |

| Call Open Interest: | 6.448M | 6.171M | 63.019K | 3.093M | 254.331K | 3.204M |

| Put Open Interest: | 11.454M | 10.597M | 62.506K | 5.273M | 387.902K | 6.836M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5800, 5700, 5000] |

| SPY Levels: [575, 570, 580, 550] |

| NDX Levels: [19600, 20500, 20000, 20200] |

| QQQ Levels: [490, 500, 480, 495] |

| SPX Combos: [(6002,88.66), (5950,80.95), (5898,86.03), (5875,75.12), (5863,70.13), (5858,76.51), (5852,91.49), (5840,77.70), (5834,76.97), (5829,71.77), (5823,90.59), (5817,88.44), (5811,83.33), (5806,81.98), (5794,85.90), (5782,78.45), (5748,75.10), (5725,89.88), (5713,71.58), (5702,95.73), (5673,96.72), (5650,94.55), (5626,88.61), (5621,82.68), (5598,95.87), (5574,87.70), (5563,86.12), (5551,87.81), (5522,90.20), (5499,95.04)] |

| SPY Combos: [564.84, 557.37, 579.76, 562.54] |

| NDX Combos: [19598, 19740, 19314, 20389] |

| QQQ Combos: [476.75, 480.18, 469.88, 474.78] |

0 comentarios