Macro Theme:

Key dates ahead:

- 3/28: Core PCE

- 3/31: Q-End OPEX (JPM Roll)

- 4/2: Tariff Deadline

3/27: Vol continues to look cheap after the 3/26 ~1% SPX decline ahead of GDP/Jobs data today (3/27), Core PCE tomorrow (3/28), the JPM expiry (3/31) and an alleged tariff announcement on 4/2. This implies that “wingy” put structures (ex: put spreads, put flies) centered near the JPM 5,565 strike into 3/31 offer interesting risk/reward. Additionally, we like 1-month put spread hedges in case of a “no deal” or “hanging chad” tariff outcome (per the 3/25 update, below).

3/25: April 2 Tariff Scenario:

- In a positive outcome, we’d look for a move into 5,950, with major resistance at 6,000. This area is also where we believe vanna fuel would be totally “burned off” with VIX hitting 14’s

- In a negative outcome, the immediate downside support level to watch is 5,500. We do not currently see reasons for SPX to drop below 5,500, and would have to update models if/when that target zone is hit.

3/24: We are looking to lock in some long call/short put gains (see 3/19 note) into the strong stock rally on into 3/24 because a signed tariff deal has not been reached (ref SPX 5,730). Tariffs remain a major “known-uknown” even though equities are set at open at ~3-week highs, and VIX at 3 week lows (VIX 19). Further, we now view S&P puts as relatively cheap, and so we will be looking to add downside protection into 3/31 exp (around JPM 5,565 strike), and or for >4/2 exp “no tariff deal” outcomes. ✅

Key SG levels for the SPX are:

- Resistance: 5,800

- Support: 5,700, 5,600

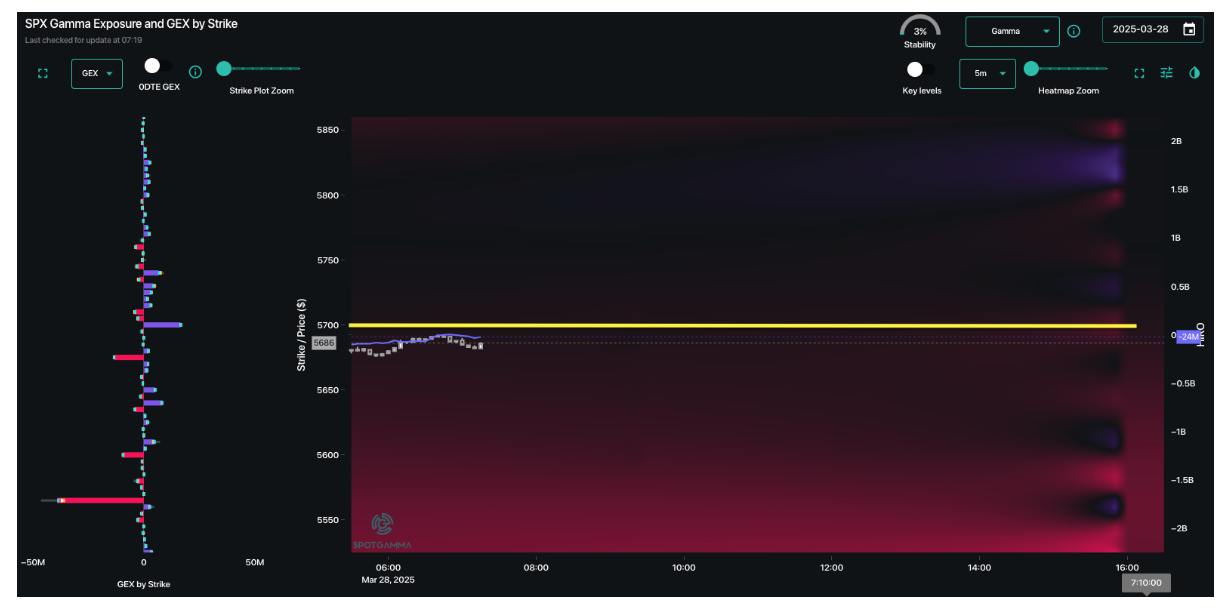

- Under 5,700 is primarily negative gamma, and high risk.

Founder’s Note:

Futures are off 10bps ahead of PCE.

TLDR: Yesterday was quite dull, and we risk being lulled to sleep again, today. But the situation is quite unstable and likely remains so until deals are signed. Not just 4/2 – traders need some certainty of agreements, even bad ones. In the options space, deals = vol. No deals = high vols.

5,700 is the dividing line today, where light to moderate positive gamma exists >=5,700, and its increasing negative gamma below. This suggests traders may want to lean long 5,700, with resistance in the 5,740-5,750 area.

We think its best to avoid avoid longs below 5,700 until first support, for today, at 5,640. Below there we’d watch for a possible bounce at 5,600, but the major, longer term support is at 5,565 into Monday’s JPM roll.

If you look at our original gamma model (dealers are long calls & short puts), you see that net

call gamma

(positive gamma) overtakes net

put gamma

(negative) at 5,272. Historically, this is seen as a “zero

gamma flip

point”, wherein volatility should contract above that level, and dealer flows are supportive. While this assumption is naive compared to current models seen in TRACE (and those being launched on 4/2), we still think the general idea/sentiment has & can serve us well. The other interesting thing about 5,727 is that the much-watched 200d MA is near there at ~5,740 – a level technical gurus tout as critical.

That 200d level meant nothing over the past few sessions, but knowing it’ll drag a core segment of analysts into the market is notable. We do not think a move back above this level is likely until at least 4/2 (and/or if early deals are made).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5740.9 | $5693 | $567 | $19798 | $481 | $2065 | $204 |

| SG Gamma Index™: |

| -2.024 | -0.379 |

|

|

|

|

| SG Implied 1-Day Move: | 0.70% | 0.70% | 0.70% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5777.9 | $5730 | $570 | $19590 | $484 | $2080 | $220 |

| Absolute Gamma Strike: | $6047.9 | $6000 | $570 | $19600 | $480 | $2090 | $205 |

| Call Wall: | $6047.9 | $6000 | $580 | $19600 | $490 | $2090 | $240 |

| Put Wall: | $5697.9 | $5650 | $560 | $19000 | $480 | $2000 | $200 |

| Zero Gamma Level: | $5793.9 | $5746 | $570 | $19748 | $488 | $2092 | $217 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.730 | 0.632 | 0.999 | 0.722 | 0.814 | 0.395 |

| Gamma Notional (MM): | ‑$870.159M | ‑$1.476B | ‑$2.335M | ‑$530.353M | ‑$21.815M | ‑$1.222B |

| 25 Delta Risk Reversal: | -0.047 | -0.028 | -0.057 | -0.036 | -0.037 | -0.016 |

| Call Volume: | 472.88K | 1.637M | 8.98K | 755.221K | 20.655K | 271.634K |

| Put Volume: | 738.677K | 2.01M | 7.644K | 1.026M | 17.508K | 302.787K |

| Call Open Interest: | 6.561M | 6.378M | 64.211K | 3.275M | 266.682K | 3.309M |

| Put Open Interest: | 11.789M | 10.79M | 65.711K | 5.358M | 397.35K | 6.96M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5700, 5800, 5000] |

| SPY Levels: [570, 560, 550, 575] |

| NDX Levels: [19600, 20000, 19500, 19900] |

| QQQ Levels: [480, 490, 485, 500] |

| SPX Combos: [(5950,77.44), (5898,81.06), (5853,82.26), (5824,69.58), (5801,70.75), (5773,69.42), (5722,73.34), (5699,95.49), (5693,74.16), (5682,70.56), (5676,97.19), (5671,86.21), (5653,98.64), (5642,73.49), (5631,68.77), (5625,96.99), (5614,78.88), (5602,98.08), (5574,94.41), (5568,92.91), (5551,93.40), (5528,89.42), (5523,85.98), (5500,97.03), (5477,74.88), (5471,81.15), (5448,85.25), (5420,75.25)] |

| SPY Combos: [557.94, 562.49, 560.22, 547.71] |

| NDX Combos: [19739, 19323, 19601, 19521] |

| QQQ Combos: [476.66, 480.05, 469.88, 475.21] |

0 comentarios